BTCFi: What It Is, How It Works, and Why It Matters in Crypto

When you hear BTCFi, the fusion of Bitcoin’s network with decentralized finance protocols that let you earn interest, borrow, or trade without surrendering custody of your BTC. Also known as Bitcoin DeFi, it’s not a new coin—it’s a way to make Bitcoin work like a financial tool, not just a store of value. For years, Bitcoin was seen as digital gold—hold it, wait, hope it goes up. But BTCFi changes that. It lets you use your Bitcoin directly in DeFi apps—no wrapping, no bridges, no trusting third parties. You keep your private keys, but now your BTC can lend, earn yield, or act as collateral.

This shift matters because Bitcoin’s network is the most secure in crypto, but until recently, it couldn’t interact with smart contracts. BTCFi fixes that with sidechains, layer-2 solutions like Lightning, and new protocols built specifically to bring Bitcoin into DeFi ecosystems. You can now stake BTC on platforms that pay you in BTC, borrow USDT against your Bitcoin holdings, or trade BTC pairs on decentralized exchanges without ever converting it to ETH or another token. It’s Bitcoin, but with more utility. And it’s not theoretical—projects like RenBTC, tBTC, and now native Bitcoin DeFi apps on Bitcoin L2s are already live, with billions locked in.

But BTCFi isn’t risk-free. Unlike centralized crypto exchanges that promise 10% APY, Bitcoin DeFi often has lower yields because the system prioritizes security over speed. You might earn 3-5% instead of 15%, but your coins stay on Bitcoin’s chain. That’s a trade-off: less profit, more safety. Also, not all BTCFi platforms are equal. Some rely on custodians, others use complex multi-sig setups. You need to know who holds what—and if the code has been audited. The same scams that target Ethereum DeFi—fake liquidity pools, rug pulls disguised as BTC yield farms—exist here too. Watch out for projects that promise high returns on unverified Bitcoin-based tokens.

What you’ll find in the posts below isn’t hype. It’s real stories: exchanges that vanished overnight, tokens with zero volume pretending to be Bitcoin-backed, airdrops that don’t exist, and DeFi protocols that actually work. You’ll see how Bitcoin adoption in Venezuela ties into BTCFi—people using it to trade, not just hold. You’ll learn why some crypto exchanges shut down because they couldn’t handle Bitcoin’s security demands. And you’ll find out how tools like software wallets and blockchain identity systems play into keeping your BTC safe while using it in DeFi. This isn’t about chasing the next moonshot. It’s about understanding how Bitcoin is becoming more than money—and how to use it without getting burned.

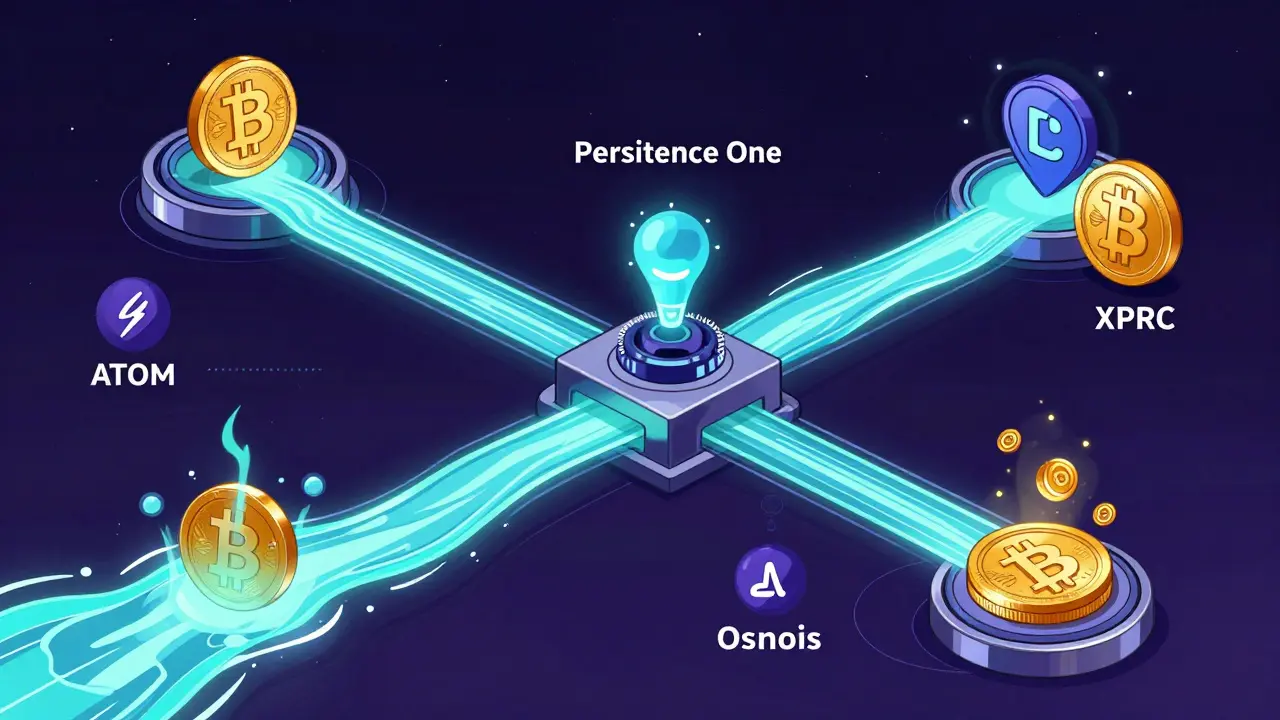

Persistence DEX is a niche decentralized exchange built for BTCFi and Cosmos ecosystem assets. With low volume but unique staking-integrated liquidity, it's ideal for XPRT holders and Bitcoin DeFi users seeking low-slippage swaps.

Read More