What is UniFarm (UFARM) Crypto Coin - Full Overview

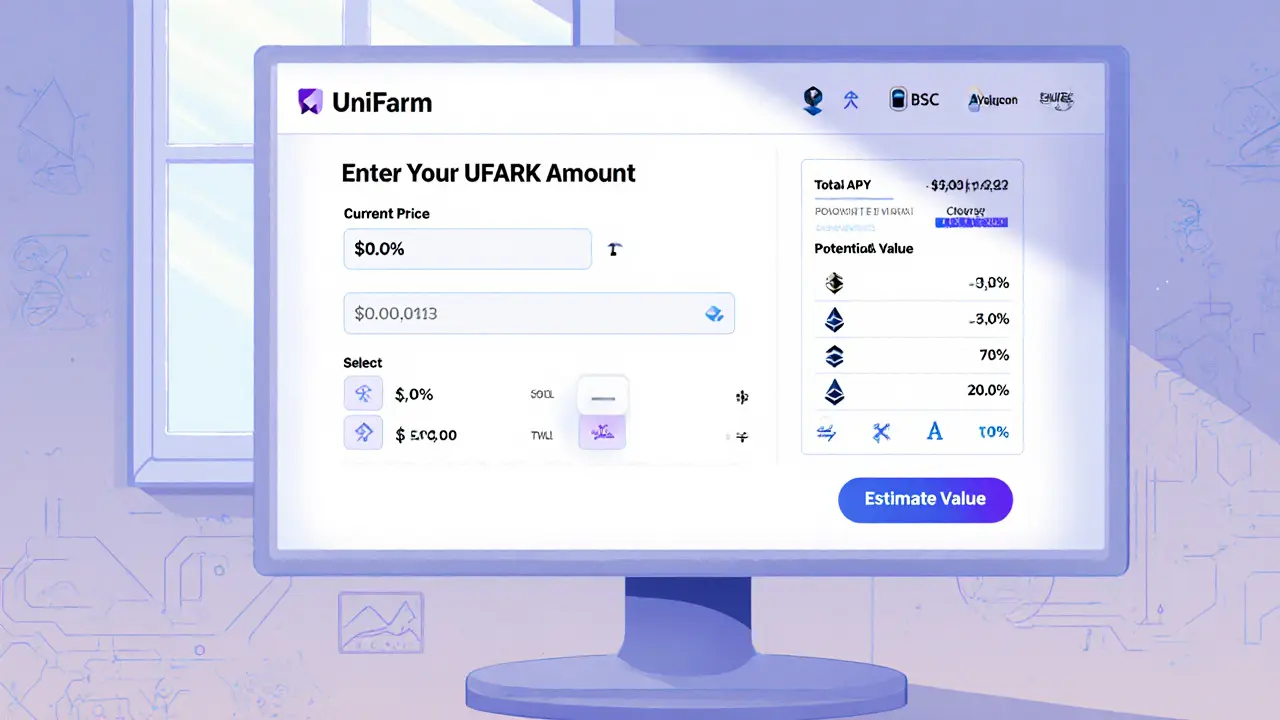

UFARM Token Value Estimator

This tool estimates the potential value of your UFARM holdings based on current market data and projected growth metrics.

Note: This is for educational purposes only and does not constitute financial advice.

Estimated Value Analysis

Current Price: $0.00001243

Total Value: $0.00

Potential Value (APY): $0.00

TVL: $496.21k

Market Cap: $1,870.84

Circulating Supply: 38.38M

Analysis: Based on current market conditions and the guaranteed minimum 36% APY, your investment could grow significantly over time. However, actual returns depend on various factors including market volatility, token adoption, and platform performance.

Key Takeaways

- UFARM is the native token of the UniFarm DeFi platform, used for governance, staking rewards and premium features.

- UniFarm operates on four blockchains - Ethereum, BSC, Polygon and Avalanche - letting users pick the network that fits their cost and speed needs.

- The protocol guarantees a minimum 36% APY by letting you farm up to five different tokens from a single stake.

- Tokenomics: 1billion total supply, ~38.4million circulating, market cap under $2k, TVL around $496k.

- Future roadmap points toward a SaaS model, on‑chain insurance and NFT farming, expanding utility beyond simple staking.

What is UniFarm (UFARM) Token?

UniFarm (UFARM) is a governance and utility token that powers a multi‑chain DeFi platform combining group staking with an IDO launchpad. Launched after a one‑day ICO on 19April2021 that raised $2.3million, UFARM now supports over 12000 users across four major networks. The token’s primary role is to let holders vote on protocol upgrades, stake for diversified yield, and unlock premium pool access through a tiered system.

How UniFarm Works: Group Staking and IDO Launchpad

UniFarm’s core offering is a group staking protocol that pools user funds and farms multiple project tokens at once. Instead of staking a single asset and receiving only that token, a UniFarm participant can stake UFARM and automatically earn up to five different tokens, each from separate DeFi projects. This multi‑token farming reduces the complexity of managing several positions and spreads risk across a basket of assets.

The platform also doubles as an Initial DEX Offering (IDO) launchpad. New projects can list their token on UniFarm’s launchpad, gaining immediate exposure to the pooled community of UFARM holders. In return, the launchpad feeds fresh token rewards into the staking pools, keeping the APY attractive and the ecosystem vibrant.

Tokenomics at a Glance

Understanding the numbers helps you gauge possible upside and dilution risk. The table below summarizes the most relevant figures as of October2025.

| Metric | Value |

|---|---|

| Total Supply | 1000000000 UFARM |

| Circulating Supply | 38375920 UFARM |

| Current Price | $0.00001243 USD |

| Market Cap | ≈ $1870.84 USD |

| Fully Diluted Market Cap | $48750.42 USD |

| Total Value Locked (TVL) | $496.21k |

| Number of Holders | 7080 |

Core Use Cases of UFARM

UFARM is more than a speculative coin; it fulfills six distinct roles within the UniFarm ecosystem.

- Governance: Holders vote on protocol upgrades, fee structures and new feature deployments.

- Staking: By locking UFARM in the group pools, users earn a blend of project tokens with a guaranteed minimum 36% APY.

- Premium Pool Access: Tiered holdings unlock exclusive pools that offer higher yields and early‑access token sales.

- Platform Fees: As UniFarm shifts toward a SaaS model, UFARM will become the primary payment method for premium services.

- Add‑On Features: Tier‑based eligibility for on‑chain insurance, NFT farming and other upcoming modules.

- Collaboration Tickets: Partnerships with wallets, launchpads and service providers dispense tickets and special offers to UFARM holders.

Multi‑Chain Deployment

UniFarm runs on four blockchains, each bringing unique advantages:

- Ethereum - widest developer ecosystem, high security, but higher gas fees.

- Binance Smart Chain (BSC) - low fees and fast confirmation times, ideal for high‑frequency staking.

- Polygon - Layer‑2 solution offering near‑zero fees while retaining Ethereum security.

- Avalanche - high throughput and customizable subnets, useful for large‑scale pool deployments.

This multi‑chain approach lets users migrate assets to the network that best matches their cost, speed and risk preferences, while keeping the underlying UFARM utility consistent across all chains.

Potential Benefits and Risks

Benefits

- Diversified Yield: Farming up to five tokens from one stake spreads reward risk.

- Guaranteed Minimum APY: The 36% floor protects against market‑wide yield drops.

- Premium Tier Incentives: Larger holders gain access to higher‑yield pools, encouraging long‑term holding.

- Low Market Cap Relative to TVL: A TVL‑to‑market‑cap ratio of ~0.0038 suggests the token may be undervalued.

Risks

- Liquidity constraints - many exchanges report zero or minimal trading volume, making large exits costly.

- Market visibility - ranking inconsistencies (e.g., #860 vs #3154) indicate limited recognition among broader crypto audiences.

- Token dilution - as more UFARM moves into circulation, per‑token value could be pressured unless demand rises.

- Platform reliance - any security breach or smart‑contract bug could affect all four chains simultaneously.

Future Roadmap: SaaS and Add‑Ons

The development team is pivoting UniFarm toward a stand‑alone Software‑as‑a‑Service (SaaS) offering. This shift aims to let external developers build custom pool logic, integrate on‑chain insurance or launch NFT‑farming campaigns without re‑architecting the core protocol.

Key upcoming features include:

- On‑Chain Insurance: Users can purchase protection against smart‑contract failures using UFARM as payment.

- NFT Farming: Earn unique NFTs as additional rewards for sustained staking, potentially opening secondary market value.

- Developer SDK: A toolkit for third‑party projects to plug into UniFarm’s liquidity pools, creating new revenue streams.

These add‑ons reinforce the token’s utility beyond simple governance, aligning incentives for both retail participants and institutional builders.

Getting Started with UFARM

- Acquire UFARM on a supported exchange (e.g., Binance, Crypto.com) or via a Web3 wallet that supports the four networks.

- Transfer UFARM to a compatible wallet (MetaMask, Trust Wallet, etc.) and connect it to the UniFarm dashboard.

- Select your preferred blockchain network based on fee & speed considerations.

- Choose a staking pool - standard pools require only UFARM, while premium pools demand a higher token balance.

- Confirm the transaction, sit back, and monitor rewards through the UniFarm UI. Rewards are distributed automatically and can be re‑staked for compound growth.

Remember to keep an eye on daily APY fluctuations and any governance proposals that could alter fee structures or pool compositions.

Frequently Asked Questions

What makes UFARM different from other DeFi tokens?

UFARM combines governance, a guaranteed minimum 36% APY, and a tier‑based premium access model. It also lets you farm up to five different tokens from a single stake, which most single‑token staking platforms don’t offer.

Is UFARM safe to stake?

The protocol has been audited and runs on four reputable blockchains. However, as with any DeFi product, there’s smart‑contract risk and liquidity risk, so only stake what you can afford to lose.

Can I earn rewards without holding UFARM?

Staking without UFARM limits you to standard pools with lower yields. Premium pools, insurance, and NFT farming all require UFARM holdings to unlock.

Where can I buy UFARM?

UFARM is listed on major exchanges like Binance and Crypto.com. You can also receive it via direct wallet transfers from other users or through the UniFarm launchpad.

What is the roadmap for UniFarm beyond staking?

The team plans to evolve into a SaaS platform, offering on‑chain insurance, NFT farming, and a developer SDK. These additions aim to broaden utility and generate revenue beyond token appreciation.

12 Comments

This is just another rug pull waiting to happen. $2k market cap with $500k TVL? That’s not undervalued-that’s a trap. They’re pumping it with their own wallets and calling it ‘multi-chain innovation.’ Wake up, people.

I’ve been staking UFARM for 8 months now. The rewards are steady, and I like how the team keeps adding features without overpromising. It’s not the flashiest, but it’s honest work. That’s rare in DeFi these days.

OMG this is so exciting!!! 🌟 From India to the world-UniFarm is bringing real utility to the masses! 🇮🇳✨ The 36% APY is just the beginning... imagine NFT farming with Indian cultural motifs next?! 🏮🪷 I’m already saving my UFARM for the launch!!!

Oh cool, another project that promises 'guaranteed' returns. 🙄 Let me guess-your 'minimum 36% APY' is backed by... your own token? And the TVL is literally less than what I spent on coffee this week? Cute.

If you’re not holding UFARM, you’re missing out on the future of DeFi. This isn’t just staking-it’s a movement. The SaaS model? On-chain insurance? That’s institutional-grade thinking. Most projects are still stuck in 2021. UniFarm is building for 2030.

How do I know if the multi-chain support is real? I tried connecting to Polygon but the dashboard kept crashing. Is this just marketing or does it actually work? Anyone tried it on BSC?

The tokenomics are concerning. With a circulating supply of under 4% of total supply, the dilution risk is substantial. While the current TVL is impressive, the lack of liquidity on major exchanges suggests limited adoption beyond a small, closed group.

36% APY is a joke. No one’s getting that unless they’re staking with the dev team’s own wallets. This is pump and dump 2.0. Don’t fall for it.

Guys, I know it looks small but look at the roadmap-this is a sleeper. The NFT farming feature alone could blow up. Imagine holding an NFT that gives you bonus UFARM just for staking longer. That’s genius. And the insurance? That’s next-level protection. Don’t sleep on this.

I staked 10k UFARM on BSC and got 3 tokens in 2 days. No drama. No gas wars. Just chill rewards. The team is real. The code is clean. If you want real yield without the hype, this is it. 🚀

The multi-chain approach is technically sound. However, the low market cap and lack of exchange listings suggest minimal external interest. Until liquidity improves, I recommend only allocating a small portion of portfolio.

I’m not saying it’s a scam... but... why does the price keep dropping every time someone posts about it? And why are there so many ‘premium pools’? Are we paying to play? This feels like a pyramid... but I’m still staking because the rewards are real... for now...