Camelot Crypto Exchange Review: A Deep Look at the Arbitrum-Based DEX

When you're trading crypto on a decentralized exchange, you don't want another yield farm that collapses in a week. You want something that lasts. That’s where Camelot comes in. Launched in December 2022, Camelot isn’t just another DeFi platform trying to cash in on hype. It’s built specifically for the Arbitrum network - one of the fastest-growing Ethereum Layer 2 solutions - and designed to give developers and liquidity providers real, sustainable tools, not just temporary rewards.

What Makes Camelot Different?

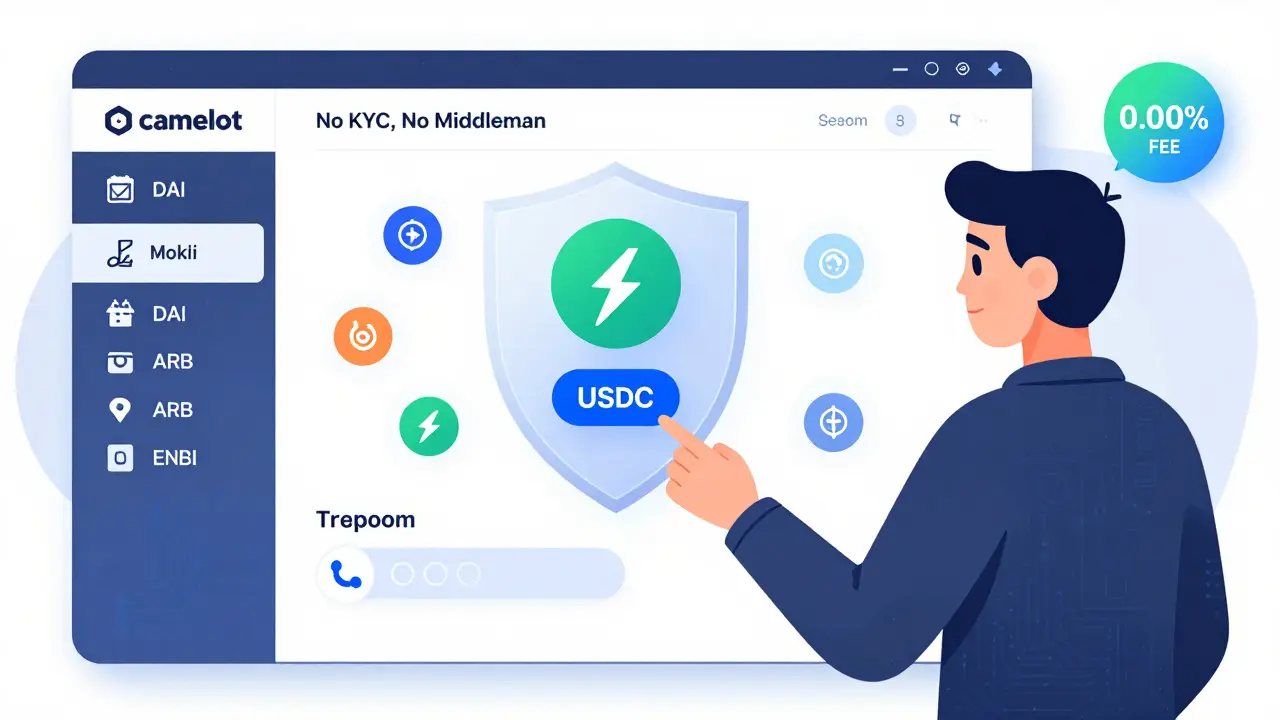

Most decentralized exchanges (DEXs) rely on simple automated market makers (AMMs) where liquidity is spread thin across wide price ranges. That means slippage, high fees, and inefficient capital use. Camelot changed that by adopting Algebra’s V2 codebase, which brings concentrated liquidity to the table. Think of it like this: instead of putting your money across a 10-mile stretch of road, you put it exactly where the traffic is - between $1.20 and $1.30 for a specific token pair. That makes trades faster, cheaper, and more efficient for everyone. This isn’t just a technical upgrade. It’s a shift in philosophy. While other DEXs chase short-term yield farming rewards, Camelot focuses on infrastructure. It’s built for builders - the developers launching new tokens on Arbitrum - and the traders who want to swap them without paying 0.2% fees every time.Trading on Camelot: No App, No Leverage, But Low Fees

You won’t find a mobile app for Camelot. It’s web-only. That’s not a flaw - it’s intentional. The platform targets users who already know how to connect a wallet and understand DeFi basics. If you’re still learning, you might want to start with something simpler. But if you’re comfortable with MetaMask or WalletConnect, you’re good to go. There’s no leverage trading. No margin calls. No stop-losses built into the interface. That’s a trade-off. You’re not getting the tools of a centralized exchange like Binance. But you’re also not risking forced liquidations or platform-level hacks. Camelot operates purely through smart contracts. Your funds stay in your wallet. The trade happens on-chain. No middleman. The fees? They’re nearly zero. According to FxVerify, both maker and taker fees are currently 0.00%. That’s unheard of on centralized exchanges, where you’re typically paying 0.1% to 0.25% per trade. Even on other DEXs, fees often hover around 0.2%. Camelot’s fee structure is designed to attract volume, not extract it. The platform makes money through governance token emissions, not trading fees.Supported Tokens and Minimum Deposits

Camelot supports over 90 cryptocurrencies, mostly native to the Arbitrum ecosystem. You’ll find major tokens like ARB, USDC, WETH, and DAI. But you’ll also find lesser-known tokens from new projects launching on Arbitrum - the kind of tokens you won’t find on Coinbase or Kraken. If you’re into early-stage DeFi, this is where the action is. The minimum deposit? Just $1. That’s lower than most centralized exchanges. You can start small, test the waters, and scale up as you get comfortable. There’s no KYC. No identity verification. You just connect your wallet and go.The GRAIL Token: Governance, Not Just a Coin

Camelot’s native token, GRAIL, isn’t just a speculative asset. It’s the backbone of the platform’s governance. The total supply is capped at 100,000 tokens - a tiny number compared to tokens like UNI or AAVE. That scarcity matters. GRAIL is earned through staking in incentivized liquidity pools. The more you stake, the more you earn. But here’s the twist: you don’t vote with GRAIL. You vote with xGRAIL, a derivative token you get by locking up your GRAIL. This system prevents whale dominance. If someone hoards GRAIL but doesn’t lock it up, they get no voting power. It’s a smart design that encourages long-term commitment. Voting is gasless. You don’t pay Ethereum fees to submit or vote on proposals. Instead, the DAO - made up of the core team and trusted advisors - executes approved changes. This keeps the process fast and efficient. It’s not fully decentralized in the purest sense, but it’s far more community-driven than most DeFi projects. Price predictions for GRAIL vary wildly. CoinLore suggests it could hit $1,616 by the end of 2025, with long-term projections reaching $13,673 by 2040. These are speculative estimates, not guarantees. But the fact that GRAIL has a hard cap and real utility makes it more than just a meme coin.Who Is Camelot For?

Camelot isn’t for everyone. If you want to buy Bitcoin with a credit card, go to Coinbase. If you want to day trade with leverage, Binance is your spot. But if you’re into Arbitrum, care about low fees, want to support early-stage DeFi projects, and understand how liquidity pools work - then Camelot is one of the best options out there. It’s especially good for:- Developers launching tokens on Arbitrum who need a reliable DEX for trading

- Liquidity providers who want to earn yield without constant re-staking

- Traders who hate paying 0.2% fees on every swap

- Users who prefer non-custodial, permissionless trading

- Beginners who don’t know what a wallet is

- People who want mobile trading or margin trading

- Those expecting customer support to fix their mistakes

User Traffic and Experience

Camelot gets around 70,000 organic visits per month. That’s not massive compared to Uniswap or SushiSwap, but it’s solid for a niche DEX focused on one chain. The bounce rate is 49%, which is actually decent for DeFi - it means nearly half the visitors stick around long enough to do something. Average visit time is just over a minute. That’s not because the site is boring. It’s because users come in, swap a token, stake some liquidity, and leave. The interface is clean. The process is fast. No fluff. There’s no affiliate program with cash bonuses. No contests. No referral rewards beyond the standard yield farming. That’s refreshing. Camelot doesn’t try to trick you into staying. It just gives you tools and lets you decide.

Regulation and Security

Camelot isn’t regulated. It doesn’t need to be. It’s a decentralized exchange. No company owns it. No bank holds your money. Your funds are secured by Ethereum and Arbitrum’s blockchain. That’s the whole point. But it also means there’s no recourse if you send funds to the wrong address or lose your private key. You’re fully responsible. Smart contracts have been audited by reputable firms. No major exploits have occurred since launch. The code is open-source. You can check it yourself. That’s more than you can say for many centralized exchanges that have been hacked multiple times.How to Get Started

Here’s how to use Camelot in five simple steps:- Get an Ethereum wallet that supports Arbitrum - MetaMask, Trust Wallet, or Coinbase Wallet all work.

- Add the Arbitrum network to your wallet (RPC: https://arb1.arbitrum.io/rpc).

- Buy some ETH or ARB and send it to your wallet.

- Go to camelot.exchange and connect your wallet.

- Swap tokens, add liquidity, or stake GRAIL - the options are all on the dashboard.

Final Thoughts: Is Camelot Worth It?

Camelot isn’t the biggest DEX. It’s not the flashiest. But it’s one of the most thoughtfully built. It doesn’t chase trends. It builds infrastructure. It doesn’t promise moonshots. It offers real utility. For anyone active in the Arbitrum ecosystem, it’s not just a good option - it’s the best one. The concentrated liquidity model, near-zero fees, and governance token design show a level of maturity that’s rare in DeFi. If Arbitrum keeps growing - and there’s no sign it’s slowing down - Camelot will grow with it. GRAIL could become one of the most valuable governance tokens in the space. You won’t find customer service. You won’t find a mobile app. But you will find a platform that respects your autonomy, rewards your participation, and doesn’t take a cut every time you trade. In a world full of extractive platforms, that’s rare. And valuable.Is Camelot a centralized or decentralized exchange?

Camelot is a decentralized exchange (DEX). It runs entirely on the Arbitrum blockchain using smart contracts. No company controls your funds, and there’s no central server to hack. You trade directly from your wallet.

Does Camelot have a mobile app?

No, Camelot does not have a mobile app. It’s a web-only platform. You need to use a browser on your phone or computer and connect your wallet through MetaMask, Trust Wallet, or another compatible wallet.

What is the minimum deposit on Camelot?

The minimum deposit is $1. You can start trading or providing liquidity with as little as $1 worth of ETH, ARB, or any other supported token. There’s no account minimum or KYC requirement.

Can I earn passive income on Camelot?

Yes. You can earn passive income by staking your GRAIL tokens or providing liquidity to trading pairs. The platform offers incentivized pools that reward users with additional GRAIL. These yields are paid out automatically through the smart contract.

Is GRAIL a good investment?

GRAIL isn’t a typical investment. It’s a governance token with a fixed supply of 100,000. Its value is tied to the usage and growth of the Camelot platform. If Arbitrum grows and more projects use Camelot, GRAIL demand could rise. But like all crypto assets, it’s volatile and speculative. Do your own research before staking or buying.

Does Camelot support limit orders?

Yes. Camelot supports limit orders through its advanced trading interface. This is rare on DEXs and gives users more control over their trades compared to basic AMMs that only do instant swaps.

Are there any fees on Camelot?

As of early 2026, both maker and taker fees are 0.00%. This is possible because Camelot generates revenue through token emissions, not trading fees. You still pay Ethereum network gas fees when you transact, but the exchange itself charges nothing.

Is Camelot regulated?

No, Camelot is not regulated by any government or financial authority. As a decentralized exchange, it operates without intermediaries. This means no KYC, no freezes, and no customer support - but also no censorship or government interference.

Can I use Camelot if I’m not on Arbitrum?

No. Camelot is built exclusively for the Arbitrum network. You need to have ETH or ARB on Arbitrum to use it. You can bridge funds from Ethereum or other chains using Arbitrum’s official bridge, but you cannot connect wallets from other networks like Solana or Polygon.

What’s the difference between GRAIL and xGRAIL?

GRAIL is the native token you earn from staking and liquidity provision. xGRAIL is a derivative token you receive when you lock up your GRAIL. You use xGRAIL to vote on governance proposals. Locking GRAIL increases your voting power and rewards you with additional GRAIL over time.

22 Comments

Camelot is the real deal no app no BS just pure onchain trading if you ain't using it you're leaving money on the table

US blockchain dominance is real. This is how it's done. No crypto cronyism. Just code.

The concentrated liquidity model is a paradigm shift in AMM design. The Algebra V2 integration enables optimal capital efficiency and reduces impermanent loss by orders of magnitude compared to constant product mechanisms.

I appreciate how Camelot doesn't try to be everything to everyone. It serves a specific need with precision. That's rare in DeFi.

This is the kind of project that makes me believe in crypto again. No hype. Just solid infrastructure. Keep building!

Arbitrum is where the future is. Camelot is just the first step.

Concentrated liquidity? More like concentrated delusion. Everyone knows AMMs are doomed. This is just a prettier coffin.

One must consider the epistemological implications of a governance token whose voting power is mediated through a derivative instrument. The ontological security of decentralized autonomy is thus contingent upon the temporal commitment of its participants, which introduces a hermeneutic loop of incentivized loyalty.

The xGRAIL mechanism is genius. It prevents whale capture without sacrificing decentralization. This is how you design governance.

0.00% fees? Please. They’re just fronting the gas costs until the next bear market. Then watch the liquidity vanish like it never existed.

The philosophical core of Camelot is the rejection of extraction. In a world where every platform monetizes your attention, your data, your trades - this is an act of radical hospitality. You’re not a user. You’re a steward.

Why are Americans always so proud of crypto that doesn’t even need government? It’s like they built a rocket and then acted like they invented gravity.

They say no KYC but what about the moral KYC? If you're trading tokens from projects that don't even have whitepapers, are you really contributing to progress or just feeding the machine?

No mobile app? Wow what a surprise. Next they'll tell us the moon landing was fake and we still use floppy disks

This is all a FedPeg scheme. They're using Arbitrum to launder money from the shadow banking system. GRAIL is just a front for quantitative easing in crypto form. 🤫💸

They said the same thing about Mt. Gox. 'No central server' 'smart contracts audited' 'open source' - until the keys got stolen. You think they didn't backdoor the contract? I’ve seen the pattern too many times.

The $1 minimum deposit is incredibly thoughtful. It lowers the barrier for new participants without compromising the integrity of the protocol. This is how inclusive finance should look.

why is everyone acting like this is the first time someone did concentrated liquidity lmao remember curve? remember balancer? this is just rebranded

The fact that they don’t have an affiliate program is the only reason I’m even considering this. Everyone else is selling your friends’ data for a 5% kickback.

Honestly just connect your wallet and go. No need to overthink it. If you understand wallets you already know what to do.

There is something profoundly poetic about a system that rewards patience over speculation - where value is not extracted but cultivated, where governance is not bought but earned through time and commitment. GRAIL, in its quiet scarcity, becomes not a currency but a covenant - a silent promise between those who believe in the architecture of trust, not the architecture of greed. In a world of flashing banners and countdown timers, Camelot is the cathedral.

Author here. Thanks for the thoughtful replies. We didn’t build Camelot to be the biggest - just the most honest.