Crypto Bankruptcy Claims: What Happens When a Crypto Exchange Crashes

When a crypto bankruptcy claim, a legal request by users to recover funds after a crypto exchange shuts down or goes insolvent. Also known as crypto asset recovery, it's the only path left when an exchange disappears with your Bitcoin, Ethereum, or altcoins. Most people think if they hold crypto on an exchange, it’s safe—like money in a bank. But it’s not. Exchanges don’t hold your coins in your name. They hold them in their own wallets. When they go under, those coins become part of the company’s assets—subject to court orders, creditor claims, and long, messy legal battles.

Think of it like this: if you deposit cash in a bank, the FDIC protects you up to $250,000. No such safety net exists for crypto. When FTX collapsed in 2022, customers lost billions. Some got back pennies on the dollar after years of court proceedings. Others are still waiting. crypto exchange failure, the sudden shutdown or insolvency of a digital asset platform due to mismanagement, fraud, or lack of liquidity. Also known as exchange collapse, it’s not rare—it’s becoming common. GCOX, Almeedex, GDEX, and UniWorld didn’t just fade away—they vanished with no warning, no communication, and no way to get your money back. These aren’t outliers. They’re examples of what happens when you trust an exchange that doesn’t prove it’s solvent.

Recovering your crypto isn’t about filing a form. It’s about understanding crypto asset recovery, the legal and technical process of reclaiming digital assets after an exchange’s insolvency. Also known as crypto bankruptcy claims, it involves proving ownership, joining creditor pools, and navigating court-appointed trustees. You need documentation—transaction histories, wallet addresses, KYC records. You need to act fast. Once assets are liquidated, the order of payment favors banks, lenders, and big investors. Retail users? They’re last in line. Some jurisdictions, like the U.S. and Australia, are starting to tighten rules. But in places like China or Nepal, there’s no legal recourse at all. If you’re holding crypto on an exchange right now, ask yourself: do you know who controls your keys? Do you know if this platform is even legally allowed to operate where you live?

The posts below dig into real cases—exchanges that died, users who lost everything, and the few who fought back and got something back. You’ll see how GCOX, GDEX, and Almeedex failed, why some airdrops vanished with the platforms that offered them, and how jurisdictional rules make all the difference. This isn’t theory. It’s what happens when the system breaks. And if you’re not prepared, you could be next.

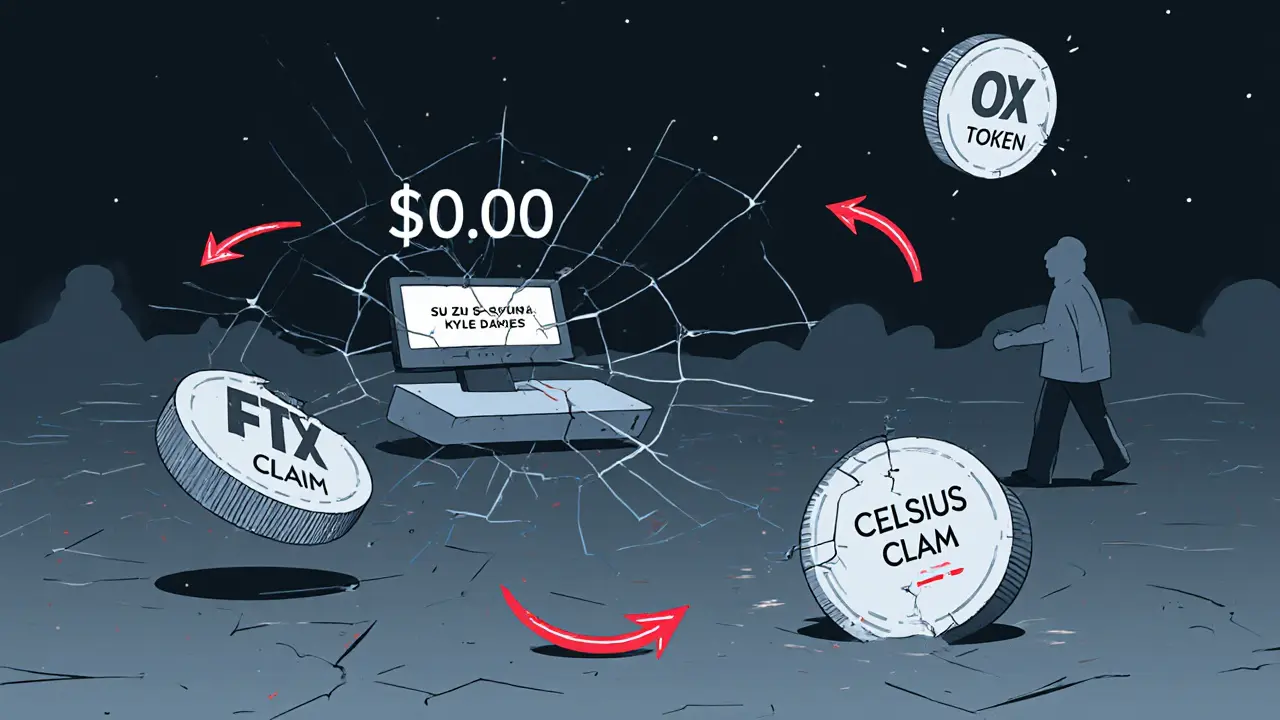

OPNX was a crypto exchange that tried to trade bankruptcy claims from failed firms like FTX and Celsius. It shut down in 2024 after failing to attract users, with less than $625,000 in total volume. Its OX token remains traded but has no real use.

Read More