Blockchain Reliability: What Works, What Fails, and How to Spot the Truth

When we talk about blockchain reliability, the ability of a distributed ledger to maintain accurate, tamper-proof records without central control. Also known as trustless systems, it’s the foundation of everything from Bitcoin to DeFi apps—but not all blockchains deliver on that promise. Some are built with real security, clear rules, and real oversight. Others? They’re digital ghosts with fake volume, hidden backdoors, and no accountability.

Look at what happened to BitForex, a once-top crypto exchange that vanished with $56 million in user funds. Or TradeOgre, a privacy-focused platform shut down after authorities seized $40 million in assets. These weren’t random glitches. They were failures of blockchain reliability—systems that looked decentralized but weren’t built to last. Meanwhile, platforms like Kyrrex, a regulated exchange with FinCEN registration and MiCA compliance, prove that reliability can exist when there’s real legal structure behind the code.

Reliability isn’t just about not getting hacked. It’s about transparency, accountability, and user control. blockchain identity, a system where you own your data with cryptographic keys instead of trusting corporations, is one of the most promising tools here. It’s already being used by banks and governments to cut fraud. But if you’re using a wallet or exchange that doesn’t let you control your keys, you’re not using blockchain—you’re using someone else’s database with a fancy label.

And then there’s the hidden cost: MEV exploitation, when bots sneak in front of your trades to steal profits before you even see them confirm. This isn’t a bug—it’s a feature in some systems. If your DeFi trades are being front-run constantly, your blockchain isn’t reliable. It’s rigged.

What you’ll find below isn’t a list of hype coins or shiny new apps. It’s a collection of real stories—exchanges that collapsed, tokens that vanished, airdrops that never existed, and a few platforms that actually earned trust. Some posts show you how to spot a scam before you send a dime. Others explain why even well-known systems can fail. And a few reveal how real reliability looks: regulated, transparent, and built for users—not just investors.

Don’t assume blockchain means safety. Assume nothing until you’ve checked the facts. The difference between losing money and keeping it often comes down to one question: Is this system built to last—or just to take your crypto and disappear?

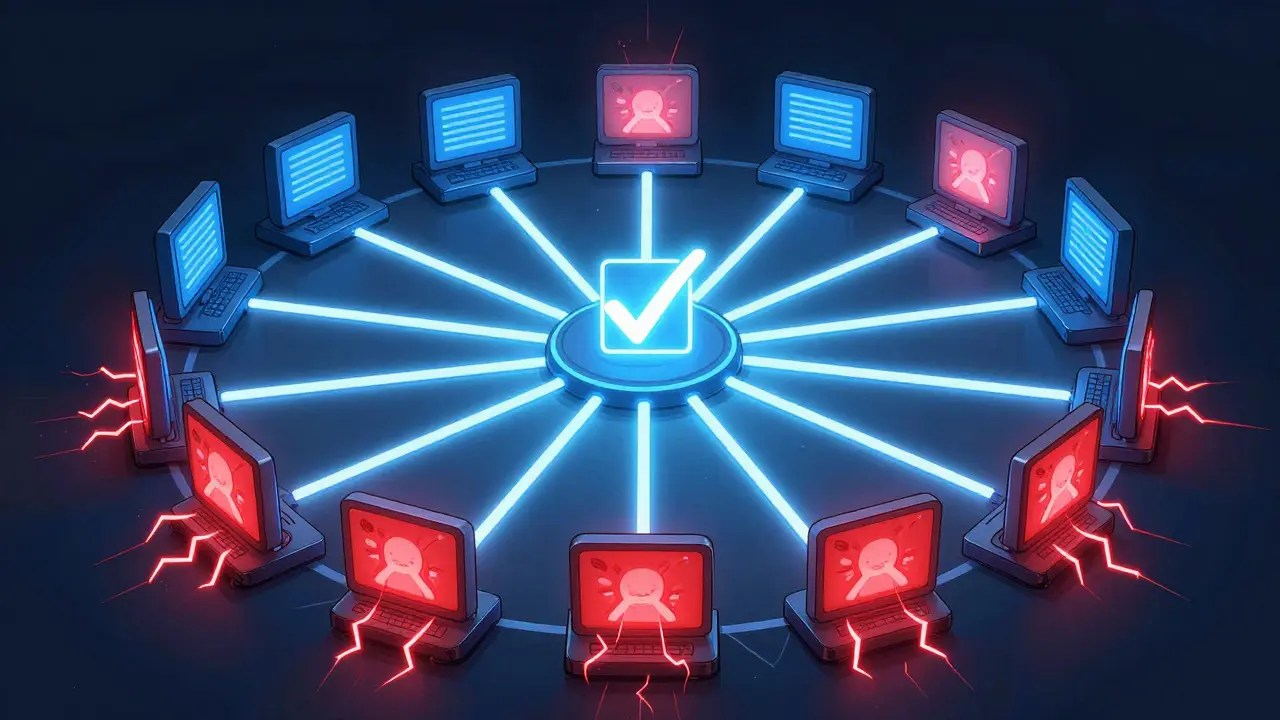

Byzantine Fault Tolerance (BFT) ensures blockchain networks stay reliable even when up to one-third of nodes are malicious. It delivers instant transaction finality - critical for enterprises - unlike Bitcoin's slow, probabilistic model.

Read More