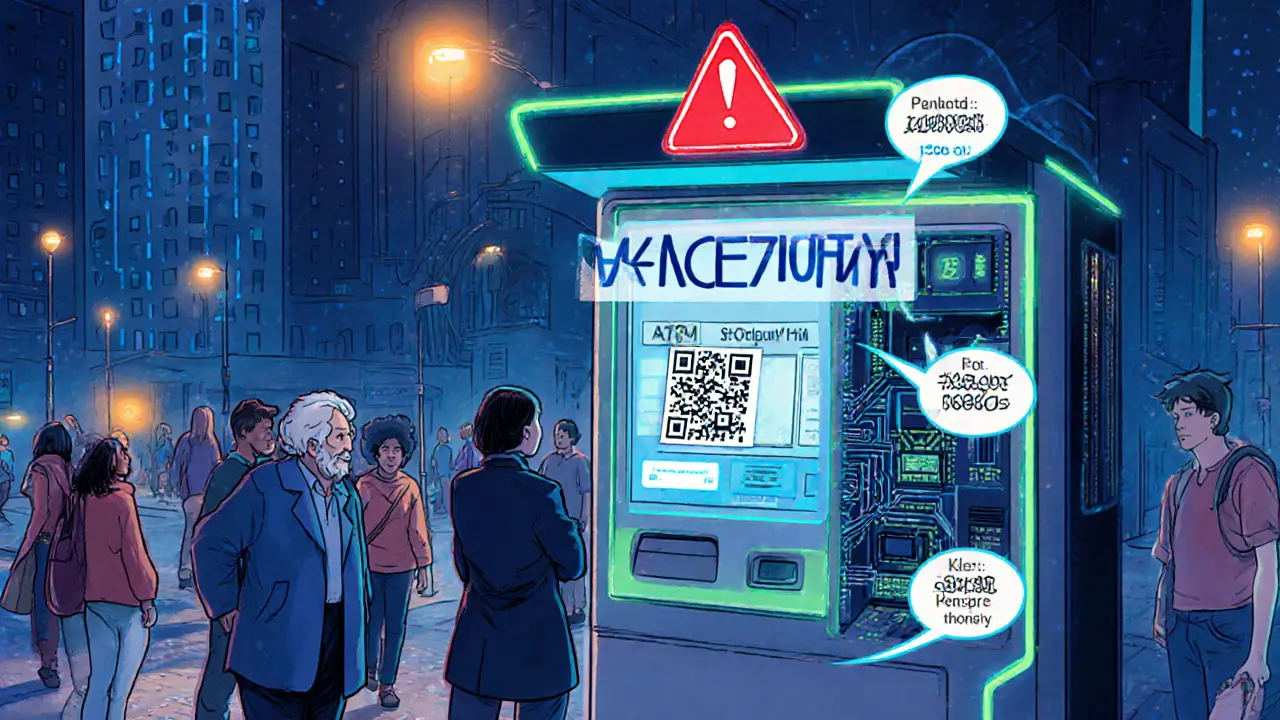

Lamassu vulnerability – what you need to know

When dealing with Lamassu vulnerability, a critical security flaw discovered in Lamassu‑manufactured Bitcoin ATMs that lets attackers steal crypto or tamper with transaction logs. Also known as Lamassu ATM exploit, it exposes the device’s firmware and private keys, putting users’ funds at risk. The flaw isn’t just a tiny bug; it encompasses outdated firmware code, weak key storage, and an unchecked network interface. In plain terms, the vulnerability Lamassu Bitcoin ATM, the physical kiosk that lets people buy or sell Bitcoin in cash can be turned into a money‑stealing bot if the attacker gains remote access. This connection between the device and the underlying software means that any breach instantly jeopardizes every transaction processed on that machine.

Related security concepts you should watch

Beyond the core issue, cryptocurrency ATM security, the broader set of practices that protect cash‑to‑crypto kiosks from tampering, hacking, and fraud plays a huge role in how quickly the vulnerability spreads. When a firmware bug is left unpatched, the whole network of ATMs becomes a soft target, and the security patch, the official software update released to fix the flaw becomes the single line of defense. The relationship is simple: Lamassu vulnerability requires an immediate security patch, and the availability of that patch directly influences user trust in crypto ATMs. Another related piece is PCI compliance, the set of standards for protecting cardholder data and preventing fraud. While PCI focuses on card payments, many ATM operators adopt its guidelines to harden network ports and restrict unauthorized access, which in turn reduces the attack surface for the Lamassu flaw.

What does this mean for you, the operator or user? First, confirm that your machine runs the latest firmware version – the vendor should list the patch ID in the admin console. Second, enable two‑factor authentication on remote management interfaces; this adds a layer that blocks attackers who might have sniffed the network. Third, regularly audit the device’s logs for suspicious activity; unusual cash‑in or cash‑out patterns often signal a compromised kiosk. By treating the vulnerability as a symptom of broader ATM security hygiene, you can protect not only a single device but the entire ecosystem of crypto‑enabled cash points. Below you’ll find a curated set of articles that dive deeper into each of these topics, from detailed reviews of crypto exchanges to hands‑on guides for securing Bitcoin ATMs.

Crypto ATM scams have caused $246.7million in losses, mainly affecting seniors. Learn how vulnerabilities, weak regulation, and real‑world cases fuel fraud, plus tips and new laws to stay safe.

Read More