Decentralized Exchange (DEX) Overview

When talking about decentralized exchange, a platform that lets users trade digital assets directly, without a middle‑man holding their funds. Also known as DEX, it runs on smart contracts, provides peer‑to‑peer liquidity, and promises more privacy than traditional crypto exchanges. Decentralized exchange encompasses peer‑to‑peer trading, requires smart contracts for order matching, and is shaped by evolving regulation. This opening definition sets the stage for the topics covered in the posts below.

Key Players and Real‑World Examples

One of the most talked‑about DEXs is dYdX, a derivatives platform that markets itself as a decentralized exchange but still blocks users from certain jurisdictions. dYdX shows how a DEX can offer complex products like perpetual contracts while still grappling with compliance rules. The platform’s geographic restrictions illustrate the triple: dYdX – is a decentralized exchange – that blocks certain countries. Understanding dYdX helps you see the line between true decentralization and the need to meet legal requirements.

Another related entity is the broader category of crypto exchange, any service, centralized or decentralized, where users can buy, sell, or swap cryptocurrencies. While centralized exchanges like Binance hold user assets in custodial wallets, DEXs let you stay in control of your private keys. This distinction matters because custody risk, fee structures, and order‑book transparency differ dramatically. Crypto exchanges overall require robust security measures; DEXs add the layer of smart‑contract audits to protect users.

The underlying blockchain, the distributed ledger that records every transaction on a DEX is the engine that makes peer‑to‑peer trades possible. Each trade is a transaction that gets validated by network nodes, ensuring immutability without a central authority. Because DEXs rely on blockchain data, network congestion, gas fees, and protocol upgrades directly affect user experience. For example, high gas fees on Ethereum can make small trades uneconomical, pushing traders toward layer‑2 solutions or alternative blockchains.

Regulation is the fourth pillar shaping DEXs today. Governments worldwide are figuring out how to apply existing financial laws to decentralized platforms. When a regulator classifies a token as a security, DEXs may need to implement KYC/AML checks or restrict access, as seen with dYdX’s country bans. This creates a feedback loop: stricter rules push developers to design more privacy‑preserving protocols, while lax environments attract higher trading volumes but also increase fraud risk. Keeping an eye on regulatory trends is essential for anyone planning to trade on a DEX.

All these pieces – the DEX definition, notable platforms like dYdX, the wider crypto exchange ecosystem, the blockchain infrastructure, and the regulatory backdrop – intertwine to form the landscape you’ll navigate. Below you’ll find in‑depth reviews, security analyses, fee breakdowns, and practical how‑to guides that dive into each of these aspects. Whether you’re curious about swapping tokens without an intermediary, weighing the safety of a new DEX, or trying to understand how geo‑restrictions might affect you, the collection of articles that follows will give you the concrete information you need to trade confidently.

TonicDEX is a fast, low-fee decentralized exchange built on NEAR and Aurora. It offers full self-custody and access to early tokens but requires crypto experience. No KYC, no fiat on-ramps, and no safety net - just pure DeFi.

Read More

W3Swap is a decentralized exchange likely built on Shardeum, offering fast, low-cost trades for niche tokens. It’s not for beginners, but active DeFi users may find it a powerful alternative to slower, pricier DEXes like Uniswap.

Read More

Camelot is a decentralized exchange built on Arbitrum with near-zero trading fees, concentrated liquidity, and a unique governance token called GRAIL. Learn how it works, who it's for, and why it stands out in DeFi.

Read More

SushiSwap on Polygon offers low-cost, fast crypto swaps with staking, lending, and governance. Learn how it compares to Uniswap and QuickSwap, and whether it's right for your DeFi strategy in 2026.

Read More

DEx.top is a fast, non-custodial crypto exchange with low fees and no KYC. Learn how it works, where it shines, and who should avoid it in 2026.

Read More

Daexs Exchange has no verifiable presence in the crypto industry as of 2025. No contracts, no liquidity, no audits. This review exposes it as a likely scam and guides users toward trusted alternatives like Uniswap and PancakeSwap.

Read More

KokomoSwap shows no signs of being a legitimate crypto exchange in 2025. No official website, no audits, no community. This review exposes it as a likely scam and guides users to trusted alternatives like Uniswap and Binance.

Read More

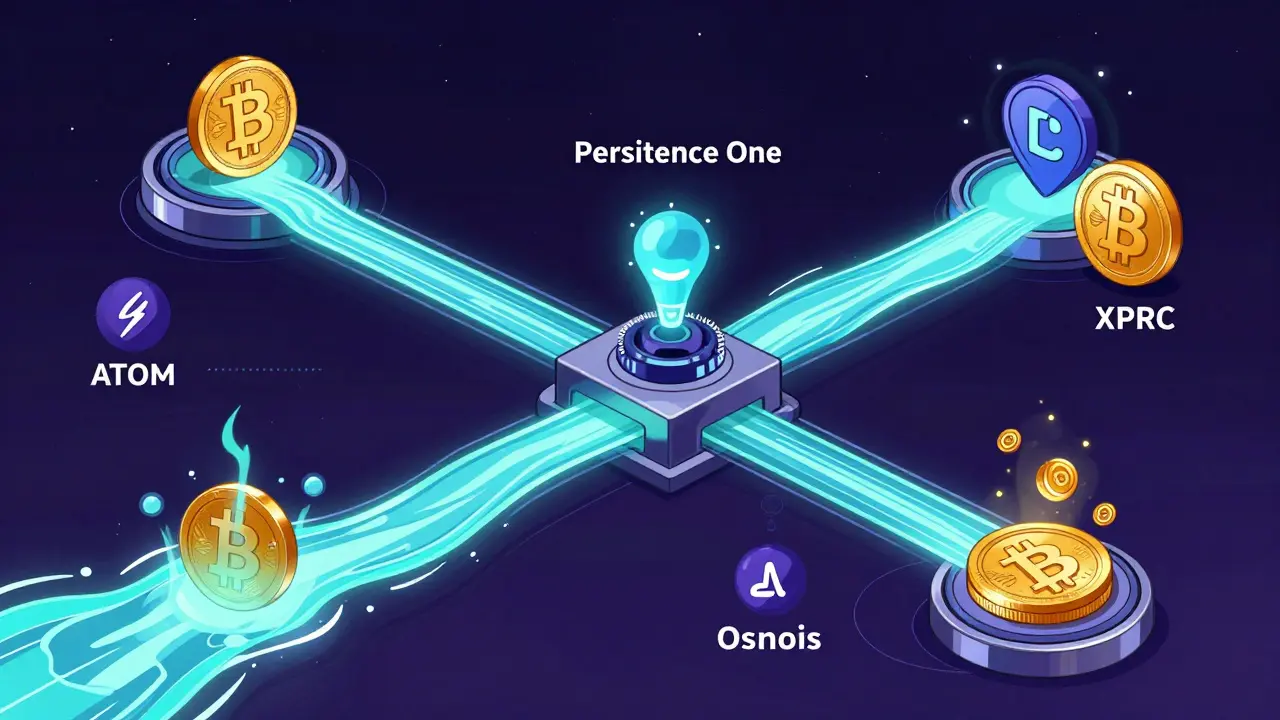

Persistence DEX is a niche decentralized exchange built for BTCFi and Cosmos ecosystem assets. With low volume but unique staking-integrated liquidity, it's ideal for XPRT holders and Bitcoin DeFi users seeking low-slippage swaps.

Read More

Sushiswap v3 on Ethereum offers concentrated liquidity, on-chain limit orders, and DCA features for active traders. Learn how it compares to Uniswap, where it shines, and the risks you need to know before using it.

Read More

A detailed ViteX review covering speed, zero gas fees, trading pairs, VX token rewards, security, pros & cons, and future roadmap for cryptocurrency traders.

Read More