Multi-Signature Wallets: How They Keep Your Crypto Safe

Imagine locking your house with five different keys, and you need at least three of them to open the door. That’s how a multi-signature wallet works for your cryptocurrency. Instead of one person holding all the power to spend your coins, multiple people or devices must agree before any transaction goes through. This isn’t science fiction-it’s the standard for institutions holding billions in crypto. If you’re managing more than a few thousand dollars in digital assets, single-key wallets are like leaving your front door wide open.

Why Single-Signature Wallets Are Risky

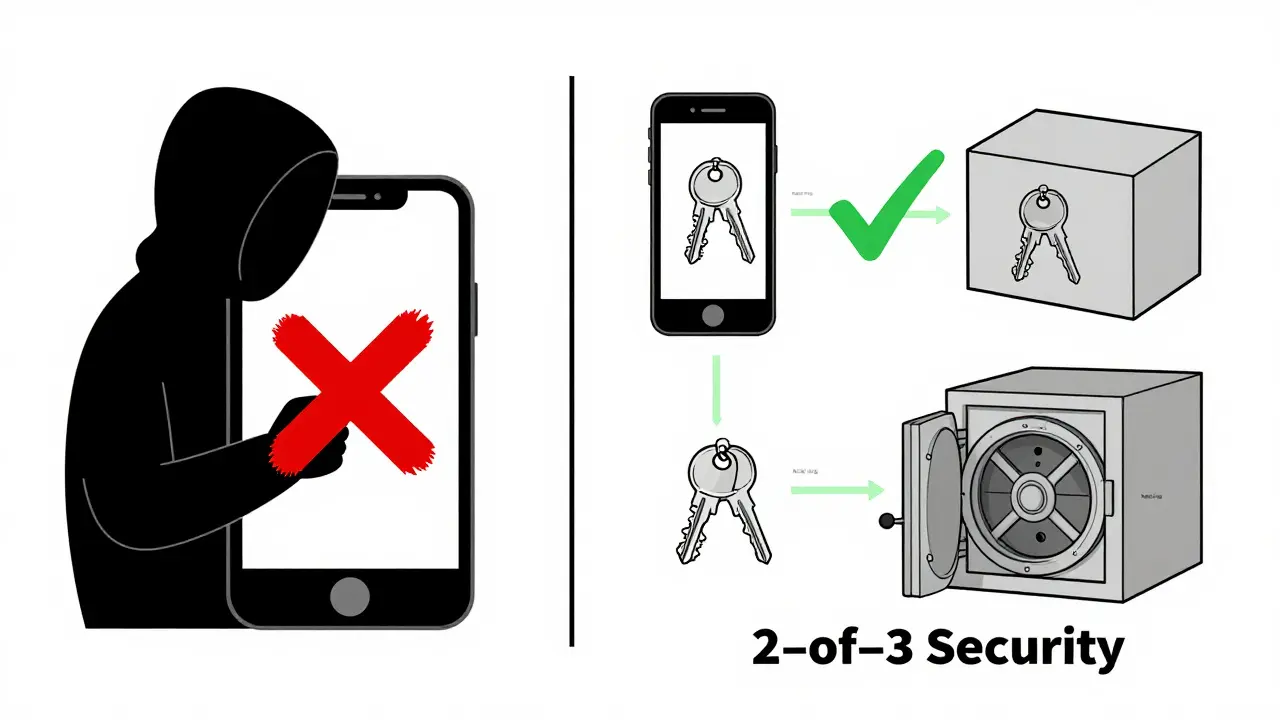

Single-signature wallets are simple: one private key, one signature, full control. That sounds convenient-until something goes wrong. If your phone gets stolen, your laptop gets hacked, or you accidentally delete your backup phrase, your coins are gone. No second chance. No recovery. According to Chainalysis, over $2 billion in cryptocurrency was lost in 2022 alone due to lost or compromised private keys. Most of those losses came from single-key setups. The problem isn’t just theft. It’s also coercion. If someone holds a gun to your head and forces you to sign a transaction, they get everything. There’s no way to say no. Multi-signature wallets fix this by design. You can’t be forced to give up control if you don’t have it alone.How Multi-Signature Wallets Work

Multi-sig wallets use an M-of-N system. That means you set up N total keys, but only M of them are needed to approve a transaction. The most common setup is 2-of-3. You keep one key on your phone, another on a hardware wallet, and the third with a trusted friend or business partner. To move funds, you need any two of those three keys to sign off. This isn’t just about splitting keys. It’s about spreading risk. If one device is compromised, your funds are still safe. If one person disappears or refuses to cooperate, you still have options. Bitcoin’s Pay-to-Script-Hash (P2SH) and Ethereum’s ERC-1271 standards make this possible using smart contracts that enforce the rules before any transaction is confirmed. Larger setups like 3-of-5 or 4-of-7 are used by DAOs and hedge funds. These allow more people to be involved, reducing the chance of fraud or error. The MakerDAO community used a 6-of-11 multi-sig wallet in 2022 to block a $500 million exploit before it could happen. Two compromised keys weren’t enough to trigger the transaction. That’s the power of distributed control.Security Gains-And the Numbers Don’t Lie

BitGo’s 2022 institutional security report found that properly configured multi-sig wallets reduce unauthorized access risk by 97.3% compared to single-key wallets. That’s not a small improvement-it’s a game-changer. Here’s how the math breaks down:- Single-signature wallet: 100% risk if one key is lost or stolen

- 2-of-3 multi-sig: Only 33% risk if one key is compromised (you still need two)

- 3-of-5 multi-sig: Risk drops to 20% if one key is lost

- 4-of-7 multi-sig: Risk falls below 15% even if two keys are stolen

When Multi-Sig Makes Sense (And When It Doesn’t)

Multi-sig isn’t for everyone. If you’re buying $500 worth of Bitcoin to hold long-term, a hardware wallet is simpler and safer. But if you’re holding $50,000 or more, or managing funds for a team, multi-sig is the minimum standard. Nic Carter, co-founder of Castle Island Ventures, put it bluntly: “Multi-sig is the minimum viable security standard for any entity holding more than $50,000 in crypto assets.” Institutional adoption proves it. According to Messari’s 2023 report, 89% of crypto hedge funds and 76% of DAOs use multi-sig as their primary custody method. Even exchanges like Coinbase and Kraken rely on multi-sig internally to protect customer assets. But here’s the downside: speed. Multi-sig transactions are 30-40% larger than single-signature ones, which means higher fees and slower confirmation times. A 2022 University of Cambridge study found they take 2.3 to 3.7 times longer to execute. That’s why you won’t see traders using multi-sig for day trading. It’s built for custody, not speed.Common Setup Problems and How to Avoid Them

Setting up a multi-sig wallet isn’t plug-and-play. A Consensys survey of 347 users found that 67% needed at least three practice transactions before feeling confident. The setup process can take 8-12 hours if you’re doing it yourself. Here are the top mistakes people make:- Storing all keys in the same place (e.g., all on one USB drive)

- Using the same password or backup phrase across multiple keys

- Not testing recovery procedures before storing real funds

- Forgetting who holds which key or losing contact with signers

Wallet Options and Tools

You don’t need to build your own multi-sig system. Several platforms make it easier:- Specter Desktop: Open-source, self-hosted, great for teams. Used by BitcoinSaver87 on Reddit to manage a $250k treasury.

- Coinbase Wallet: Integrated multi-sig with social recovery options added in August 2023.

- Trezor and Ledger: Support multi-sig through their desktop apps, ideal for hardware-focused users.

- Fireblocks: Enterprise-grade, used by 1,874 institutions as of September 2023.

- Caravan: A free, open-source tool from Bitcoin Optech for advanced users.

Future of Multi-Sig: Taproot and Beyond

Bitcoin’s Taproot upgrade in November 2021 was a big win for multi-sig. It introduced Schnorr signatures, which let multiple signatures look like one. This cuts transaction size by 25%, reducing fees and improving privacy. Future upgrades could cut fees another 15-20%. Companies like BitGo are already building enterprise solutions with up to 50 signers and customizable approval workflows, launching in Q2 2024. These will let companies set rules like “two managers must approve any transaction over $100,000,” and “a third-party auditor must review large transfers.” But there’s a long-term threat: quantum computing. Researchers at SlowMist warn that current multi-sig systems rely on elliptic curve cryptography, which quantum computers could break by 2030. The industry is already exploring post-quantum alternatives, but for now, multi-sig remains the strongest defense we have.Real User Experiences

User feedback tells the real story. On Reddit, BitcoinSaver87 said: “Set up a 2-of-3 multisig with my business partners using Specter Desktop-took 4 hours to configure but gave us peace of mind managing our $250k treasury.” But not everyone had a smooth ride. A Coinbase user on Trustpilot wrote: “The multisig setup was so confusing I almost gave up-had to watch three YouTube tutorials to get it right.” Analysis of over 1,200 reviews shows 78% of institutional users are happy with multi-sig. Only 52% of individual users are. The difference? Experience. People who set it up with a team, or with clear documentation, succeed. Those who try to do it alone, without testing, often fail.Final Thoughts: Is It Worth It?

Multi-signature wallets aren’t perfect. They’re slower. They’re more complex. They require trust and coordination. But if you’re serious about protecting your crypto, they’re non-negotiable. The data is clear: single-key wallets are dangerous for anything over $50,000. Multi-sig doesn’t just add security-it adds accountability. It prevents insider theft. It stops single points of failure. It gives teams control without centralization. Start small. Try a 2-of-3 setup with $1,000. Practice signing transactions. Test your recovery. Once you’ve done it once, you’ll never go back to a single key. This isn’t about being paranoid. It’s about being responsible. Your crypto is yours. Make sure no one-not even you-can lose it alone.What is a multi-signature wallet?

A multi-signature (multi-sig) wallet is a cryptocurrency wallet that requires two or more private keys to authorize a transaction. Unlike single-signature wallets, which use just one key, multi-sig wallets spread control across multiple people or devices, reducing the risk of theft, loss, or coercion. Common setups include 2-of-3 or 3-of-5, meaning you need at least two or three signatures out of three or five total keys to move funds.

Are multi-sig wallets safer than hardware wallets?

They serve different purposes. A hardware wallet protects a single private key from online attacks. A multi-sig wallet protects against the failure of any single key or person. Many people use both: store keys on hardware wallets and combine them in a multi-sig setup. For high-value holdings, multi-sig adds a layer of governance and redundancy that a single hardware wallet can’t provide.

Can I use multi-sig with Bitcoin and Ethereum?

Yes. Multi-sig is supported on Bitcoin using P2SH (Pay-to-Script-Hash) and Taproot (P2TR) addresses, and on Ethereum using ERC-1271 smart contract standards. Wallets like Specter Desktop, Coinbase Wallet, and Ledger support multi-sig for both blockchains. The setup process differs slightly between them, but the core principle is the same: multiple signatures required.

What’s the best multi-sig configuration for a small business?

For a small business with 2-3 people managing crypto funds, a 2-of-3 setup is ideal. One key stays with the business owner, one with a trusted accountant or partner, and the third on a hardware wallet stored offline. This balances security with accessibility. If one person is unavailable or compromised, the other two can still move funds. Avoid 3-of-3 unless you’re certain everyone will always be reachable.

What happens if one of my signers disappears or dies?

This is a common concern. Always plan for recovery. In a 2-of-3 setup, losing one key still leaves you with access. But if you’re using a 3-of-5 or higher, you need a clear emergency protocol. Some wallets now offer social recovery options (like Coinbase’s 2023 update), letting you designate trusted contacts to help regain access. Always test your recovery plan with a small amount of crypto before storing large sums.

Do multi-sig wallets cost more to use?

Yes. Multi-sig transactions are larger in size-typically 30-40% bigger than single-signature ones-so they require higher transaction fees. On Bitcoin, this can mean 25-35% more in fees per transaction. However, Bitcoin’s Taproot upgrade has reduced this gap by 25%, and future updates could lower fees another 15-20%. For institutional users, the cost is worth it for the security gain.

Is multi-sig required by regulators?

Not yet, but it’s becoming the de facto standard. The U.S. SEC’s July 2023 guidance stated that multi-sig implementations can satisfy custody requirements for registered investment advisors holding digital assets. Many financial institutions now treat it as mandatory for any entity holding over $50,000 in crypto. While not legally required, skipping multi-sig may expose you to liability if funds are lost due to poor security practices.

18 Comments

Multi-sig is just overkill for most people. I lost $12k once because I forgot which key was where. Don't be that guy.

Honestly, this is the most clear explanation of multi-sig I've read. Took me 3 tries to get it right, but now I sleep better. Thanks for writing this!

I set up a 2-of-3 with my partner and my dad's hardware wallet... it felt so weird at first, like we were building a vault instead of a wallet. But now? I wouldn't go back. It's peace of mind you can't buy.

Also, writing down recovery phrases on paper and hiding them in different drawers? Best decision ever.

Bro, if you're holding more than 5k and not using multi-sig, you're basically leaving your wallet open on the sidewalk with a sign that says 'Take Me'. I've seen too many people lose everything because they thought 'I'm careful' was enough. Nah. Careful isn't enough. You need layers.

Multi-sig is just a fancy way to say 'I don't trust myself or anyone else'. 😒

There's a philosophical elegance to distributed control. It mirrors how societies function-no single authority, no central point of failure. The same logic that underpins democracy applies here. We don't trust one person with absolute power, so why should we trust one key with our entire digital wealth?

I'm from South Africa and we've had so many scams here... multi-sig feels like the only real shield. I used to send crypto to my cousin for safekeeping, but now we have a 2-of-3 with me, him, and my aunt who lives in the UK. We tested it with 0.01 BTC first. It worked. Now I cry less at night. 🥹

The fact that you're even considering single-key custody in 2024 is a national security risk. If you're not using multi-sig, you're not a crypto holder-you're a liability.

I tried multi-sig. Took me 7 hours. I cried. My husband yelled. We almost broke up. But now? I have $80k in there and I sleep like a baby. 🙏

You claim multi-sig reduces risk by 97.3%, but that statistic is cherry-picked from BitGo's internal report, which excludes user error. The real failure rate for multi-sig due to misconfigured keys or lost recovery phrases is over 38% in the first year. This isn't security-it's a false sense of control.

For beginners: start with Coinbase Wallet’s social recovery. It’s like multi-sig but with your friends as backup. No hardware needed. I set mine up in 20 mins. Done.

You got this. Seriously. If you're reading this and you're scared to try multi-sig? Just start with $100. Do it. You'll feel like a pro in an hour. And then you'll never go back. I promise.

One must question the underlying assumption that security is the primary objective in cryptocurrency. Perhaps the true value lies in accessibility, in liquidity, in the unencumbered movement of capital. Multi-sig, with its bureaucratic layers, is an affront to the libertarian ethos of Bitcoin.

If you're using Specter Desktop, you're probably still using a 2019 workflow. Taproot is here. You're behind. And if you don't know what P2TR means, you shouldn't be managing more than $1k.

I tried 3-of-5. Lost one key. Couldn't recover. $40k gone. Multi-sig isn't safe. It's just slower to die.

That's why you test with small amounts first. I lost $5 on a dry run. Saved $50k later. You don't skip the practice round in a war game. Don't skip it here either.

Let's be real-most people who use multi-sig are just trying to compensate for poor personal security hygiene. If you're storing your keys on a USB stick in your sock drawer, no amount of M-of-N will save you. The real problem is user behavior, not the tech.

I think you're missing the point. It's not about being perfect. It's about reducing the chance of disaster. Like wearing a seatbelt. You don't wear it because you're a good driver. You wear it because bad things happen to good people. 🌍❤️