Byzantine Fault Tolerance: How Blockchains Stay Reliable Even When Things Go Wrong

When you send Bitcoin or swap tokens on a decentralized exchange, you expect that transaction to go through—no matter what. That’s not magic. It’s Byzantine Fault Tolerance, a system design that lets networks agree on truth even when some participants are dishonest or fail. Also known as BFT, it’s the quiet engine behind every major blockchain that refuses to crash, even under attack. Without it, crypto would be just a bunch of untrustworthy computers talking to each other.

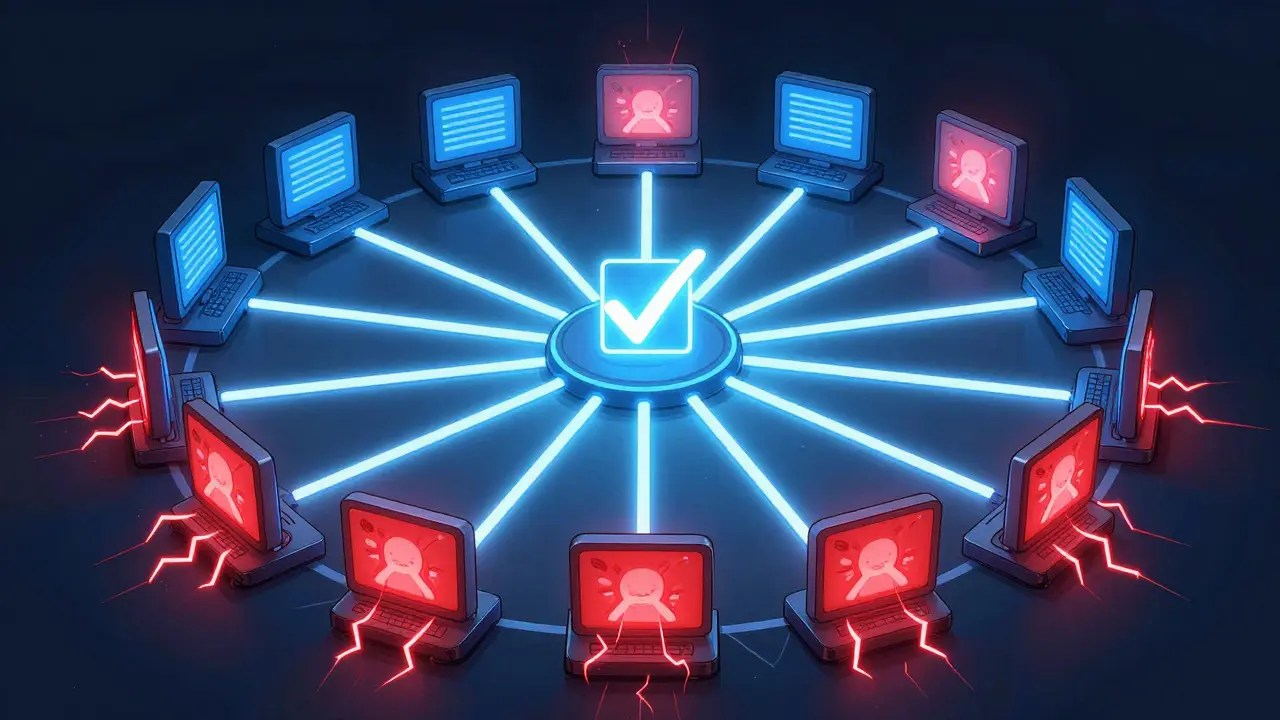

Think of it like a group of generals trying to coordinate an attack, but some are traitors. They can’t trust each other, and they can’t rely on a single leader. Byzantine Fault Tolerance solves this by requiring a majority of honest nodes to confirm every action. If 67% agree, the system moves forward. If not, it stalls. This is how networks like Ethereum, Cosmos, and even private blockchains stay secure. It doesn’t matter if a few nodes are hacked, turned off, or lying—the rest keep things running. That’s why exchanges like Kyrrex and Persistence DEX can operate without central control. They don’t need a bank or a CEO. They just need enough honest participants.

But BFT isn’t the only way. Some chains use Proof of Work, others use Proof of Stake. But if you’re looking at a blockchain that’s fast, energy-efficient, and designed for real-time trading—like a DEX or a DeFi protocol—you’re almost certainly looking at a BFT-based system. It’s what lets Sushiswap v3 confirm trades in seconds without a central server. It’s why BitForex’s collapse wasn’t caused by a consensus failure, but by bad management. BFT protects the network, not the company running it.

That’s why you’ll see BFT mentioned in posts about crypto exchanges, wallet security, and even airdrop scams. If a platform claims to be decentralized but doesn’t explain how it reaches consensus, it’s probably lying. Real BFT systems are transparent about their rules. They don’t just say "we’re secure"—they show you how they prevent fraud, even when insiders turn bad. That’s the difference between a real blockchain and a fake one.

Below, you’ll find real-world examples of how this concept plays out—in failed exchanges, secure DeFi platforms, and even scams trying to trick you into thinking they’re built on solid ground. You’ll see how BFT protects users, where it fails, and why understanding it can save you from losing money to fake platforms like TEMBTC or Bitcoin.me. This isn’t theory. It’s survival.

Byzantine Fault Tolerance (BFT) ensures blockchain networks stay reliable even when up to one-third of nodes are malicious. It delivers instant transaction finality - critical for enterprises - unlike Bitcoin's slow, probabilistic model.

Read More