Blockchain Finality: What It Is, Why It Matters, and How It Protects Your Trades

When you send Bitcoin or swap tokens on a decentralized exchange, you need to know that transaction is blockchain finality, the point at which a transaction is permanently confirmed and cannot be reversed. It’s not just a technical detail—it’s the reason your crypto doesn’t vanish after you hit send. Also known as transaction finality, it’s what makes blockchains trustworthy instead of just fast ledgers. Without it, every trade would be a gamble. Imagine sending 5 ETH to a DEX, only to have it undone minutes later because someone rewrote the last few blocks. That’s what happens without finality—and it’s not theoretical. Several crypto platforms have collapsed because they ignored it.

Finality isn’t the same as confirmation. A transaction might show as confirmed after one block, but in some chains, that’s not enough. Proof of Stake, a consensus method used by Ethereum, Solana, and many newer blockchains. Also known as PoS, it enables faster finality by having validators lock up tokens to verify transactions. In contrast, Bitcoin uses Proof of Work, a slower, energy-heavy method where miners compete to add blocks. Also known as PoW, it achieves finality gradually—typically after six confirmations. That’s why Bitcoin trades feel safer over time, while Solana swaps can settle in seconds. But speed isn’t everything. If a PoS chain gets hacked or validators collude, finality can be reversed. That’s what happened with the Ronin Bridge hack in 2022—finality was broken, and $625 million vanished.

That’s why DeFi safety, the practice of ensuring your trades on decentralized platforms won’t be undone or stolen. Also known as smart contract security, it depends heavily on how well the underlying blockchain enforces finality matters more than you think. If you’re using a DEX like Sushiswap or Persistence DEX, you’re trusting its chain to finalize your trade. If the chain has weak finality, your order could get front-run, rolled back, or even erased. That’s not just a risk—it’s a hidden tax on your trades. And if you’re holding crypto on an exchange like BitForex or TradeOgre, you’re relying on their backend to honor finality. When those platforms shut down, users lost funds because finality was never properly enforced—or worse, ignored.

Finality isn’t just about technology—it’s about trust. You don’t need to be a coder to understand it. You just need to know: if a blockchain can’t prove a transaction is permanent, then your money isn’t safe. That’s why platforms like Kyrrex and Binance.US highlight their chain’s finality time. That’s why scams like TEMBTC and Bitcoin.me don’t even bother—they don’t run real blockchains. They just steal before finality even has a chance to kick in.

Below, you’ll find real-world breakdowns of exchanges, tokens, and hacks—all tied to one truth: blockchain finality determines whether your crypto lives or dies. Some posts show you how to spot weak finality before you trade. Others expose platforms that pretended it didn’t matter. And a few reveal how the smartest traders use finality as a filter to avoid losses before they even happen.

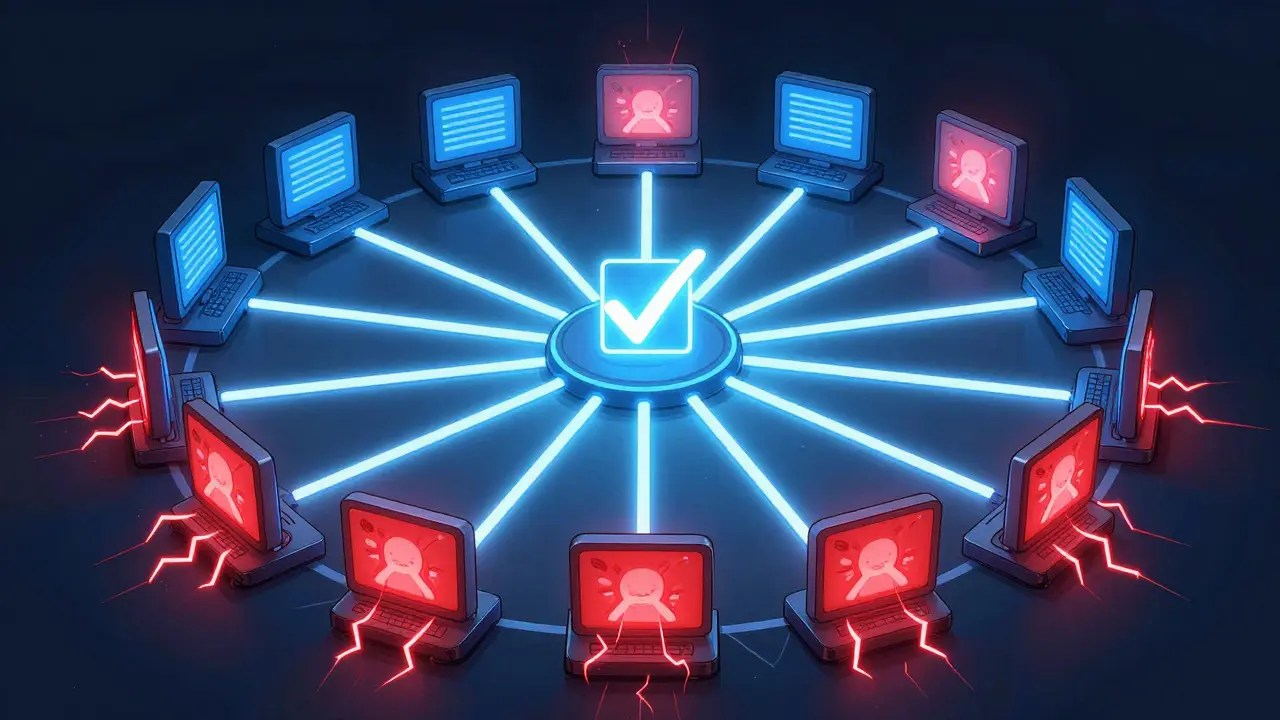

Byzantine Fault Tolerance (BFT) ensures blockchain networks stay reliable even when up to one-third of nodes are malicious. It delivers instant transaction finality - critical for enterprises - unlike Bitcoin's slow, probabilistic model.

Read More