Crypto ATM Scams: What They Are and How to Stay Safe

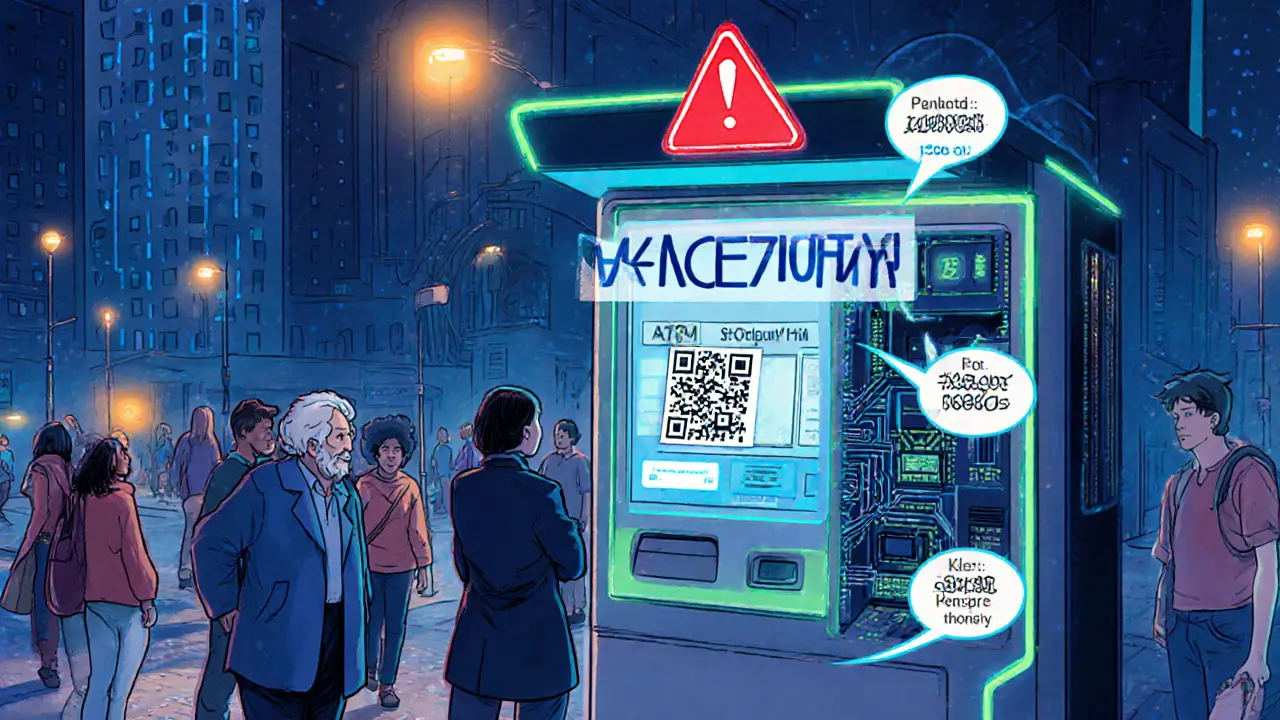

When dealing with crypto ATM scams, fraudulent activities that target users of cryptocurrency ATMs. Also known as crypto kiosk fraud, these scams exploit the anonymity and instant cash‑out features of machines that let you buy or sell digital coins. Below we’ll break down how the scams work, why they matter, and what you can do before you walk up to a kiosk.

Understanding the Core Players

A crypto ATM, a self‑service terminal that swaps cash for crypto or vice‑versa often operates like a traditional bank ATM but without a bank account. KYC regulations, know‑your‑customer rules that require identity verification are supposed to stop bad actors, yet many machines skip strict checks to speed up transactions. When KYC is weak, scammers can set up fake ATMs or tamper with legitimate ones, turning them into money‑laundering hubs. The relationship is simple: crypto ATM scams thrive where crypto ATMs and lax KYC regulations intersect.

Another key entity is the cryptocurrency exchange, online platforms where users trade digital assets. Many scams start at the ATM, then move the stolen crypto to an exchange that lacks robust anti‑money‑laundering (AML) controls. This creates a chain: fraudulent ATM → unverified exchange → hard‑to‑trace funds. Understanding this chain helps you spot red flags before you even insert cash.

Scammers use several tactics. The most common is a fake kiosk that looks identical to a legitimate machine but is actually a piece of hardware loaded with skimming devices. When you insert your card or scan a QR code, the device captures your private keys or personal data and sends them to the fraudster. Another method involves “phishing ATMs” that display a fake QR code on the screen, prompting you to send crypto to an address controlled by the attacker. Both tactics rely on the user’s trust in the physical presence of the machine.

Money‑laundering is a hidden driver behind many of these scams. Once thieves obtain crypto from a compromised ATM, they often funnel it through multiple exchanges and mixers to obscure the trail. This is why regulators stress the importance of AML compliance across both ATMs and exchanges. When a jurisdiction enforces strict KYC on ATMs, the volume of successful scams drops dramatically, showing a clear cause‑and‑effect relationship.

So, what can you do? First, verify the ATM’s legitimacy. Look for branding, official signage, and a visible URL that matches the operator’s website. Second, always scan the QR code with a trusted wallet app that shows the exact address before confirming a transaction. Third, be wary of machines that ask for unusually large cash deposits or promise unusually low fees – these are classic bait. Fourth, if the ATM asks for a phone number or email, treat it as a red flag; reputable kiosks usually require only a wallet address.

Education and vigilance are your strongest defenses. Keep an eye on news outlets and community forums that track recent ATM fraud reports. Platforms like Reddit’s r/cryptocurrency and specialized blogs often share screenshots of fake ATMs and warn users about new tactics. By staying informed, you can spot patterns – for example, a surge in scams targeting a specific city often means a batch of counterfeit machines has been deployed there.

The impact of crypto ATM scams ripples beyond individual losses. When users hear about thefts, they lose confidence in the broader crypto ecosystem, which can cause market volatility. Moreover, the fallout forces exchanges to tighten their own compliance, affecting the overall user experience. This feedback loop shows how a single scam type can influence regulation, market perception, and technology development across the industry.

Below you’ll find a curated selection of articles that dive deeper into each aspect we discussed: reviews of exchanges that have struggled with security, detailed case studies of ATM fraud, and step‑by‑step guides on securing your crypto transactions. Whether you’re a first‑time user or a seasoned trader, the pieces ahead will give you the practical tools you need to spot a scam before it takes your money.

Crypto ATM scams have caused $246.7million in losses, mainly affecting seniors. Learn how vulnerabilities, weak regulation, and real‑world cases fuel fraud, plus tips and new laws to stay safe.

Read More