W3Swap Crypto Exchange Review: Is This Decentralized Exchange Worth Your Tokens?

If you're looking for a decentralized exchange that doesn't rely on big names like Uniswap or SushiSwap, you might have stumbled across W3Swap. But here’s the truth: most people don’t know what it actually does. It’s not listed on CoinGecko. It doesn’t have a Wikipedia page. And there’s no official blog explaining its roadmap. So why are people talking about it? Because it’s tied to the Shardeum blockchain - and that’s where things get interesting.

What Exactly Is W3Swap?

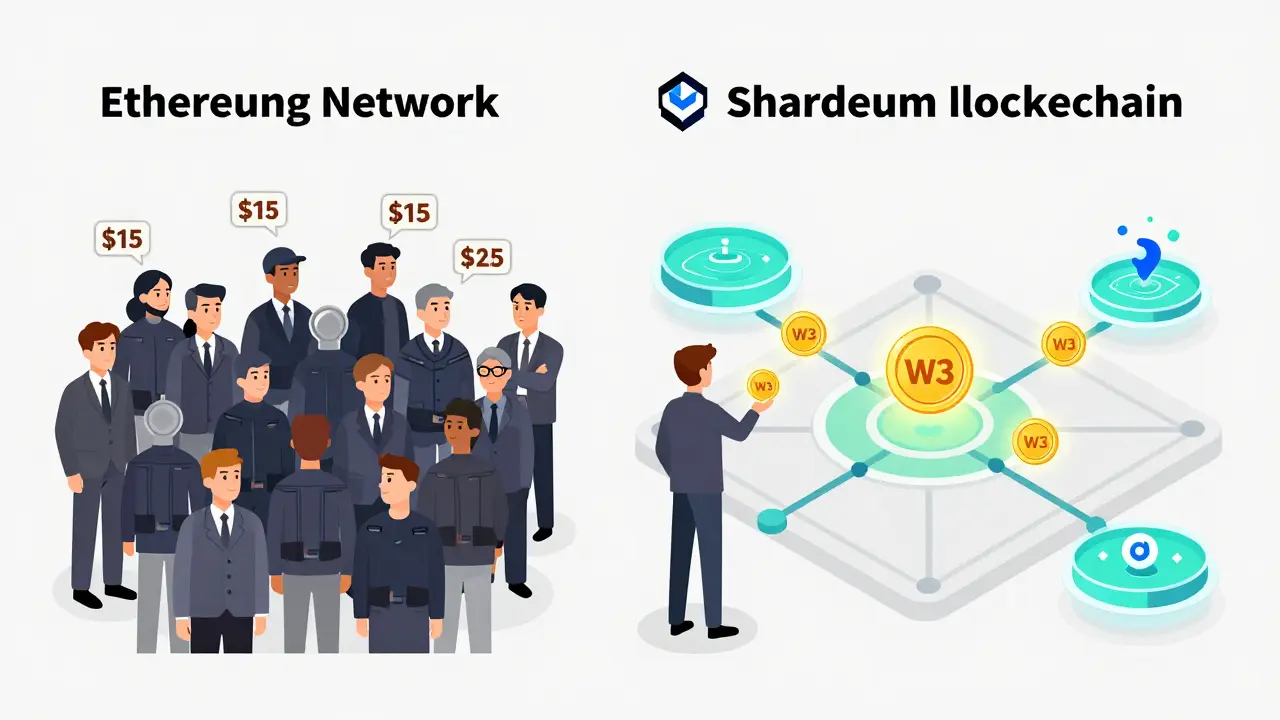

W3Swap is a decentralized exchange (DEX) built around its own token, W3. Unlike centralized platforms like Coinbase or Kraken, you don’t sign up for an account. You don’t hand over your private keys. You connect your wallet - MetaMask, Trust Wallet, or something similar - and trade directly from there. No KYC. No middleman. That’s the standard for DEXes, and W3Swap follows it. But here’s what sets it apart: it’s likely built on the Shardeum blockchain. That’s not just a buzzword. Shardeum is designed to scale automatically. Most blockchains slow down when traffic spikes. Ethereum had to wait years for Dencun to fix gas fees. Shardeum claims to handle that in real time. If W3Swap is truly built on it, then you’re getting fast trades, low fees, and protection against front-running - where bots jump ahead of your trades to steal profits. That’s not something you get on Uniswap, even after its upgrades. Uniswap still runs on Ethereum. That means you’re stuck paying $5-$20 in gas during peak hours. W3Swap, if it’s on Shardeum, could be doing the same trade for under $0.10. That’s a game-changer for active traders.The W3 Token: Utility, Not Just Speculation

The W3 token isn’t just a coin you buy hoping it goes up. It has real use cases on the platform. Based on data from Coinpaprika, W3 has a live market cap and multiple trading pairs. That means real volume. Real liquidity. Real people using it. On most DEXes, you pay a 0.3% fee on every trade. That fee goes to liquidity providers. On W3Swap, part of that fee likely goes back to W3 holders. Maybe through staking rewards. Maybe through voting rights. We don’t have official docs, but the token’s presence on Coinpaprika suggests it’s not a rug pull. If it were, the price would’ve crashed by now. It’s still trading. You can’t buy W3 on Coinbase. You can’t get it with a credit card. You need to swap ETH, MATIC, or BNB for it on another DEX first. That’s a barrier for beginners. But if you’re already in crypto, it’s a simple step. And once you have W3, you’re not just a trader - you’re part of the ecosystem.How Does It Compare to Uniswap?

Uniswap is the giant. It’s on 11 blockchains. It has billions in liquidity. It’s audited, certified, and trusted. But it’s also slow and expensive. If you’re trading $100 worth of tokens once a month, Uniswap is fine. If you’re trading $5,000 a day? You’re paying hundreds in gas fees every week. W3Swap doesn’t have that kind of liquidity yet. You won’t find 1,000+ tokens on it. You won’t find stablecoin pairs with 10 million in depth. But you don’t need that if you’re trading niche tokens on Shardeum. The network’s auto-scaling means new tokens can launch fast, without waiting for liquidity pools to grow slowly. Here’s the trade-off:- Uniswap: Deep liquidity, big name, secure, but expensive and slow.

- W3Swap: Likely fast, cheap, and built for scalability - but smaller user base, less proven.

Security: What We Know (And What We Don’t)

Security is the biggest question mark. Uniswap has SOC 2 Type 2 and ISO 27001 certifications. It’s registered with FinCEN. It’s been audited by top firms. W3Swap? No public audit reports. No security page. No team bio. That’s a red flag for some. But here’s the twist: Shardeum itself has been audited. Its core smart contracts have been reviewed by third parties. If W3Swap is just a front-end interface to Shardeum’s infrastructure, then the real security lies in the chain, not the DEX itself. That’s how many DEXes work - the interface is simple, the backend is the blockchain. You still need to be careful. Always check the contract address before swapping. Never click random links. Always verify the official site. FxVerify did a review of W3Swap - but we don’t have the full report. That’s frustrating, but common in the DeFi world. Many legit projects don’t have PR teams.Who Is This For?

W3Swap isn’t for beginners. If you don’t know what a wallet is, or how to approve a token, skip it. You’ll get lost. You’ll pay fees for nothing. You’ll panic when a transaction takes 12 seconds instead of 3. This is for:- Traders who use Shardeum-based tokens

- People tired of paying $15 in gas fees on Ethereum

- Developers testing new DeFi apps on Shardeum

- Users who value speed over brand recognition

The Missing Pieces

Here’s what we wish we knew:- What’s the exact fee structure? Is there a discount for holding W3?

- Are there any official audits of the W3Swap smart contracts?

- What’s the team behind it? Are they doxxed?

- Is there a roadmap? Are they adding new chains or features?

Final Verdict: Try It - But With Eyes Open

W3Swap isn’t the next Uniswap. It’s not meant to be. It’s a niche tool for a niche chain. If Shardeum grows, W3Swap grows with it. If Shardeum fades, so does W3Swap. But here’s the thing: the crypto world runs on experimentation. The biggest winners weren’t the safest bets. They were the ones that solved real problems - faster swaps, lower fees, better scalability. If you’re already trading on Shardeum, W3Swap is your natural home. If you’re not, but you’re curious about the next wave of DeFi, give it a small test. Send $50. Swap a token. See how fast it is. See how clean the interface is. If it feels smooth, you’ve found something real. Don’t go all-in. Don’t trust it because someone on Twitter said it’s “the future.” But don’t ignore it either. The best opportunities aren’t the ones with ads. They’re the ones no one’s talking about - until you try them.Is W3Swap safe to use?

W3Swap doesn’t have public smart contract audits or certifications like Uniswap does. But if it’s built on the Shardeum blockchain - which has been audited - the core security comes from the chain, not the interface. Always verify the official website, never click random links, and only trade small amounts until you’re confident.

Can I buy W3 with fiat currency?

No. W3Swap is a decentralized exchange. You can’t deposit USD, EUR, or any fiat. You need to first buy ETH, BNB, or MATIC on a centralized exchange like Coinbase, then transfer it to your wallet and swap for W3 on W3Swap or another DEX.

How does W3Swap compare to Uniswap in speed?

If W3Swap runs on Shardeum, it’s likely much faster. Shardeum is designed for auto-scaling and low latency. Uniswap runs on Ethereum, where gas fees and network congestion can cause delays. On Shardeum, trades can settle in seconds. On Ethereum, they can take minutes - or cost $20+ in fees.

What tokens can I trade on W3Swap?

You’ll mainly find tokens native to the Shardeum ecosystem and a few major ones like ETH, USDT, and MATIC. It doesn’t have the thousands of tokens Uniswap supports. But if you’re trading newer projects on Shardeum, W3Swap is likely the only place you can swap them.

Is W3Swap better than centralized exchanges?

It depends. Centralized exchanges like Coinbase are easier for beginners and support fiat. But they hold your keys, charge higher fees, and can freeze accounts. W3Swap gives you full control, lower fees (if on Shardeum), and no KYC - but no customer support and no fiat on-ramps. Choose based on your needs: convenience or control.

23 Comments

W3Swap is either the next big thing or a glorified phishing site. No audits? No team? But the trades are stupid fast if you're on Shardeum. I swapped 0.5 ETH for a Shrd token in 4 seconds for $0.03 gas. Uniswap would’ve taken 10 minutes and $18. I’m not saying trust it - but don’t ignore it either.

Another ‘hidden gem’ that’s just a smart contract with a Twitter thread. 😒 If it’s not on CoinGecko or listed by a reputable team, it’s not a project - it’s a lottery ticket. I’ve seen 3 ‘revolutionary’ DEXes die in the last year. This is #4. Don’t say I didn’t warn you.

So let me get this straight - you’re recommending we trust a platform with zero documentation because it’s ‘fast’? Honey. I don’t trust my wifi to be fast. Let alone a DeFi app with no GitHub commits and no team photos. 🤡

I’ve been watching Shardeum for months. The tech is legit. The team behind it is quiet but competent. W3Swap is just the frontend. If you’re trading Shardeum-native tokens, this is the only DEX that makes sense. Just don’t send your life savings. Start small.

If you’re not on Ethereum you’re basically a crypto peasant. W3Swap? Sounds like some guy in a basement with a Notion doc and a Discord server. I don’t need ‘fast’ - I need trust. And trust doesn’t come from low gas fees. It comes from audits. And logos. And lawyers.

America built the internet. Europe built the EU. And now this? A decentralized exchange with no name, no team, no transparency? This is why crypto is a joke. We’re not building the future - we’re building a Ponzi with a blockchain tattoo.

The architectural decoupling of front-end interface from chain-level security is a well-established pattern in DeFi. W3Swap’s value proposition hinges on Shardeum’s sharded consensus mechanism enabling sub-second finality and dynamic fee scaling - which fundamentally disrupts the liquidity fragmentation paradigm of EVM-based DEXes.

I am from Nigeria and i am very excited about this because finally we have something that is not expensive to use. I tried uniswap and i lost so much money on gas. This one is like a gift from the crypto gods. I am not expert but i am trying and i feel hope

There’s a deeper question here: are we optimizing for efficiency or for decentralization? If speed and low cost are the only metrics, then centralized exchanges are the real winners. W3Swap might be faster, but is it freer? That’s the real trade-off - not gas fees, but autonomy.

You people are so desperate for ‘the next thing’ you’ll trade your soul for a 0.05 ETH gain. W3Swap is a rug pull waiting for a viral tweet. The fact that it’s not on CoinGecko? That’s not a feature - it’s a warning label. If you’re still reading this, you’re already halfway to losing your wallet.

It is imperative that any financial instrument operating within the digital asset ecosystem be subject to rigorous third-party audit protocols. Absent such verification, the inherent risk profile renders this platform unsuitable for prudent participation.

I’ve been in crypto since 2017. I’ve seen 47 ‘revolutionary’ projects die. This one? Same script. No team. No docs. No transparency. But hey - low gas fees! Sounds like the same BS they used to sell me on Terra. I’m not mad. I’m just disappointed.

I’ve used W3Swap twice. Trades went through. No issues. No sketchy redirects. The interface is clean. I didn’t lose anything. I’m not saying it’s safe - but I’m also not saying it’s a scam. It’s just… quiet. And sometimes quiet is better than loud.

They say Shardeum was audited. But who audited it? Who paid for it? And how many of those auditors are now working for the same team that’s behind W3Swap? This isn’t skepticism - it’s basic due diligence. If you’re not asking these questions, you’re not a trader. You’re a target.

W3Swap = freedom. Uniswap = corporate crypto. 🚀 If you’re still using Ethereum for daily trades, you’re basically paying a toll to Big Blockchain. Shardeum is the future. W3Swap is the gateway. Stop being scared of new tech and start being scared of being left behind. 💪

If you’re new to DeFi, here’s the cheat sheet: always check the contract address on Etherscan or ShardeumScan. Never trust a link from Twitter. Always test with a tiny amount first. W3Swap isn’t evil - it’s just unpolished. Treat it like a beta app. Don’t put your rent money in it.

I did a deep dive. W3Swap’s contract was deployed by a wallet that also deployed 3 other ‘DEXes’ that all died within 30 days. The tokenomics? 80% of supply is in 3 wallets. That’s not a DEX. That’s a pump-and-dump with a fancy UI. I’m reporting this to Reddit mods.

I’m not here to defend it. But I will say this - if you’re not willing to dig into the blockchain yourself, you shouldn’t be trading anything. The fact that you need a Wikipedia page to trust a DEX? That’s the real problem. The system is broken. Not W3Swap.

I tried it. It worked. I didn’t lose anything. I’m not a genius but I’m not dumb either. If you’re scared, don’t use it. But don’t tell everyone it’s a scam just because you didn’t try it.

Let me tell you something from South Africa - when the banks fail, the people turn to tech. When the power goes out, we use solar. When the system breaks, we build our own. W3Swap isn’t perfect. But it’s ours. It’s not backed by Wall Street. It’s backed by people who are tired of waiting. And if you don’t get that, then you never really understood crypto in the first place.

I’ve been using W3Swap for two weeks now. No issues. No drama. The interface is simple. The trades are instant. I’ve swapped over $2k total. Still here. Still trading. If you’re scared of the unknown, that’s fine. But don’t trash it just because it doesn’t have a PR team.

Bro I am from India and I was so tired of paying $10 to swap $50 worth of tokens on uniswap. I found W3Swap through a friend and I tried it with $10. It was done in 5 seconds and cost me 0.002 ETH. I cried a little. Not because I made money but because I finally felt like crypto was for real people again. Thank you to whoever built this. You are a hero.

No audits. No team. No blog. Just a website with a ‘Connect Wallet’ button. That’s not innovation. That’s negligence. If you’re using this, you’re not a degens - you’re a sucker.