Cryptocurrency: Guides, Exchanges, Airdrops and Tokens

When talking about Cryptocurrency, digital assets secured by cryptography that enable peer‑to‑peer value transfer without a central bank. Also known as crypto, it powers everything from simple payments to complex decentralized finance. Cryptocurrency isn’t a single product; it’s an ecosystem that includes crypto exchange, platforms where users trade digital assets, manage wallets, and access market data, airdrop, free token distributions used to reward community members or promote new projects and individual token, the tradable unit of a blockchain project, often representing utility, governance or a share of revenue. Understanding how these pieces fit together helps you navigate the space with confidence.

Key Concepts in the Crypto World

The first semantic link is simple: Cryptocurrency encompasses token trading. Tokens give each project its unique purpose—some fuel DeFi apps, others grant voting rights. Next, Cryptocurrency requires secure exchanges because you need a trusted place to buy, sell, or hold assets. Finally, Airdrops influence token distribution by creating instant holders and boosting network effects. These three ideas form the backbone of most articles on our site, whether you’re checking out an exchange review, a new airdrop alert, or a deep dive into tokenomics.

When you pick a crypto exchange, look at three attributes: fee structure, security measures, and asset variety. Low fees improve margin for traders, strong security (like multi‑factor authentication and cold storage) protects your holdings, and a broad asset list lets you explore emerging tokens without hopping platforms. Our exchange reviews break down each of these points with real‑world numbers, so you can compare Binance, Coinbase, MorCrypto and dozens of niche platforms side by side.

Airdrops work differently. Rather than paying a purchase price, you fulfil eligibility rules—holding a certain token, completing a KYC, or joining a community group. The reward is usually a fresh token that may appreciate as the project grows. We detail claim steps, tax considerations, and timing tricks that let you capture the full value before the market reacts.

Tokens themselves vary widely. Some, like platform tokens, gain value from utility within a broader ecosystem (think governance voting or fee discounts). Others are pure speculation, driven by hype and limited supply. Our token guides cover market cap, circulating supply, liquidity depth, and risk factors, giving you a quick checklist before you invest.

Beyond the basics, the crypto space touches on margin trading, blockchain tech, and financial inclusion. Margin trading lets seasoned investors amplify exposure, but it demands strict risk controls—stop‑loss orders, position sizing, and a broker that offers transparent margin requirements. Blockchain technology underpins every token, providing immutable ledgers and smart contract capabilities that power everything from NFTs to decentralized exchanges.

Financial inclusion is another powerful angle. In many developing regions, traditional banks are scarce, but mobile phones are common. Crypto can deliver fast, low‑cost remittances, savings tools, and access to global markets. We explore case studies where digital wallets empower unbanked users, and we discuss regulatory hurdles that still need to be cleared.

All these topics—exchanges, airdrops, tokens, margin tools, and inclusion—show up in the articles below. Whether you’re hunting the next high‑yield airdrop, comparing fees across platforms, or trying to understand why a token like PACO is labeled a dead coin, our curated list provides the practical details you need. Dive in to see reviews, how‑to guides, and analysis that keep you ahead of the curve.

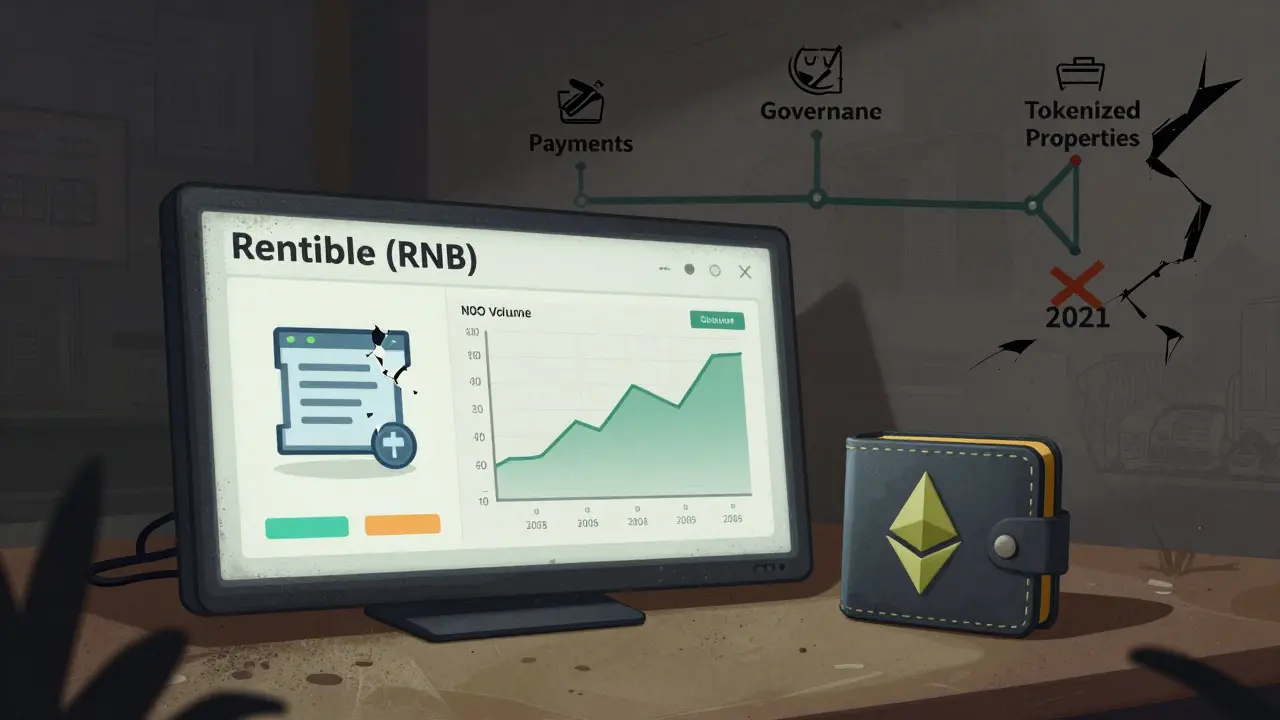

Rentible (RNB) was meant to revolutionize rental payments with crypto, but it never gained traction. Now trading at $0.033, down 99% from its peak, it's a dead project with no development, no users, and no future.

Read More