JPEX Crypto Exchange Review 2025: Scandal, Risks & How It Stacks Up

JPEX Risk Assessment Calculator

Evaluate JPEX Risk Factors

Risk Assessment Result

When you hear the name JPEX is a cryptocurrency exchange that promised ultra‑high leverage and lofty interest rates but ended up at the center of Hong Kong’s biggest crypto fraud case, you probably wonder whether it’s a legitimate platform or a cautionary tale. This review pulls together the technical features, regulatory red flags, real‑world user fallout, and how JPEX compares to established exchanges like Binance and Coinbase. By the end, you’ll know if JPEX is worth a second look-or best avoided altogether.

What JPEX Offered on Paper

JPEX marketed itself as a one‑stop shop for crypto traders:

- High‑leverage trading up to 300x on major pairs.

- Automated arbitrage powered by the so‑called JPEX Automatic Arbitrage AI system (IAIA), which claimed to exploit price gaps across exchanges.

- Asset‑management services where users could lock crypto and earn interest, promoted as a “risk‑free” dividend generator.

- A publicly announced Proof of Reserves (PoR) certificate showing 8,889 BTC and $400million in JPC tokens, albeit without third‑party audit verification.

All of this sounded appealing, especially to traders chasing big gains, but the promised features came with glaring omissions-no clear licensing, minimal documentation, and a thin veil of corporate identity.

Who Was Behind JPEX?

The platform was operated by WEB3.0 Technical Support Limited, a company that kept a low profile and never disclosed a physical address. The exchange’s marketing material referenced a JPEX Foundation that supposedly held a diversified crypto reserve, but regulatory investigators could not locate any audited holdings.

The Regulatory Red Flag: Unlicensed in Hong Kong

The Hong Kong Securities and Futures Commission (SFC) officially labeled JPEX as an unlicensed virtual asset trading platform. Under Hong Kong’s new crypto framework introduced in 2022, any exchange offering leveraged products must obtain a Type 1 licence. JPEX never applied, putting it squarely outside legal protection for users.

Scandal Unfolds: The Legal Fallout

In late 2023, dozens of investors reported that their USDT deposits vanished. Police investigations logged **2,636 reports** totaling roughly **HK$1.6billion** in losses. The case escalated to the Hong Kong District Court, where on **October292024** the court ruled in favor of plaintiffs Chan Wing Yan and another individual. The judgment recognized crypto tokens as **property** capable of being held in trust, ordering the return of **HK$1.85million** and setting a precedent for future digital‑asset disputes.

By April2024, 72 arrests had been made and **HK$228million** in assets were frozen. The scandal not only exposed investor vulnerability but also tested the robustness of Hong Kong’s emerging regulatory regime.

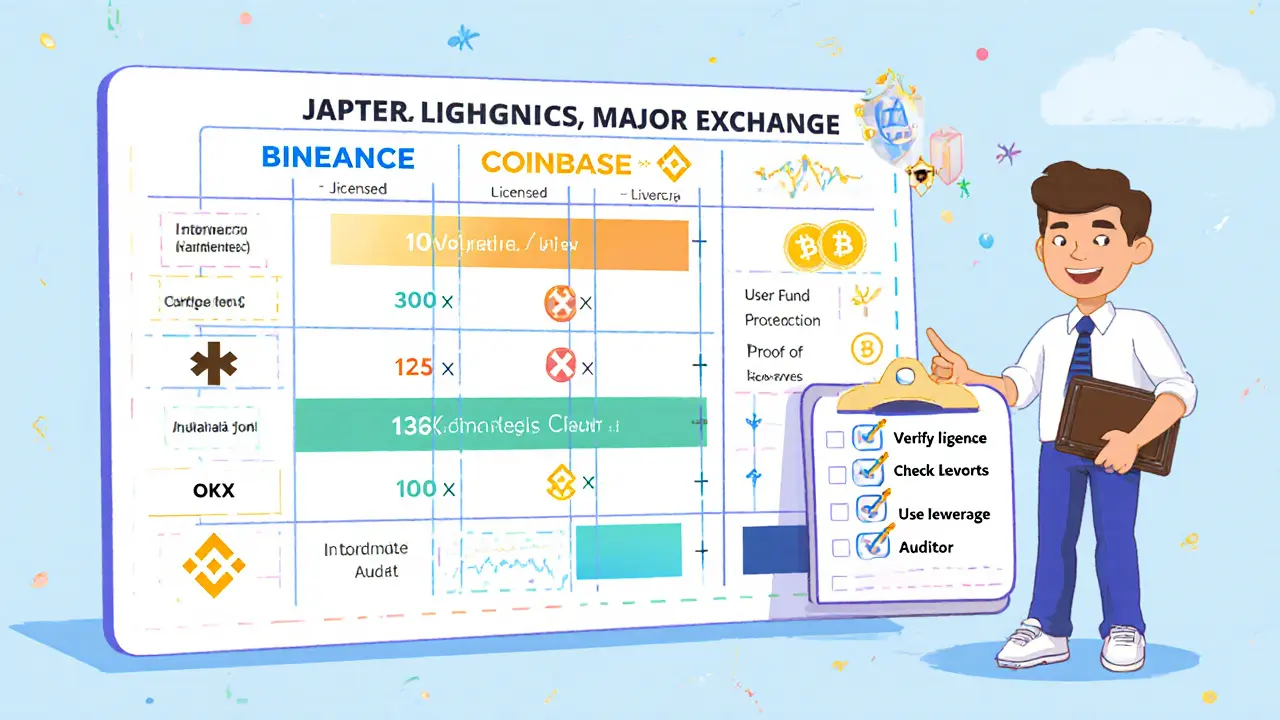

Comparing JPEX to Established Exchanges

| Feature | JPEX | Binance | Coinbase | OKX |

|---|---|---|---|---|

| Licensing (HK) | Unlicensed | Licensed (Virtual Asset Service Provider) | Licensed (Virtual Asset Service Provider) | Licensed (Virtual Asset Service Provider) |

| 24‑hour Trading Volume (HK$) | Not disclosed | HK$221.6bn | HK$38.8bn | HK$35.7bn |

| Maximum Leverage | 300x (high‑risk) | 125x (selected pairs) | 10x (via margin) | 100x (selected pairs) |

| User Fund Protection | None (no insurance) | Insurance fund + SAFU | FDIC‑covered cash balances (US) | Insurance fund |

| Proof of Reserves | Self‑issued certificate, no audit | Third‑party audit (Coinfirm) | Third‑party audit (G&A) | Third‑party audit (Chainalysis) |

The table makes it clear: JPEX falls short on every regulatory and transparency metric that seasoned traders rely on. While high leverage can amplify profits, it also magnifies losses-especially when the platform offers no safeguard against insolvency.

Real‑World User Experiences

Most online reviews of JPEX are buried in court filings rather than typical rating sites. The most frequently cited complaints include:

- Deposits of USDT or USDC disappearing after “maintenance” periods.

- Customer support responding only to generic emails, often with broken links.

- Withdrawal limits that shrink without explanation, effectively locking funds.

- Promises of 10‑15% monthly interest that never materialized, later revealed to be unsustainable “Ponzi‑style” payouts.

In contrast, users on Binance or Coinbase regularly mention transparent fee structures, clear KYC processes, and responsive help desks. Those differences matter when you’re moving real money.

Why the JPEX Scandal Matters for Hong Kong’s Crypto Future

Hong Kong is positioning itself as an Asia‑Pacific crypto hub, but the JPEX case highlighted gaps in the city’s enforcement capabilities. The SFC’s decisive action-labeling the platform illegal, freezing assets, and pushing for stronger licensing-signals a move toward stricter oversight. Academic research, such as the 2024 study by Noble Po‑Kan Lo and Tony Hon YiuLau, concluded that while Hong Kong’s regulatory framework is improving, it still struggles with decentralized finance (DeFi) structures that can bypass traditional licensing.

For investors, the takeaway is clear: Choose exchanges that are fully licensed, have auditable reserves, and provide documented user protection. The JPEX episode serves as a practical reminder that high returns often come with hidden risks.

How to Safely Trade Crypto in 2025

If you’re still eager to trade crypto after reading this review, follow these best‑practice steps:

- Verify the exchange’s licensing status on the regulator’s website (e.g., SFC’s list of approved virtual asset service providers).

- Check for a publicly available Proof of Reserves audit from a reputable third party.

- Start with a modest position-especially when using leverage. A common rule is to risk no more than 1‑2% of your capital per trade.

- Use hardware wallets for long‑term holdings; keep only what you need for active trading on the exchange.

- Stay informed about regulatory updates in your jurisdiction to avoid sudden platform bans.

By sticking to these guidelines, you reduce the chance of ending up in a courtroom like the JPEX plaintiffs.

Bottom Line: Is JPEX Worth Your Money?

Short answer: avoid JPEX. The platform’s unlicensed status, missing audit trail, and proven history of fund misappropriation outweigh any lure of high leverage or hefty interest payouts. Established exchanges-Binance, Coinbase, OKX, Bybit, and Upbit-offer comparable tools with far stronger user protection and regulatory compliance.

Long answer: If you’re a risk‑tolerant trader who can afford to lose every dollar you allocate, you might still encounter JPEX’s marketing on social media. But even then, the legal uncertainty and potential for account freezes make it a poor choice compared to licensed alternatives that still provide 100‑plus‑times leverage without exposing you to fraud.

Frequently Asked Questions

What is JPEX and who runs it?

JPEX (JP‑EX Crypto Asset Platform) is a cryptocurrency exchange operated by WEB3.0 Technical Support Limited. It offered high‑leverage trading, an automated arbitrage AI system, and interest‑bearing accounts, but it never obtained a Hong Kong licence.

Is JPEX licensed by the Hong Kong SFC?

No. The Hong Kong Securities and Futures Commission publicly classified JPEX as an unlicensed virtual asset trading platform, meaning it operates outside the legal framework that protects investors.

How much money did users lose in the JPEX scandal?

Police reports recorded roughly HK$1.6billion in losses across 2,636 complaints. Individual cases, such as the HK$1.85million judgment for Chan Wing Yan, illustrate the scale of loss per victim.

Can I still withdraw funds from JPEX?

As of October2025, most withdrawal requests are either frozen or rejected. The ongoing criminal investigation means users should treat any remaining balance as potentially unrecoverable and seek legal advice.

What alternatives should I consider for high‑leverage trading?

Licensed platforms like Binance (up to 125x), OKX (up to 100x), and Bybit (up to 100x) provide leverage with insurance funds, audited reserves, and clear regulatory status, making them safer choices.

Did the JPEX case change Hong Kong’s crypto regulations?

Yes. The case prompted the SFC to tighten enforcement, increase inspections of virtual asset service providers, and clarify that crypto assets are treatable as property for trust‑related claims.

15 Comments

JPEX’s rise and fall feels like a modern tragedy, a cautionary tale whispered in every crypto chat room.

It promised sky‑high leverage, like a phoenix promising to lift traders to the heavens, only to crash with a roar that echoed through Hong Kong’s courts.

The lack of any real licence was the first red flag, a glaring neon sign that said “proceed at your own peril.”

When users saw their USDT evaporate, the panic was palpable, a collective gasp that turned into a chorus of lawsuits.

The SFC’s decisive action finally placed a spotlight on the platform’s shadowy operators.

Even the self‑issued proof of reserves turned out to be a house of cards, collapsing under basic scrutiny.

In the end, JPEX taught us that glittering promises often hide hollow foundations.

High leverage is a double‑edged sword; without proper safeguards, it becomes a weapon against its own users.

Regulators are now more vigilant, but the memory of JPEX lingers like a warning sign on a dark road.

For anyone tempted by “300x” returns, remember that the higher the climb, the farther the fall.

Choose exchanges that wear their licenses like armor and audit their reserves like open books.

Only then can you trade with confidence rather than fear.

lol jpex was a total scam dont even think about it

Oh sure, JPEX was just a misunderstood pioneer, secretly funded by intergalactic investors who love watching retail traders burn their wallets for sport.

All those “unlicensed” accusations are clearly a smokescreen orchestrated by the SFC to protect their own hidden crypto stash.

Meanwhile, the missing USDT is probably hiding in a vault guarded by a cabal of memes and Ponzi‑lords.

But hey, if you enjoy being part of a grand experiment in financial chaos, keep your eyes glued to the next hype wave.

Take a breath and look at the facts they’re simple no licence no insurance means you’re on your own so stick to platforms that actually protect you and learn from this mess you’ll do better next time

The JPEX saga reads like a neon‑lit noir novel, where shadowy code‑wizards trade dreams for leverage and the city of Hong Kong becomes a stage for financial bloodsport.

Every press release shouted “300x” like a siren’s call, intoxicating the reckless and the hopeful alike.

Behind the glitter lay a maze of shell companies, a self‑issued reserve certificate that glittered with false security.

When the SFC finally ripped the mask, the fallout was a torrent of frozen assets, arrests, and a courtroom drama that will be taught in law schools.

For the everyday trader, this is a brutal reminder that high‑risk promises often mask fatal flaws.

Stay vigilant, demand real audits, and never trust a platform that hides behind vague “foundations.”

I feel for everyone who lost hard‑earned money on JPEX; it’s heartbreaking to see hopes dashed by a platform that pretended to safeguard funds.

What’s comforting is that the legal system finally recognized crypto tokens as property, giving victims a path to recovery.

Going forward, lean on exchanges that offer clear insurance, transparent reserves, and proper licensing.

Remember, your safety comes first, and there are many reputable options that respect that principle.

Keep your eyes open and your wallet closed to shady sites.

When evaluating any exchange, start with the basics: licensing, proof of reserves, and user protection mechanisms.

These pillars create a safety net that prevents the kind of fallout we saw with JPEX.

Think of them as the guardrails on a mountain road; without them, a small slip can become a catastrophic tumble.

Educate yourself, ask the right questions, and share this knowledge with fellow traders so the community grows stronger together.

Esteemed members of this discourse, the tragedy of JPEX stands as a stark testament to the perils inherent in unregulated financial ventures.

Its audacious promises of excessive leverage were matched only by an egregious disregard for fiduciary responsibility.

Such conduct, unbecoming of any respectable entity, necessitates the stringent oversight now enforced by the Hong Kong Securities and Futures Commission.

Let this episode serve as a solemn reminder that innovation must be tempered by accountability.

Hey folks, despite the JPEX mess there are still plenty of safe places to trade, so stay positive and keep exploring reputable platforms-you’ll find a good fit!

I’ve been watching the crypto scene for a while, and the JPEX collapse is another reminder that high‑risk offers often lack the behind‑the‑scenes safeguards.

Keeping a cool head and doing due diligence can save a lot of hassle down the road.

The incident underscores a critical failure in on‑chain liquidity provisioning and custodial risk management.

Without third‑party audit trails, the PoR becomes a superficial metric, offering no real assurance of solvency.

Future protocols should integrate verifiable reserve attestations using zero‑knowledge proofs to mitigate such systemic exposures.

JPEX marketed 300x leverage as a gateway to massive profits.

Regulators flagged it as unlicensed early on.

Users deposited USDT expecting safety.

The platform offered no insurance fund.

Proof of reserves was self‑issued, not audited.

In late 2023 withdrawals stalled mysteriously.

Thousands reported missing funds to Hong Kong police.

Investigators logged over HK$1.6 billion in complaints.

The SFC declared the exchange illegal.

Court rulings recognized crypto tokens as property.

Arrests followed, freezing HK$228 million in assets.

Major exchanges like Binance provide insurance and audits.

Leverage on reputable platforms caps at lower levels, reducing risk.

Investors should verify licensing before committing capital.

Always keep only trade‑necessary funds on exchanges.

Stay informed about regulatory updates to avoid similar pitfalls.

Honestly, the JPEX fiasco is a textbook case of why due diligence matters 😒

The legal precedent set by the Hong Kong courts affirms that digital assets warrant property rights, which may influence future regulatory frameworks.