Cryptocurrency ATM Fraud: Risks, Signs, and Prevention

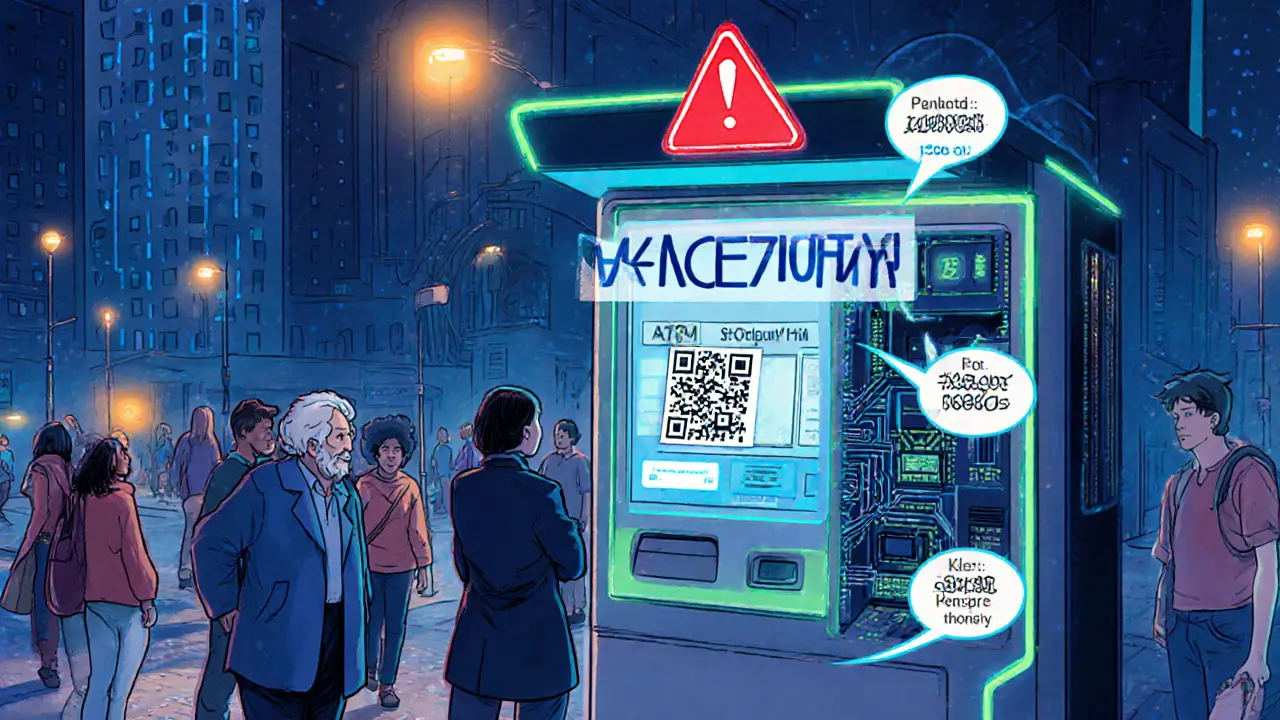

When dealing with cryptocurrency ATM fraud, a scheme where criminals manipulate crypto‑cash machines to steal digital assets or personal data. Also known as crypto ATM scam, it blends traditional ATM skimming tricks with the anonymity of blockchain transactions. Cryptocurrency ATM fraud often exploits weak KYC compliance, the process that verifies a user’s identity before allowing high‑value crypto trades and lax physical security at vending locations. The result is a perfect storm: a victim walks away with cash, while the thief walks away with Bitcoin or a linked wallet address. This opening gives you the basics before we dig into real‑world tactics and safeguards.

One common sub‑type is ATM skimming, the placement of hidden devices that capture card data and PIN numbers that attackers pair with a malicious software update on the crypto machine. The stolen data lets them bypass the ATM’s built‑in security and initiate a crypto transfer to a wallet they control. Another related threat is cryptocurrency exchange scams, where fake exchange portals lure victims after a compromised ATM transaction. The scam chain shows how cryptocurrency ATM fraud intertwines physical theft, digital deception, and regulatory loopholes, creating a multi‑layered risk profile for users and operators alike.

How the fraud works and how to protect yourself

The attack typically follows three steps: data capture, transaction hijack, and laundering. First, the skimmer records the card’s magnetic stripe and PIN. Second, the attacker uses that information to initiate a withdrawal at the crypto ATM, often adding a tiny surcharge that goes unnoticed. Finally, the stolen crypto is moved through mixers or chain‑hopping services to obscure its origin. This chain demonstrates a semantic triple: "Cryptocurrency ATM fraud" → "requires" → "ATM skimming devices". Another triple: "Weak KYC compliance" → "enables" → "exchange scams". Understanding these links helps you spot red flags, like unusually high fees, unexpected network confirmations, or a machine that looks tampered with.

Practical defenses start with physical vigilance. Check the card slot and keypad for loose parts, overlays, or visible cameras. Most legitimate machines have tamper‑evident seals; a broken seal is a warning sign. On the digital side, always verify the wallet address displayed on the screen before confirming a transaction. Use a hardware wallet for larger amounts; its private keys never leave the device, making it harder for a thief to siphon funds even if they control the ATM. Additionally, choose providers that enforce strict KYC and AML policies – they are more likely to monitor suspicious activity and freeze compromised accounts.

For operators, the stakes are higher because a single breach can damage reputation and attract regulatory scrutiny. Implement regular firmware audits, install anti‑skimming hardware, and train staff to spot anomalies. Partner with crypto exchanges that offer real‑time transaction monitoring; this creates a feedback loop where suspicious withdrawals trigger alerts before funds disappear. By treating "cryptocurrency ATM fraud" as a systemic issue rather than an isolated incident, operators can build resilience that protects both users and the broader ecosystem.

Regulators are also stepping in. Many jurisdictions now require crypto ATMs to register as money‑service businesses and to maintain detailed logs of every transaction. These logs enable law enforcement to trace illicit flows and deter fraudsters who rely on anonymity. While compliance adds operational overhead, it also raises the barrier for attackers who thrive on lax oversight. In short, stronger KYC/AML frameworks act as a deterrent, reducing the incentive for fraudsters to target ATMs in the first place.

Below you’ll find a curated set of articles that break down each piece of the puzzle – from real‑world case studies of ATM scams to step‑by‑step guides on securing your crypto wallet after a breach. Dive in to see how the industry is responding, what tools you can use today, and which red flags to watch for tomorrow.

Crypto ATM scams have caused $246.7million in losses, mainly affecting seniors. Learn how vulnerabilities, weak regulation, and real‑world cases fuel fraud, plus tips and new laws to stay safe.

Read More