OPNX Exchange: What It Is, Why It Matters, and What You Need to Know

When you hear OPNX exchange, a decentralized trading platform built for institutional and retail crypto traders. Also known as OPNX, it’s not just another crypto exchange—it’s designed to bridge the gap between traditional finance and blockchain trading with real liquidity and institutional-grade tools. Unlike platforms that rely on thin order books or fake volume, OPNX focuses on actual trading activity, deep liquidity pools, and seamless cross-chain asset swaps. If you’re tired of exchanges that look good on paper but fall apart when you try to trade, OPNX tries to fix that.

What makes OPNX different? It’s built on a hybrid model that combines order book trading with automated market makers, letting users trade everything from Bitcoin to tokenized stocks without switching platforms. This means you can buy ETH, sell a tokenized gold asset, and trade a DeFi token—all in one place. The platform also integrates with major wallets like MetaMask and WalletConnect, so you don’t have to give up control of your keys. It’s not just a place to trade—it’s a place to manage your portfolio like a pro. Related to this, decentralized exchange, a peer-to-peer trading platform that doesn’t hold your funds. Also known as DEX, it’s the backbone of how OPNX operates without relying on centralized custody. And unlike many DEXs that are slow or confusing, OPNX keeps the interface clean and fast, even under heavy load.

But here’s the thing: OPNX isn’t for everyone. If you’re just starting out and want to buy your first $10 of Bitcoin with a credit card, you’ll find better options. But if you’re trading larger amounts, care about slippage, or want to access tokenized assets not available on Binance or Coinbase, OPNX gives you tools most exchanges don’t even offer. It’s used by traders who need real-time data, low fees, and institutional-grade APIs—not just hype and marketing. And because it’s built on blockchain infrastructure, you get transparency you won’t find on traditional platforms. That’s why you’ll see posts here about OPNX alongside reviews of other platforms like GDEX, GCOX, and Almeedex—because they’re all part of the same conversation: trading platform, a system where users buy, sell, or swap digital assets. Also known as crypto trading platform, it’s the engine behind every move you make in the market.

What you’ll find below aren’t ads or sponsored posts. These are real reviews, breakdowns, and warnings from people who’ve tried OPNX and other similar platforms. Some found value. Others lost money. The posts here don’t sugarcoat anything. You’ll see what works, what doesn’t, and what to watch out for before you deposit your first dollar. This isn’t about guessing—it’s about knowing what’s real.

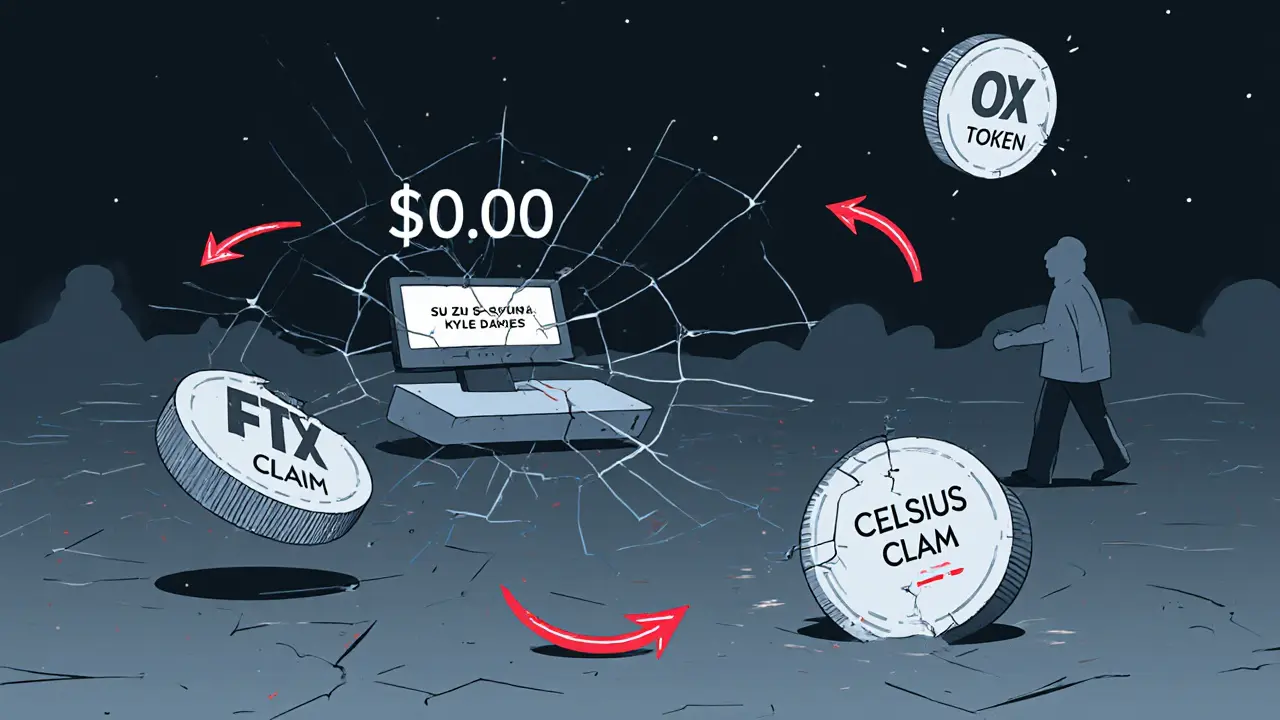

OPNX was a crypto exchange that tried to trade bankruptcy claims from failed firms like FTX and Celsius. It shut down in 2024 after failing to attract users, with less than $625,000 in total volume. Its OX token remains traded but has no real use.

Read More