OPNX Review: What You Need to Know Before Investing

When you hear OPNX, a cryptocurrency project that claims to offer decentralized trading and tokenized assets. Also known as OPNX Token, it's been promoted as a next-gen platform for crypto trading and liquidity mining. But behind the flashy website and influencer posts, there’s a lot of silence. No major exchange listings. No clear team. No audits. Just a token with a website and a promise.

OPNX relates directly to decentralized exchanges, platforms that let users trade crypto without a middleman, but unlike Uniswap or Sologenic, OPNX doesn’t have a live, active trading pool. It also ties into crypto airdrops, free token distributions used to build early user bases—and that’s where most people first encounter it. But airdrops don’t equal legitimacy. Many projects use them to create fake hype, then vanish. OPNX has all the signs: vague whitepapers, no GitHub activity, and zero real trading volume on CoinGecko or CoinMarketCap.

What’s worse? The same people pushing OPNX are often the ones promoting other dead coins like UniWorld or GCOX—projects that vanished after collecting funds. If OPNX were real, it would be listed on at least one major exchange by now. It wouldn’t need you to join a Telegram group to "claim" your tokens. It wouldn’t rely on TikTok influencers with stock footage of trading charts. Real projects don’t hide behind anonymity and buzzwords.

You’ll find plenty of posts here that dig into similar cases—GDEX, Almeedex, GCOX—each one showing the same pattern: flashy launch, empty promises, and quiet death. OPNX fits right in. This isn’t about one bad token. It’s about a system that preys on new investors who don’t know what to look for. The good news? You’re here now. Below, you’ll find real reviews, broken-down tokenomics, and red flags from users who lost money. No sugarcoating. Just what happened, who got burned, and how to avoid the next one.

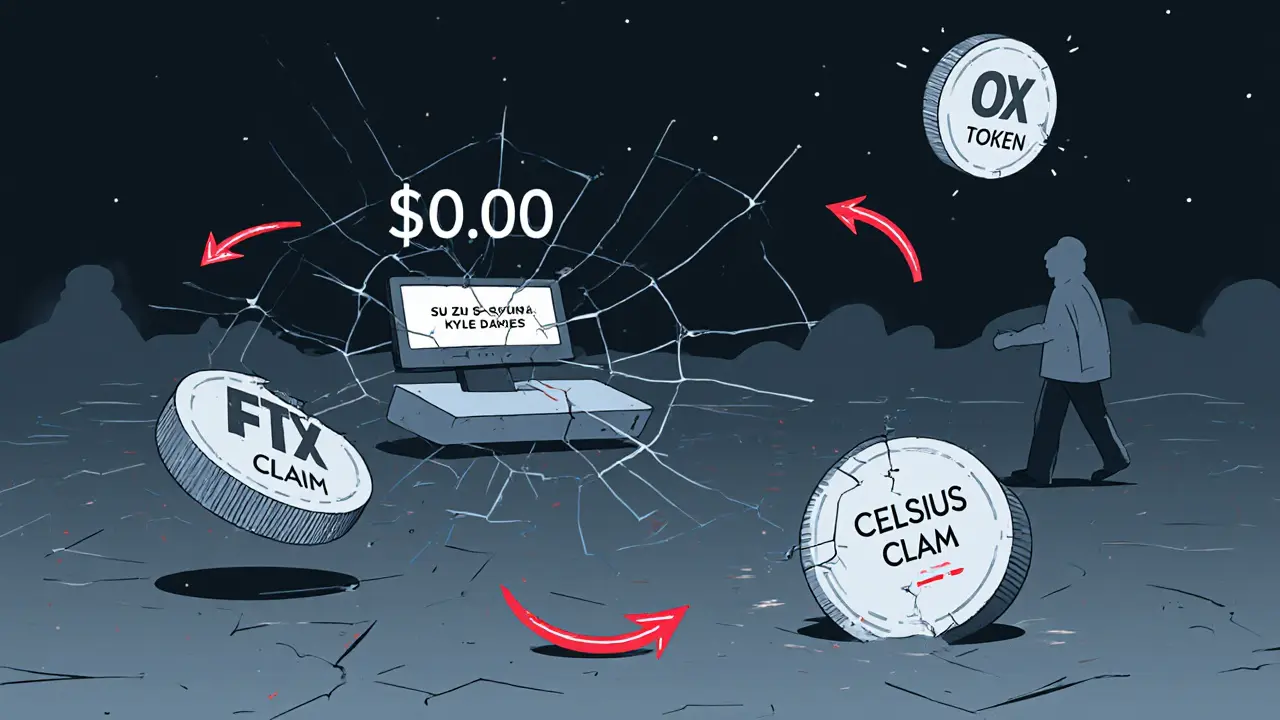

OPNX was a crypto exchange that tried to trade bankruptcy claims from failed firms like FTX and Celsius. It shut down in 2024 after failing to attract users, with less than $625,000 in total volume. Its OX token remains traded but has no real use.

Read More