Exchange Server SE: What It Is and Why It Matters for Crypto Trading

When you hear Exchange Server SE, a type of server system designed to manage and process high-volume financial transactions, often used by trading platforms to handle order matching and user authentication. Also known as financial server infrastructure, it's not a crypto exchange you sign up for—it's the hidden engine running behind platforms like Kraken, Kyrrex, or even failed ones like OPNX. Most people think of exchanges as websites or apps where you buy Bitcoin. But behind every click, trade, or withdrawal, there’s a server system working nonstop to match buyers and sellers, secure data, and keep everything running. Without solid server infrastructure, even the best crypto platform crashes under load, gets hacked, or loses user trust.

Real exchanges like Kyrrex and BitBegin rely on server systems that handle thousands of trades per second, verify user locations, and enforce regional restrictions—like Kraken blocking users in 14 countries. These systems aren’t just code. They’re built with redundancy, encryption, and fail-safes to prevent downtime. When a platform like 99Ex or Coinviva disappears overnight, it’s often because they skipped the basics: reliable server architecture. No audits, no backups, no security layers—just a fake website with no real backend. Meanwhile, regulated exchanges use server setups that comply with MiCA and FinCEN rules, keeping user funds and data protected.

Blockchain identity verification and hybrid blockchains both need strong server infrastructure to function. Your self-sovereign identity data doesn’t just live on-chain—it’s accessed and validated through secure servers. Same with NFT storage: Arweave and IPFS rely on distributed networks, but the front-end apps that let you view or trade those NFTs? They run on servers. Even airdrops like ASK or MTLX depend on server systems to verify wallet addresses and distribute tokens fairly. If the server is slow, buggy, or unsecured, your free tokens might never arrive—or worse, get stolen.

So when you read a review about a crypto exchange, don’t just check the fees or coin list. Ask: What’s powering this? Is it a thin web page with no real backend, or a properly built system that can handle pressure, audits, and regulation? The difference isn’t just technical—it’s the difference between losing your money and trading safely. Below, you’ll find real-world breakdowns of exchanges that got it right, those that failed, and the scams hiding behind fake server claims.

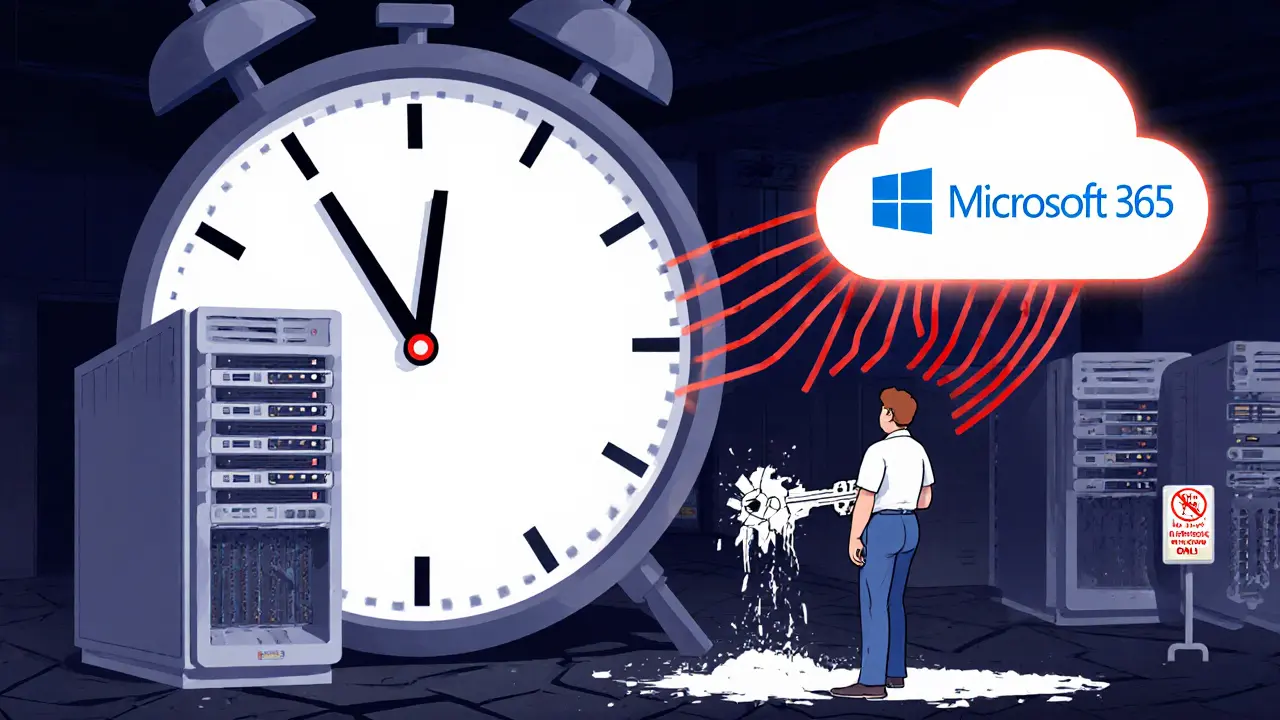

Microsoft is ending perpetual licenses for Exchange Server. Starting in 2025, you must pay an annual subscription or migrate to Exchange Online. No extended updates. No exceptions. Here's what you need to know.

Read More