Crypto Exchange Scam: How to Spot Fake Platforms and Avoid Losing Your Crypto

When you hear about a crypto exchange scam, a fraudulent platform designed to steal users’ funds by pretending to be a legitimate trading service. Also known as fake crypto exchange, it often looks just like the real thing—until your money vanishes and customer support disappears. These aren’t rare mistakes. They’re organized operations targeting people who don’t know what to look for.

A real regulated crypto exchange, a platform legally licensed to operate and subject to oversight by financial authorities. Also known as licensed crypto platform, it discloses its location, registration number, and compliance team. It doesn’t promise 10x returns overnight. It doesn’t ask you to send crypto to a personal wallet. It doesn’t have a website that looks like it was built in 2017. Platforms like Kyrrex and BitBegin are examples of exchanges that publish their regulatory status clearly. In contrast, sites like Coinviva and Almeedex have no verifiable presence, no physical address, and no track record—classic signs of a crypto scam, a deceptive scheme that tricks users into sending funds with no intention of returning them. Also known as crypto fraud.

Scammers use the same tricks over and over. They create fake airdrops—like the so-called IMM airdrop—that don’t exist. They clone real exchange logos and copy their UI. They run ads on social media with fake testimonials. They even hire people to post in crypto forums pretending to be happy users. The goal? Get you to connect your wallet or send crypto to a deposit address. Once you do, it’s gone. No chargeback. No recovery. No second chance. The best defense? Always check if the exchange is listed on CoinMarketCap or CoinGecko with real trading volume. Look for FinCEN, MiCA, or other official registrations. If they don’t mention them, walk away.

You’ll find plenty of examples in the posts below. Some platforms, like GCOX and OPNX, shut down after failing to attract users. Others, like GDEX and Almeedex, never had real operations to begin with. Even projects tied to real names—like Cratos or Caduceus—turned out to be empty shells after the airdrop. The pattern is clear: if it sounds too good to be true, it is. If you can’t find a team, a license, or a track record, it’s not worth the risk. These aren’t just warnings—they’re lessons learned from real losses. What follows is a collection of real cases, breakdowns, and red flags you can use to protect yourself before you trade.

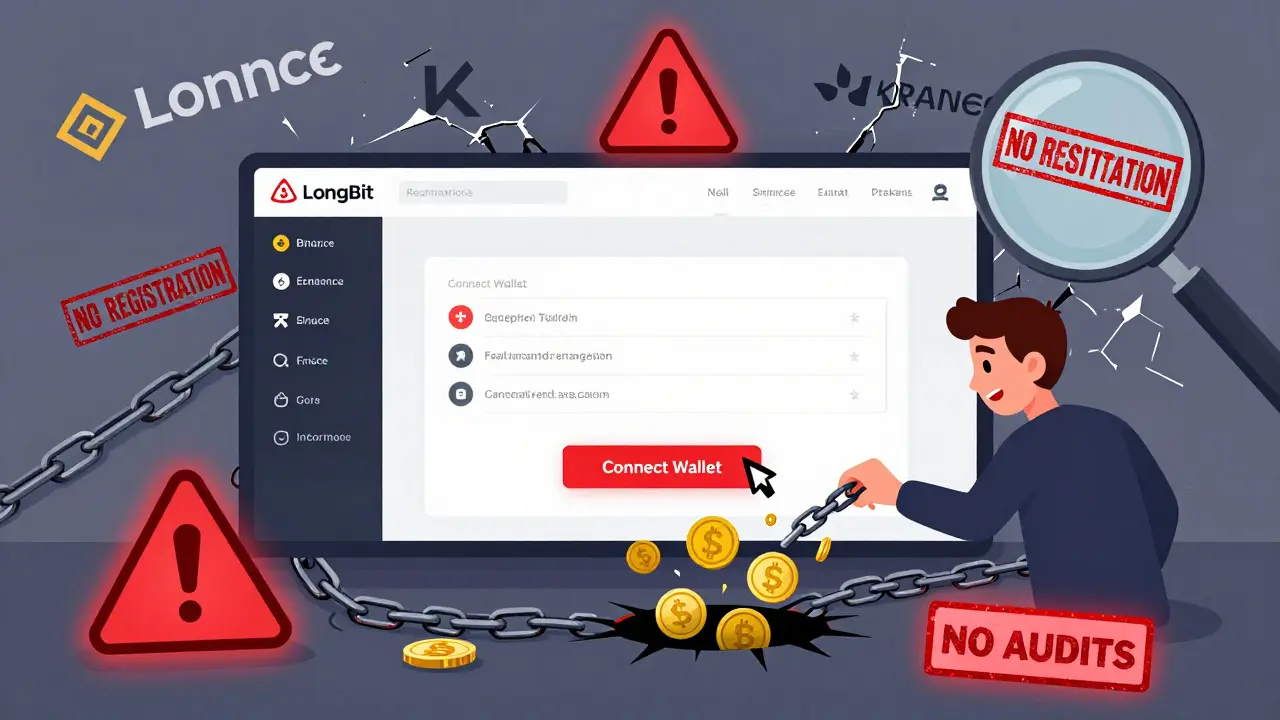

LongBit crypto exchange is not a real platform-it's a scam. No legitimate records, reviews, or security practices exist. Learn how to spot fake exchanges and protect your crypto from phishing traps.

Read More

BiteBTC crypto exchange is inactive and flagged as a scam in 2025. Users report locked funds, high withdrawal fees, and zero customer support. Avoid this platform and use Binance, Coinbase, or Kraken instead.

Read More

Bitcoin.me is not a legitimate crypto exchange - it's a scam site designed to steal cryptocurrency. No regulatory oversight, no security features, and users are already reporting losses. Avoid it at all costs.

Read More

99Ex is not a real crypto exchange - it's a scam. No audits, no reviews, no legitimacy. Learn how these fake platforms work and which exchanges are actually safe to use in 2025.

Read More