Winstex Crypto Exchange Review: Risks, Tokenomics, and Alternatives

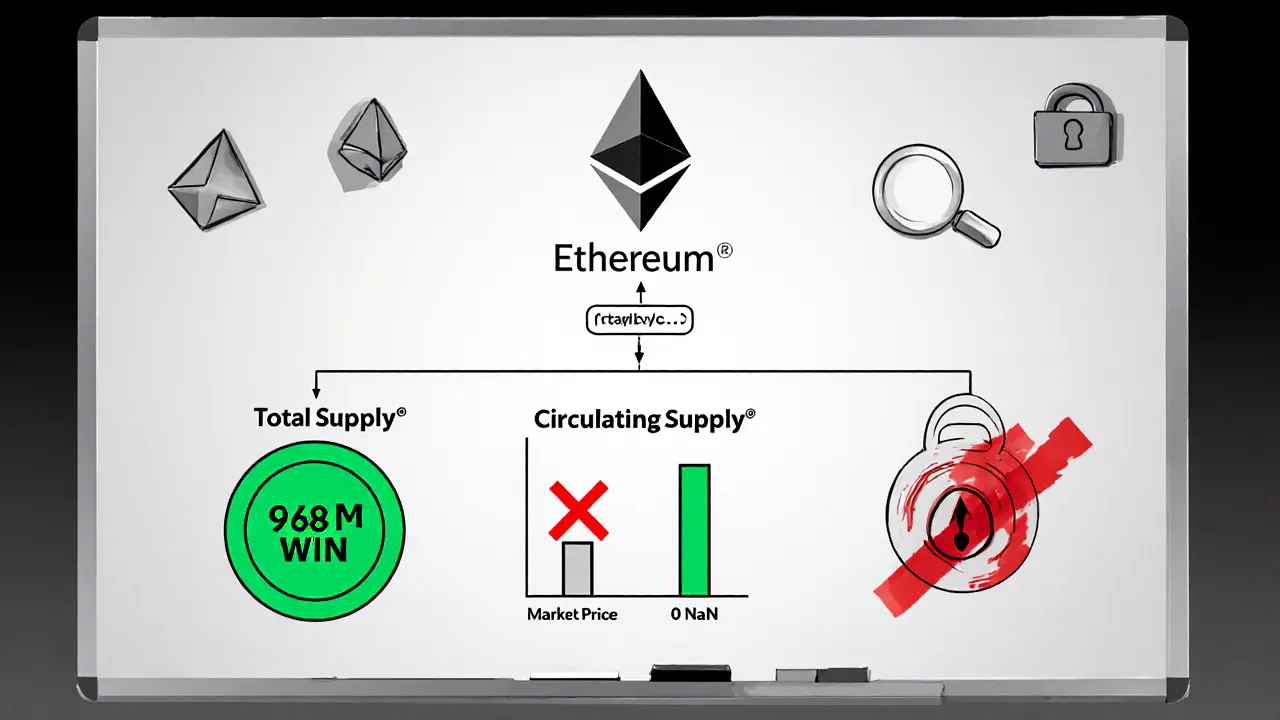

Winstex Exchange Status Checker

Website Status

Checking if the official website is accessible

Token Supply

Verifying circulating supply of WIN token

Market Activity

Checking for active trading on major exchanges

Regulatory Compliance

Verifying presence of regulatory disclosures

Risk Assessment

Based on current data, Winstex presents significant risks including:

- Offline website with no access to core services

- Zero circulating supply of WIN token

- Lack of market activity and trading data

- No regulatory disclosures or security audits

Critical Risk Warning

Winstex exchange appears to be non-operational based on current data.

Recommended action: Avoid investing or using this platform until verifiable proof of operation is provided.

When you hear about a new Winstex cryptocurrency exchange, the first question is whether it actually works. WIN token is billed as the native utility token that pays fees on the platform, but a slew of warning signs make the promised benefits feel shaky.

Quick Take

- Official website offline - you can’t even reach the landing page.

- No circulating supply for WIN token despite a 968million total supply.

- Price data shows $NaN on major trackers, indicating no active market.

- Claims of 1,000+ crypto pairs are unverified; no third‑party audits.

- Safer to stay away until clear evidence of operation emerges.

What Winstex Claims to Be

According to its (now unreachable) website, Winstex positioned itself as a multi‑platform exchange - web, Android and iOS - that lets users send, receive and swap the WIN token for more than a thousand other cryptocurrencies. The platform mirrors the fee‑discount model used by Binance (via BNB) and KuCoin (via KCS). Holding WIN was supposed to shave a few percent off trading fees and unlock premium features.

Tokenomics at a Glance

The WIN token lives on the Ethereum blockchain (contract 0x4CAc…F29C5a). Here are the key numbers pulled from public trackers:

- Total supply: 968million WIN

- Circulating supply: 0 WIN

- Maximum supply: undefined (no hard cap)

- Current price on major platforms: $NaN

Zero circulating supply is a red flag. In a functioning exchange, the native token is either pre‑mined for early investors or released gradually to reward users. The lack of any tokens in wallets suggests the distribution never happened, or the project was halted before launch.

Platform Features - What Can Be Verified

Because the website is down, we rely on archived screenshots and the few mentions that survived on third‑party sites. The claimed feature list includes:

- Web dashboard with order‑book view.

- Mobile apps for Android and iOS with QR‑code deposits.

- Support for over 1,000 crypto assets.

- Fee discounts when paying with WIN.

None of these can be independently confirmed. No app store listings exist under the Winstex name, and community forums show zero user‑generated screenshots or tutorials.

Red Flags That Should Stop You in Your Tracks

Multiple independent signals point to a non‑operational project:

- Offline website: Blockspot.io logs show the domain winstex.com has been unreachable for months.

- Zero circulating supply despite a massive total supply.

- Price feeds showing $NaN on CoinMarketCap and Coinbase - a clear sign of no trading activity.

- Absence from major exchange rankings and fee‑comparison charts.

- No regulatory information, licensing details, or compliance statements.

- Silence on social media - no Reddit threads, Telegram groups, or Twitter accounts with meaningful followings.

When you add up these points, the risk profile looks more like a dead project than a hidden gem.

Security & Compliance - What We Can’t Verify

Legitimate exchanges publish security audits, cold‑storage percentages, and insurance coverage. Winstex provides none of these. The smart‑contract address is public, but without an audit you can’t confirm there aren’t hidden mint or burn functions that could be abused later.

Regulatory compliance is another missing piece. Exchanges operating in the U.S., EU or Asia typically disclose their jurisdiction, AML/KYC policies, and licensing bodies. No such documentation exists for Winstex, making it impossible to gauge legal risk.

| Feature | Winstex | Binance | KuCoin |

|---|---|---|---|

| Native token | WIN | BNB | KCS |

| Fee discount with native token | Claimed, unverified | Up to 25% off | Up to 20% off |

| Active website | Offline (as of Oct2025) | Online | Online |

| Circulating supply of native token | 0 WIN | ~163M BNB | ~165M KCS |

| Regulatory disclosures | None | Extensive (various jurisdictions) | Moderate |

Where to Look Next - Safer Alternatives

If you want a fee‑discount token and a reliable exchange, consider platforms that have proven track records:

- Binance - massive liquidity, clear fee schedule, and a native token (BNB) that consistently gives discounts.

- KuCoin - user‑friendly mobile apps, 1,800+ trading pairs, and a token (KCS) that pays daily dividends.

- Coinbase Pro - regulated in the U.S., transparent security practices, and no native token needed for low fees.

All three have active communities, regular security audits, and live price feeds, eliminating the guesswork you face with Winstex.

Bottom Line

Based on the data available in October2025, Winstex review points to a platform that is effectively dead. The offline website, zero circulating supply, and missing market activity make any interaction extremely risky. Until the team provides verifiable proof of operation, it’s best to stay clear and allocate your capital to established exchanges.

Frequently Asked Questions

Is Winstex still operational?

All public checks indicate the official website is offline and no trading activity is visible. This strongly suggests the exchange is not currently operational.

Can I buy WIN token on any major exchange?

No. WIN is not listed on major exchanges like Binance, Coinbase, or Kraken. Price feeds show $NaN, meaning there is no active market.

What are the main risks of using Winstex?

Key risks include total loss of funds due to potential platform shutdown, lack of security audits, no regulatory compliance, and the possibility of a token dump if the project were to revive without proper safeguards.

How does WIN token compare to BNB or KCS?

Unlike BNB and KCS, WIN has zero circulating supply and no established fee‑discount mechanism. BNB and KCS are actively used on their native exchanges, have transparent tokenomics, and generate regular trading volume.

Should I consider Winstex for long‑term investment?

Given the lack of operational evidence, the investment is extremely high‑risk. Most analysts recommend avoiding WIN until the project can prove it is alive and compliant.

13 Comments

Hey everyone, I get why the warning signs are scary, but it's good to step back and assess calmly. The offline website alone is a red flag, yet sometimes projects rebound after a relaunch. If you already have any WIN tokens, consider moving them to a secure wallet and keep an eye on official channels for any updates. Diversifying into established exchanges like Binance or KuCoin can mitigate the risk while you wait for clarity. Ultimately, protecting your capital is the priority, and staying informed will help you make the best decision.

From a technical standpoint, the absence of a circulating supply violates basic tokenomics principles, which implies either a halted distribution or a deliberate concealment. Moreover, the fact that the contract address is publicly visible but lacks an audit raises concerns about hidden mint functions that could be exploited later. The platform's claim of 1,000+ pairs is statistically improbable without any order‑book data or API endpoints to verify depth. This pattern aligns with a classic pump‑and‑dump scaffold, where the token is fabricated to lure speculative capital before a silent exit. In short, until a verifiable audit and active market data are presented, the risk vector remains unacceptably high.

Reading through the review, one cannot help but notice the consistency of the red flags: offline website, zero circulating supply, no market data, and a complete lack of regulatory disclosures, all of which combine to form a pattern that is, frankly, quite worrying.

Contemplating the nature of existence, one might see Winstex as a metaphor for promises unkept; we construct expectations, only to confront an empty void where substance should reside. The absence of tangible activity reflects a larger philosophical void.

i think it might actually be a good oppurrtunity.

First off, the fact that the website has been down for months is a major signal that the platform is not operational. Second, zero circulating supply means there are no tokens in users' hands, which defeats the purpose of a utility token. Third, the price‑feed showing $NaN on trackers indicates a lack of trading activity. Fourth, the absence of any third‑party audit leaves the smart contract unchecked and potentially vulnerable. Fifth, without regulatory disclosures, you have no protection against legal repercussions. Sixth, no listings on major exchanges means you cannot easily buy or sell the token. Seventh, there are no community channels like Telegram or Discord where users can get support. Eighth, the claimed 1,000+ trading pairs are unverified and likely fabricated. Ninth, the tokenomics table shows a total supply but no distribution plan. Tenth, the token contract has no visible mint or burn functions, which raises concerns about hidden mechanisms. Eleventh, the lack of a live order book makes price discovery impossible. Twelfth, the platform's in‑app features cannot be validated without an app store presence. Thirteenth, the security model is unclear, leaving funds at risk. Fourteenth, the user experience cannot be assessed without a functional UI. Fifteenth, given all these points, the safest move is to avoid any interaction with Winstex until concrete evidence of operation emerges.

While the review is thorough, the ultimate judgment is clear: Winstex fails on every critical metric and should be avoided.

One might suspect that the missing infrastructure is not a mere oversight but a deliberate veil, perhaps orchestrated by unseen entities to manipulate market sentiment. The alignment of failures across technical, regulatory, and community dimensions suggests a coordinated concealment, rather than random neglect.

Let's try to keep the discussion constructive; even if Winstex looks dubious now, it could still learn from these issues.

Honestly, the whole hype around WIN is just noise-no real utility, no liquidity, just a ghost project.

Looks like another dead horse in the crypto zoo.

From a moral standpoint, promoting a platform with no transparency borders on fraud, and regulators should be alerted to such opaque practices.

Sure, because trusting a dead site makes perfect sense.