Crypto ATM Scams: $246Million Losses and How to Protect Yourself

Crypto ATM Safety Checker

Use this tool to assess whether a cryptocurrency ATM meets recommended safety standards. Answer the following questions:

Your safety assessment will appear here after answering the questions above.

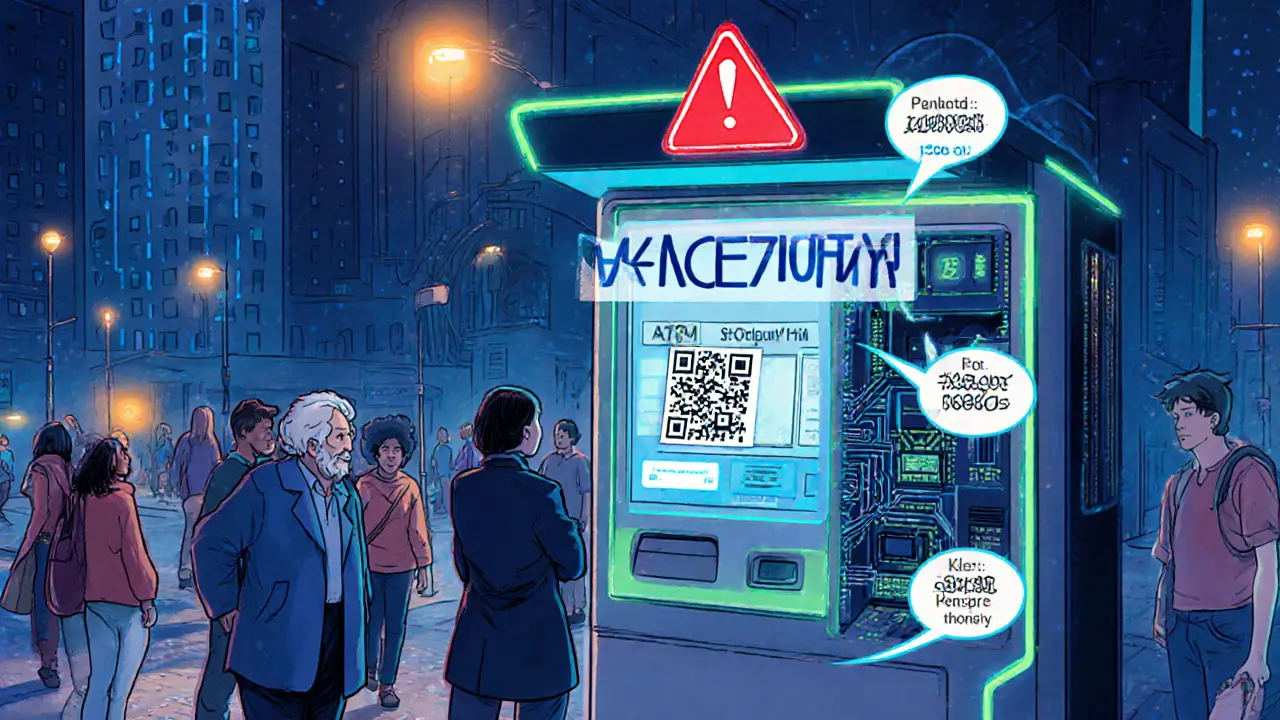

crypto ATM scams have cost victims $246.7million in just one year, and the numbers keep climbing. If you’ve ever thought about buying Bitcoin at a kiosk, you need to know why these machines are such a magnet for fraud and what you can do before you insert cash.

TL;DR

- Crypto ATMs processed $246.7million in fraudulent transactions in 2024.

- Vulnerabilities like CVE‑2024‑0674 let attackers take full control of some machines.

- Regulatory gaps mean many operators skip basic anti‑money‑laundering checks.

- Arizona’s new law caps daily limits and forces refunds for early‑reporting victims.

- Stick to reputable exchanges, verify signage, and never ignore on‑screen warnings.

What is a Cryptocurrency ATM?

Cryptocurrency ATM is a specialized kiosk that lets you exchange fiat cash for digital assets such as Bitcoin, Ethereum, or stablecoins, and vice versa. The device typically accepts cash, debit cards, or sometimes QR‑code scans, then prints a receipt with a wallet address. Because the transaction is irreversible, the user must trust the machine’s software and the operator’s compliance practices.

How Scammers Exploit These Machines

Two major attack vectors create the perfect storm for fraud:

- Technical exploits - Security researcher Gabriel Gonzalez of IOActive uncovered a trio of critical flaws in the Lamassu Douro Bitcoin ATM. The most severe, CVE‑2024‑0674, lets an unprivileged user drop a malicious

/tmp/extract/package/updatescript.jsfile and gain root access during the update routine. Once attackers have root, they can replace the wallet firmware, swap the displayed QR code, or install a hidden backdoor that siphons funds after a user confirms the transaction. - Social‑engineering tricks - Fraudsters set up fake kiosks in high‑traffic areas, mimic legitimate branding, and walk victims through a “quick verification” step that actually copies their private keys. Because the ATM dispenses crypto directly to a wallet you control, there is no chargeback mechanism once the transaction is confirmed.

Both tech‑savvy and low‑tech scammers profit from the same core weakness: the machine’s design prioritizes ease of use over rigorous identity checks.

The Scale of the Problem: $246Million in Losses

The FBI Internet Crime Complaint Center (IC3) logged 10,956 complaints linked to crypto ATMs in 2024, adding up to $246.7million in victim losses. Two‑thirds of those victims were over 60 years old, a demographic that often struggles with digital‑currency jargon and is less likely to double‑check a QR code on a screen.

Arizona alone accounted for $177million of the national total, with the city of Scottsdale reporting $5million in losses this year and Peoria families losing nearly $1million the previous year. These figures illustrate not only the financial impact but also the geographic concentration of fraud in states with a high density of kiosks.

Regulatory Gaps and the Push for Reform

Unlike traditional bank ATMs, crypto ATMs operate in a largely unregulated arena. The Financial Crimes Enforcement Network (FinCEN) issued Notice FIN‑2025‑NTC1 on August42025 warning that many operators ignore Bank Secrecy Act (BSA) obligations such as Customer Identification Programs (CIP) and Suspicious Activity Reporting (SAR). Without these safeguards, the machines become a blind spot for law‑enforcement monitoring.

At the state level, Arizona rolled out the Cryptocurrency Kiosk License Fraud Prevention law. The law caps daily transaction limits at $2,000 for new users and $10,500 for existing customers, mandates on‑screen warnings that must be acknowledged, and requires operators to refund fees and transaction amounts if a victim reports fraud within 30days. While the law is a step forward, enforcement remains uneven and many kiosks in neighboring states still operate without comparable protections.

Real‑World Victim Stories

JaneM., a 68‑year‑old retiree from Tucson, walked up to a newly installed kiosk, inserted $1,200, and watched the screen display a QR code for a “secure wallet.” Within minutes, the transaction confirmed, and the machine printed a receipt. When Jane tried to view the wallet on her phone, the address led to a cold wallet that she never controlled. She filed a report with the FBI’s IC3, but the cryptocurrency had already moved through a mixer and vanished.

Another case involved a group of seniors in Scottsdale who were approached by a “crypto education” volunteer. The volunteer directed them to a nearby kiosk, helped them scan a code, and took a $5,000 “service fee.” The victims later discovered their funds were sent to a wallet owned by the fraudster. Because the kiosk operator had no KYC process, the transaction went unnoticed until the victims reported it.

These stories underscore a common pattern: seniors are targeted, the scams involve a physical kiosk, and the irreversibility of crypto transactions leaves victims with little recourse.

Prevention Tips for Anyone Using Crypto ATMs

- Check operator credentials. Look for a visible license number, contact details, and a link to the operator’s website. Verify the information on the state’s financial regulator portal.

- Read on‑screen warnings. Recent regulations force kiosks to display fraud warnings. Don’t click “I agree” without reading the text.

- Inspect the QR code. Use a separate device (your phone) to scan the code before confirming the transaction. Compare the wallet address shown on the kiosk with the one on your phone.

- Limit transaction size. Keep daily purchases under $2,000 whenever possible, especially if you’re a first‑time user.

- Prefer reputable exchanges. Large exchanges like Coinbase, Kraken, or Gemini offer stronger KYC and fraud‑recovery mechanisms than most kiosks.

- Report suspicious activity quickly. State laws like Arizona’s require reporting within 30days for a full refund.

Industry Response and Future Outlook

Experts such as James Wyler, President of Trusted Security Solutions, warn that the convergence of quantum‑computing threats and existing vulnerabilities could make current encryption standards obsolete, raising the stakes for crypto ATM security.

Nancy LeaMond of AARP notes that lawmakers on both sides of the aisle are pushing for “commonsense rules” that balance innovation with consumer safety. In 2025, at least 40 states introduced legislation concerning digital assets, and 11 states enacted specific crypto ATM regulations.

FinCEN’s red‑flag indicators now include “multiple high‑value crypto ATM transactions from the same wallet within a 24‑hour window” and “use of new, unverified kiosk operators.” While these guidelines help financial institutions spot suspicious patterns, they do not directly compel kiosk operators to adopt similar monitoring.

Looking ahead, the industry faces a trade‑off: stricter KYC and monitoring will likely reduce fraud but could also raise barriers for legitimate users seeking quick, low‑cost access to crypto. The $246million loss figure suggests that the current low‑friction model is unsustainable without tighter oversight and better user education.

Comparison: Crypto ATMs vs. Traditional Bank ATMs

| Feature | Crypto ATM | Traditional Bank ATM |

|---|---|---|

| Regulatory oversight | Limited - many operators skip BSA/KYC | Strict federal and state supervision |

| Transaction reversibility | Irreversible once confirmed | Reversible through dispute and charge‑back |

| Typical fees | 5‑15% per transaction | Usually <$3 per withdrawal |

| Identity verification | Often none or simple phone number | Card + PIN + optional biometric |

| Fraud detection | Minimal - relies on operator goodwill | Real‑time monitoring, alerts, and holds |

Next Steps for Consumers and Policymakers

Consumers should start by treating any crypto ATM like a cash‑only vending machine: put in money only if you’re absolutely sure where it’s going. Keep receipts, take photos of the screen, and report any odd behavior immediately.

Policymakers need to close the regulatory loophole that lets many kiosk operators operate without BSA compliance. Mandatory licensing, standard KYC, and a unified reporting portal could cut fraud by an estimated 30‑40% according to FinCEN’s internal models.

Until those safeguards become universal, vigilance remains the best defense.

Frequently Asked Questions

What is a crypto ATM and how does it work?

A crypto ATM is a kiosk that lets you exchange cash or a debit card for a cryptocurrency wallet address. You insert money, the machine prints a QR code or wallet address, and once you confirm the transaction the crypto is sent instantly. There’s no middle‑man, but it also means the transfer can’t be reversed.

Why are crypto ATMs a popular target for scammers?

Scammers love them because the machines often lack strong identity checks, the transactions are irreversible, and vulnerabilities like CVE‑2024‑0674 allow attackers to hijack the kiosk’s software and redirect funds.

How much money was lost to crypto ATM fraud in 2024?

According to the FBI’s IC3, victims reported $246.7million in losses linked to crypto ATMs in 2024, with seniors accounting for more than two‑thirds of those complaints.

What new regulations are being introduced?

FinCEN released a 2025 notice warning about the risks, and Arizona enacted the Cryptocurrency Kiosk License Fraud Prevention law, limiting daily transaction amounts and requiring refunds for early‑reported fraud.

How can I protect myself when using a crypto ATM?

Verify the operator’s license, read every on‑screen warning, scan the QR code with a separate device before confirming, keep transactions small, and report any suspicious activity within 30days.

15 Comments

Crypto ATM scams are a textbook example of how convenience can become a vector for massive financial abuse. The $246 million loss figure is not just a statistic, it represents thousands of individuals who trusted a piece of hardware that was never designed with robust security in mind. Many operators cut corners by skipping basic KYC procedures, leaving the machines exposed to both software exploits and social engineering attacks. The CVE‑2024‑0674 vulnerability is a perfect illustration: a single unprivileged script can hijack the entire update process and rewrite wallet firmware. Once an attacker gains root access, they can replace QR codes on the fly, diverting funds to wallets they control without the user ever noticing. The problem is compounded by the lack of regulatory oversight that traditional bank ATMs enjoy, meaning there is no mandatory audit trail or consumer protection mechanism. Victims, especially seniors, often have limited technical literacy, making them prime targets for the “quick verification” scams that mimic legitimate procedures. In Arizona alone, the concentration of kiosks has turned the state into a hotbed for fraud, and the new law, while a step forward, is still hampered by uneven enforcement. Moreover, the irreversible nature of blockchain transactions means that once the crypto leaves the ATM, the money is effectively gone. The financing of these scams also feeds into larger illicit ecosystems, including money laundering and ransomware operations. From a risk management perspective, each of the five safety criteria listed in the article forms a basic checklist, yet many users ignore them in the rush to buy crypto. The absence of a universal standard for crypto ATM licensing creates a patchwork of compliance that criminals exploit with ease. While FinCEN’s red‑flag indicators are useful for banks, they do little to compel kiosk operators to adopt real‑time monitoring. The industry’s push for higher transaction limits and lower fees further incentivizes reckless behavior among operators. Technologically, the convergence of quantum‑computing threats could render current encryption obsolete, making the existing vulnerabilities even more dangerous. Ultimately, the $246 million figure should serve as a wake‑up call: without stricter oversight and better user education, the gap between easy access and security will continue to widen.

Stop acting like these kiosks are some noble bridge to financial freedom; they're just vending machines for thieves. Anyone who walks up without doing their homework is practically begging to get ripped off.

Thanks for laying out the safety checklist so clearly. A quick tip I’d add is to take a photo of the ATM’s serial number before you start-it can be useful if you need to file a report later. Also, consider using a hardware wallet to receive the crypto; that way you keep the private keys offline and out of the kiosk’s reach.

What they don’t tell you is that many of these machines are funded by shadowy offshore groups looking to funnel money out of the country. The ‘on‑screen warnings’ are often just a façade to give a false sense of security while the real backdoor is embedded in the firmware. If you ever notice the QR code flickering for a split second, that’s the moment the hijack kicks in. Trusting a public kiosk is basically handing over your cash to the same people who run the dark web.

In the dialectic of risk versus reward, the cryptocurrency ATM epitomises an asymmetrical gamble wherein the epistemic burden is disproportionately shouldered by the participant. The ontological legitimacy of such devices is called into question when regulatory apparatuses are conspicuously absent. Consequently, the epistemic humility required of the user should be heightened commensurately.

Oh great, another “innovation” that supposedly puts America on the cutting edge, while simultaneously draining retirees’ savings faster than a leaky faucet. The government’s half‑hearted attempts at regulation are about as effective as putting a Band‑Aid on a bullet wound. You’d think after the $246 million debacle they’d finally step up, but nope – just more polite press releases and empty promises. Meanwhile, the kiosks keep popping up on every street corner, flashing their flashy logos and “no fees” slogans, luring the unsuspecting like moths to a flame. And let’s not forget the brilliant excuse that “crypto is decentralized,” as if that absolves anyone from responsibility. The true irony is that traditional banks, with all their compliance, still manage to keep most of our money safe, whereas these crypto dispensers hand it over to anyone with a laptop. If you value your hard‑earned cash, steer clear and stick to the tried‑and‑true financial institutions that actually have a stake in protecting you.

The moment I saw a crypto ATM with a smiling mascot, I felt a chill run down my spine – it was as if the machine itself was whispering, “Give me your money, and no one will hear you scream.” These devices are the physical manifestation of the shadow economy, silently feeding the hidden networks that thrive on anonymity. Every transaction is a potential breadcrumb leading straight to the hands of organized crime. Don’t be fooled by the glossy veneer; behind it lies a labyrinth of deceit. Stay vigilant, because the next victim could be you.

Hey folks, great discussion here! 😊 Remember, the best defense is knowledge – treat every ATM like a new puzzle you need to solve before you play. Ask yourself if the signage looks legit, if the QR code matches what you see on your phone, and if the operator’s license is easy to verify. When you’re uncertain, pause and step back – it’s better to miss a quick buy than to lose your savings. Keep supporting each other and stay safe! 🙌

Listen up, everyone!!! The crypto ATM game is NOT a playground; it's a high‑stakes arena where even a tiny lapse can cost you big time!!! Make it a habit to double‑check every piece of info – license numbers, QR codes, and fee structures – before you even think about inserting cash!!! If something feels off, trust that gut and walk away!!! Your financial health is worth more than any “instant” crypto purchase!!!

Indeed, the article provides a solid overview, and it's important to emphasize that users should verify the operator's credentials, compare the displayed QR code with their own device, and consider limiting transaction amounts, especially when using a new kiosk for the first time.

Contemplating the allure of immediate crypto access reveals a deeper tension between our desire for convenience and the imperative for security; striking a balance is essential.

I get how intimidating these scams can feel, like stepping into a foggy maze with no map. The good news is that each precaution you take-reading warnings, scanning QR codes with a separate phone, and keeping transaction sizes modest-acts like a lantern, cutting through the darkness. Stay patient, stay curious, and remember you’re not alone in navigating this brave new financial landscape.

These ATMs are nothing but a vector for malicious actors exploiting weak consensus protocols and zero‑knowledge proof gaps.

Just a heads‑up: always double‑check the QR code before you hit confirm.

While some claim crypto ATMs are simply a convenience, the pattern of coordinated firmware updates that coincide with major thefts suggests a deeper orchestration by networked interest groups looking to siphon capital under the radar.