Cryptocurrency: Guides, Reviews, and Latest Insights

When navigating Cryptocurrency, a digital asset secured by cryptography that enables peer‑to‑peer transactions without a central authority. Also known as crypto, it has reshaped finance, gaming, and social platforms. Cryptocurrency isn’t a single product; it spans thousands of tokens, each with its own tokenomics, community, and use case. Understanding the basics—how decentralised ledgers work, why scarcity matters, and what drives price swings—gives you a solid footing before you dive into trading or investing. This foundation also helps you see how other parts of the ecosystem, like exchanges or airdrops, fit together and impact your decisions.

One of the most practical ways to interact with digital assets is through a crypto exchange, an online platform where users can buy, sell, and swap cryptocurrencies while managing wallets and accessing market data. Also known as exchange, it acts as the gateway between fiat money and the crypto world. Exchanges differ in fees, security measures, supported assets, and regulatory compliance, so choosing the right one is a key step in any trading strategy. For instance, a low‑fee exchange can boost small‑scale profitability, while a highly regulated platform may offer insurance and stronger dispute resolution. The relationship between exchanges and regulation, the set of laws and guidelines governing financial activities, including crypto trading shapes everything from KYC requirements to the availability of certain tokens. Knowing how regulation influences exchange features helps you avoid unexpected lock‑outs and stay compliant.

Another hot topic that keeps the community buzzing is the airdrop, a distribution method where projects give free tokens to eligible users, often to boost awareness or reward early supporters. Also known as token giveaway, airdrops can provide a low‑risk entry point to new projects, but they also come with pitfalls like scams or tax obligations. Spotting legitimate airdrops often involves checking the project's technical whitepaper, community activity, and whether the distribution aligns with its tokenomics. As regulations tighten, many jurisdictions are clarifying how airdrops are taxed and what disclosures are required, linking back to the broader regulatory framework. By staying informed about how airdrops work, how they’re reported, and how they intersect with exchange listings, you can capture free value while minimizing risk.

Below you’ll find a curated collection of reviews, deep‑dives, and step‑by‑step guides that unpack each of these elements. From exchange fee breakdowns to real‑world airdrop claim tutorials, the articles are designed to give you actionable insights and help you navigate the fast‑moving crypto landscape with confidence.

The Midnight (NIGHT) airdrop by Cardano’s Glacier Drop distributed 24 billion tokens across eight blockchains in 2025. With strict eligibility, vesting schedules, and a three-phase recovery system, it wasn’t a giveaway - it was a network launch. If you missed the deadline, here’s what’s still possible.

Read More

Over 20 million Pakistanis use cryptocurrency not for speculation, but to bypass inflation, slow banks, and receive international payments. This is crypto as a lifeline - not a luxury.

Read More

Bull Finance's BULL token airdrop lacks transparency, team verification, or utility. No legitimate project operates this way. Learn why this airdrop is likely a scam and how to protect your wallet.

Read More

Subnet Tokens isn't a crypto exchange - it's a misleading data aggregation of Bittensor subnet tokens. Learn how to safely trade and stake subnet tokens, avoid scams, and understand the real mechanics behind this complex AI crypto ecosystem.

Read More

LongBit crypto exchange is not a real platform-it's a scam. No legitimate records, reviews, or security practices exist. Learn how to spot fake exchanges and protect your crypto from phishing traps.

Read More

TonicDEX is a fast, low-fee decentralized exchange built on NEAR and Aurora. It offers full self-custody and access to early tokens but requires crypto experience. No KYC, no fiat on-ramps, and no safety net - just pure DeFi.

Read More

Multi-jurisdictional compliance for blockchain projects isn't optional - it's a survival requirement. Learn how GDPR, MiCA, and state laws in the U.S. create legal risks that can shut down your platform overnight.

Read More

The BLP airdrop by BullPerks in 2021 was a small community event that gave out $30 each to 100 people. Today, the token is nearly worthless with almost no trading. No new airdrops exist. Here’s what really happened.

Read More

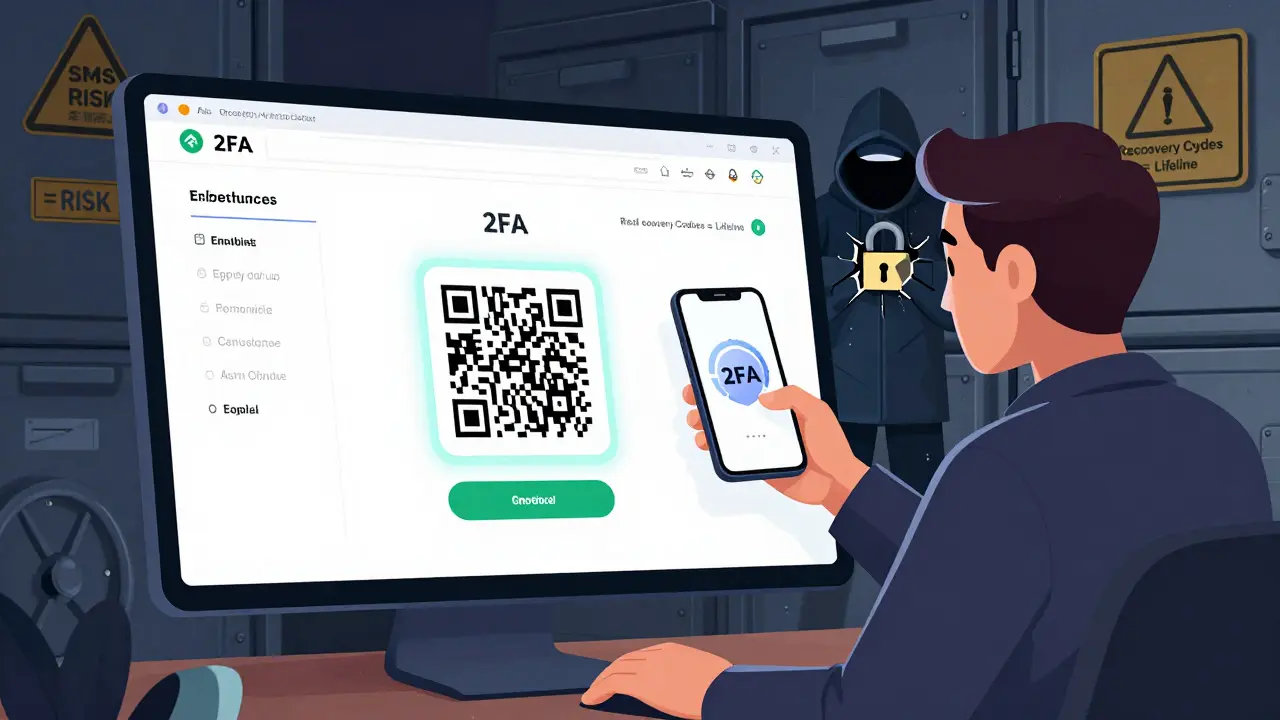

Enable 2FA on crypto exchanges to protect your assets from hacks. Learn how to set it up with authenticator apps, avoid SMS risks, save recovery codes, and prevent permanent lockouts.

Read More

Learn how to claim 34 LGX tokens from the Legion Network SuperApp airdrop in 2026. No investment needed. Just download the app, use referral code DRtZ7lb, and start earning with real utility.

Read More

Rentible (RNB) was meant to revolutionize rental payments with crypto, but it never gained traction. Now trading at $0.033, down 99% from its peak, it's a dead project with no development, no users, and no future.

Read More

Bitfinex is a professional-grade crypto exchange built for experienced traders. With deep liquidity, advanced order types, and low-latency execution, it excels in derivatives and margin trading - but lacks beginner support and insurance on deposits.

Read More