February 2025 Archive – Crypto, Blockchain & Stock Market Insights

When you look at February 2025, the second month of 2025, known for sharp crypto price swings and fresh DeFi token releases, you instantly see a snapshot of three worlds colliding: digital money, decentralized tech, and traditional equities. February 2025 wasn’t just a calendar slot; it acted as a playground where traders tested new strategies and developers pushed blockchain upgrades.

Key forces that shaped the month

The cryptocurrency, a digital asset class that includes Bitcoin, Ethereum and dozens of altcoins market felt the impact of two major events. First, Bitcoin’s price broke the $70,000 barrier before slipping back to $62,000, prompting a wave of short‑term trading ideas. Second, Ethereum’s Shanghai upgrade unlocked staking withdrawals, which sparked a surge in DeFi liquidity.

Meanwhile, the blockchain, the underlying distributed ledger technology powering cryptocurrencies and many enterprise solutions ecosystem rolled out several layer‑2 scaling solutions, lowering gas fees and widening access for retail users. These upgrades directly influenced DeFi, decentralized finance platforms that let people earn yield, borrow, and trade without banks projects, many of which launched yield farms with APYs topping 30%.

On the traditional side, the stock market, global equity exchanges where companies raise capital and investors buy shares reacted to tech earnings and Fed commentary. The S&P 500 nudged higher after strong results from semiconductor firms, while the Nasdaq showed volatility that mirrored crypto sentiment.

Putting it together, February 2025 archive encompasses crypto price analysis, blockchain scaling updates, and equity market reactions. It also requires a solid grasp of technical analysis tools – candlestick patterns, moving averages, and on‑chain metrics – to make sense of the noise. Traders who combined these skill sets often spotted cross‑asset opportunities, like using Bitcoin’s volatility to hedge Nasdaq exposure.

Another crucial link is that blockchain technology influences DeFi growth, and DeFi activity, in turn, feeds back into cryptocurrency demand. For example, when a new liquidity pool launched on a layer‑2 chain, the resulting token swaps boosted Ethereum’s transaction volume, which helped push gas prices down and attracted more users.

Across the month, you’ll notice a pattern: major protocol upgrades sparked short‑term price spikes, while macro‑economic cues drove longer equity trends. Readers who follow both worlds tend to spot arbitrage windows – buying a crypto asset when it dips after a stock market rally, then selling when the crypto market rebounds.

Below you’ll find a curated collection of articles, guides, and market snapshots that captured these dynamics as they unfolded. From Bitcoin’s break‑out analysis to DeFi tokenomics deep‑dives and equity earnings recaps, the archive gives you a concise toolbox for staying ahead in a fast‑moving market.

Explore Honk (HONK) crypto - its Solana roots, tokenomics, recent price swings, technical signals, buying steps, and outlook up to 2034. Get the facts before you invest.

Read More

Explore how global bodies, the UK‑US partnership, and the EU's MiCA framework are shaping crypto regulation, tackling cross‑border challenges, and setting the stage for future coordination.

Read More

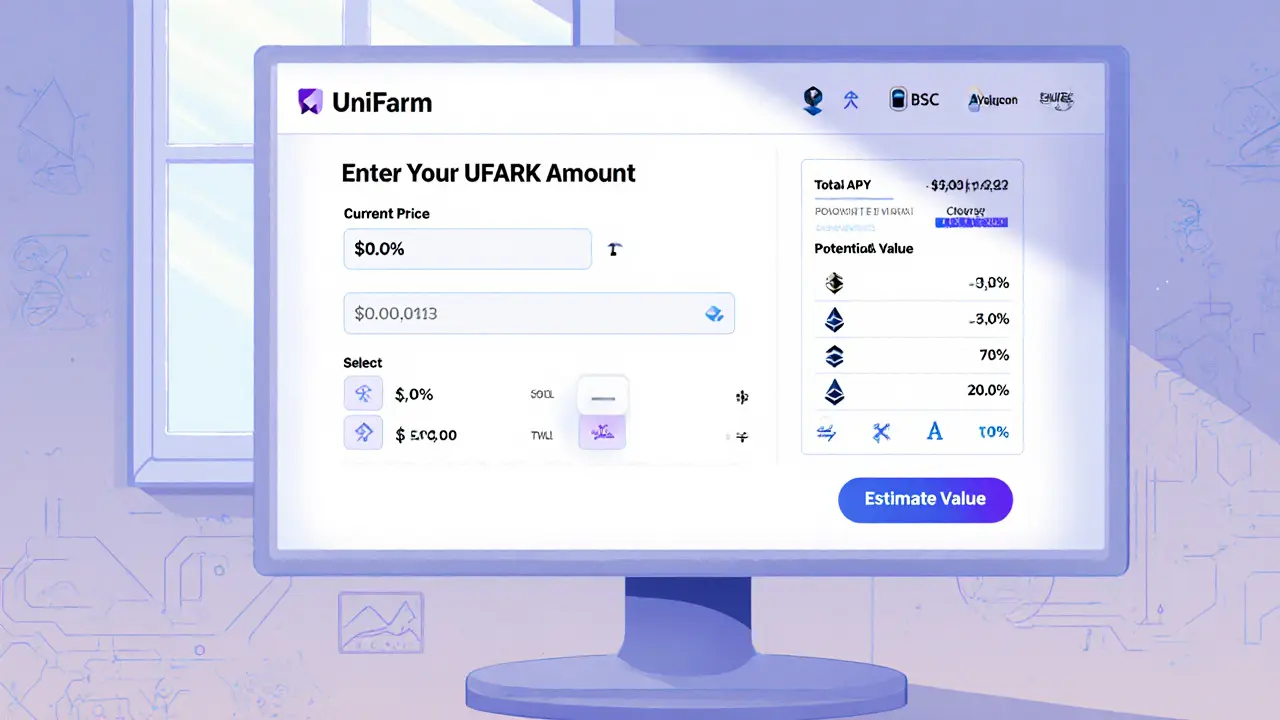

A detailed look at UniFarm (UFARM) - its purpose, tokenomics, staking mechanics, multi‑chain deployment, benefits, risks, and future roadmap.

Read More

A practical review of WethioX Exchange covering fees, security, regulatory status, and how it compares to Binance, Bybit, Toobit and WEEX for African crypto traders.

Read More