Meme Coin Basics and How to Navigate the Hype

When you hear meme coin, a cryptocurrency that thrives on internet jokes, viral memes, and community hype. Also known as memecoin, it mixes pop culture with finance, often spiking in price after a single tweet or meme trend. Trading happens on crypto exchange, online platforms where users buy, sell, and swap digital assets, and many projects kick‑start their community with a free airdrop, a token giveaway that rewards early supporters or holders. To separate the flash‑in‑the‑pan from something that could stick around, you need to grasp the tokenomics, the economic design governing a coin’s supply, distribution, and incentives. These three pieces—exchange access, airdrop mechanics, and tokenomics—form the backbone of every meme‑driven project.

Why meme coins matter right now

The biggest driver behind a meme coin is community sentiment. A funny image, a catchy phrase, or a celebrity shout‑out can push a token from a few cents to multiple dollars in hours. Platforms like Reddit, Twitter, and TikTok act as the unofficial marketing department, amplifying hype and creating a feedback loop where price moves fuel more buzz. At the same time, airdrops act as a catalyst: by handing out free tokens, projects lower the entry barrier, spark word‑of‑mouth, and often lock users into the ecosystem through staking or voting rights.

But hype alone doesn’t guarantee longevity. This is where tokenomics steps in. A clear supply cap, transparent burn mechanisms, and well‑defined use‑cases (like paying for NFTs, accessing a gaming platform, or voting on governance) give a meme coin a purpose beyond jokes. Conversely, unlimited supply, opaque treasury handling, or pure pump‑and‑dump patterns raise red flags. Most exchanges now require projects to publish a whitepaper or tokenomics sheet before listing, which helps traders spot the red flags early.

Risk management is essential. Meme coins are notorious for extreme volatility—price can swing 100% in a single day. Traders should set stop‑loss limits, only allocate a small portion of their portfolio, and watch community sentiment metrics (like Telegram member growth or tweet volume). Regulatory scrutiny is also creeping in; some jurisdictions treat meme tokens the same as securities if they promise profits based on others’ efforts. Staying on reputable exchanges reduces the chance of getting caught in a scam or a sudden delisting.

The articles below dive into real‑world examples, from exchange reviews that show how you can safely buy and sell meme assets, to airdrop guides that walk you through claim steps, and tokenomics breakdowns that highlight why some meme projects survive while others fade. Whether you’re looking for the next viral hit or just want to understand the mechanics behind the hype, this collection gives you practical tools and insights to make smarter moves in the meme‑coin space.

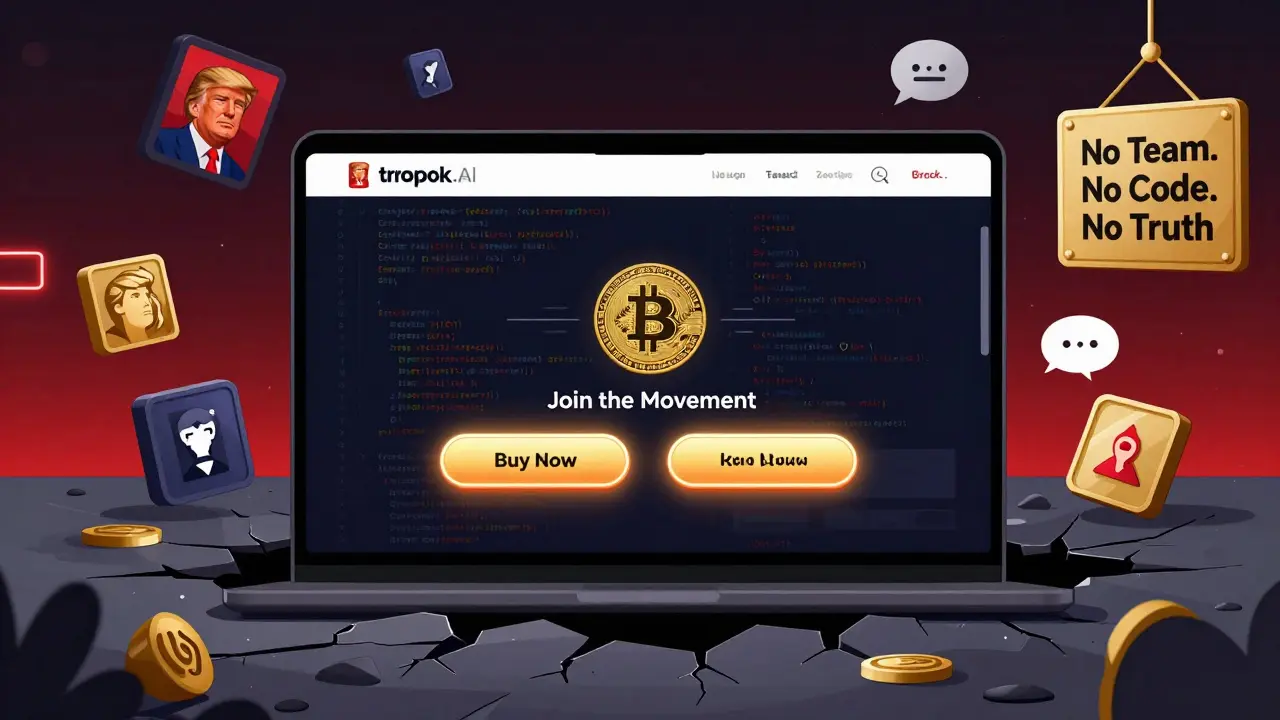

TRUMP GROK (trumpgrok.org) is a meme coin with no real ties to Donald Trump or Grok AI. It has no utility, no exchange listings, and massive price manipulation. Learn why it's a high-risk scam.

Read More

Paco (PACO) is a joke meme token with no team, zero liquidity and a $17K market cap. This 2025 guide explains its specs, market data, risks and why experts call it a dead coin.

Read More

A clear, conversational guide to Miniature Woolly Mammoth (WOOLLY) crypto coin-what it is, how it works on Ethereum and Solana, where to trade, price trends, and key risks.

Read More