FinCEN crypto ATM notice: essential guide for operators and users

When dealing with FinCEN crypto ATM notice, the U.S. Treasury’s Financial Crimes Enforcement Network guidance that forces cryptocurrency ATM operators to file reports and apply anti‑money‑laundering controls. Also known as FinCEN ATM rule, it covers transaction thresholds, customer verification, and suspicious activity reporting. The agency FinCEN, Financial Crimes Enforcement Network enforces these rules to curb illicit finance, while the device itself – a crypto ATM, a kiosk that lets users buy or sell digital assets for cash – becomes a point of data collection. Under the broader AML regulations, laws requiring monitoring of financial transactions to prevent money laundering and terrorism financing, the notice demands that operators keep logs, verify identities, and file Currency Transaction Reports once a day’s worth of activity tops $10,000. In short, FinCEN crypto ATM notice encompasses reporting requirements, crypto ATMs require AML compliance, and FinCEN enforces AML regulations on crypto ATMs.

Why compliance matters for every stakeholder

For a kiosk owner, ignoring the notice can trigger hefty fines, seizure of equipment, or even criminal charges. Practical compliance starts with a KYC (Know Your Customer) flow that captures name, address, and government ID before the first coin is dispensed. Next, the system must generate a record for each transaction, flagging amounts that exceed the $10,000 threshold and automatically sending a Currency Transaction Report to FinCEN. Many operators integrate third‑party AML screening tools that scan wallets against sanction lists – a step that mirrors the recent OFAC sanctions relief stories we cover for Syrian users. If you run a multi‑state crypto ATM network, you also need a centralized compliance dashboard to track reports across jurisdictions, because state‑level money‑transmitter licenses often reference the same FinCEN guidelines. These operational steps echo the risk‑management advice we give for crypto exchanges, where due diligence, insurance, and audit trails are equally crucial.

Understanding the FinCEN crypto ATM notice not only protects you from regulatory headaches but also builds trust with users who expect privacy and security. Below you’ll find a curated collection of articles that dive deeper into related topics – from exchange reviews that highlight AML features to real‑world cases of non‑compliant platforms facing shutdowns. Whether you’re setting up a new ATM, upgrading an existing fleet, or just curious about how U.S. policy shapes the crypto landscape, the posts ahead will give you actionable insights, concrete examples, and the latest updates to keep your operations on the right side of the law.

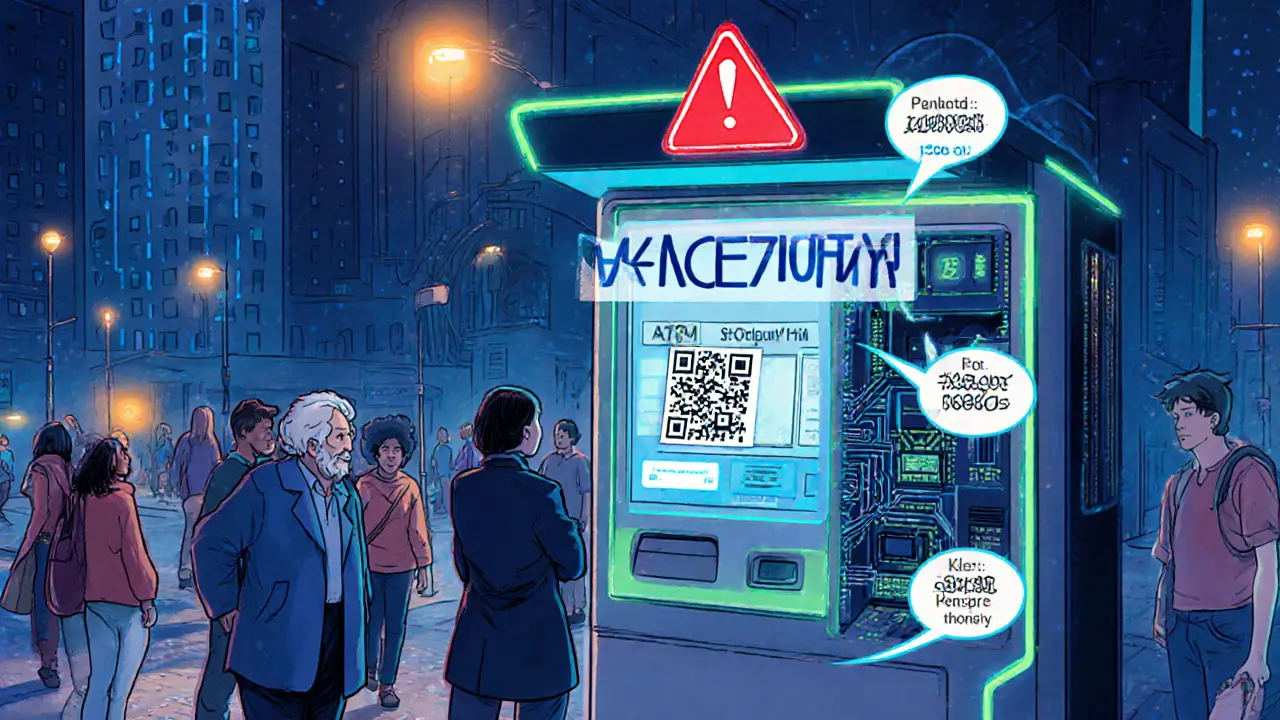

Crypto ATM scams have caused $246.7million in losses, mainly affecting seniors. Learn how vulnerabilities, weak regulation, and real‑world cases fuel fraud, plus tips and new laws to stay safe.

Read More