Persistence DEX Crypto Exchange Review 2025: Niche BTCFi Trading in the Cosmos Ecosystem

BTCFi Slippage Calculator

Calculate BTCFi Trade Slippage

Most crypto traders think of Uniswap or PancakeSwap when they need a decentralized exchange. But if you're trading Bitcoin derivatives, Liquid Staking Tokens, or assets native to the Cosmos ecosystem, Persistence DEX might be the only game in town. Launched in 2023 and rebuilt in late 2025 with major upgrades, it’s not trying to beat the biggest DEXs. It’s trying to solve a problem they ignore: how to trade BTC and its variants with low slippage, without relying on Ethereum or BNB Chain.

What Persistence DEX Actually Does

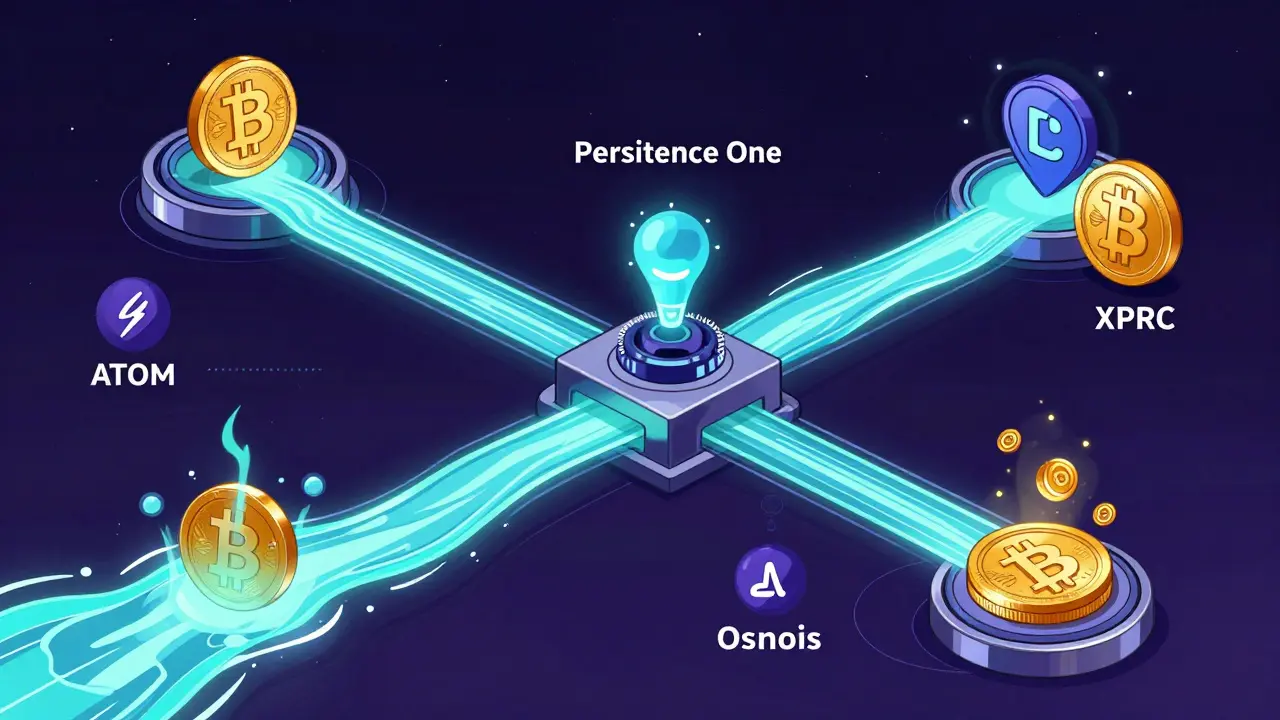

Persistence DEX isn’t another general-purpose swap platform. It’s a specialized AMM built on the Persistence One blockchain, designed for one thing: moving BTC-related assets across chains with minimal friction. Think of it as a bridge for Bitcoin DeFi - but instead of connecting to Ethereum, it connects to Cosmos.

Its core assets are XPRT (the native token), BTC, WBTC, renBTC, LSTs like stBTC and bBTC, and a few stablecoins. You won’t find thousands of tokens here. There are only 6 coins and 12 trading pairs as of December 2025. The most active pair? XPRT/ATOM, which made up nearly half of all volume that day. That tells you who the real users are: Cosmos ecosystem traders looking to move between chains and earn yield.

The magic happens in the BTCFi Liquidity Hub, launched in July 2025. This isn’t just another liquidity pool. It’s a custom-designed system that aggregates fragmented BTC liquidity from Bitcoin sidechains, wrapped tokens, and LSTs into one place. The result? Near-zero slippage on BTC swaps - something even top DEXs struggle with. On average, trades settle in under 80ms. That’s faster than most Ethereum L2s.

How It Works (And Why It’s Different)

Most DEXs run on Ethereum or BNB Chain. Persistence DEX runs on its own layer-1 blockchain, optimized for cross-chain asset routing. It uses the IBC protocol to talk directly to ATOM, Osmosis, and other Cosmos chains. You don’t need to bridge to Ethereum or use a wrapped token if you’re coming from a Cosmos-based wallet like Keplr or Leap.

Here’s the catch: you need to understand IBC. If you’ve never sent ATOM to Osmosis or moved stATOM to Crescent, you’ll spend your first few hours figuring out how to bridge assets. Transfers take 3-5 minutes on average. It’s not instant, but it’s predictable. Compare that to Ethereum-based bridges that can take hours or fail outright.

There’s no margin trading. No futures. No options. Just spot trading at a standard 0.3% fee - inferred from industry norms since Persistence doesn’t publish its fee schedule. That’s fine if you’re trading BTC derivatives. It’s a dealbreaker if you’re looking to leverage your position.

Trading Volume and Liquidity: The Hard Truth

On December 5, 2025, Persistence DEX reported $4,164 in 24-hour volume. That’s a 1,316% spike from the day before - impressive on paper, but tiny in context. PancakeSwap hits that much in under 30 seconds. Uniswap does it in 5 minutes.

The liquidity depth is shallow. If you try to swap more than $500 worth of XPRT for ATOM, you’ll feel the slippage. CoinGecko’s data shows empty bid-ask spreads on several pairs, meaning there’s no real market depth. One pair - DYDX/USDC - was flagged as an anomaly, suggesting possible price manipulation or bot activity.

This isn’t a flaw. It’s a trade-off. Persistence DEX isn’t built for retail traders dumping USDT into random tokens. It’s built for users who want to move BTCFi assets between chains and earn yield from both staking and liquidity provision. If you’re one of those users, the low volume doesn’t matter. If you’re looking for deep liquidity, keep scrolling.

Security: Low Volume, Low Target

In 2025, DEXs lost $3.1 billion to hacks. Flash loan attacks, liquidity draining, rounding errors - the usual suspects. Persistence DEX hasn’t been hacked. But that’s not because it’s bulletproof. It’s because there’s not enough money here to make it worth the effort.

The September 2025 Core-1 Chain Upgrade included security improvements, but no public audit reports are available. SlowMist, a top blockchain security firm, says AMMs with complex cross-chain logic are vulnerable to reentrancy and pool manipulation. Persistence’s architecture is new, and new means untested.

That said, its low volume might be its best defense. Hackers don’t target exchanges with $4,000 in daily volume. They go after the $10 billion ones. So while it’s not audited like Uniswap, it’s also not a juicy target.

Who Should Use It?

Persistence DEX is not for everyone. Here’s who it’s for:

- You hold XPRT and want to stake it while also providing liquidity

- You trade BTC derivatives and need low slippage in a non-Ethereum environment

- You’re already in the Cosmos ecosystem and use Keplr or Leap

- You’re tired of paying high Ethereum gas fees to trade wrapped BTC

- You believe in Bitcoin DeFi and want to support infrastructure that doesn’t rely on Ethereum

Here’s who should avoid it:

- You want to trade ETH, SOL, or AVAX

- You need deep liquidity for large trades

- You don’t want to learn IBC transfers

- You’re looking for stablecoin pairs like USDT/USDC or DAI/USDC

- You expect a polished UI like Uniswap

Integration With the Persistence Ecosystem

This is where Persistence DEX shines. It’s not a standalone exchange. It’s part of a larger ecosystem built around XPRT staking. When you provide liquidity on the DEX, you earn trading fees. But you also keep earning staking rewards on your XPRT. That’s rare. Most DEXs force you to choose: stake or provide liquidity. Persistence lets you do both.

It’s a compounding yield play. If you stake 1,000 XPRT and add 500 XPRT to the XPRT/ATOM pool, you get staking APR (around 8-10% as of late 2025) plus liquidity mining rewards. That’s not a gimmick - it’s a real incentive for long-term holders to lock up their assets.

Compare that to Osmosis, the dominant Cosmos DEX. Osmosis has 10x the volume and 50x the pairs. But it doesn’t integrate with staking the same way. Persistence DEX’s strength isn’t scale - it’s synergy.

Future Roadmap: What’s Coming

Persistence One’s roadmap, updated in September 2025, shows clear direction:

- Integration with Bitcoin Layer-2s like Lightning Network and Rootstock

- Expanded stablecoin support beyond USDC and USDT

- Potential derivatives trading in 2026

- Improved UI and mobile wallet support

Delphi Digital predicts that niche DEXs like this could capture 5-7% of the total DEX market by 2026 - if they solve liquidity. Persistence DEX has the architecture. Now it needs users.

Right now, it’s a quiet experiment. But if Bitcoin DeFi grows as projected - and Messari says the BTCFi market is already $45 billion - then having a dedicated, low-slippage, Cosmos-native DEX could be a game-changer.

Getting Started

If you’re ready to try it:

- Get a Keplr or Leap wallet

- Buy XPRT on a CEX like KuCoin or Gate.io

- Send XPRT to your wallet via IBC or Gravity Bridge

- Connect your wallet to Persistence DEX

- Choose a pair - XPRT/ATOM or BTC/XPRT are the best starting points

- Swap, stake, and earn

There’s no tutorial video. No YouTube walkthrough. The documentation is solid but dry. You’ll learn by doing. Expect a 2-3 hour onboarding curve if you’re new to Cosmos.

The Bottom Line

Persistence DEX isn’t trying to be the next Uniswap. It’s trying to be the go-to place for Bitcoin DeFi inside the Cosmos ecosystem. It’s narrow. It’s niche. It’s under-the-radar.

But for the right user - someone who holds XPRT, trades BTC variants, and hates Ethereum fees - it’s one of the most elegant solutions out there. The volume is tiny, the UI is basic, and the liquidity is thin. But the technical design? It’s smart. The integration with staking? It’s unique. And the focus on BTCFi? It’s ahead of its time.

If you’re not in the Cosmos ecosystem, walk away. But if you are? Give it a shot. It might be the quietest gem in DeFi right now.

Is Persistence DEX safe to use?

Persistence DEX hasn’t been hacked, and its low trading volume makes it a low-priority target for attackers. However, it hasn’t undergone a public third-party audit, and its cross-chain architecture introduces new risks. Use only what you can afford to lose, and avoid large trades until liquidity improves.

Can I trade ETH or SOL on Persistence DEX?

No. Persistence DEX only supports assets native to the Persistence One blockchain and its connected Cosmos ecosystem. This includes XPRT, ATOM, BTC, WBTC, stBTC, and a few stablecoins. Ethereum and Solana assets are not supported.

Do I need to pay gas fees on Persistence DEX?

You pay transaction fees in XPRT, not in ETH or BNB. Fees are minimal - typically less than $0.01 per trade - because the Persistence blockchain is optimized for low-cost, fast transactions. This is one of its biggest advantages over Ethereum-based DEXs.

How does Persistence DEX compare to Osmosis?

Osmosis has far more trading pairs (over 1,000), deeper liquidity, and higher volume. But it doesn’t integrate with XPRT staking or focus on BTCFi assets. Persistence DEX is smaller but more specialized. If you trade BTC derivatives in Cosmos, Persistence is better. If you trade general tokens, Osmosis wins.

Can I earn passive income on Persistence DEX?

Yes. You can earn trading fees by providing liquidity, and you can earn staking rewards on your XPRT. The platform lets you do both at the same time, creating a compounded yield. This is unique among DEXs and makes it attractive for long-term holders.

Is Persistence DEX regulated?

No. Like most DEXs, it operates without a legal entity or licensing. It’s not subject to MiCA (EU) or SEC rules because it doesn’t act as a custodian or intermediary. However, future regulations around token classifications could impact how BTCFi assets are treated on the platform.

What wallets work with Persistence DEX?

Keplr and Leap wallets are officially supported. You must connect one of these to interact with the exchange. MetaMask and other Ethereum wallets won’t work unless you bridge assets through Gravity Bridge first.

25 Comments

Persistence DEX is one of those rare projects that actually understands the problem it's solving. No fluff, no fake volume, just a clean, focused tool for BTCFi in Cosmos. If you're tired of paying $20 in gas to swap wrapped BTC on Ethereum, this is your lifeline. The IBC integration is smooth once you get past the initial learning curve. And yes, the volume is tiny - but that’s the point. It’s not for degens. It’s for builders.

low volume?? lol this thing is a graveyard. i tried swapping 200 xprt for atom and got 15% slippage. the UI looks like it was built in 2018. who even uses this? someone needs to tell the devs they’re not in 2021 anymore

Hey miriam - I feel you on the UI, but give it a second chance. It’s not pretty, but it’s functional. I used it last week to move stBTC from my Keplr to the BTCFi hub and it worked flawlessly. The real win is earning staking rewards + trading fees at the same time. That’s not something you get on Uniswap. It’s like DeFi meets compound interest. 🤝

the fact that you call it a 'lifeline' means you're already brainwashed. this is a glorified testnet. nobody uses this. if it were real it'd have 100x the volume. also why is everyone pretending iBC is hard? its just another bridge. stop acting like you're a crypto monk

It’s not that the volume is low - it’s that the user base is intentionally narrow. That’s not a flaw. It’s a feature. Most DEXs are designed to attract speculators. This one is designed to serve a specific technical niche. If you don’t need BTCFi liquidity on Cosmos, you don’t need this. Simple.

OH MY GOD I JUST LOST 400 DOLLARS ON XPRT/ATOM AND NOW I’M CRYING IN THE BATHROOM. WHO LET THIS HAPPEN? I THOUGHT THIS WAS A DEX NOT A ROULETTE WHEEL. THE SLIPPAGE WAS WORSE THAN A FED MEETING. I’M NEVER TRUSTING COSMOS AGAIN

While it's true that Persistence DEX lacks the liquidity and polish of larger platforms, its architectural integrity deserves recognition. The integration of staking rewards with liquidity provision creates a sustainable economic model that incentivizes long-term participation rather than short-term speculation. This is not merely a trading interface - it is a governance-aligned infrastructure for a nascent financial layer. One must consider the context of its development: a small team, limited resources, and a clear vision. The fact that it operates without a single reported exploit speaks volumes about its design philosophy.

Oh wow, a crypto project that doesn’t try to be everything to everyone? What a radical concept. Next they’ll tell us Bitcoin isn’t supposed to be a meme coin. America built the moon landing, not some Cosmos sidechain with 4k in volume. This is why we can’t have nice things.

lol i tried this once. spent 3 hours trying to send xprt from kucoin. ended up just buying btc on binance and calling it a day. why make life harder?

It is not the lack of volume that renders Persistence DEX insignificant - it is the absence of institutional validation. No audit. No legal entity. No tier-1 venture backing. This is the digital equivalent of a garage workshop claiming to build fighter jets. The architecture may be elegant, but elegance without authority is mere ornamentation.

There’s a quiet beauty in building something so specific that the world ignores it. Most projects scream for attention - they want to be the next Uniswap, the next SushiSwap, the next Pancake. But Persistence DEX doesn’t care. It’s not trying to be the center of the universe. It’s trying to be the quiet corner where Bitcoin’s DeFi soul can breathe without Ethereum’s noise. That’s not niche - it’s spiritual. And maybe, just maybe, that’s the future: not bigger, but more intentional.

YES! This is exactly what crypto needs right now - not another 500-token swap platform with 10,000 bots, but a focused, thoughtful tool for people who actually understand what they’re doing. I’ve been staking XPRT for 8 months and adding liquidity to XPRT/ATOM has been the most consistent yield I’ve ever seen. The UI is clunky? Yes. But the results? Real. Keep going, Persistence team - you’re doing important work! 💪✨

Look, if you’re scared of IBC or low volume, you’re not ready for this space. Persistence DEX isn’t for people who want hand-holding. It’s for people who want real DeFi - the kind that doesn’t rely on Ethereum’s bloated infrastructure. I’ve made more consistent returns here in 3 months than I did on Uniswap in a year. Stop complaining about the UI and learn how to use it.

Anyone else notice how the XPRT/ATOM pair dominates volume? That’s not a coincidence. It means the real users aren’t swapping BTC - they’re moving between Cosmos chains. So is this really a BTCFi DEX, or just a Cosmos liquidity router with BTC as a side feature?

It is a fascinating, if profoundly underwhelming, artifact of ideological purity in a landscape dominated by greed. The insistence on non-Ethereum infrastructure is noble, yet the lack of audit and the minuscule liquidity render it a theoretical exercise - a museum piece of DeFi idealism, preserved in amber, never to be touched by the real economy. One cannot build a financial system on virtue alone.

Low volume ≠ bad. It means it’s for the right people. If you need deep liquidity, go to Osmosis. If you want BTCFi without Ethereum, this is it. Simple.

IBC is a nightmare. The docs are written by people who think ‘user-friendly’ means ‘not crashing’. This isn’t DeFi - it’s a beta test for a blockchain lab. And the fact that they’re calling it ‘BTCFi’ when 80% of volume is XPRT/ATOM? That’s marketing spin with a side of delusion.

I respect the vision, but the execution is still rough. I’ve had two transactions fail mid-IBC transfer and had to wait 4 hours for a refund. The team needs to fix the reliability before they start calling it ‘elegant’.

Okay, I’ll admit - I was skeptical. But I tried swapping 100 XPRT for ATOM and it worked. The UI is clunky, but the speed? Insane. 78ms settlement. I’ve seen Ethereum L2s take longer. And the fact that I earned staking rewards on top? That’s the real magic. I’m not a crypto bro - I just want to earn yield without paying $15 in gas. This delivers.

maybe the volume is low because most people dont know about it or theyre scared of the learning curve but if you stick with it it actually works pretty well. i used to hate iBC but now i think its kind of cool how it just talks to other chains. its like magic but slower and with less drama than ethereum

Let me be blunt: this is a glorified liquidity aggregator for a tokenomics experiment with zero real adoption. The ‘BTCFi’ branding is a desperate attempt to ride a hype wave. The only people using this are those who already hold XPRT and have nothing better to do. It’s not innovation - it’s inertia disguised as vision.

As someone who moved from Toronto to Vancouver to get into Cosmos DeFi, I can say this: Persistence DEX is the quiet hero of the ecosystem. I use it daily to move stATOM to XPRT and back. The UI isn’t pretty, but it’s reliable. And yes, the volume is low - but that’s because it’s not for tourists. It’s for the builders who stay. Keep going, team. Canada’s rooting for you 🇨🇦

you call this a dex? its a side project with a website. i bet the devs still use a free cloudflare account. also why is the fee 0.3%? no one even knows. i think they just copied it from uniswap and forgot to change it

I used to think DeFi was all about big numbers - volume, TVL, hype. But this? This made me rethink everything. I’m not a trader. I’m just someone who wants to earn while holding. Persistence DEX lets me do that without jumping through 10 hoops. The UI is basic, sure - but the experience? Peaceful. Like a quiet forest after a storm. And yes, I cried when my first swap went through. It felt like winning a tiny, invisible battle.

Of course it’s low volume - you’re not supposed to be here unless you’re already deep in the Cosmos rabbit hole. If you’re still asking ‘why not just use Uniswap?’ then you’re not the target audience. This isn’t for people who think ‘BTC’ means ‘Bitcoin’ - it’s for people who know the difference between WBTC, renBTC, and stBTC. If you don’t, go play with your meme coins. This space doesn’t need you.