Consensus Mechanism: How Blockchains Agree on Truth

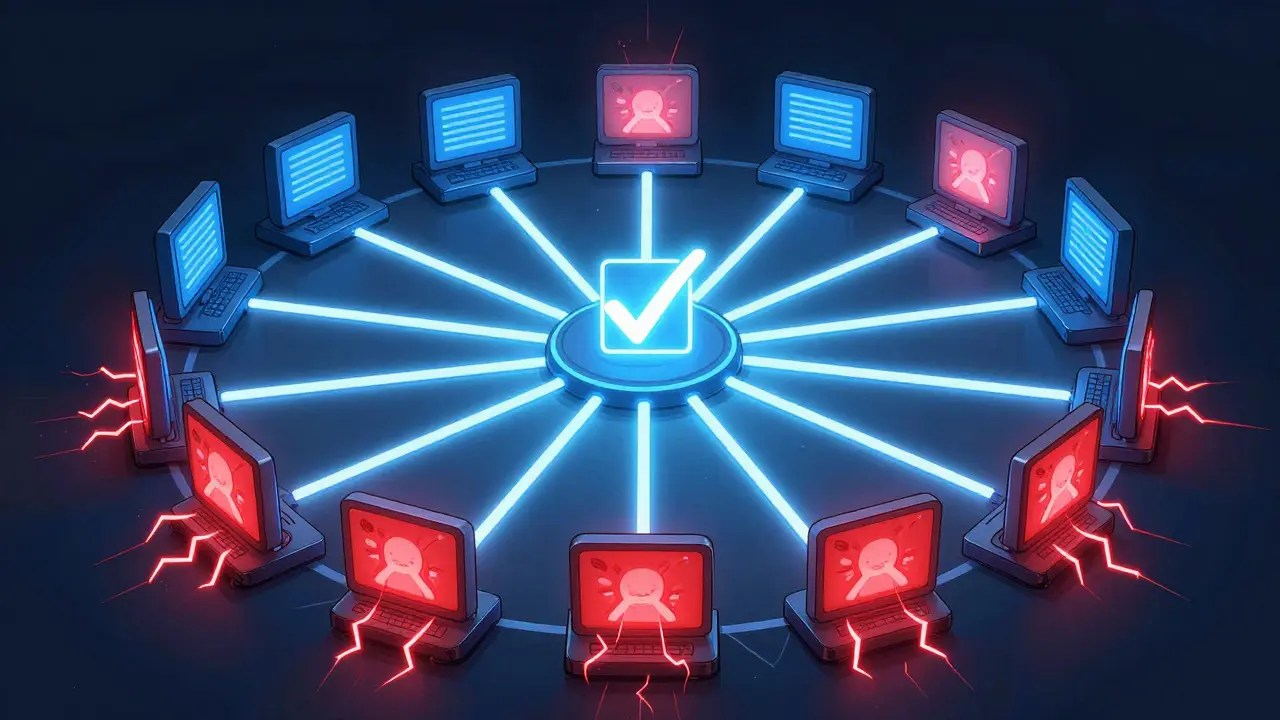

When you send Bitcoin or swap tokens on a decentralized exchange, no bank or company approves the transaction. Instead, a consensus mechanism, a system that lets distributed computers agree on the state of a ledger without a central authority. Also known as blockchain agreement protocol, it’s what stops people from spending the same crypto twice. Without it, blockchains would collapse into chaos. Every time a new block is added, dozens or even thousands of nodes must verify it using the same rules. That’s the job of the consensus mechanism.

There are two main types you’ll run into: proof of work, the original method used by Bitcoin, where miners compete to solve complex math puzzles using powerful hardware, and proof of stake, a more energy-efficient system where validators are chosen based on how much crypto they lock up as collateral. Proof of work is tough and slow—Bitcoin uses more electricity than some countries. Proof of stake is faster and cheaper, which is why Ethereum switched to it in 2022. But both have trade-offs: one uses tons of power, the other can favor the rich. Other variants like delegated proof of stake or practical Byzantine fault tolerance exist too, each suited for different blockchains like Binance Chain or Cosmos.

These systems aren’t just technical details—they shape who controls the network, how secure it is, and even how much it costs to use. If a blockchain uses proof of work, you’re likely dealing with mining rigs, high fees, and slow confirmations. If it uses proof of stake, you might see staking rewards, faster trades, and lower energy use. That’s why you’ll see posts here about exchanges like BitForex collapsing or TradeOgre shutting down—poorly designed consensus or weak security can make a platform vulnerable to hacks, fraud, or regulatory raids. You’ll also find guides on DeFi platforms like Sushiswap and Persistence DEX, where consensus affects how trades settle and how liquidity is secured. Even airdrops like ASK or CRTS rely on blockchain networks that use these mechanisms to distribute tokens fairly. Understanding how consensus works helps you spot which platforms are built to last—and which are just digital ghosts with no real foundation.

Byzantine Fault Tolerance (BFT) ensures blockchain networks stay reliable even when up to one-third of nodes are malicious. It delivers instant transaction finality - critical for enterprises - unlike Bitcoin's slow, probabilistic model.

Read More