Crypto Security: Protect Your Assets from Scams, Hacks, and Exploits

When you hold crypto, crypto security, the practice of safeguarding digital assets from theft, fraud, and unauthorized access. Also known as digital asset protection, it's not optional—it's the difference between keeping your money and losing it to a phishing site you didn’t even know existed. Most people think security means a strong password. But in crypto, your password doesn’t matter if someone steals your private key. Real security means you control your keys, not an exchange. And that’s where things get tricky.

That’s why self-sovereign identity, a system where you own and manage your digital identity without relying on third parties is becoming essential. Platforms like Kyrrex and blockchain-based verification tools use this to let you prove who you are without handing over your personal data to a central database. It’s not sci-fi—it’s already used by banks in the UAE and hospitals in Europe. Meanwhile, crypto scams, fraudulent schemes designed to trick users into giving up their crypto or private keys are everywhere. Fake airdrops like FAN8, PNDR, and CSHIP don’t exist—but their websites do, and they’re built to steal. Even legit-looking exchanges like Bitcoin.me and 99Ex are traps. If it sounds too easy to get free tokens, it’s a scam. If an exchange has no regulation, no reviews, and no clear team, it’s a ghost.

And then there’s the hidden cost: blockchain security, the underlying protocols and network rules that prevent manipulation, front-running, and MEV exploitation. On Ethereum and other chains, bots watch your trades and jump in front of you to profit before you even confirm. That’s not a glitch—it’s a feature built into the system. Without tools to protect against it, you’re paying a hidden tax every time you swap tokens. Even your favorite exchange might be part of the problem. TradeOgre shut down because it didn’t follow rules. Binance.US stays open because it does. Kraken blocks users in 14 countries because compliance isn’t optional anymore. Security isn’t just about your wallet—it’s about who runs the platform you trust.

You don’t need to be a tech expert to stay safe. You just need to know what to look for. In the posts below, you’ll find real stories of people who lost everything to fake airdrops, got locked out of exchanges that vanished overnight, and learned the hard way why no-KYC platforms can’t be trusted. You’ll see how Venezuelans use crypto to survive inflation, how Nigerian traders avoid bank freezes with P2P, and why UAE regulations are making crypto safer for everyone. These aren’t theory pieces—they’re lessons from the front lines. Read them. Learn them. Then protect your crypto like your life depends on it—because it does.

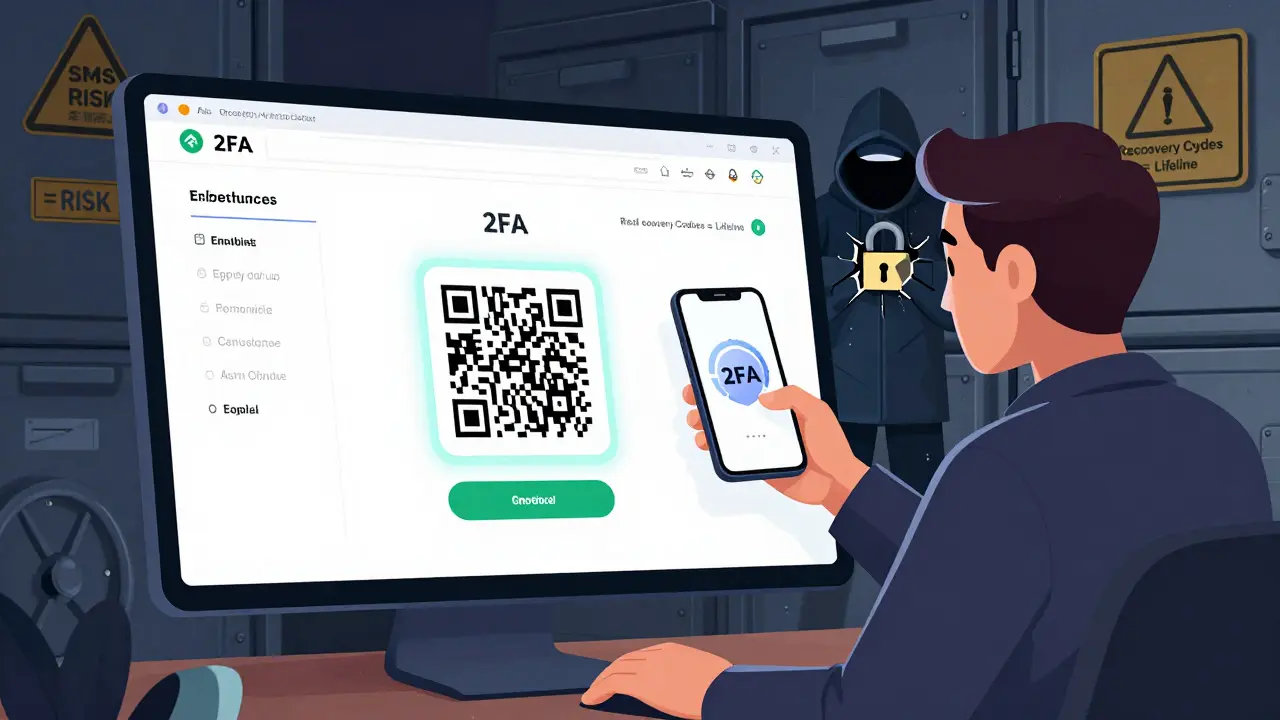

Enable 2FA on crypto exchanges to protect your assets from hacks. Learn how to set it up with authenticator apps, avoid SMS risks, save recovery codes, and prevent permanent lockouts.

Read More

Multi-signature wallets require multiple keys to authorize crypto transactions, drastically reducing theft and loss risks. Used by institutions holding billions, they're the gold standard for secure digital asset custody.

Read More

Software wallets offer unmatched convenience for trading and using DeFi, but they come with serious security risks. Learn how to use them safely and when to switch to hardware wallets.

Read More