What is Thala (THL) Crypto Coin? A Realistic Look at the Aptos DeFi Token

THL Risk Assessment Tool

This tool helps you assess the risk level of investing in Thala (THL) based on current market conditions. Remember: Thala has experienced a 93% price drop, has low liquidity, and high volatility. Only invest what you can afford to lose.

Risk Assessment Inputs

Key THL Risk Factors

Your Risk Assessment

-

Thala (THL) isn't just another crypto coin. It's a governance token built for a specific purpose on the Aptos blockchain - to power a set of decentralized finance tools that aim to make trading, lending, and stablecoin usage easier within the Aptos ecosystem. But here’s the truth: most people who buy THL don’t understand what it actually does. They see a low price and think it’s a hidden gem. The reality is far more complex.

What Thala (THL) Actually Is

Thala is not a currency you use to pay for coffee. It’s a governance token for a DeFi protocol built on Aptos. Think of it like owning a voting share in a small financial cooperative. Holders of THL can vote on changes to the protocol - things like adjusting fees on Thala Swap, changing how the Move Dollar (MOD) stablecoin is backed, or deciding where the protocol’s treasury funds go. There’s no CEO making decisions. It’s all community-driven.

The protocol has three main parts:

- Move Dollar (MOD) - an algorithmic stablecoin pegged to $1, designed to stay stable without needing reserves like USDT or USDC.

- Thala Swap - a decentralized exchange (DEX) that lets users trade crypto directly on Aptos. It’s different from other DEXs because it uses dynamic pool weights, meaning liquidity pools can adjust how much of each token they hold based on market conditions.

- Launchpad - a tool for new projects on Aptos to raise funds fairly, without big investors dominating the early sale.

THL doesn’t earn interest. It doesn’t pay dividends. Its only real function is voting. That’s it. If you’re holding THL hoping for price gains from staking rewards or yield farming, you’re mistaken.

Supply, Market Cap, and Price History

There are only 100 million THL tokens ever going to exist. That’s fixed. But right now, only about 58 million are in circulation. The rest are locked up and will be released slowly over the next few years. This matters because when those tokens unlock, they flood the market - and prices usually drop.

Thala’s price tells a wild story. It hit an all-time high of $3.13 in mid-2023. Today, it trades around $0.034. That’s a 99% drop. Why? Because the entire crypto market crashed, and Thala had no real users or liquidity to hold it up. Most of the early buyers were speculators who sold as soon as the price popped. There’s no big company backing it. No celebrity endorsement. No major exchange listing beyond small ones like Gate.io and CoinMarketCap.

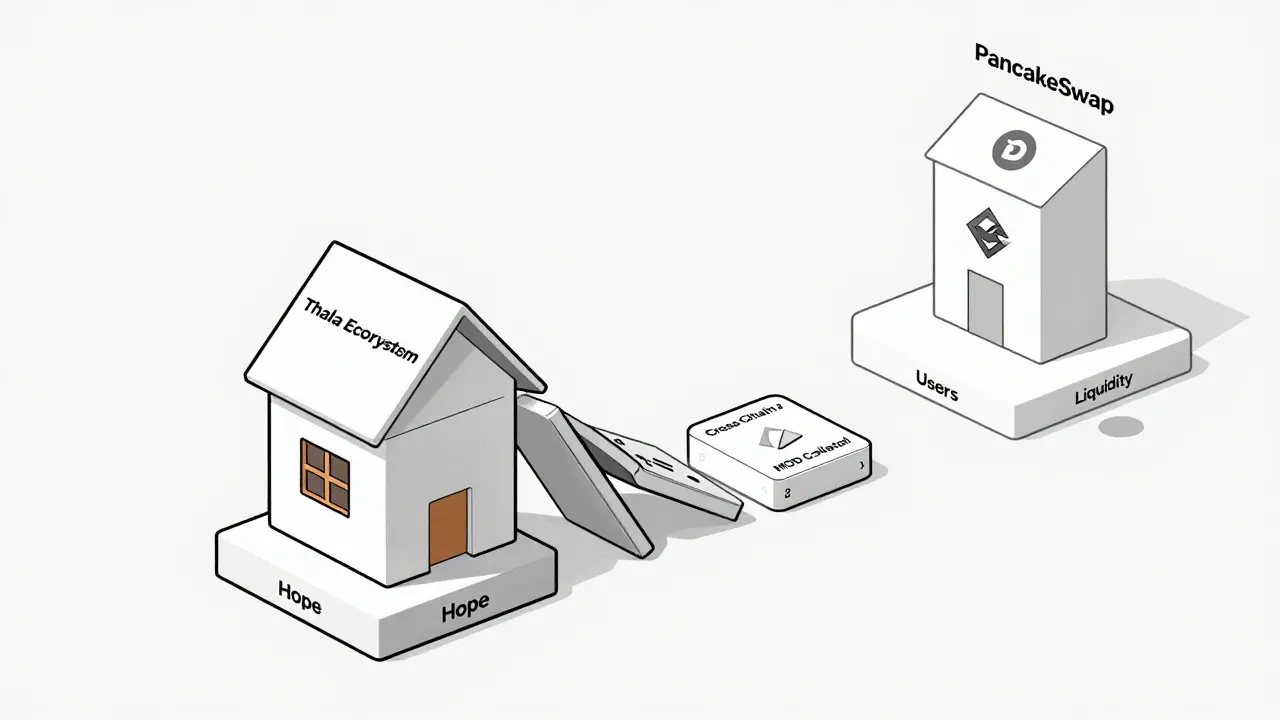

Its market cap hovers around $2 million. That’s tiny. For comparison, Uniswap’s UNI token has a market cap over $3 billion. Even smaller DeFi tokens on Ethereum or Solana often trade at 10x Thala’s value. Thala’s value isn’t based on adoption - it’s based on hope. And hope doesn’t pay bills.

Why Thala Is Risky

Let’s be blunt: Thala is high-risk. Here’s why:

- Low liquidity - You can’t trade more than $500 on Thala Swap without slippage hitting 3% or more. That means if you try to sell $1,000 worth of THL, you might only get $970 back because there aren’t enough buyers.

- High volatility - In the last 30 days, THL swung up and down by over 11%. That’s more than double the average for other Aptos tokens.

- Weak community support - The official Telegram group has 2,300 members, but 58% of messages are negative. People complain about broken oracles, slow support, and confusing interfaces.

- Hard to use - You need an Aptos wallet like Petra or Martian. You need to understand how MoveVM works. You need to know what a liquidity pool is. Most retail users can’t even get past the wallet setup.

Analyst Benjamin Cowen labeled Thala as “high risk” because its trading volume is only 8.65% of its market cap. Healthy projects stay under 5%. When volume is this high relative to market cap, it usually means whales are dumping on unsuspecting buyers.

How Thala Compares to Other Aptos DeFi Projects

Aptos has dozens of DeFi protocols. Thala is one of the smallest. Here’s how it stacks up:

| Protocol | Market Cap | TVL (Total Value Locked) | Key Feature |

|---|---|---|---|

| Thala (THL) | $2.16M | $1.66M | Stablecoin + AMM combo |

| PancakeSwap (APTOS) | $150M | $165M | Simple, popular AMM |

| liquidswap | $110M | $124M | Fixed 50/50 pools, easy to use |

| Stargate (Aptos) | $85M | $98M | Multi-chain bridging |

Thala’s unique selling point - combining a stablecoin and a flexible AMM - sounds smart on paper. But in practice, users don’t care. They want simple, fast, cheap swaps. PancakeSwap and liquidswap deliver that. Thala’s complexity is a bug, not a feature.

Who Uses Thala? And Why?

Most THL holders are retail traders with less than $1,000 invested. Institutional investors barely touch it - only 2.3% of supply is held by large wallets. That’s a red flag. Big money doesn’t invest in projects without clear utility or strong teams.

There are two types of people using Thala:

- Speculators - They buy when the price dips, hoping for a pump. They sell fast. They don’t vote. They don’t care about the protocol.

- Early adopters - These are crypto-native users who believe in Aptos. They use Thala Swap because they want to support the ecosystem. They vote on governance proposals. They’re rare.

If you’re not one of those two, you shouldn’t be holding THL. It’s not a store of value. It’s not a yield asset. It’s a bet on a small, struggling project surviving.

What’s Next for Thala?

The Thala team has a roadmap. It’s ambitious:

- Q1 2024 - Cross-chain support for Ethereum and Polygon. This could bring in new users, but it’s risky. Cross-chain bridges have been hacked for billions.

- Q3 2024 - Move Dollar (MOD) will accept real-world assets as collateral. This is a huge leap. If it works, MOD could become a real stablecoin. If it fails, the whole project collapses.

- Q4 2024 - Integration with Aptos Layer 2. This should lower fees and speed up transactions.

- Q2 2025 - A decentralized identity layer. This could help with KYC and compliance.

These are good ideas. But ideas don’t make a project successful. Execution does. And Thala has shown poor execution so far: slow development, weak documentation, and low user adoption.

Delphi Digital estimates Thala has only a 45% chance of surviving three years. The Aptos Foundation’s internal report says 68%. That’s a huge gap. Which one should you believe? Look at the data: 93% price drop in a year, low liquidity, negative sentiment. The market is already voting.

Should You Buy Thala (THL)?

If you’re looking to invest, the answer is no - unless you’re prepared to lose everything.

Here’s when THL might make sense:

- You’re a developer building on Aptos and need to vote on protocol changes.

- You’re testing DeFi tools and want to experiment with a stablecoin + AMM combo.

- You have $50 to spare and treat it like a lottery ticket.

Here’s when you should avoid it:

- You want passive income or staking rewards.

- You’re new to crypto and don’t understand liquidity pools or governance.

- You’re counting on THL to make you rich.

Thala isn’t a scam. The code is open. The team has published real updates. But it’s a project that’s running on fumes. It needs a massive influx of users and liquidity to survive. So far, it’s not getting it.

If you still want to try it, start small. Use a wallet you control. Don’t connect your main portfolio. And never invest more than you can afford to lose.

Is Thala (THL) a good investment?

Thala is not a good investment for most people. It’s a high-risk, low-liquidity token with no real utility beyond voting. The price has dropped 93% in a year, and there’s little evidence it will recover. Only experienced DeFi users with a high risk tolerance should consider it - and even then, only with money they can afford to lose.

How do I buy Thala (THL)?

You can buy THL on exchanges like Gate.io and CoinMarketCap. You’ll need an Aptos-compatible wallet like Petra or Martian. Transfer USDT or USDC to your wallet, then swap it for THL on Thala Swap. Never send crypto directly from an exchange to Thala - always use a wallet first.

Can I stake Thala (THL) for rewards?

No, THL cannot be staked for rewards. It’s purely a governance token. There’s no yield farming, no liquidity mining, and no staking program. Any site claiming to offer THL staking is likely a scam.

What’s the difference between THL and Move Dollar (MOD)?

THL is the governance token used to vote on protocol changes. MOD is the algorithmic stablecoin pegged to $1. You can use MOD to trade or lend, but you can’t vote with it. THL gives you control; MOD gives you stability.

Is Thala safe to use?

The code has been audited, but safety isn’t just about audits. Thala has low liquidity, which means large trades can crash the price. There are also reports of oracle failures affecting MOD’s peg. Use it only for small, experimental trades. Never put your life savings into it.

Final Thoughts

Thala (THL) is a technically interesting project. It’s built on a fast, secure blockchain. It has real innovation in its stablecoin and AMM design. But innovation doesn’t equal success. In crypto, adoption wins. Liquidity wins. Community wins.

Thala has none of those in meaningful amounts. It’s a project clinging to life. If you’re curious, play with it - but don’t invest. If you’re looking for real DeFi opportunities on Aptos, look at PancakeSwap or liquidswap. They’re not glamorous. But they work.

Thala might rise again. But betting on it is like betting on a small startup with no customers and a broken website. The odds are against you.

21 Comments

THL is a ghost town bro. I bought at $0.10 and now its $0.034. No one's trading. No one's voting. Just me and 3 other weirdos in the telegram group talking to ourselves. 😅

The analysis presented here is methodologically sound and accurately reflects the structural deficiencies of Thala as a decentralized finance instrument. The absence of yield mechanisms and the concentration of token distribution among retail speculators are critical red flags.

Y’all acting like THL is supposed to be a blue chip. It’s a $2M project on a chain with $15B in TVL. If you bought it expecting to get rich, you were never meant to be here. Go play with UNI or SOL tokens. This ain’t your grandma’s crypto.

I love how Thala is like that tiny coffee shop downtown that makes the best latte but no one knows about it 🤍 The code is clean, the team is real, and the vision? Fire. 💥 Maybe it’s not for everyone, but if you believe in Aptos, this is the heartbeat. Don’t bet on the price-bet on the future.

The whole thing feels like a math problem no one asked for. Why do we need dynamic pool weights when PancakeSwap just works? The complexity is the problem not the feature. Also why is MOD even a thing when USDC exists

USA thinks it owns crypto now? Thala is built on Aptos which is Indian-developed tech. You guys just trade and cry. The real builders are silent. Wait till MOD goes global and you realize you were betting against the future. 🇮🇳🔥

I appreciate the honesty here. Most posts are just pump-and-dump fluff. This one actually explains why THL isn't for everyone. I respect that. Not every token needs to be a moonshot.

I think the real story here isn't THL's price-it's how little we understand what 'value' means in DeFi. Is it liquidity? Adoption? Governance power? THL forces us to ask that question. And maybe that's more valuable than any token.

If you're new to crypto, don't touch THL. But if you're curious and have $20 to lose? Go try it. Use a small wallet. Learn how the AMM works. Vote on a proposal. It's like a free DeFi bootcamp. Just don't call it an investment.

This is all part of the Great Crypto Reset. The Fed, the SEC, the banks-they're all pushing small projects like Thala into oblivion so only their approved tokens survive. THL is being assassinated by systemic power. The 99% drop? Not market failure. It's suppression.

Low liquidity + high volume = whale bait. That’s all.

I read this whole thing and just sighed. Like… why does this even exist? 🤡

I like that Thala is trying something different. Maybe it's not perfect but at least someone is building on Aptos without copying Ethereum. I'm keeping my small stack

You think this is bad? Wait till the next audit reveals the MOD oracle is controlled by one dev’s phone. And then you’ll see the real drama. I’ve seen this movie before. The credits roll in 3… 2…

I’ve held THL since launch. I don’t care about the price. I vote. I use Thala Swap. I’ve watched it grow from 200 users to 1,200. It’s slow. But real. Most crypto projects are just fireworks. This is a campfire. Warm. Quiet. Lasting.

I appreciate the transparency. No hype. Just facts. That’s rare.

You people are so naive. Thala is a front for some VC group laundering money through Aptos. The 'team' is anonymous. The roadmap is just a fairy tale. And you’re all just feeding the beast. Wake up.

I laughed when I saw THL at $3. Then I cried when I saw it at $0.03. But honestly? I still use Thala Swap because it’s the only DEX on Aptos that doesn’t glitch every 2 minutes. So I guess I’m weird. 🤷♂️

As someone who’s lived in India and the US, I’ve seen how crypto culture shifts. In India, people see THL as a chance to build. In the US, they see it as a gamble. Both are right. But only one will survive the next cycle.

The Delphi Digital 45% survival estimate is statistically insignificant given the minuscule market cap and the absence of institutional oversight. The token’s velocity exceeds 1200% annually, indicating extreme speculative churn. Furthermore, the governance participation rate hovers below 0.7%, rendering the entire democratic framework a performative artifact. This is not a protocol-it is a liquidity graveyard dressed in blockchain aesthetics.

I used to think Thala was dead. Then I voted on a proposal last week. Just me and 12 others. But we changed the fee structure. That felt… meaningful. Maybe that’s enough.