Persistence DEX: What It Is, How It Works, and Why It Matters

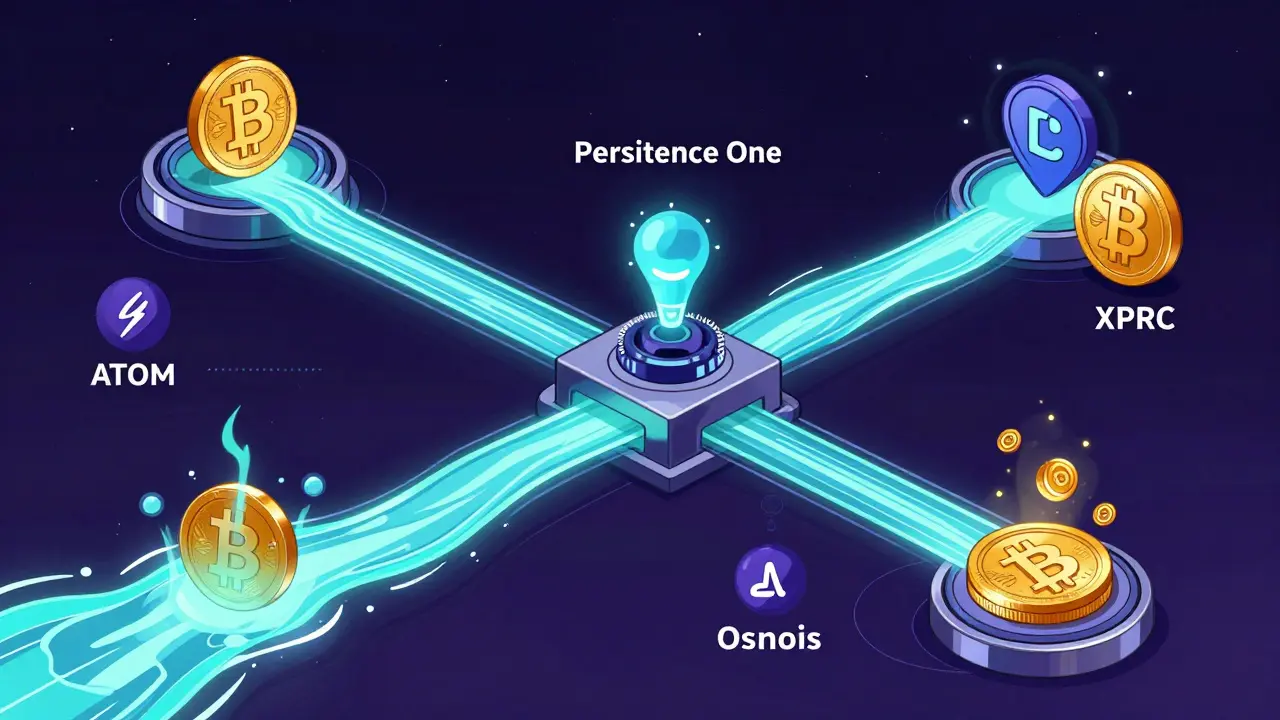

When you trade crypto on a Persistence DEX, a decentralized exchange built on the Cosmos network that connects multiple blockchains to enable seamless trading and staking. It's not just another DeFi platform—it's designed to let you move assets between chains without wrapping or bridges, making it faster and safer for cross-chain activity. Unlike Uniswap or Sushiswap, which mostly work on Ethereum, Persistence DEX taps into the Cosmos ecosystem, letting you interact directly with chains like Bitcoin, Ethereum, and Solana through its inter-blockchain communication (IBC) protocol.

This matters because most DeFi platforms lock you into one network. If you own Bitcoin or Solana tokens and want to earn yield, you usually have to convert them into wrapped versions—adding risk and complexity. Persistence DEX removes that step. You can stake your ATOM, trade your BTC via IBC, or lend your SOL—all without leaving the platform. It’s a decentralized exchange, a platform where users trade crypto directly from their wallets without a central authority. It's also a cross-chain liquidity hub. The platform’s native token, XPRT, powers governance and fee discounts, and holding it gives you a share of trading fees and staking rewards across connected chains.

What makes Persistence DEX stand out isn’t just its tech—it’s how it solves real problems. If you’ve ever lost money on a bridge exploit or waited hours for a transaction to confirm across chains, you know the pain. Persistence DEX cuts through that noise. It’s used by traders who want to move fast, by stakers who want yield on multiple assets, and by developers building apps that need multi-chain access. You won’t find it on every crypto blog, but the users who rely on it don’t talk about it—they just use it.

Below, you’ll find real reviews and breakdowns of platforms and tokens connected to this space—from how staking works on Persistence to what happens when a token like THL or PNDR crashes, and why fake airdrops keep popping up around legitimate projects. You’ll see what works, what doesn’t, and what to watch out for when you’re trading across chains.

Persistence DEX is a niche decentralized exchange built for BTCFi and Cosmos ecosystem assets. With low volume but unique staking-integrated liquidity, it's ideal for XPRT holders and Bitcoin DeFi users seeking low-slippage swaps.

Read More