OPNX Crypto Exchange Review: The Failed Platform That Tried to Trade Bankruptcy Claims

Bankruptcy Claim Value Calculator

Calculate Your Claim's Value

Estimate the value of your crypto bankruptcy claim from platforms like FTX or Celsius. Compare selling early at a discount versus waiting for potential full repayment.

Results

OPNX tried to create a market for bankruptcy claims but failed due to low volume and lack of trust. The calculator shows how this might have affected claim holders.

Value if Sold Early

$0.00

Selling your claim now at a discount rate

Value if Waiting

$0.00

Full repayment after estimated time

Important Context

OPNX was shut down after $625,000 in total trading volume because the market for these claims was too small. Most claim holders who waited received full repayment from FTX, making early sales at a discount less attractive.

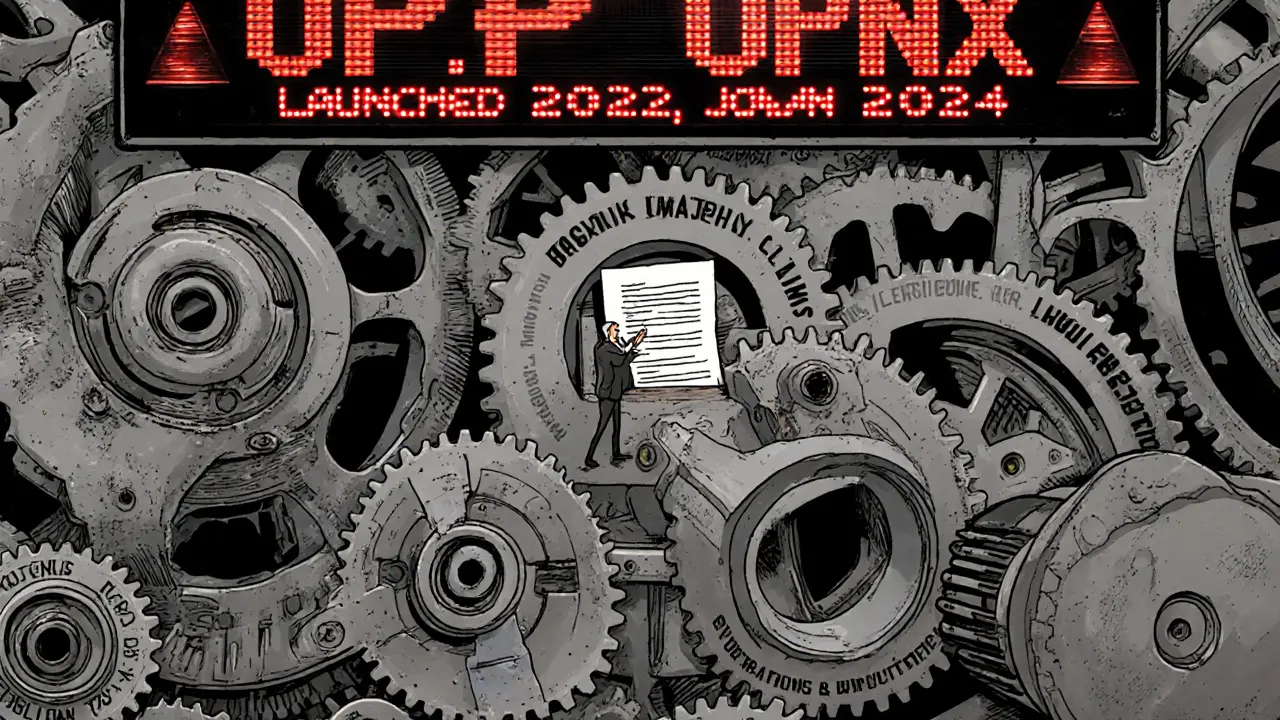

OPNX was never meant to be another Binance or Coinbase. It didn’t offer spot trading for Bitcoin or Ethereum. It didn’t have margin trading, staking, or even a mobile app. Instead, OPNX tried to do something no other exchange had ever attempted: turn crypto bankruptcy claims into tradeable assets. Launched in 2023 after the FTX collapse, it promised creditors of failed companies like Celsius, BlockFi, and FTX a way to sell their claims for cash instead of waiting years for a payout that might never come. But by February 14, 2024, the platform was gone - shut down with less than $625,000 in total trading volume across its entire life.

What Was OPNX Really Trying to Do?

OPNX was built on a simple, if ambitious, idea: bankruptcy claims from collapsed crypto firms were sitting idle, worth nothing until recovery began - if it ever did. Creditors had no way to cash out early. OPNX created a marketplace where you could sell your claim to FTX or Celsius for a fraction of its potential value, and someone else could buy it hoping for a bigger payout later. The platform used a token called OX (Open Exchange Token) for trading and as collateral for derivatives. It also kept the FLEX token from its predecessor, CoinFLEX. Users could deposit their bankruptcy claim documents, get them tokenized, and then trade them like stocks. You could even use those tokenized claims as collateral to trade crypto futures. It sounded smart on paper. In practice? It barely worked.Why Did OPNX Fail So Hard?

The biggest problem? No one wanted to trade. In its first 24 hours, OPNX recorded less than $2 in trades. That’s not a typo. Over its entire six-month run, total volume never topped $625,000. Compare that to Binance, which does that much in under five minutes. Without volume, liquidity vanished. If you wanted to sell your FTX claim, there was no buyer. If you wanted to buy one, the price was either too high or too low - no middle ground. The founders, Su Zhu and Kyle Davies, were already infamous. Before OPNX, they ran Three Arrows Capital, a hedge fund that blew up in 2022, losing over $3 billion in client money. Many in the crypto community saw OPNX not as innovation, but as a comeback attempt by two men with a damaged reputation. Why trust them with your only shot at recovering money from FTX? Even worse, the platform didn’t make it easy. To list a claim, you had to upload legal documents, prove ownership, and wait for manual approval. There was no chat support. No live help. No tutorials. You were expected to understand bankruptcy law, claim valuation, and derivatives trading all at once - and no one had the time or patience for that.The OX Token: A Ghost of a Platform

The OX token was supposed to be the lifeblood of OPNX. It was used to pay fees, stake for rewards, and trade derivatives. But when the exchange shut down, OX didn’t die - it just drifted. The token kept trading on exchanges like Gate.io, MEXC, and Uniswap. Meanwhile, a new platform called OX.Fun popped up, claiming to be the successor. It focused on derivatives trading around the OX token and even hit $39 million in volume in January 2024 - far more than OPNX ever did. But here’s the catch: OPNX’s founders weren’t running OX.Fun. They were listed as “advisers.” No official connection. No transparency. Just a vague hint that maybe, just maybe, OX.Fun was the real product all along - and OPNX was just a test run that failed. Users were left confused. What happened to their OX tokens? Were they still worth anything? Could they trade them on OX.Fun? No answers. Just silence.

Who Was OPNX Even For?

OPNX wasn’t for beginners. It wasn’t for casual traders. It wasn’t even for most experienced crypto users. It was built for a tiny group: people who held legal claims against defunct crypto companies and were desperate to get cash now. But even those people were hesitant. Why sell your FTX claim for 10 cents on the dollar when you might get 80 cents later? Most held on, hoping for full repayment - which, by early 2024, FTX had started delivering. That killed the whole premise. The market for bankruptcy claims was too small, too complex, and too slow-moving. OPNX tried to force a solution onto a problem that didn’t need fixing - at least not in the way they imagined.The Bigger Picture: Why This Failed

The crypto exchange market in 2023 was worth over $24 billion. OPNX captured less than 0.001% of that. It wasn’t just underperforming - it was irrelevant. It launched at the worst possible time. After FTX collapsed, the industry was trying to rebuild trust. Regulators were cracking down. Investors wanted stability, not experimental derivatives tied to legal claims. Meanwhile, the big exchanges - Binance, Coinbase, Kraken - kept improving. They added fiat on-ramps, better security, staking, and education. OPNX offered none of that. It didn’t even have a working mobile app. And then there was the leadership. Su Zhu and Kyle Davies had already lost billions. Their credibility was gone. No one wanted to give them another chance - especially not with their own money.

What Happened After the Shutdown?

OPNX stopped trading on February 7, 2024. Withdrawals stayed open until February 14. After that, the website vanished. The Telegram group, which had over 3,000 members, became a graveyard of questions: “Is OX.Fun legit?” “Will my OX tokens ever be useful?” “Can I get my money back?” The answer to all of them? Probably not. The OX token still trades on a few exchanges, but without OPNX, it has no utility. No platform to use it on. No reason to hold it. It’s just another dead crypto token - a digital ghost.Final Verdict: Don’t Trust the Ghosts

OPNX wasn’t a scam in the traditional sense. It didn’t steal funds. It didn’t fake volume. It just built something no one needed - and then disappeared when it failed. If you held a bankruptcy claim from FTX or Celsius, OPNX offered a way out. But the price was too low, the platform too broken, and the team too tainted. Most people chose to wait - and now, with FTX paying back customers in full, they were right to do so. OPNX is a cautionary tale: even the most clever ideas fail if the people behind them lack trust, the market doesn’t exist, and the product is too complicated for anyone to use. Don’t look for OPNX. It’s gone. Don’t chase OX tokens. They’re worthless without a platform. And don’t believe the next big idea from the same founders. History doesn’t repeat - it just echoes.Was OPNX a scam?

No, OPNX wasn’t a scam in the way that a Ponzi scheme steals money. It didn’t take deposits or promise guaranteed returns. It was a legitimate platform that tried to create a new market for bankruptcy claims. But it failed because no one used it, the founders had a bad reputation, and the product didn’t solve a real problem well enough to survive.

Can I still trade OX tokens?

Yes, OX tokens are still traded on exchanges like Gate.io, MEXC, Uniswap, and Bitget. But since OPNX shut down, there’s no official platform to use them. OX.Fun claims to be a successor, but it’s not connected to the original team. Without utility, OX is just a speculative token with no clear value.

Why did OPNX shut down?

OPNX shut down because it had almost no trading volume - less than $625,000 total. Creditors preferred to wait for FTX’s full repayment instead of selling claims at steep discounts. The platform’s complex setup, lack of support, and the founders’ damaged reputation made it impossible to attract users. When FTX announced full repayments in early 2024, the reason for OPNX’s existence vanished.

Who were the founders of OPNX?

OPNX was founded by Su Zhu and Kyle Davies, the co-founders of Three Arrows Capital, a crypto hedge fund that collapsed in 2022 after losing over $3 billion in client funds. Their involvement made many in the crypto community deeply skeptical of OPNX from the start, seeing it as a comeback attempt rather than a legitimate innovation.

Is OX.Fun the same as OPNX?

No, OX.Fun is not the same as OPNX. It’s a separate platform focused on derivatives trading around the OX token. The OPNX founders are listed only as “advisers,” with no official control or ownership. OX.Fun has higher trading volume, but it’s unclear how it relates to the original platform - and whether it’s sustainable.

Should I buy OX tokens now?

No. OX tokens have no utility since OPNX closed. There’s no official platform using them, and OX.Fun doesn’t guarantee any connection. Buying OX now is pure speculation with no foundation. It’s like buying shares in a company that went bankrupt - the ticker might still trade, but the value is gone.

25 Comments

so like... OPNX was just a ghost story with a token?

they built a haunted house and then left the keys in the door

and now we're all standing outside wondering if the ghosts still want to trade

why does this feel like a breakup letter from a crypto ex?

Su Zhu and Kyle Davies trying to turn bankruptcy claims into crypto is like a failed chef opening a restaurant called ‘Leftovers & Regrets’

and then charging people to eat cold pizza while listening to the chef cry about how nobody appreciated his soufflé

the real scam was believing they had a second act

no one wanted to trade because the math didn't add up

why sell your FTX claim for 10 cents when you know you'll get 80 cents in 18 months?

the whole model was built on desperation, not opportunity

and desperation doesn't scale

OPNX didn't fail because it was too complex

it failed because it was a mirror held up to the entire crypto industry

we're all just trying to monetize our trauma

your NFT? trauma.

your memecoin? trauma.

your ‘decentralized bankruptcy claim exchange’? trauma with a whitepaper

we don't want innovation

we want a faster way to turn our losses into a speculative lottery ticket

and OPNX just did it too honestly

This is the quiet tragedy of crypto: the most brilliant ideas die not because they're bad, but because the people who need them the most are too scared to trust anyone anymore.

People holding FTX claims weren't just waiting for money-they were waiting for proof that the system could still be fair.

OPNX offered a way out, but no one believed the door was real.

It’s not about the platform. It’s about the wound.

OX.Fun is just a rebrand with a bigger ego.

Same team. Same tokens. Same lies wrapped in new code.

They never cared about creditors.

They cared about the next pump.

Don’t be fooled by volume-it’s just ghosts buying ghosts with fake money.

This was never about crypto.

This was a Western financial elite using blockchain to launder their failures.

They created a fake market so they could pretend they were innovating while quietly walking away with billions.

The real victims? The small creditors who believed in the system.

And now they’re being told to ‘wait’ while the same men buy yachts.

I can't believe people are still talking about this like it's a tragedy.

These guys lost $3 BILLION and now they're acting like they're the victims?

OPNX was a vanity project for two men who couldn't handle losing.

They didn't build a platform.

They built a stage for their redemption arc.

And guess what? The audience walked out.

The saddest part? The people who actually needed OPNX didn't have the bandwidth to figure it out.

They were already drowning in legal docs, emails from lawyers, and sleepless nights.

Adding a crypto exchange with zero UX was like handing someone a life raft made of origami.

Good idea. Bad delivery.

OPNX was a fascinating case study in how not to build a product.

They assumed intelligence = adoption.

They assumed complexity = sophistication.

They assumed reputation = trust.

None of those things are true in crypto.

Trust is built in the small moments-support, clarity, responsiveness.

OPNX offered none.

I remember reading the whitepaper... it sounded like a sci-fi novel written by a finance professor who’d been binge-watching ‘Suits’ and ‘Black Mirror’ back to back.

Tokenized claims? Derivatives on legal documents? You’re not building a platform-you’re building a metaphor for capitalism’s collapse.

And then they shut it down like it was a bad dream.

It was.

Honestly, I think OPNX was ahead of its time.

Imagine if this had launched after a *successful* recovery-like if FTX had paid 50% upfront and people were still waiting for the rest.

Then maybe people would’ve traded claims like stocks.

But timing is everything.

And crypto? It doesn’t do patience.

I still hold some OX tokens... just in case.

Not because I think they’re valuable.

But because I believe in ghosts.

And maybe one day, someone will build something real on top of this wreckage.

Until then... I keep them like a relic.

The real tragedy isn’t that OPNX failed.

It’s that the people who lost the most-creditors, small investors, regular folks who believed in crypto’s promise-were never the ones who got to decide what happened next.

It was always the same names.

The same faces.

The same broken promises.

And now we’re just arguing about a token that doesn’t work.

We’ve been trained to mourn the wrong things.

OX.Fun is a honeypot.

They’re using the OX token to attract speculators while quietly draining liquidity.

Every time someone buys OX thinking it’s ‘the next OPNX,’ they’re feeding the machine.

It’s not a successor.

It’s a trap.

And the founders? They’re watching from the shadows, laughing.

The fundamental flaw in OPNX’s design was the assumption that financial distress could be commodified without empathy.

Bankruptcy claims aren’t assets-they’re human stories.

Behind every claim is someone who lost their savings, their job, their peace of mind.

Turning that into a derivatives market wasn’t innovation.

It was exploitation dressed in blockchain.

i still have my ox tokens in my wallet like a lucky charm 😅

maybe one day someone will make a new platform and say ‘hey remember this?’

and we’ll all be like ‘yeah that was wild’

until then... i just keep it there. like a crypto fossil.

Let’s be clear: OPNX wasn’t a platform. It was a legal loophole wrapped in a PR campaign.

They didn’t want to help creditors.

They wanted to turn their own failure into a liquidity event.

And when the market realized that? They vanished.

That’s not failure.

That’s strategy.

This whole thing proves one thing: Americans are too lazy to understand their own legal rights.

If you’re holding a bankruptcy claim, you should be in court, not on a crypto exchange.

OPNX didn’t fail because it was bad.

It failed because people didn’t want to do the work.

They wanted magic.

And crypto? It doesn’t do work.

I used to work with people who lost everything in FTX.

Some of them cried when they talked about their claims.

They didn’t want to trade them.

They wanted someone to say, ‘I see you. I know this isn’t fair.’

OPNX didn’t offer that.

It offered a spreadsheet and a token.

And that’s why it died.

Honestly? I’m kinda proud of OPNX.

They tried something no one else would touch.

It didn’t work.

But at least they tried.

Most of us are just waiting for the next meme coin to drop.

They built a ghost.

And sometimes, even ghosts need to be tried.

In India, we say: 'Don't chase the wind.'

OPNX chased the wind.

It looked like money.

But it was just air.

And now the wind has gone.

What's left? Silence.

You think OPNX was the scam?

Wait till you see what happens when OX.Fun gets listed on Coinbase.

They’ll pump it to $0.50.

Then vanish.

And the same people who called OPNX a scam will be the ones screaming ‘FOMO’ about OX.Fun.

History doesn’t repeat.

It just finds new victims.

i still have my ox tokens. not because i think they're worth anything.

but because i want to remember how dumb we all were.

we thought blockchain could fix broken systems.

we forgot it just makes them faster.

and louder.

and more expensive.

and still broken.

Let me be perfectly clear: OPNX was never meant to succeed. It was a controlled demolition of public trust. The founders needed a narrative: ‘Look, we tried to fix crypto’s biggest problem!’ Then, when it failed, they could say, ‘See? The market isn’t ready!’ Meanwhile, they quietly shifted all OX liquidity to OX.Fun, where they could manipulate the price without regulation. This wasn’t innovation. It was a legal fiction engineered to launder reputation. The OX token? A Trojan horse. The ‘advisers’? Ghostwriters for the next scam. And you? You’re still holding the bag.