What is XcelPay (XLD) Crypto Coin? A Complete 2025 Overview

XcelPay (XLD) Token Valuation Calculator

Investment Analysis Results

Tokens Purchased:

Total Value at Current Price:

Potential Value at ATH ($1.145):

Potential Value at $0.01:

Risk Assessment:

Liquidity Status:

Market Cap:

Circulating Supply:

When you hear the name XcelPay, you’re probably wondering whether it’s another meme token or a serious tool for everyday crypto transactions. In 2025 the project still promises a self‑custodial wallet that works with both Ethereum and Bitcoin, but the market data, development activity, and community buzz tell a more nuanced story. This guide breaks down exactly what XcelPay (XLD) is, how its tokenomics work, where you can actually trade it, and what risks you should weigh before putting any money in.

TL;DR

- XcelPay (XLD) is a low‑market‑cap crypto aiming to simplify DeFi through a self‑custodial wallet that supports ETH and BTC.

- Current price hovers around $0.002 on major exchanges, with a circulating supply of ~57.9M out of a 1B max supply.

- Liquidity is thin - 24‑hour volume barely exceeds $20, making large trades difficult.

- Development updates are scarce; the roadmap is vague, and community activity is minimal.

- Investing in XLD is high‑risk, suitable only for those who can handle extreme price swings and potential token dilution.

What is XcelPay?

XcelPay is a cryptocurrency ecosystem that markets itself as a one‑stop solution for sending, receiving, and spending digital assets. The core idea is to lower the entry barrier to decentralized finance (DeFi) by offering a self‑custodial wallet where users control their private keys. In theory, the wallet should let anyone handle Ethereum (Ethereum) and Bitcoin (Bitcoin) without needing separate apps.

The project’s website describes XcelPay as “building a unified crypto ecosystem for mass adoption.” That’s an ambitious claim, especially when you compare it to established players like MetaMask or Trust Wallet, which already dominate the wallet market. XcelPay’s differentiator is the alleged integration of a native token-XLD-that can be used for transaction fees, rewards, and possibly future staking, though concrete details are sparse.

Tokenomics: Supply, Distribution, and Value

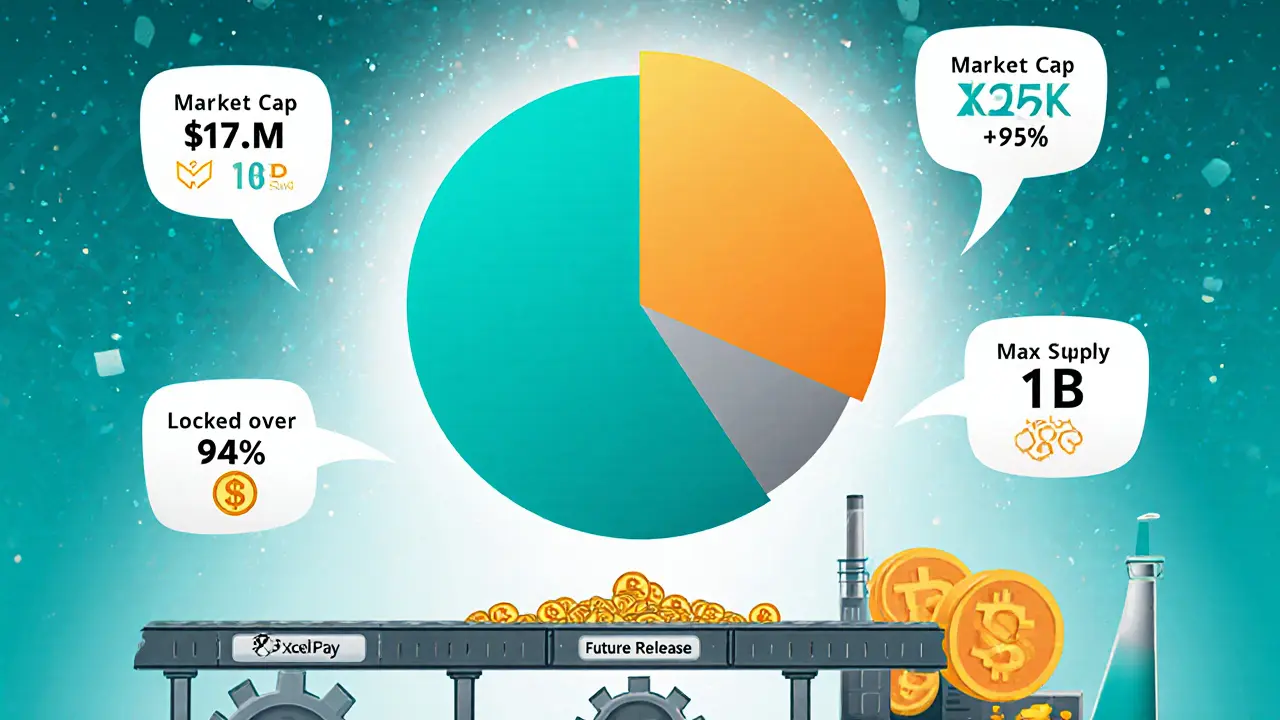

The native token, identified as XLD, has a maximum supply of 1billion tokens. As of October2025, roughly 57.9million XLD are circulating, representing about 5.8% of the total supply. This means that over 94% of the tokens are still locked or held by the team and early investors, a factor that could cause future dilution if large portions are released.

Market capitalization varies slightly between data providers: Coinbase lists it near $108K, Binance reports $114K, and CoinMarketCap shows $125K. The fully diluted valuation-what the market cap would be if all 1billion tokens were in circulation-ranges from $1.87M to $2.15M, underscoring the token’s micro‑cap status.

Holder count is modest, with about 52.9K addresses holding XLD. The volume‑to‑market‑cap ratio sits at roughly 0.1%, confirming that trading activity is extremely thin.

Current Market Data and Price History

Pricing across the major exchanges is consistent enough to see the market’s low liquidity. Below is a snapshot of the most recent prices:

| Exchange | Price (USD) | 24‑h Volume (USD) | Market Cap (USD) |

|---|---|---|---|

| Coinbase | 0.0019 | 16.56 | 108,410 |

| Binance | 0.001976 | ≈0 | 114,434 |

| CoinMarketCap | 0.002074 | 18.10 | 125,020 |

The all‑time high (ATH) is a point of debate: Coinbase records $0.43 on Nov62021, while Binance lists a peak of $1.145. Regardless of the exact figure, current prices represent a 99%+ drop from any ATH, a typical fate for many micro‑cap tokens launched during the 2020‑2021 boom.

Weekly price movement is flat to slightly negative. Binance shows a ‑0.26% change over the past 24hours and a ‑14.08% slide over seven days. Such modest swings can be misleading because a single large trade can swing the price dramatically given the low volume.

Wallet Functionality and Technical Outlook

The XcelPay wallet claims to be self‑custodial, meaning users retain full control of their private keys. It supports both Ethereum and Bitcoin, implying some form of cross‑chain capability. However, the technical whitepaper does not elaborate on the underlying blockchain, consensus algorithm, or whether a layer‑2 solution is used.

Because the wallet can handle ERC‑20 tokens (through its Ethereum support) and native Bitcoin transactions, it can serve as a bridge for users who want a single app for two major networks. That said, the lack of transparent roadmaps, audit reports, or developer activity on platforms like GitHub raises questions about security and future upgrades.

In the broader DeFi landscape, XcelPay positions itself more as a consumer‑friendly entry point than a sophisticated protocol. It does not currently offer automated market making, yield farming, or staking, which differentiates it sharply from established DeFi platforms such as Uniswap or SushiSwap.

Competitive Landscape

When you line up XcelPay against the wallet giants-MetaMask, Trust Wallet, and hardware options like Ledger-you’ll notice a few gaps:

- Liquidity: Established wallets are linked to massive ecosystems; XcelPay’s token rarely trades.

- Features: MetaMask supports a vast array of dApps, while XcelPay’s ecosystem is still under development.

- Community: Major wallets have active developer forums and social channels; XcelPay’s social presence is minimal.

On the DeFi side, XcelPay competes indirectly with protocols that lower entry barriers-e.g., Coinbase Wallet or Crypto.com Pay. Those platforms already have strong brand recognition and deeper liquidity pools, making it tougher for XLD to capture a meaningful market share unless it rolls out unique incentives or partnerships.

Risks and Investment Considerations

Investing in XLD means accepting a high‑risk profile typical of micro‑caps:

- Liquidity risk: With daily volumes under $20, exiting a position may take hours or require a deep discount.

- Dilution risk: Over 94% of tokens are not circulating; future releases could flood the market.

- Development uncertainty: No recent code commits, vague roadmap, and limited public communication suggest possible stagnation.

- Regulatory exposure: As a DeFi‑focused token, XLD could attract scrutiny if regulators tighten rules around custodial and self‑custodial solutions.

- Price volatility: The token has already lost more than 99% of its peak value; while a rebound is theoretically possible, it would require substantial adoption or a major partnership.

Only allocate money you can afford to lose, and consider diversifying into higher‑cap, more liquid assets if you need stability.

How to Buy and Store XLD

If you decide the risk is worth it, here’s a practical step‑by‑step:

- Create an account on a supported exchange-Binance, Coinbase, or any platform that lists XLD.

- Complete KYC (if required) and deposit fiat or a major crypto like BTC or ETH.

- Search for the ticker “XLD” and place a market or limit order. Remember that low liquidity may cause slippage.

- Transfer the purchased XLD to the XcelPay wallet for self‑custody. Download the wallet from the official site, generate a new seed phrase, and back it up securely.

- Keep the seed phrase offline; losing it means losing access to your tokens.

Because the wallet also handles ETH and BTC, you can use the same app for multiple assets, simplifying your crypto management if you’re comfortable with the XcelPay ecosystem.

Frequently Asked Questions

What problem does XcelPay aim to solve?

XcelPay tries to make DeFi accessible to everyday users by offering a self‑custodial wallet that supports both Ethereum and Bitcoin, reducing the need for multiple apps.

Is XLD a good long‑term investment?

Given its tiny market cap, low liquidity, and unclear development roadmap, XLD is high‑risk. It may suit speculative traders but is not recommended for most long‑term investors.

How many XLD tokens are in circulation?

Approximately 57.9million XLD are circulating, about 5.8% of the 1billion total supply.

Where can I trade XLD?

XLD is listed on Binance, Coinbase, and appears on CoinMarketCap’s price tracker. Liquidity is very thin, so expect slippage.

Is the XcelPay wallet secure?

The wallet is self‑custodial, so you control the keys, which is good for privacy. However, the project lacks public audits and regular code updates, so security cannot be fully guaranteed.

Bottom line: XcelPay offers an interesting concept-a single wallet for the two biggest blockchains-but the reality is that the token is still a speculative micro‑cap with limited adoption. If you’re curious, test the wallet with a small amount, keep an eye on any development announcements, and always prioritize security.

23 Comments

Oh wow, another "revolutionary" crypto token that promises to change the world while secretly being funded by the same shadowy cabal that controls the global banking system, right? The marketing materials read like a fever dream where Elon Musk, the Illuminati, and a batch of bored programmers all collude to create a digital Ponzi scheme that will apparently solve all our financial woes. They tout "decentralization" while the code lives on a handful of servers owned by anonymous offshore foundations that are probably registered under a shell company in the Cayman Islands. Sure, the whitepaper mentions a "unique consensus algorithm" that supposedly prevents any manipulation, but have you ever considered that the algorithm could be a glorified lottery designed to reward early insiders?

And let’s not forget the tokenomics: a total supply that is so massive it makes hyperinflation look like a mild inconvenience, while the circulating supply is a trickle that only a select few can actually access. The liquidity pools are as thin as a one‑cent piece, meaning if you try to sell even a modest amount, the price will nosedive faster than a skydiver with a hole in their parachute. The team behind XLD claims they are engaged in "ongoing development," yet the GitHub repository hasn't seen a commit in over a year, which is the digital equivalent of a tombstone.

Now, the risk disclaimer, buried at the bottom of the page in tiny font, tells you to only invest what you can afford to lose. That's a polite way of saying, "Don't bother, because it's a total scam." The community chat is filled with bots spouting scripted hype, while anyone who dares to ask a question about the token's real use case is instantly labeled a "hater" or a "shill." If you think the only risk here is market volatility, think again – the real risk is becoming another pawn in a grand experiment to test how far people will go for a shiny new meme coin before they realize they've handed over their life savings to a faceless entity that probably doesn't exist.

Esteemed readers, one must contemplate the ontological ramifications of a token that purports to epitomize financial sovereignty while concurrently existing within the confines of a pre‑existing monetary architecture. The dialectic herein is reminiscent of Sartre's existentialism, albeit with a veneer of blockchain bravado. 😊

Honestly, why do we keep making these so‑called "innovative" coins when America’s money is already perfect? The whole thing is a joke and the developers are just lazy hacks cashing in on hype without a single real use‑case prove it's not a scam.

Hey folks, just wanted to add a quick note for anyone digging into XLD. The project’s roadmap is vague, and there’s no clear partnership announced yet. If you’re looking for a token with solid fundamentals, you might want to explore projects that have transparent development updates and active community engagement. Also, always double‑check contract addresses before interacting.

While we’re dissecting the moral integrity of digital assets, it’s worth noting that promoting a coin with such dubious transparency borders on irresponsible advocacy. We have a collective duty to caution newcomers about the speculative labyrinth that these tokens often represent, lest we become complicit in their financial misadventures.

Just a friendly reminder: always verify the token’s contract on reputable sites and keep an eye on the liquidity pool. It’s a simple step that can protect you from many common pitfalls in the crypto space.

There's nothing but a hidden agenda here – the elites are using XLD as a conduit to funnel money into their offshore accounts while the rest of us are left with nothing but buzzwords and broken promises. Wake up, people.

Ah, the drama! Yet another token crowds its way into the market, cloaked in lofty rhetoric and over‑punctuated proclamations; one must ask: is this genuine innovation or merely another echo in the cavern of crypto’s perpetual hype?

Hey team, I see you’re putting in effort, keep pushing forward and remember that every setback is a setup for a stronger comeback. You’ve got this!

Thanks for the info. I’ll make sure to double‑check the contract address before any transactions.

Looks promising!

From my experience, a token’s longevity often depends on the community’s willingness to contribute code, documentation, and real‑world use cases. If you see active GitHub commits, that’s a good sign. Otherwise, it might just be a hype train with no destination.

The market dynamics here are plainly toxic; the token suffers from low liquidity, high volatility, and a glaring absence of substantive utility, rendering it a precarious speculative instrument at best.

Nice overview, thanks for sharing.

Let’s stay positive and keep encouraging each other. Even if this coin doesn’t take off, the learning experience is invaluable.

Yo, i think this coin is overrated, its just a fad. I dunno why ppl waste time on it.

I appreciate the balanced discussion here and would be happy to help clarify any technical details for those interested.

The token’s whitepaper fails to address crucial security considerations, which is a red flag for any serious investor.

One must question whether the very architecture of XLD is not merely a veneer, an elaborate tapestry woven to conceal the inexorable march of the technocratic oligarchy that seeks to ensnare the masses within layers of cryptographic illusion.

In plain terms, the token’s price is volatile and the community support is limited. If you decide to invest, do so responsibly.

Dear participants, I recommend conducting a thorough due‑diligence process, examining the token’s audit reports, and ensuring compliance with relevant regulations before proceeding.

Looks like another overhyped project, but hey, maybe someone will find a use‑case we haven’t thought of.

Stay optimistic, keep learning, and don’t let a single token dictate your overall crypto journey.