TSX token – What you need to know

TSX token is stirring interest among both stock‑market fans and crypto enthusiasts. When working with TSX token, a blockchain‑based security token that mirrors the performance of the Toronto Stock Exchange index. Also known as TSX Index Token, it blends traditional equity exposure with the speed of digital assets. Its tokenomics, the supply schedule, distribution model and staking rewards that shape scarcity and value are engineered to keep price movements predictable while rewarding long‑term holders. The underlying blockchain, a decentralized ledger that records every transaction transparently ensures traceability and reduces settlement delays, a clear upgrade from traditional clearing houses. In short, TSX token encompasses tokenomics, leverages blockchain tech, and offers a hybrid asset class for modern investors.

Getting the token listed on a reputable crypto exchange, platforms that match buyers and sellers for digital assets and provide market data is the next critical step. Exchanges act as the primary price‑discovery engine, so their liquidity depth directly influences TSX token’s market price. At the same time, futures markets on these platforms add another layer of price signals; futures contracts can push spot prices higher or lower based on trader sentiment. This dynamic means that a robust exchange listing not only boosts visibility but also stabilizes price swings. In practice, traders watch exchange order books, volume spikes, and futures contract open interest to gauge where the TSX token might head next.

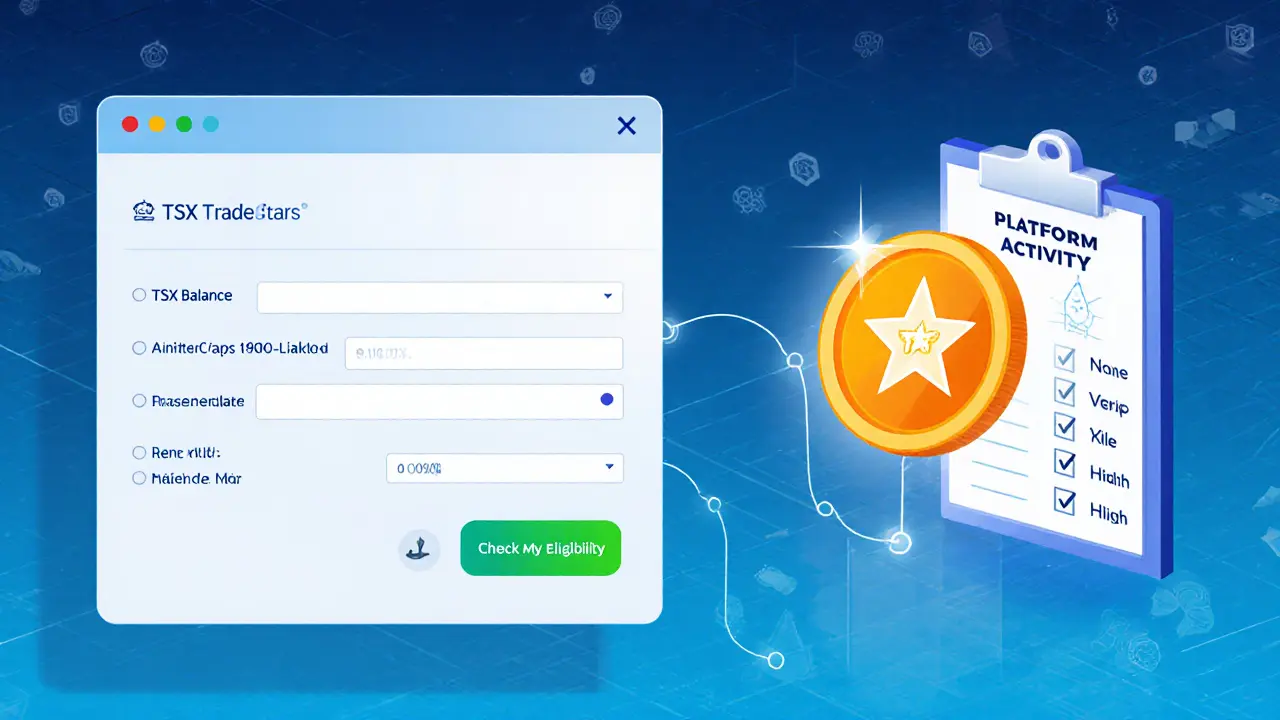

Community incentives also play a big role. A well‑timed airdrop, a free distribution of tokens to existing or new holders designed to grow the user base can dramatically increase holder counts, creating a virtuous cycle of demand and liquidity. When an airdrop targets active DeFi participants, it often sparks immediate trading activity, pushing the token into higher volume brackets on exchanges. Moreover, airdrops tied to staking or yield‑farming programs give participants a reason to lock up their TSX tokens, reducing circulating supply and potentially nudging prices upward. These community‑driven moves dovetail nicely with broader DeFi integration.

Speaking of DeFi, the TSX token is already finding use cases beyond simple holding. Integration with DeFi, decentralized finance protocols that enable lending, staking and yield farming without intermediaries opens doors to earning passive income, borrowing against token value, or participating in liquidity pools that reward contributors in native or partner tokens. Some platforms even experiment with NFT‑backed collateral, letting users lock an NFT that represents a physical asset while using TSX token as a bridge to crypto markets. For traders who enjoy margin strategies, the token’s relatively low volatility compared to pure‑play cryptos makes it a candidate for short‑term leveraged bets, especially when paired with volatility‑based indicators derived from both equity and crypto data streams.

Key aspects to watch in 2025

Regulatory outlook is a major factor for any hybrid asset. Changes in securities law or crypto‑specific guidelines can affect how the TSX token is classified, influencing everything from exchange listing requirements to tax treatment. Keep an eye on announcements from Canadian securities regulators and the Toronto Stock Exchange itself, as they may introduce new compliance checkpoints for tokenized indexes. Market volatility is another pulse‑check metric; while the token aims for stability, broader macro trends—interest‑rate shifts, geopolitical events, or major crypto market moves—can cause sudden spikes. Finally, token supply mechanics, such as scheduled burns or new issuance tied to fund inflows, will directly impact scarcity and thus price. Monitoring these three pillars—regulation, volatility, and supply—helps traders anticipate shifts before they fully materialize.

All this context sets the stage for the articles below. You’ll find deep dives on tokenomics, step‑by‑step guides for exchange listings, practical tips on leveraging airdrops, and tactical advice for using TSX token within DeFi and margin‑trading frameworks. Dive in to equip yourself with the knowledge you need to navigate this evolving asset class confidently.

Learn everything about the rumored TradeStars (TSX) and CoinMarketCap community airdrop, token details, eligibility, and how to prepare for potential rewards in 2025.

Read More