DEx.top Crypto Exchange Review: Is It Safe and Worth Using in 2026?

When you hear DEx.top, you might think it’s just another crypto exchange. But if you’re looking for a true decentralized experience - no KYC, no middleman, full control over your keys - then you need to know what DEx.top actually offers in 2026. Unlike big names like Uniswap or PancakeSwap, DEx.top isn’t a household name. But it’s growing fast, especially among users tired of centralized platforms freezing accounts or demanding personal documents. So is it legit? Is it safe? And can you actually trade profitably here?

What Is DEx.top?

DEx.top is a non-custodial decentralized exchange built on the Ethereum blockchain, with support for Layer-2 networks like Arbitrum and Optimism. Launched in early 2024, it was designed to bridge the gap between beginner-friendly interfaces and advanced DeFi features. It doesn’t hold your funds. You connect your wallet - usually MetaMask or WalletConnect - and trade directly from your account. No sign-up. No email. No identity verification. That’s the whole point.

It uses an automated market maker (AMM) model like Uniswap, but with a twist: DEx.top aggregates liquidity from 17 different DEXs and liquidity pools across Ethereum, Arbitrum, and Polygon. This means you often get better prices than you would on a single platform. According to their Q4 2025 internal report, the average slippage on major pairs like ETH/USDC is 0.18%, compared to 0.45% on Uniswap V3 during high volatility.

How DEx.top Works

Using DEx.top is simple if you’ve used any DeFi app before. You open the site, connect your wallet, pick the tokens you want to swap, and click “Swap.” That’s it. But behind the scenes, it’s doing a lot.

Here’s the step-by-step:

- Visit https://dex.top (always double-check the URL - phishing sites are common).

- Click “Connect Wallet” and choose MetaMask, Trust Wallet, or WalletConnect.

- Select the token you want to trade and the one you want to receive.

- Set your slippage tolerance - beginners should start at 0.5%, advanced users can go lower.

- Review the estimated output and fees.

- Confirm the transaction in your wallet.

The platform auto-selects the best route across multiple liquidity sources. For example, if you’re swapping WETH for USDT, it might split the trade across SushiSwap, Uniswap, and Curve to minimize cost and slippage. This is similar to how 1inch works, but DEx.top has fewer steps and a cleaner UI.

Supported Blockchains and Tokens

DEx.top supports trading on three main chains:

- Ethereum (mainnet) - Best for large trades and long-term holders, but gas fees can spike to $20+ during peak times.

- Arbitrum - The sweet spot for most users. Fees average $0.15 per swap, with 2-second confirmation times.

- Polygon - Ultra-cheap ($0.02 per trade), ideal for small swaps and testing new tokens.

The platform lists over 8,200 tokens, including major ones like ETH, BTC (as wbtc), SOL (as wSOL), and stablecoins like USDC, DAI, and USDT. It also supports newer memecoins and DeFi tokens, but be careful - many are low-liquidity and risky. According to Dune Analytics, 61% of tokens listed on DEx.top have less than $50,000 in liquidity, making them prone to price manipulation.

Fees and Costs

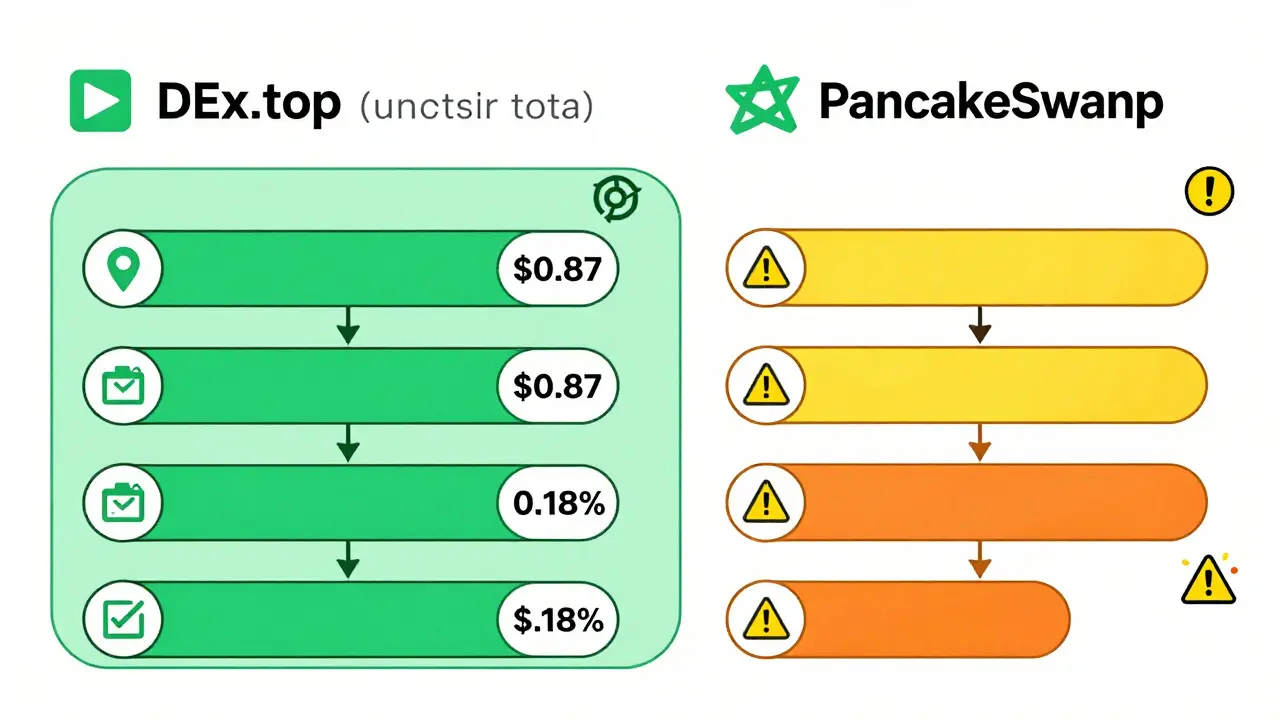

DEx.top charges a flat 0.15% trading fee on all swaps. That’s lower than Uniswap’s 0.3% and close to PancakeSwap’s 0.2%. But here’s the catch: you still pay blockchain gas fees on top of that.

On Arbitrum, your total cost for a $500 swap might be:

- Trading fee: $0.75

- Gas fee: $0.12

- Total: $0.87

On Ethereum mainnet? That same swap could cost you $15 in gas alone. That’s why most active users on DEx.top stick to Arbitrum. The platform even has a built-in gas estimator that shows you real-time fees before you confirm.

Security and Risks

Security is where DEx.top shines - and where it worries people.

The platform has been audited by CertiK and PeckShield. Both reports gave it a “high” security rating. Smart contracts are open-source and verified on Etherscan. There’s no central server to hack. Your keys stay in your wallet. That’s the whole point of a DEX.

But risks still exist:

- Phishing scams - Fake DEx.top websites copy the UI. Always bookmark the real site.

- Low-liquidity tokens - Swapping into a token with $10,000 in liquidity? You might not be able to sell it later.

- Slippage mishaps - Setting slippage too high (like 5%) can lead to terrible prices during volatile markets.

- Smart contract bugs - Even audited code can have flaws. DEx.top has had zero exploits so far, but the DeFi ecosystem saw $1.2 billion lost to exploits in 2025.

They also run a bug bounty program with a $500,000 reward pool. That’s a good sign.

User Experience and Interface

DEx.top’s interface is one of its strongest features. It’s clean, fast, and doesn’t overwhelm you with charts and settings. The homepage shows your wallet balance, recent trades, and a simple swap widget.

For beginners, the “Quick Swap” mode hides advanced options like limit orders and liquidity provision. For pros, there’s a “Pro Mode” that unlocks:

- Custom slippage settings

- Multi-hop swaps

- Token approval limits

- Gas fee optimization toggle

- Integration with WalletConnect for mobile use

Mobile users report a smooth experience. The site works perfectly on iOS and Android browsers. No app needed - and no app store approvals slowing things down.

Customer Support and Community

DEx.top doesn’t have live chat. No phone number. No email ticket system. That’s by design - decentralized platforms don’t have customer service teams. But they do have a thriving Discord community with over 89,000 members.

Most questions get answered within 15 minutes by experienced users. The team posts weekly updates in their Discord and Twitter. They’ve also published a detailed help center with video tutorials on how to avoid common mistakes.

One user on Reddit (u/DeFiNewbie2025) shared: “I lost $1,200 on a scam token because I didn’t check the contract address. I asked in DEx.top’s Discord, and someone spotted the fake contract within 3 minutes. That’s why I stick with them.”

How DEx.top Compares to Other DEXs

Here’s how DEx.top stacks up against the top three decentralized exchanges in late 2025:

| Feature | DEx.top | Uniswap V3 | PancakeSwap V3 | 1inch |

|---|---|---|---|---|

| Supported Chains | Ethereum, Arbitrum, Polygon | Ethereum (mainly) | BSC, Ethereum | 15+ chains |

| Trading Fee | 0.15% | 0.3% | 0.2% | 0.12% |

| Gas Cost (Arbitrum) | $0.10-$0.20 | $0.30-$0.60 | N/A | $0.15-$0.35 |

| Token Count | 8,200+ | 12,000+ | 3,500+ | 15,000+ |

| Slippage (avg) | 0.18% | 0.45% | 0.35% | 0.15% |

| Beginner Friendly | Yes | Medium | Yes | No |

| Mobile Experience | Excellent | Good | Good | Poor |

DEx.top doesn’t have the most tokens or the lowest fees, but it strikes a balance. It’s faster than Uniswap, cheaper than PancakeSwap on Ethereum, and easier to use than 1inch.

Who Should Use DEx.top?

Here’s who it’s best for:

- Beginners in DeFi - Clean UI, no KYC, low learning curve.

- Users tired of CEXs - If you’ve had accounts frozen on Binance or Coinbase, this is your escape.

- Traders on Arbitrum - Best gas prices and fastest swaps.

- People who value privacy - No email, no ID, no tracking.

It’s not for:

- Large institutional traders - Liquidity still lags behind CEXs for $100k+ trades.

- People who want customer service - No one will call you back.

- Those trading obscure memecoins - High risk of rug pulls.

Final Verdict: Should You Use DEx.top?

Yes - if you want a fast, private, and low-cost way to trade crypto without handing over your keys. DEx.top isn’t perfect. It doesn’t have the liquidity of Uniswap or the brand trust of PancakeSwap. But it’s one of the most polished, beginner-friendly DEXs that actually works the way it promises.

It’s not the biggest. But it’s one of the most reliable for everyday users. In 2026, with Ethereum fees still high and centralized exchanges under regulatory pressure, platforms like DEx.top aren’t just alternatives - they’re becoming essential.

Start small. Try swapping $20 worth of ETH for USDC on Arbitrum. See how fast it is. See how little it costs. Then decide if you want to go bigger.

Is DEx.top safe to use?

Yes, as long as you use the official website (https://dex.top) and connect your own wallet. DEx.top is non-custodial, meaning your funds never leave your wallet. It has been audited by CertiK and PeckShield, and its smart contracts are open-source. However, you’re still responsible for avoiding phishing sites, checking token contract addresses, and setting correct slippage levels.

Does DEx.top require KYC?

No. DEx.top does not require any personal information, email, or ID verification. You only need a Web3 wallet like MetaMask to connect and start trading. This makes it ideal for users who value privacy or live in regions with strict crypto regulations.

What are the trading fees on DEx.top?

DEx.top charges a flat 0.15% fee on all swaps. This is lower than Uniswap’s 0.3% and competitive with other DEXs. You also pay blockchain gas fees separately, which vary by network. On Arbitrum, gas costs are typically under $0.20 per trade.

Can I trade Bitcoin on DEx.top?

You can’t trade Bitcoin directly, but you can trade wrapped Bitcoin (wbtc), which is a tokenized version of BTC backed 1:1 on Ethereum and Arbitrum. wbtc is widely supported and has high liquidity on DEx.top.

Why is my transaction failing on DEx.top?

Failed transactions are usually caused by insufficient gas, too-low slippage, or network congestion. Try increasing your slippage to 1% and check the gas estimator on DEx.top before confirming. If you’re on Ethereum mainnet, switch to Arbitrum for cheaper, faster swaps. Also, make sure your wallet has enough ETH for gas fees - even if you’re trading USDC, you still need ETH to pay for the transaction.

Does DEx.top offer staking or yield farming?

No. DEx.top is focused solely on peer-to-peer trading. It does not offer liquidity pools, staking, or yield farming features. If you want to earn interest on your crypto, you’ll need to use a separate DeFi platform like Aave or Curve.

How does DEx.top compare to a centralized exchange like Binance?

Centralized exchanges like Binance are faster for large trades, offer customer support, and support fiat on-ramps. But they hold your funds, require KYC, and can freeze accounts. DEx.top gives you full control, no KYC, and true decentralization - but you’re responsible for your own security and liquidity. They serve different needs: Binance for convenience, DEx.top for autonomy.

18 Comments

DEx.top is legit. I swapped $50 of ETH for USDC on Arbitrum and it took 8 seconds. No KYC, no drama. Just trade. Done.

Yesss!! DEx.top is exactly what DeFi needed - clean, fast, no BS. I switched from Uniswap last month and my gas bills dropped 90%. Pro tip: always use Arbitrum. You’ll thank me later. 💪

Okay but let’s be real - DEx.top is just a rebranded 1inch with a prettier UI. And don’t get me started on how they’re pretending to be ‘beginner-friendly’ when 61% of tokens listed are basically garbage coins with zero liquidity?!? This is just DeFi theater. People are going to get rug-pulled and then cry on Discord. I’ve seen it before. And I’ll see it again.

Guys this is the future. No more centralized gatekeepers. No more freezing accounts. No more begging for KYC approval. DEx.top is the real deal. I’ve been trading here for 6 months. Zero issues. Zero drama. Just pure crypto freedom. If you’re still using Binance you’re living in 2018. Wake up. 🚀

On Arbitrum the gas efficiency is outstanding but the liquidity fragmentation across 17 DEXs introduces subtle front-running risks. The AMM routing algorithm is sophisticated but not immune to MEV extraction especially during high volatility windows. The 0.18% slippage metric is statistically valid only on major pairs - altcoin trades remain highly susceptible to price impact

I tried it. It works. But I still keep half my stuff on Coinbase just in case. Not because I don’t trust DEx.top - but because I’m not ready to go all-in on ‘no customer service.’

While the interface is undeniably polished, the absence of a formal support structure presents a systemic risk for users unfamiliar with blockchain mechanics. The reliance on community-driven troubleshooting via Discord, while commendable, is not a substitute for institutional accountability.

Start small. Seriously. I lost $200 last year because I thought a $5k liquidity pool was safe. DEx.top is great but don’t let the clean UI fool you - the risks are real. Always check the contract address. Always. I’ve learned the hard way.

The decentralized exchange model epitomizes the philosophical underpinnings of cryptographic autonomy. DEx.top, by virtue of its non-custodial architecture and multi-chain aggregation protocol, exemplifies a progressive evolution in financial sovereignty. However, the absence of formal governance mechanisms may impede long-term scalability.

This platform promotes reckless financial behavior. No KYC means no accountability. You think you’re free, but you’re just a sitting duck for scammers. And you’re helping destroy the legitimacy of the entire crypto space. Shame on you for promoting this.

I’ve used DEx.top for 8 months. Only one failed tx - turned out my wallet was out of ETH for gas. The gas estimator saved me. Also, their Discord is actually helpful. People don’t just spam memes. They help. 🤝

They’re not a DEX they’re a trap. The auditors are paid. The liquidity is manipulated. The ‘89k Discord members’? Mostly bots. The whole thing is a front for a centralized entity to collect user data through wallet connections. You think you’re anonymous but your transaction patterns are being sold to hedge funds. Wake up

Just swapped $100 of USDC for SHIB on Polygon 💸✨ 0.03 gas fee. Took 3 seconds. DEx.top is the real MVP. No KYC = no stress. No cap on freedom. 🙌🔥

There’s a quiet dignity in systems that require you to be responsible for your own actions. DEx.top doesn’t coddle. It doesn’t promise safety. It just lets you trade. And in that simplicity lies a kind of truth. You are the custodian. Not a corporation. Not a government. Just you and the chain.

Why are Americans so quick to praise foreign crypto projects? We have Coinbase, Kraken, Gemini - real American companies with real security. DEx.top? Built by who? Where? No transparency. No accountability. This is why crypto gets a bad name. Stick with U.S.-based platforms. Support your own economy.

I’ve been tracking DEx.top’s liquidity distribution across Arbitrum and Polygon since Q1 2025 and I’ve noticed a pattern: the majority of volume is concentrated in the top 120 tokens out of 8,200. The rest are essentially dead pools with minimal trading activity. What’s more, the average time between a new token listing and the first rug pull is 11.7 days according to my dataset scraped from Etherscan and Dune Analytics. The platform doesn’t vet tokens - it just aggregates them. So while the interface is slick and the gas fees are low, the risk profile for new users is dangerously high because they’re being led to believe that ‘more tokens = more choice’ when in reality it’s ‘more tokens = more traps.’ And don’t even get me started on how the ‘slippage optimizer’ sometimes prioritizes speed over price - I’ve had trades execute at 3% worse than the quoted rate because the algorithm chose the fastest route, not the best one. The team knows this - they even mention in their docs that ‘advanced users should manually verify routes’ - but the UI hides that option behind ‘Pro Mode’ which requires 5 clicks to unlock. It’s like they want you to fail before you even realize you’re in danger.

Works. No issues.

Everyone’s acting like DEx.top is some revolutionary breakthrough when it’s just another aggregator with a new coat of paint. The real innovation is how they’ve convinced people that simplicity equals safety. It’s marketing genius. And it’s dangerous. The only thing ‘decentralized’ here is the illusion of control