OPNX Shutdown: What Happened and What It Means for Crypto Projects

When OPNX, a crypto exchange that promised fast trading and low fees but never delivered real liquidity or transparency shut down without warning, hundreds of users lost access to their funds. It wasn’t an isolated incident. OPNX is just one of many crypto platforms that appeared legitimate—until they didn’t. What made OPNX different wasn’t its tech, but how quickly it vanished after collecting deposits and promoting itself with influencer hype. This is the reality for too many projects that skip building real infrastructure and focus only on marketing.

OPNX shutdown didn’t happen in a vacuum. It followed the same pattern as GCOX, a crypto exchange that collapsed after failing to attract real traders, and GDEX, a cluster of low-volume platforms with no clear leadership or user support. These aren’t just bad luck stories—they’re warning signs. When a platform has no trading volume, no clear team, and no audits, it’s not a business. It’s a temporary collection of funds waiting to disappear. OPNX had all three red flags. Its website looked polished, its Discord was active, and its tokenomics sounded smart. But none of that matters if there’s no real infrastructure behind it.

What’s worse is how easily people get fooled. OPNX claimed to be a next-gen exchange, but it never listed major coins. It didn’t integrate with popular wallets. It didn’t have a clear roadmap beyond vague promises. And when users asked about withdrawals, the answers got vague. That’s the classic sign of a project that was never meant to last. The same thing happened with UniWorld (UNW), a dead coin with zero trading and no blockchain. People chase shiny new names without checking if the foundation is real. OPNX shutdown was predictable if you knew where to look.

So what should you do? Don’t trust hype. Don’t follow influencers who get paid to promote. Look at trading volume, check if the team is real, and see if anyone else is using the platform. If it’s not on CoinGecko or CoinMarketCap, that’s a red flag. If the website has no contact info beyond a form, that’s another. OPNX shutdown teaches us one thing: if a crypto project feels too easy to join, it’s probably too good to be true. The posts below dig into other failed exchanges, dead tokens, and hidden scams—so you won’t be the next person left holding worthless assets.

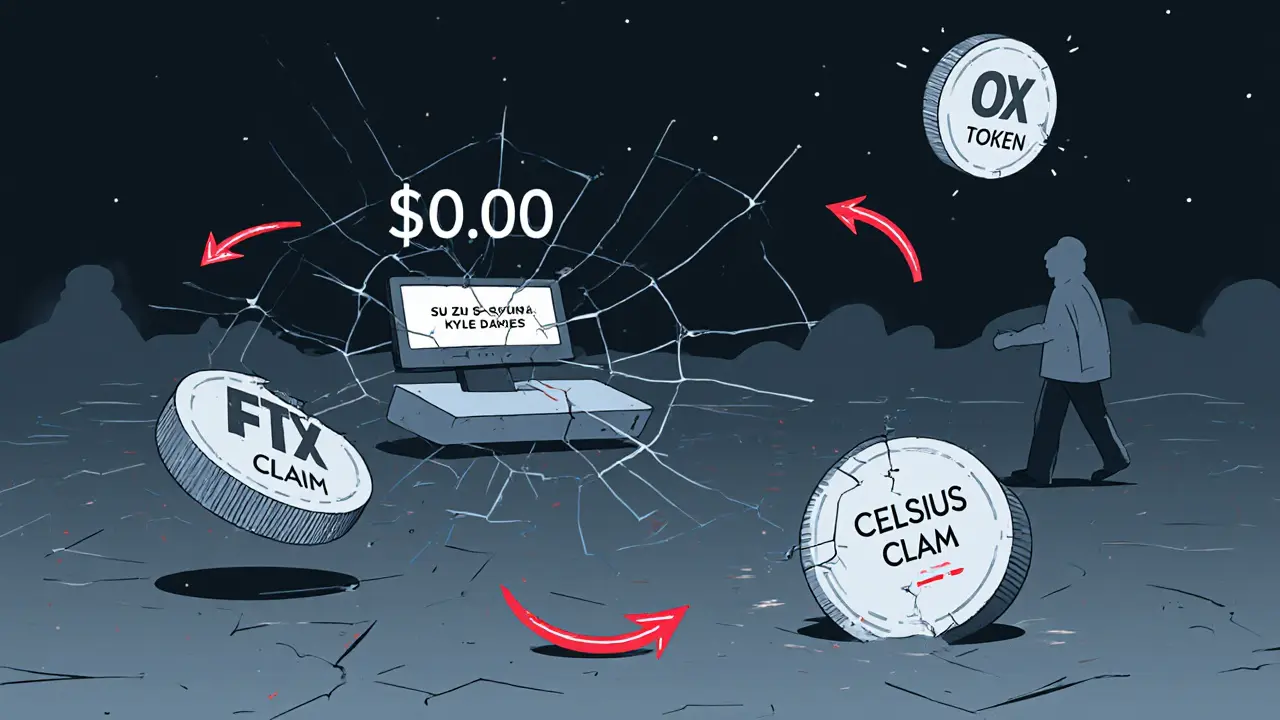

OPNX was a crypto exchange that tried to trade bankruptcy claims from failed firms like FTX and Celsius. It shut down in 2024 after failing to attract users, with less than $625,000 in total volume. Its OX token remains traded but has no real use.

Read More