TradeStars (TSX) and CoinMarketCap Community Airdrop: Complete Details for 2025

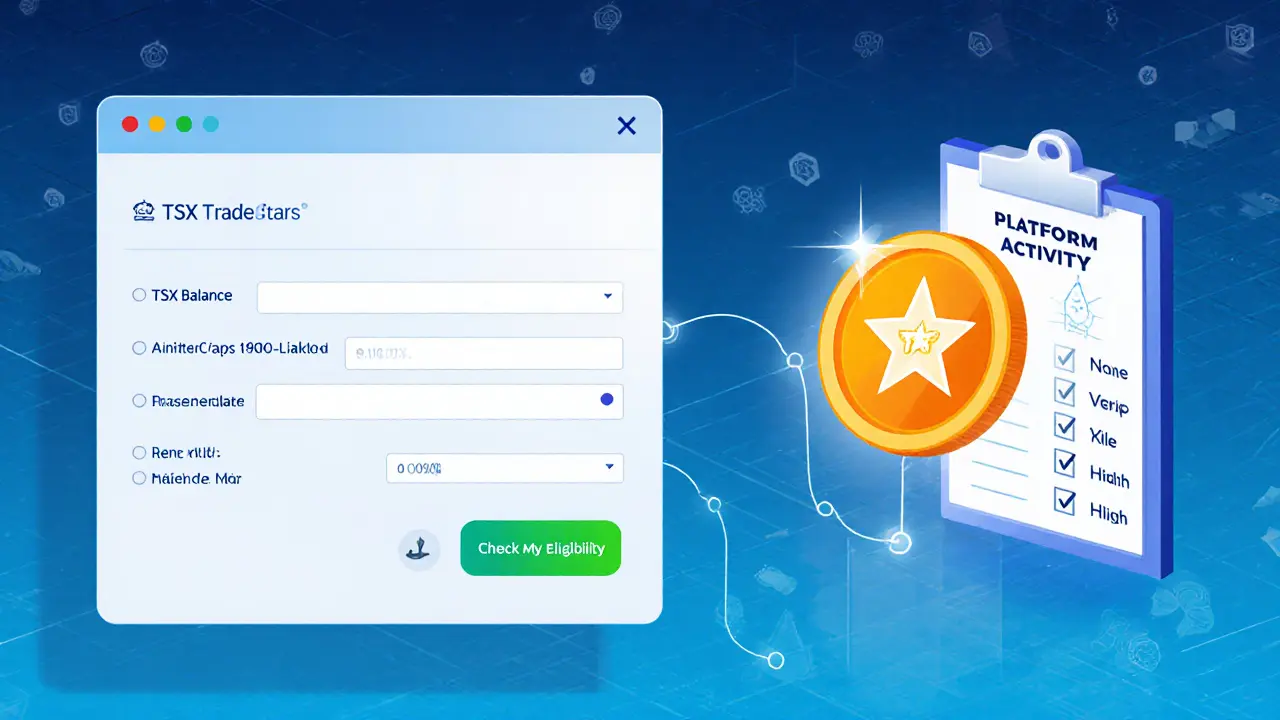

TradeStars (TSX) Airdrop Eligibility Checker

The TradeStars × CoinMarketCap airdrop is still unconfirmed. This tool helps you evaluate your eligibility based on known criteria.

Your TSX holdings, wallet activity, and platform engagement determine potential eligibility.

TSX Token Info

Max Supply: 100 million TSX

Circulating Supply: 13.54 million TSX

Contract Address: 0x734c…499bfd

Utility: In-game staking rewards and governance voting

Scarcity Factor: High (low circulating supply vs max supply)

Previous Airdrop Comparison

Past CMC airdrops allocated between 10-200 TSX per user depending on activity.

Historical examples show significant value increases post-distribution.

Your Airdrop Eligibility Result

- Create a verified CoinMarketCap account and enable two-factor authentication.

- Connect a compatible wallet (MetaMask, Trust Wallet, or Coinbase Wallet) to your CMC profile.

- Add the TSX contract (0x734c…499bfd) to your wallet’s watchlist.

- Participate in at least one TradeStars activity - such as joining a fantasy contest, staking a small amount of TSX, or voting on a governance proposal.

- Follow TradeStars and CoinMarketCap on Twitter, Discord, and Telegram for real-time announcements.

- Record the block number of any TSX transaction you make; this can serve as proof of activity if a snapshot is taken.

- Double-check the snapshot date and ensure your wallet holds the minimum required TSX.

- When the claim portal opens, follow the step-by-step guide, sign the claim transaction, and confirm receipt in your wallet.

Key Takeaways

- The TradeStars × CoinMarketCap airdrop is still unconfirmed; keep an eye on official channels for exact dates.

- TSX is the utility token powering TradeStars’ fantasy‑sports‑and‑DeFi ecosystem.

- Typical airdrop eligibility includes early platform use, staking, or governance participation.

- Past airdrops (Uniswap, ENS, Berachain) illustrate how token value can skyrocket after distribution.

- Follow a step‑by‑step preparation checklist to maximize any potential reward.

If you’ve been hunting crypto freebies, the rumored TradeStars airdrop partnered with CoinMarketCap is generating buzz. Below we break down everything you need to know about TradeStars, its TSX token, how CoinMarketCap runs community airdrops, and practical steps you can take right now.

What is TradeStars and the TSX token?

TradeStars is a fantasy sports platform built on blockchain that blends decentralized finance (DeFi) with daily‑fantasy‑sports (DFS) gameplay. Users trade "fantasy stocks" that mirror real‑world athlete performance, stake TSX for rewards, and vote on product road‑maps. The ecosystem revolves around the native utility token TSX (TradeStars Token), which serves two core purposes: in‑game staking rewards and governance voting.

Tokenomics are transparent: the maximum supply caps at 100million TSX, with roughly 69.99million minted to date and 13.54million circulating. The contract address (0x734c…499bfd) can be inspected on major blockchain explorers, giving users confidence in supply metrics.

How CoinMarketCap runs community airdrops

CoinMarketCap (CMC) regularly partners with projects to distribute free tokens to its community. The process typically follows three stages: announcement, snapshot, and claim.

CoinMarketCap is a leading crypto data aggregator that offers price charts, market caps, and a dedicated “Earn” portal for airdrops. When a partnership is announced, CMC publishes a blog post detailing eligibility - often based on CMC account activity, portfolio tracking, or prior participation in the partner’s ecosystem.

The snapshot records qualifying wallets at a specific block height. After the snapshot, the project releases claim instructions, usually via a dedicated claim portal linked from CMC.

Known details of the TradeStars × CoinMarketCap airdrop

As of October42025, no official statement confirms the exact terms of the TradeStars × CoinMarketCap community airdrop. However, patterns from previous CMC collaborations provide a useful template:

- Eligibility: Users who have linked a CMC account, hold at least a minimal amount of TSX, or have interacted with TradeStars’ testnet or staking contracts.

- Snapshot date: Typically occurs 7‑10days after announcement; the block height is posted in the announcement.

- Distribution amount: Past CMC‑partnered airdrops ranged from 10TSX to 200TSX per eligible user, depending on activity level.

- Claim window: Usually 30‑45days. Claims are made via a web form that requires signing a transaction from the eligible wallet.

Until TradeStars or CMC releases a formal guide, the safest approach is to keep a CMC account active, track TSX on the platform, and stay tuned to TradeStars’ official Discord, Telegram, and Twitter feeds.

Why TSX tokenomics matter for airdrop value

The value of any airdropped token hinges on scarcity, utility, and market perception. TSX’s capped supply (100M) and low circulating supply (13.54M) create a strong scarcity factor. Moreover, staking and governance features give TSX genuine utility beyond a simple meme token.

Historical airdrops illustrate this effect. When Uniswap (UNI) airdropped 400UNI per early user in 2020, the token’s price surged from under $1 to over $40 within a year, delivering massive upside. A similar story unfolded for ENS, where a modest allocation grew into a high‑value asset as the Ethereum naming system gained adoption.

If TradeStars follows this trajectory, even a modest allocation of 50TSX could become a noteworthy return, especially if the platform expands its user base and introduces new staking incentives.

Step‑by‑step checklist to prepare for the airdrop

- Create a verified CoinMarketCap account and enable two‑factor authentication.

- Connect a compatible wallet (MetaMask, Trust Wallet, or Coinbase Wallet) to your CMC profile.

- Visit TradeStars’ official website and add the TSX contract (0x734c…499bfd) to your wallet’s watchlist.

- Participate in at least one TradeStars activity - such as joining a fantasy contest, staking a small amount of TSX, or voting on a governance proposal.

- Follow TradeStars and CoinMarketCap on Twitter, Discord, and Telegram for real‑time announcements.

- Record the block number of any TSX transaction you make; this can serve as proof of activity if a snapshot is taken.

- After the official announcement, double‑check the snapshot date and ensure your wallet holds the minimum required TSX.

- When the claim portal opens, follow the step‑by‑step guide, sign the claim transaction, and confirm receipt in your wallet.

Completing these tasks puts you in the best position to receive a potential allocation, even if the exact parameters shift later.

Comparison with past high‑impact airdrops

| Airdrop | Project Type | Initial Token Value | Peak Value (12‑mo) | Typical Allocation per User |

|---|---|---|---|---|

| Uniswap (UNI) | DEX | $0.70 | $42 | 400UNI |

| Ethereum Name Service (ENS) | Naming Service | $1.20 | $71 | 25ENS |

| Arbitrum (ARB) | Layer‑2 Rollup | $0.80 | $5.60 | 100ARB |

| Berachain (BERA) | DeFi/Smart‑Contract Platform | $0.03 | $0.35 | Varies (up to 5kBERA) |

| Kaito AI (KAITO) | AI‑augmented Web3 | $0.05 | $1.20 | 200KAITO |

These examples show that a modest token allocation can translate into significant upside if the project gains traction. TradeStars, with its unique blend of fantasy sports and DeFi, sits in a niche that could attract a dedicated user base, potentially mirroring the growth patterns seen above.

Common pitfalls and security tips

- Phishing scams: Only trust announcements from the official TradeStars and CoinMarketCap social channels. Never share private keys.

- Fake claim portals: Verify the URL ends with the official domain (e.g., coinmarketcap.com/earn).

- Gas fees: Claiming may require a small Ethereum transaction fee. Ensure you have enough ETH or BNB for the network.

- Snapshot timing: If you move TSX after the snapshot but before the claim, you could miss out. Keep the required balance until the claim window closes.

- Wallet compatibility: Use wallets that support ERC‑20 tokens; older wallets may not display TSX correctly.

Staying vigilant and following the checklist above will protect you from losing out or, worse, losing funds.

Frequently Asked Questions

When is the TradeStars × CoinMarketCap airdrop expected to happen?

No official date has been published yet. Historically, CMC announces a partnership 2‑3 weeks before the snapshot, so keep an eye on both TradeStars and CMC channels over the next month.

What wallet do I need to claim the airdrop?

Any ERC‑20 compatible wallet (MetaMask, Trust Wallet, Coinbase Wallet, etc.) that you’ve linked to your CoinMarketCap profile.

Do I have to hold TSX before the snapshot?

Most CMC‑partnered airdrops require a minimum balance (often 10‑50TSX) at snapshot time. Holding more can sometimes increase your allocation.

Will there be a gas fee to claim?

Yes. Claiming involves sending a small transaction on Ethereum or the network where TSX resides. Make sure you have enough ETH (or BNB if on Binance Smart Chain) to cover it.

How can I stay updated on the airdrop?

Follow TradeStars on Twitter ( @TradeStars ), join their Discord, and subscribe to CoinMarketCap’s newsletter. Enable push notifications for both platforms.

21 Comments

The so‑called TradeStars airdrop is nothing more than a controlled narrative engineered by the crypto elite to siphon attention away from the real power structures that manipulate token distributions behind closed doors. They seed rumors, watch the hype spikes, and then quietly adjust the snapshot parameters to favor insiders. If you’re not already deep‑rooted in the network, you’ll never see the real gains.

Hey everyone, I just wanted to add a little encouragement for those diving into the TSX airdrop preparation. The checklist looks solid, and taking each step one at a time really helps keep the process from feeling overwhelming. It’s great to see the community sharing resources, and staying active on both TradeStars and CMC will only increase your chances of qualifying when the snapshot finally lands. Keep the momentum going and good luck to all!

Let us dissect the alleged mechanics of this airdrop with the rigor it deserves.

First, the claim that a simple snapshot will capture all legitimate holders ignores the prevalence of wash‑trading bots that flood the network moments before the cut‑off.

Second, the stipulated minimum balance of ten TSX is a deliberately low barrier designed to inflate the participant pool, thereby diluting any meaningful distribution.

Third, history shows that CMC‑partnered drops have often been tied to hidden vesting schedules, meaning what appears as a free grant is actually a delayed revenue stream for the project’s treasury.

Fourth, the requirement to link a CMC account creates a data repository that can be cross‑referenced with other platforms, compromising user privacy.

Fifth, the governance voting utility touted for TSX is still in beta, with no audited smart contracts released to date.

Sixth, the token’s circulating supply of 13.54 million against a 100 million cap suggests a future inflationary pressure that will erode holder value.

Seventh, the anticipated gas fees for claiming could be prohibitive for smaller participants, effectively rewarding only those with sizable ETH balances.

Eighth, the roadmap disclosures are vague at best, and no concrete milestones have been announced for integrating TSX into broader DeFi ecosystems.

Ninth, prior airdrops from similar projects have shown price spikes followed by rapid corrections once the initial hype subsided.

Tenth, community sentiment on Discord is already polarized, indicating a potential for coordinated pump‑and‑dump schemes.

Eleventh, the lack of a transparent audit report for the TSX contract raises red flags about possible backdoors.

Twelfth, the “high scarcity factor” claim is misleading given the large mintable supply still held by the developers.

Thirteenth, any claim process requiring a signature on the blockchain is vulnerable to phishing attacks if users are not meticulous.

Fourteenth, the timeline for snapshot and claim windows often overlaps with major market volatility, which could skew valuation.

Fifteenth, the overall orchestration appears to be a calculated move to generate hype, onboard new users, and ultimately boost TradeStars’ market perception without delivering substantive utility.

From a cultural integration perspective, the TSX token introduces an intriguing confluence of fantasy‑sports engagement and decentralized governance, which could serve as a blueprint for niche‑specific tokenomics.

However, the articulation of the airdrop criteria must be examined through the lens of regulatory compliance, especially given the cross‑border nature of both platforms.

Furthermore, the token’s ERC‑20 architecture ensures interoperability, but it also inherits the scalability constraints inherent to the Ethereum mainnet, potentially limiting transaction throughput during peak participation periods.

In addition, the governance model-while promising community input-requires a robust quorum mechanism to prevent vote‑splitting and ensure decisive outcomes.

Moreover, the utility of staking rewards hinges on the underlying revenue streams of TradeStars, which remain partially disclosed.

Consequently, prospective participants should calibrate their risk exposure by monitoring the evolving token distribution metrics alongside the platform’s user acquisition rates.

Just a quick heads‑up: make sure you enable two‑factor authentication on your CMC account before linking your wallet. It’s a simple step that can save you from a lot of hassle if anything fishy shows up later.

Wow, that was a lot of info, but honestly the whole “watchlist the contract” part feels a bit overblown. I mean, if you’ve already got TSX in your wallet, why does it matter if it’s on the watchlist? Just hold it and wait.

It’s ethically questionable to hype an airdrop without concrete evidence. Pumping enthusiasm for a speculative token while glossing over the risks borders on manipulation, and that’s something we shouldn’t normalize.

Considering the philosophical angle, an airdrop like this serves as a micro‑experiment in collective trust. Participants implicitly trust that the project’s governance will act in the community’s best interest, a fascinating social contract.

yeah sure, another airdrop, because that’s never been done before lol just sign the txn and hope for the best

Honestly, chasing a speculative TSX airdrop feels like a vanity parade. The real value lies in building sustainable products, not in hoping a token magically spikes after a snapshot.

From a formal perspective, the checklist does provide a systematic approach, however the inherent uncertainties of tokenomics demand a cautious optimism. One should not ignore the potential for market volatility post‑distribution.

In my view, the TSX airdrop is a golden opportunity to get ahead of the curve, especially for those who already hold a modest amount and can meet the activity thresholds without much hassle.

Hey folks, just a friendly reminder: stay patient and double‑check every step. If you run into any hiccups, the community is here to help, and it’s better to be safe than sorry.

Don't forget to keep some ETH for gas.

Yo, make sure you tweet about your TSX holdings, that way the algorithm might boost your chances without you even realizing it.

Seriously, these airdrop hype trains are just a way to milk people for their attention and gas fees. Anyone who believes this is legit is either naive or desperate.

Awesome info, everyone! 🎉 Keep the positivity flowing and let’s all support each other through the snapshot. Good vibes only! 🚀

Enough with the fluff-just follow the checklist, hold the token, and claim when the window opens. No more excuses.

Oh, here we go again-another “exclusive” airdrop that will disappear as soon as the hype fades. Classic crypto circus.

From my perspective, supporting home‑grown projects like TradeStars is a patriotic act. Let’s not hand over our tokens to every foreign experiment that passes by.

Just a note for anyone feeling overwhelmed: break down the checklist into daily tasks, set reminders, and verify each step before moving on. Consistency is key, and you’ll be prepared when the snapshot finally occurs.