TradeStars Airdrop: Everything You Need to Know

When working with TradeStars airdrop, a token distribution event launched by the TradeStars platform to reward early users and boost ecosystem growth. Also known as TradeStars token giveaway, it aims to increase community participation and liquidity. Crypto airdrop, a free token distribution to eligible wallets works on similar principles but varies in eligibility rules and token utility.

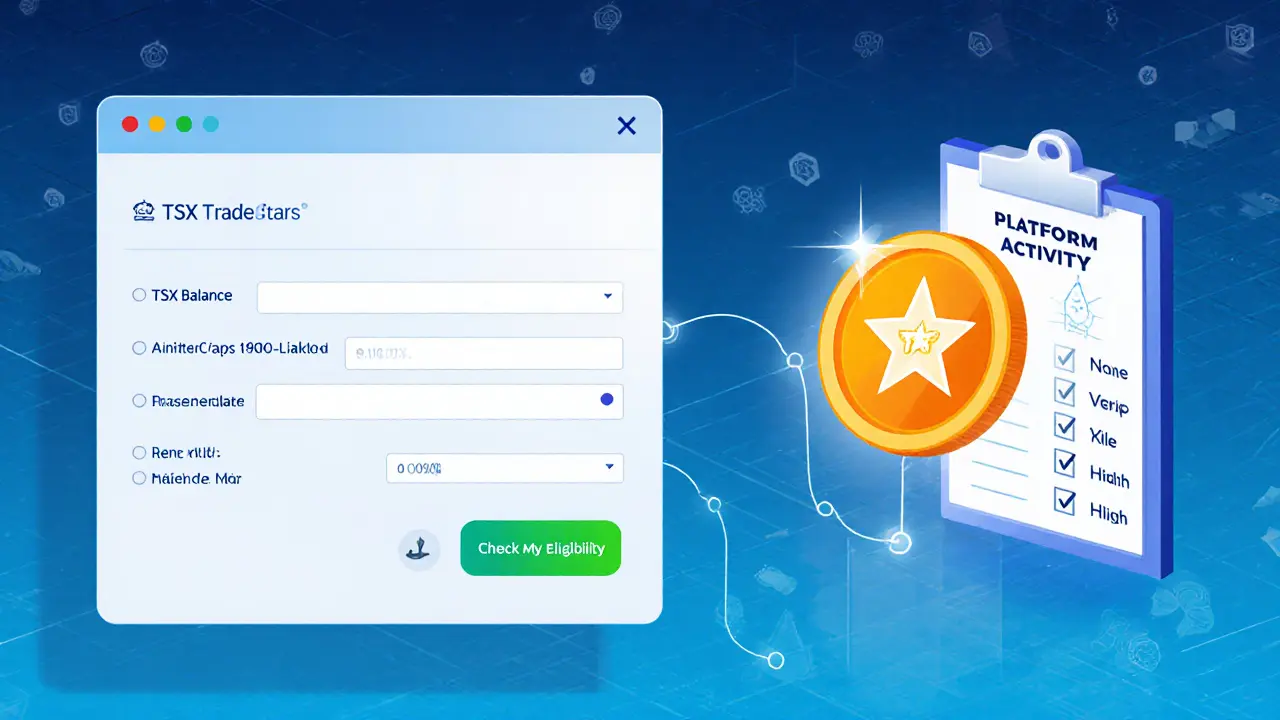

The core of any airdrop lives on a blockchain, a decentralized ledger that records token balances and transfers. Because the TradeStars token is ERC‑20, you’ll need a compatible wallet that can interact with Ethereum‑based contracts. TradeStars airdrop participants must connect such a wallet, verify their address, and sometimes fulfil simple tasks like following social channels. This requirement creates a direct link: crypto airdrop requires wallet verification, a semantic connection that underlines the process.

Key Elements of the TradeStars Airdrop

First, eligibility. TradeStars typically targets users who have held a minimum amount of its native token or who have engaged with the platform’s DeFi features. In this context, DeFi, decentralized finance applications that let users lend, borrow, or stake assets plays a big role. Users active in TradeStars' staking pool or liquidity mining program are more likely to qualify. This relationship—DeFi platforms influence airdrop eligibility—means your involvement in Yield Farming can directly increase your chances of receiving free tokens.

Second, the claim process. After the snapshot, eligible wallets receive a claim link or an automatic token transfer. The token claim process usually involves connecting your wallet to a web UI, signing a transaction, and confirming receipt. Timing matters; most airdrops have a limited window, after which unclaimed tokens revert to the project’s reserve. Missing the deadline wastes a potential reward, so set reminders when the claim period opens.

Third, risk management. Not every airdrop is trustworthy. Some may be phishing attempts or require giving up private keys—never do that. Verify the official TradeStars communication channels, check the contract address on Etherscan, and compare the token’s metadata with the project's whitepaper. A solid airdrop follows the triple: legitimacy, transparency, and community backing.

Fourth, post‑airdrop strategy. Once you own TradeStars tokens, you can decide to hold, stake, or trade them. Staking often yields additional rewards and can increase future airdrop eligibility. Trading on reputable exchanges can lock in profits if the token’s market price spikes after the distribution. Remember, the token’s value is tied to the platform’s adoption and overall market sentiment.

Finally, broader impact. A well‑executed airdrop can jump‑start network effects, attract new users, and create liquidity on decentralized exchanges. TradeStars aims to use this mechanism to grow its ecosystem, similar to how other projects have leveraged airdrops to expand their user base. Understanding this macro view helps you see the airdrop not just as a freebie but as a strategic move in the crypto landscape.

Below you’ll find a curated list of articles that dive deeper into each of these topics— from detailed eligibility checklists to step‑by‑step claim guides and risk assessments. Use them to navigate the TradeStars airdrop confidently and make the most of the opportunity.

Learn everything about the rumored TradeStars (TSX) and CoinMarketCap community airdrop, token details, eligibility, and how to prepare for potential rewards in 2025.

Read More