WethioX Exchange Review: Africa’s Crypto Trading Platform Analyzed

WethioX Exchange Transparency Checker

This tool helps assess the transparency of WethioX Exchange by comparing it against established global exchanges. Enter values to simulate different scenarios and understand the risks involved.

Fee Transparency

WethioX does not publish its fee structure. Compare with leading exchanges:

- Binance: 0.02% / 0.04%

- Bybit: 0.025% / 0.075%

- WEEX: 0.01% / 0.02%

Security Measures

WethioX lacks public disclosure of security details:

- Binance: Cold storage, 2FA, SAFU fund

- WEEX: 1,000 BTC protection fund

- Toobit: Audit reports, advanced risk control

Transparency Score Calculator

Estimate how transparent WethioX appears compared to top exchanges:

Your Results

Enter values and click "Calculate Transparency Score"

When diving into crypto platforms, WethioX Exchange is an African‑focused cryptocurrency exchange that markets itself as the easiest place for deposits and withdrawals. It promises a single pane for portfolio tracking, but the hard data that traders normally rely on - fees, liquidity, security measures - is surprisingly thin. If you’re trying to decide whether to trust your funds to a platform that barely shows up on market trackers, this review breaks down what’s known, what’s missing, and how WethioX stacks up against the heavyweights.

Key Takeaways

- WethioX is listed on CoinMarketCap as an "Untracked Listing," meaning no verified volume or pair data is available.

- The exchange’s fee schedule, leverage options, and security protocols are not publicly disclosed.

- It targets African users, but concrete market share or user growth numbers are absent.

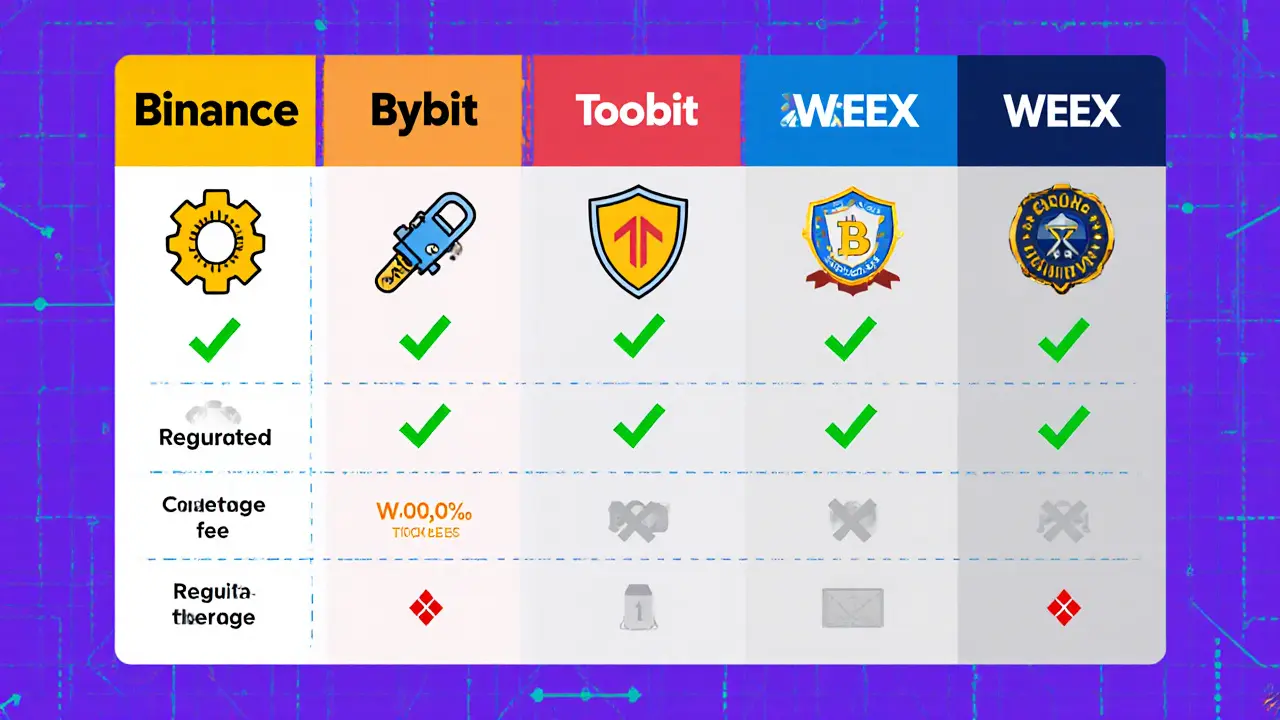

- Compared with Binance, Bybit, Toobit and WEEX, WethioX lags in transparency and documented features.

- Potential users should weigh the lack of independent reviews and community feedback before committing large sums.

What WethioX Claims to Offer

The website pitches a few clear benefits:

- Simple onboarding for beginners and advanced tools for seasoned traders.

- Instant deposits and withdrawals across African payment methods.

- Integrated portfolio performance analytics.

These sound appealing, especially for markets where banking infrastructure can be shaky. However, the promotional material stops short of giving the nitty‑gritty that regulators and savvy traders demand.

Market Position and Visibility

In the broader crypto ecosystem, visibility on aggregators like CoinMarketCap is a baseline for credibility. WethioX currently appears as an "Untracked Listing" per CoinMarketCap’s Listing Review Criteria Section B‑(3). That classification signals the platform’s trading volume and order‑book depth are not being monitored, leaving potential investors in the dark.

By contrast, global platforms such as Binance and Bybit publish real‑time volume charts, fee calculators, and regulatory disclosures. Emerging African‑centric players like Toobit and WEEX also provide transparent dashboards, making it easier to compare execution quality.

Security and Regulatory Gaps

Security is the make‑or‑break factor for any exchange. Established platforms typically detail:

- Cold‑wallet storage percentages.

- Insurance funds (e.g., WEEX’s 1,000BTC protection pool).

- Regulatory licenses in specific jurisdictions.

For WethioX, none of these details are publicly available. There is no mention of a security audit, a bug bounty program, or a custodial insurance scheme. Likewise, the exchange does not disclose whether it holds any licensing from African financial authorities or from international bodies such as the FCA or CySEC.

Without independent verification, users are left to trust the platform’s claim of "effortless" withdrawals - a red flag given the history of exit scams in the space.

Feature Comparison with Leading Exchanges

| Exchange | Fees (maker/taker) | Leverage | Security Highlights | Regulatory Status |

|---|---|---|---|---|

| Binance | 0.02% / 0.04% | Up to 125× | SAFU fund, cold storage, 2FA | Licensed in Malta, Cayman Islands |

| Bybit | 0.025% / 0.075% | Up to 100× | Cold wallets, insurance pool | Registered in Seychelles |

| Toobit | 0.03% / 0.07% | Up to 175× | Advanced risk control, audit reports | Operates under Vanuatu licence |

| WEEX | 0.01% / 0.02% | Up to 400× | 1,000BTC protection fund, cold storage | Multiple EU licences |

| WethioX Exchange | Not disclosed | Not disclosed | Not disclosed | Not disclosed |

The table makes it clear that the biggest gap for WethioX is transparency. All other exchanges list their fee tiers, leverage caps, and security measures openly - a practice that builds trader confidence.

User Community and Feedback Landscape

When you search Reddit, BitcoinTalk, or dedicated crypto review sites, you’ll find rich threads discussing Binance’s UI, Bybit’s margin rules, or Toobit’s risk‑control tools. WethioX, however, barely registers. A quick scan of the major forums shows virtually no user‑generated reviews, complaints, or success stories.

That silence could mean a fledgling user base, limited marketing, or simply that the exchange operates under the radar. In any case, the lack of community chatter removes a valuable source of real‑world insight - things like withdrawal speed, customer‑support responsiveness, or unexpected downtime.

Pros and Cons at a Glance

- Pros

- Targeted focus on African markets, potentially better local payment integration.

- Claims of a unified dashboard for portfolio tracking.

- Simple branding that may appeal to newcomers.

- Cons

- No verified trading volume or market‑pair data (untracked on CoinMarketCap).

- Fee structure, leverage, and security details are not publicly disclosed.

- Regulatory licensing and insurance coverage are unknown.

- Scarce user reviews and community presence.

Bottom Line - Should You Try WethioX?

If you’re a crypto newbie in Africa who wants a platform that speaks your language and offers easy fiat‑on‑ramps, WethioX might feel inviting. But the trade‑off is a significant information gap. Without clear fees, security guarantees, or independent audits, the risk of hidden costs or fund loss is higher than on well‑documented exchanges.

For small, experimental amounts - say, under $500 - you could test the deposit/withdrawal flow. For anything larger, consider a more transparent alternative like Binance or WEEX, where you can verify fees, read community feedback, and see real‑time liquidity.

Frequently Asked Questions

Is WethioX Exchange licensed to operate in Africa?

Public sources do not list any specific regulatory license for WethioX. Potential users should request proof of compliance directly from the platform before depositing sizable funds.

What fees does WethioX charge for trading?

The exchange does not publish a fee schedule on its website. Without disclosed maker/taker rates, users cannot calculate transaction costs in advance.

How does WethioX handle security and fund protection?

No information about cold‑wallet usage, insurance funds, or audit reports is publicly available. Traders should assume standard security measures only until proven otherwise.

Can I trade derivatives or use high leverage on WethioX?

Leverage options are not listed, so it’s unclear whether margin or futures products are offered at all.

Is there community support or a forum for WethioX users?

A quick search of Reddit, BitcoinTalk and major review sites returns almost no user posts. The platform appears to have a minimal public community.

25 Comments

Emily, let me be crystal clear: the lack of fee transparency is a glaring red flag, and it’s not just a minor inconvenience, it’s a potential financial nightmare!!!, traders deserve crystal‑clear fee schedules, otherwise you’re sailing blind, and that’s unacceptable, especially for newcomers looking for safe entry points into crypto, so demand full disclosure before you even think about depositing a single cent!

sandi khardani here, and I must say the entire premise of WethioX reads like a marketing brochure ripped from a 2015 startup that never learned to grow up, the omission of basic data such as fees and security protocols is not just sloppy, it’s dangerously negligent, you cannot trust a platform that hides its core metrics because transparency is the cornerstone of any legitimate exchange, furthermore, the “instant deposits” claim is laughably vague without any SLA documentation, and finally, the lack of community chatter is a symptom of deeper operational opacity.

Donald Barrett: this exchange is a textbook example of why crypto can be a scam‑infested jungle, no fees listed, no security audit-just blank promises.

Dear community, while the ambitions of WethioX to serve African markets are commendable, I would respectfully advise caution until such time that the platform publishes verifiable data regarding its trading volume, fee schedule, and regulatory compliance. Transparency is not a luxury but a necessity in fostering trust.

From a technical standpoint, the absence of any disclosed cold‑storage ratios, multi‑sig architecture, or even a simple audit report raises serious red‑flags. In the realm of crypto‑infrastructure, jargon such as “instant deposits” is meaningless without underlying liquidity metrics, settlement latency statistics, or proof‑of‑reserves mechanisms. One must question whether the platform’s API endpoints even expose order‑book depth, which is a baseline expectation for any serious trading venue.

Millsaps Delaine: It is, frankly, astonishing how the crypto sphere continues to conscript platforms like WethioX that masquerade under the veneer of “innovation” while refusing to disclose elementary information. One might argue that opacity is a strategic advantage, yet history teaches us that such a stance invariably culminates in user attrition and, often, financial loss. Moreover, the claim of “single pane portfolio tracking” sounds alluring, but without APIs that aggregate verified price feeds, it is merely a superficial feature. The omission of any regulatory licensing details is another glaring omission; compliance frameworks, whether from local authorities or international bodies, are the scaffolding that sustains user confidence. In addition, the lack of any published insurance fund, akin to Binance’s SAFU, leaves users exposed to potential custodial failures. Finally, the absence of community‑generated reviews suggests either a nascent user base or a deliberate effort to remain under the radar, both of which should trigger heightened scrutiny before committing any capital.

Jack Fans: i get the vibe that they want to be user‑friendly, but without clear fee tables, we can't gauge cost, also a lack of security data is a big red flag, i'd suggest wait until they post a proper audit.

Is this even a real exchange?

The silence is unsettling. Transparency matters.

Ayaz Mudarris: The proposition of a platform focused on African fiat integration is laudable, yet the foundation must be built upon measurable data. Absent fee disclosure, users cannot perform accurate cost‑benefit analyses, which is essential for informed trading decisions. Moreover, security protocols such as cold‑storage percentages and insurance provisions are non‑negotiable criteria for custodial trust. I recommend that potential users allocate only minimal funds for experimental testing until the exchange publishes comprehensive audits and regulatory certifications.

Vaishnavi Singh: Philosophically, an exchange without transparency challenges the very notion of market efficiency. In practice, this opacity incurs hidden risks that prudent traders cannot ignore.

Yo, if you’re just testing the waters, a tiny deposit won’t hurt. But don’t go all‑in until they show some real numbers.

meredith farmer: I can’t shake the feeling that this whole thing is a front for something bigger-maybe a data‑harvesting operation or a way to siphon funds under the guise of “instant deposits.” The lack of any audit feels like a wolf in sheep’s clothing.

Peter Johansson: Interesting concept, but seriously, where’s the proof of reserves? 🤔 Transparency is the only way to build trust in such markets.

Cindy Hernandez: The platform’s focus on African users could fill a real niche, yet without clear fee and security disclosures, it remains a tentative solution. I’d love to see more data before recommending it widely.

Gaurav Gautam: It’s encouraging to see an exchange targeting underserved markets, but we must demand solid compliance documentation. A transparent fee schedule, audited security measures, and verifiable volume stats would go a long way in gaining user confidence.

Alie Thompson: It is our moral responsibility to scrutinize platforms that operate in a vacuum of information, for the lack of disclosed fees alone constitutes a breach of fiduciary duty to potential users, who, in good faith, entrust their capital expecting transparency, yet WethioX offers none, which is tantamount to deception, the omission of security protocol details further exacerbates this moral failing, as users cannot assess the risk of custodial loss, and without evidence of regulatory licensing, the exchange flirts with illegality, we must also consider the broader impact on the African crypto ecosystem, where trust is fragile, and a single opaque platform can undermine collective progress, therefore, until WethioX publishes verifiable audits, fee structures, and licensing documents, it should be treated with the same caution as any unregulated entity, and prospective traders should seek alternatives that embody openness, accountability, and ethical standards.

Samuel Wilson: I concur with the concerns raised; a platform lacking fundamental disclosures cannot be deemed safe for substantial investment. It is advisable to await comprehensive transparency before proceeding.

Danny Locher: If you’re just curious, put a small amount in and see how withdrawals work. Otherwise, stick with exchanges that list their fees.

Christina Norberto: The absence of any public audit invites speculation of malfeasance, and the deliberate concealment of fee structures is a red flag of potential predatory practices.

Fiona Chow: Oh sure, “instant deposits” sounds great-if you love mystery fees and invisible security measures, go ahead.

Rebecca Stowe: Maybe start with a tiny test deposit, just to see if the platform lives up to its promises.

Aditya Raj Gontia: Lacks basic transparency.

Kailey Shelton: Not enough info to trust.

vipin kumar: If they’re hiding details, it could be part of a bigger scheme-stay vigilant.