Microsoft licensing: What It Means for Crypto and Blockchain Businesses

When we talk about Microsoft licensing, the legal framework Microsoft uses to authorize software use, partnerships, and cloud services. Also known as enterprise software agreements, it’s not just about Windows or Office—it’s a model that many blockchain companies now copy when they need to work with banks, governments, or regulated markets. If you’re running a crypto exchange, DeFi platform, or blockchain identity tool, you can’t ignore how licensing works in the real world. Microsoft doesn’t control crypto, but its approach to compliance, jurisdiction rules, and secure infrastructure is what smart crypto firms are trying to match.

Think about blockchain compliance, the process of meeting legal standards for financial tech in places like the EU, UAE, or Cyprus. Countries like the UAE and Cyprus don’t just want your app to work—they want proof you’re following rules. That means audits, KYC, AML checks, and sometimes even partnering with licensed tech providers. Microsoft’s licensing model shows how a global company handles this: clear terms, regional variations, and strict enforcement. Crypto projects that skip this? They end up blocked on Kraken, shut down like OPNX, or flagged as scams like Bitcoin.me.

Then there’s enterprise blockchain, private or hybrid networks used by banks, hospitals, and governments to keep data secure while staying transparent. These aren’t public chains where anyone can join. They’re controlled environments, just like Microsoft’s licensed software ecosystems. Companies using hybrid blockchain or self-sovereign identity don’t just want tech—they want legal cover. That’s why Kyrrex highlights its FinCEN registration and MiCA compliance. It’s not marketing fluff. It’s the same logic Microsoft uses: if you want to be trusted, you play by the rules.

You’ll notice in the posts below that licensing isn’t just about Microsoft. It’s about who gets to operate where. The UAE’s clear crypto licensing rules? That’s what attracts firms. Kraken blocking users in 14 countries? That’s licensing in action. Even fake exchanges like 99Ex and Coinviva fail because they never built any legal foundation. This isn’t about software—it’s about trust. And trust, in 2025, comes from documented compliance, not hype.

Below, you’ll find real examples of what happens when crypto projects either follow or ignore these patterns. Some got licenses. Some got shut down. Others are still pretending they don’t need them. The difference isn’t technical—it’s legal. And that’s where the real battle is.

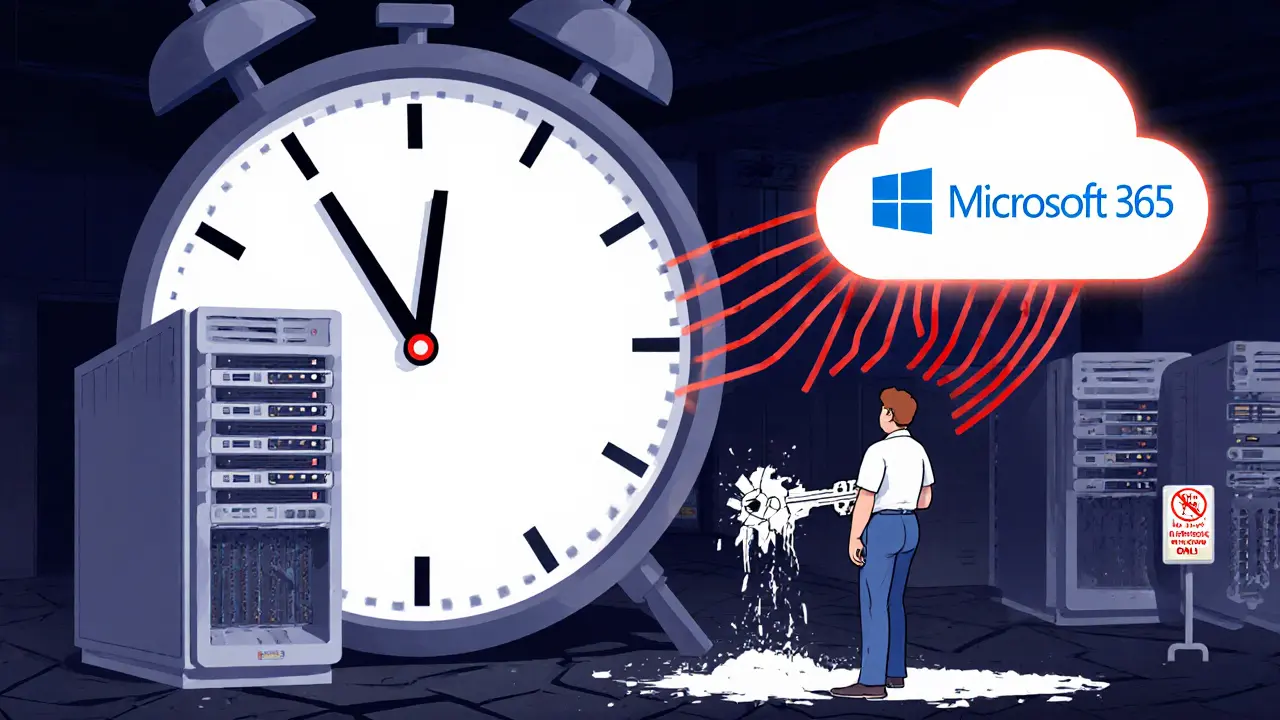

Microsoft is ending perpetual licenses for Exchange Server. Starting in 2025, you must pay an annual subscription or migrate to Exchange Online. No extended updates. No exceptions. Here's what you need to know.

Read More