Sushiswap v3 on Ethereum: A Real-World Review for Crypto Traders

Sushiswap v3 Concentrated Liquidity Calculator

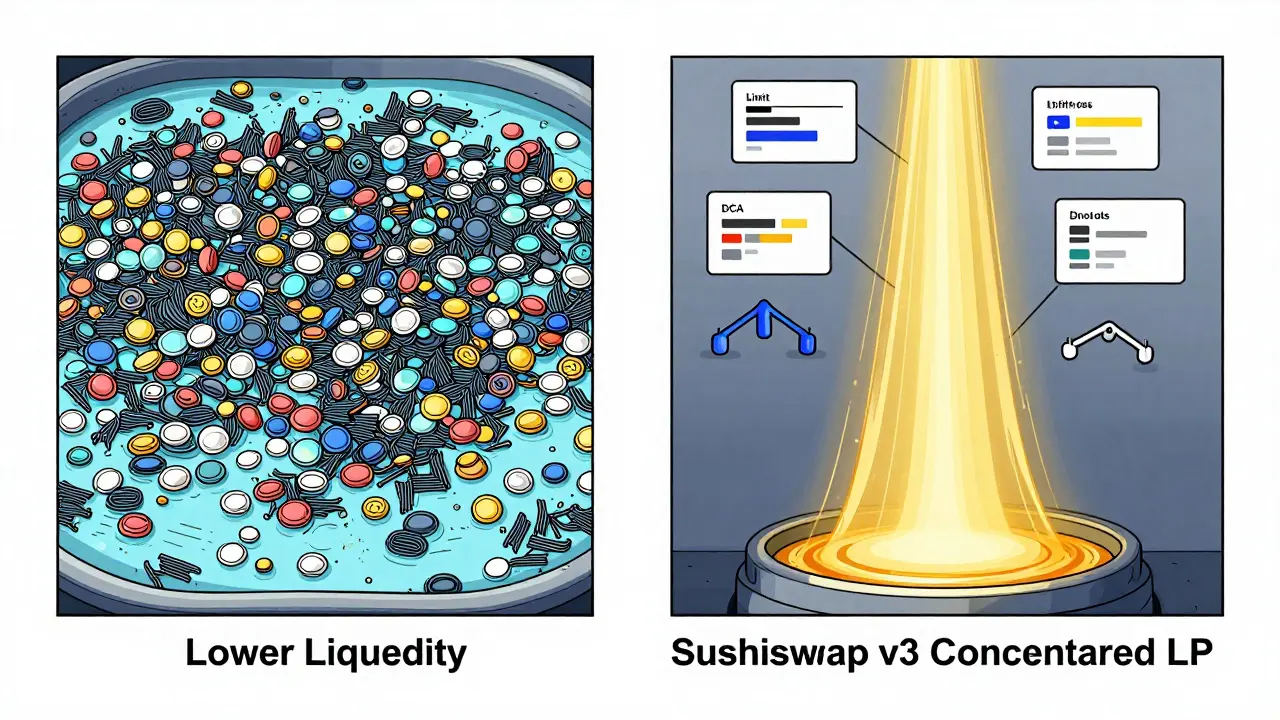

Enter your token pair and price range to estimate fee earnings and impermanent loss risks. Sushiswap v3's concentrated liquidity requires setting a specific price range where your funds are deployed. If the price stays within your range, you earn fees 4,000% more efficiently than v2. But if the price moves outside your range, you earn no fees.

Use the calculator to understand:

- Estimated fee earnings based on current liquidity and fee tier

- Impermanent loss risks when price moves outside your range

- How your position compares to v2 liquidity

Results

When setting your liquidity position:

- Use a 10-20% wider range than current price if you're not actively monitoring

- Set narrower ranges for stable assets (USDC/DAI) where volatility is low

- For volatile assets like ETH, set 30-50% wider ranges to stay active

- Check the Sushiswap Liquidity Position Simulator before depositing

Remember: Sushiswap v3 can earn you 4,000% more fees than v2 when price stays in range, but you must monitor to avoid impermanent loss.

When you’re trading crypto on Ethereum, slippage and high fees can eat into your profits fast. Most people stick with Uniswap because it’s simple and has deep liquidity. But what if you could get better yields, lower slippage on major pairs, and even set limit orders - all without leaving Ethereum? That’s where Sushiswap v3 comes in. It’s not just another fork. It’s a full upgrade designed for traders who want more control, more features, and more ways to earn - if they’re willing to learn how to use them.

What Makes Sushiswap v3 Different?

Sushiswap v3 launched on Ethereum in February 2022 as the third version of a protocol that started as a Uniswap clone with a sushi-themed logo. But it didn’t stay that way. The team rebuilt the core engine - called Trident v3 - to let liquidity providers (LPs) put their funds only where they expect price movement to happen. This is called concentrated liquidity. Instead of spreading your ETH and USDC across a wide price range like in v2, you pick a narrow band - say, between $3,200 and $3,500 for ETH. If the price stays in that zone, your capital earns fees 4,000% more efficiently than in v2, according to Sushiswap’s own benchmarks.This sounds amazing - until you realize how easy it is to mess up. If the price moves outside your range, your position stops earning fees. You’re not out of money, but you’re not earning either. You’re just holding tokens. And if the market swings hard, you could face big impermanent loss. This isn’t passive investing. It’s active trading.

Trading Fees and Liquidity Pools

Sushiswap v3 offers three fee tiers: 0.01%, 0.05%, and 0.3%. Most token pairs use 0.3%. But for stablecoins like USDC/DAI or USDT/USDC, you’ll find pools with 0.05% or even 0.01% fees. These are popular with arbitrageurs and market makers because they reduce slippage. In July 2024, Sushiswap v3 handled $2.8 billion in trading volume on Ethereum alone - about 6.2% of all DEX volume on the chain.Compared to Uniswap v3, Sushiswap’s liquidity is thinner on non-core tokens. For example, a small-cap ERC-20 token might have 35% less liquidity on Sushiswap than on Uniswap, according to Dune Analytics. That means if you’re swapping obscure tokens, you’ll likely see worse prices - sometimes over 15% slippage. Stick to ETH, USDC, DAI, WBTC, and a few top DeFi tokens. That’s where Sushiswap shines.

On-Chain Limit Orders and DCA

Here’s where Sushiswap v3 really pulls ahead. In August 2023, it integrated Orbs’ dLIMIT protocol, allowing users to set on-chain limit orders. That means you can tell the protocol: “Buy 0.5 ETH when it drops to $3,000,” and walk away. The order executes automatically when the price hits your target. No need to watch charts. No need to log in. It’s like having a Coinbase limit order - but without a middleman.Alongside that is dollar-cost averaging (DCA). You can schedule recurring buys of any token - say, $50 of SUSHI every Wednesday. The protocol executes them automatically. This is huge for retail users who want to build positions over time without timing the market. In July 2024, these two features processed $187 million in volume. That’s not a gimmick. It’s real adoption.

Yield Farming and the SUSHI Token

SUSHI is the governance token. Holders vote on protocol upgrades, fee structures, and treasury allocations. But it’s also a yield generator. You can stake SUSHI to earn a share of protocol fees - currently around 0.05% of all trading volume. Or you can provide liquidity in a pool and earn SUSHI rewards on top of trading fees. Some LPs report 20-25% APY on stablecoin pairs, especially when rewards are boosted.But here’s the catch: rewards are not guaranteed. They’re funded by new token emissions, which have dropped significantly since 2021. The protocol now relies more on fee revenue. In 2023, Sushiswap made $42 million in fees. In 2024, it’s on track for $60 million. The team projects $150 million by 2026 - but that depends on volume growth. If users stop trading, the rewards dry up.

How It Compares to Uniswap v3

| Feature | Sushiswap v3 | Uniswap v3 |

|---|---|---|

| Trading Volume (July 2024) | $2.8 billion | $24.1 billion |

| Market Share (Ethereum DEX) | 9.7% | 58.2% |

| Concentrated Liquidity | Yes | Yes |

| On-Chain Limit Orders | Yes (via Orbs) | No |

| Dollar-Cost Averaging | Yes | No |

| Liquidity Depth (Non-Core Tokens) | 35% lower | Higher |

| Interface Complexity | High for LPs | Medium |

| Multi-Chain Support | Yes (40+ chains via SushiXSwap) | Yes (but separate versions) |

Uniswap wins on volume, liquidity, and simplicity. Sushiswap wins on features. If you’re a beginner who just wants to swap ETH for USDT, Uniswap is easier. But if you’re serious about earning, setting trades in advance, or moving between chains, Sushiswap gives you tools Uniswap doesn’t.

Security and Reliability

Sushiswap v3 has been audited by OpenZeppelin and Trail of Bits - two of the most respected names in DeFi security. There’s also a $250,000 bug bounty program on Immunefi. No major exploits have occurred since launch. Gas fees on Ethereum average $1.20-$3.50 per transaction, depending on network congestion. That’s higher than Layer 2s, but still manageable for active traders.Still, risks exist. The biggest one? Impermanent loss. If you set a narrow price range during a volatile market - say, ETH between $3,100 and $3,300 - and the price shoots to $3,800, you’re left holding only USDC. You missed the upside. You didn’t lose money, but you lost opportunity. Many users on Reddit report losing 15-20% this way. It’s not a bug. It’s how concentrated liquidity works.

Who Should Use Sushiswap v3?

- Active traders who want limit orders and DCA without leaving DeFi.

- Yield farmers looking for extra SUSHI rewards on stablecoin pools.

- Multi-chain users who want to swap ETH for AVAX or MATIC without bridging manually.

- Experienced DeFi users comfortable managing price ranges and understanding impermanent loss.

Don’t use it if:

- You’re new to crypto and don’t know what gas fees or impermanent loss are.

- You want to trade low-liquidity tokens - use Uniswap or a centralized exchange instead.

- You expect passive income without monitoring your positions.

Getting Started

You need:- An Ethereum wallet (MetaMask, Trust Wallet, or Coinbase Wallet)

- Ethereum for gas (ETH)

- At least 30 minutes to learn the interface

Start with swapping. Go to app.sushi.com, connect your wallet, pick a token pair, and swap. It’s like Uniswap. Then try adding liquidity. Pick a stablecoin pair, set a price range 10% wider than the current price, and see how fees accumulate. Use the new Liquidity Position Simulator tool to test ranges before committing real funds.

Once you’re comfortable, enable limit orders and DCA. These are under the “Trade” tab. Set your targets. Walk away. The protocol handles the rest.

Community and Support

Sushiswap has one of the most active DeFi communities. Discord has over 42,000 members. Telegram has 28,000. The Discourse forum has detailed guides on liquidity management, fee tiers, and how to avoid common mistakes. New users report that the Japanese-themed UI - with names like BentoBox and Kashi - actually helps them understand DeFi concepts faster than dry technical terms.Customer support on Trustpilot gets a 3.7/5 rating. Most users say issues are resolved within 48 hours. That’s unusually fast for a DeFi protocol.

The Future of Sushiswap v3

In July 2024, the team announced “Concentrated Liquidity 2.0,” coming in Q1 2025. This update will include dynamic fee adjustments based on volatility, better price oracles, and a simpler governance system. If they deliver, Sushiswap could reclaim lost market share. Some analysts predict it could hit 12-15% of Ethereum DEX volume by 2026.But the big question remains: Can it earn enough in fees to sustain rewards without burning through SUSHI tokens? Right now, the protocol relies on incentives. Once those fade, will users stay? Only time will tell.

Final Verdict

Sushiswap v3 isn’t the easiest DEX on Ethereum. It’s not the biggest. But it’s the most ambitious. It’s the only one that gives retail traders the tools of a hedge fund - limit orders, DCA, cross-chain swaps - without requiring a KYC form. If you’re ready to move beyond basic swaps and start managing your positions like a pro, Sushiswap v3 is worth your time. Just don’t treat it like a savings account. It’s a trading platform. And like any good trading tool, it rewards skill, not luck.Is Sushiswap v3 safe to use on Ethereum?

Yes, Sushiswap v3 is considered safe for experienced users. It has been audited by OpenZeppelin and Trail of Bits, and it runs a $250,000 bug bounty program through Immunefi. No major exploits have occurred since its 2022 launch. However, like all DeFi protocols, it carries smart contract risk. Always use a non-custodial wallet, never share your seed phrase, and only interact with the official app.sushi.com site.

How do I earn rewards on Sushiswap v3?

You earn rewards in two ways. First, by providing liquidity to a trading pair - you get a share of the 0.01%, 0.05%, or 0.3% trading fees. Second, by staking your LP tokens or SUSHI tokens, you can earn additional SUSHI rewards. The highest yields are typically found in stablecoin pools like USDC/DAI, where rewards are boosted to attract liquidity. Always check the current APY on the app before depositing.

What’s the difference between Sushiswap v2 and v3?

Sushiswap v2 used a constant product formula where liquidity was spread evenly across all price ranges. That meant capital was inefficient - you earned fees even when the price wasn’t moving. v3 introduced concentrated liquidity, letting you focus your funds within custom price ranges. This boosts capital efficiency by up to 4,000% but requires active management. v3 also added limit orders, DCA, and improved cross-chain support - none of which existed in v2.

Can I use Sushiswap v3 on mobile?

Yes. You can access Sushiswap v3 through any Ethereum-compatible mobile wallet like MetaMask or Trust Wallet. Just open the wallet browser, go to app.sushi.com, and connect. The interface is fully responsive and works well on smartphones. However, managing concentrated liquidity positions is easier on a desktop due to screen size and precision controls.

Why is my liquidity position not earning fees?

Your liquidity position only earns fees when the token price stays within the range you set. If the price moves outside that range, your position becomes inactive. For example, if you set a range for ETH between $3,200 and $3,400 and ETH rises to $3,600, you’ll only hold USDC and earn no fees until the price comes back down. Use the Liquidity Position Simulator tool to test ranges before depositing.

Does Sushiswap v3 work with Layer 2 networks like Arbitrum or Optimism?

The core Sushiswap v3 protocol runs only on Ethereum mainnet. However, SushiXSwap - a separate bridge feature - lets you swap tokens across 40+ chains, including Arbitrum, Optimism, Polygon, and Avalanche. You can swap ETH on Ethereum for MATIC on Polygon, for example, without manually bridging. But the actual liquidity pools and concentrated liquidity features are only available on Ethereum.

Is SUSHI token worth holding?

SUSHI’s value comes from governance rights and a share of protocol fees - currently 5% of all trading fees. But since 2022, its price has declined as token emissions were reduced. Holding SUSHI makes sense if you plan to vote on protocol changes or stake it for additional rewards. But don’t hold it expecting price appreciation. Its utility is functional, not speculative. Many users treat it like a utility token, not an investment.

13 Comments

i just tried sushiswap v3 last week and wow the limit orders are a game changer

set my buy at $3000 for eth and went to sleep

woke up with my eth and didn't even have to check my phone

why did i wait this long

oh wow so now we're pretending concentrated liquidity is magic and not just 'active trading with extra steps'?

congrats, you turned your wallet into a day trading simulator

and yes, i'm still waiting for the 'impermanent loss' fairy to show up with a refund

the real question isn't whether sushiswap v3 is better than uniswap-it's whether we've confused financial engineering with financial wisdom

concentrated liquidity is elegant math, but it's still just a leveraged bet on price stability

when you're betting your capital on a 5% price band, you're not optimizing yield-you're gambling on market indifference

and the irony? the very feature meant to increase efficiency-narrow ranges-requires constant monitoring, which defeats the whole point of decentralized, hands-off finance

we're not building a better DEX-we're building a better trading floor

and the real tragedy? the people who need this tool the least-the ones who already understand volatility-are the ones who use it

while the ones who need protection-the retail investors-are the ones who get burned trying to 'set it and forget it'

the sushiswap team didn't democratize finance-they just made it more complex for the same people who already struggle with gas fees

we call this innovation, but it's really just sophistication as a barrier to entry

and yet, somehow, we still think this is progress

you got this

limit orders + DCA = your new best friends

start small, watch the fees stack, you got this

no stress, just strategy

you're already ahead just by reading this

the fact that sushiswap offers on-chain limit orders while uniswap still doesn't is a quiet revolution

it's not flashy, but it's the kind of quiet innovation that actually helps real people

you don't need to be a trader to benefit from automation

you just need to be tired of watching charts

if you're new to this just swap eth for usdc first

then maybe try a stable pool

don't touch narrow ranges yet

you'll thank me later

I just set up my first DCA on SUSHI... I'm so proud of myself... I did it... I didn't panic... I didn't sell... I just let it happen... and now I'm crying a little... this is the future... I'm finally part of it... I'm not just a spectator anymore... I'm a participant... I'm a DeFi warrior... and I'm not going to let anyone tell me I'm not ready... I'm ready... I'm ready... I'm ready...

i appreciate the breakdown but the interface still feels overwhelming

maybe a video walkthrough would help more people like me

not everyone wants to read a 10k-word guide just to swap tokens

so uniswap has more volume but sushiswap has the cool features

kinda like how tesla has better tech but toyota sells more cars

who cares if you're the niche option if you're the one with the real tools

also limit orders on chain? yes please

why is uniswap still sleeping

as someone who's been using sushiswap for over a year now, i can say the liquidity provider simulator is the most underrated tool here

before i started using it, i lost like 12% on a bad range for usdc-wbtc

after i learned to simulate first, my losses dropped to under 2%

and the dca feature? i've been buying 25$ of sushi every tuesday since last june

it's not exciting, but it's consistent

and honestly, the community discord is way more helpful than any tutorial

people actually answer questions there, even the noobs

and yes, the bento box name confused me at first too

but once you realize it's just a yield aggregator, it makes sense

also, don't trust apys that look too good

if it's over 30%, it's probably burning through emissions

the real yield is in the fees now, not the token rewards

and the fact that they're planning concentrated liquidity 2.0? that's huge

dynamic fees based on volatility could finally make this usable for everyone, not just the algos

i'm not saying sushiswap is perfect, but it's the only one trying to make advanced tools accessible

uniswap just keeps doing the same thing better

sushiswap is trying to do something new

and that matters

THIS IS A SCAM

sushiswap is just uniswap with extra steps and a cute logo

they're pumping sushis token like it's memecoin

and now they want you to set limit orders? LOL

you think you're smart but you're just feeding the machine

impermanent loss is a silent killer and they don't warn you

my friend lost 40k because he set a 2% range during a pump

he cried for 3 days

and now they're calling it 'innovation'

it's not innovation, it's predatory design

and don't even get me started on the 'sushi-themed UI'-it's just a distraction for people who can't do math

they want you to think you're a pro while you're getting rekt

they're not helping you-they're harvesting your ignorance

and the audits? please

openzeppelin audited mln of scams

it means nothing

the only thing that matters is your money

and your money is not safe here

limit orders work. dca works. narrow ranges are risky. stick to stable pairs if you're learning.

that's it.

you guys are overthinking this

sushiswap v3 is the only dex that actually respects your time

uniswap is for people who like watching graphs

sushiswap is for people who want to live their lives

if you're not using limit orders and dca, you're leaving money on the table

and if you're scared of impermanent loss, you shouldn't be in crypto at all

this isn't a savings account-it's a trading platform

and if you can't handle that, get out now

but don't pretend the problem is the tool

the problem is you not leveling up