Arizona Crypto ATM Law – What You Need to Know

When dealing with Arizona crypto ATM law, the state’s set of rules that govern the placement and operation of cryptocurrency vending machines. Also known as AZ crypto ATM regulation, it defines who can operate a machine, what licenses are required, and how operators must handle customer data. Understanding this law is the first step to keeping your business on the right side of the Arizona Money Transmission Act, a broader statute that treats crypto ATM services as money transmission activities and enforces strict consumer protection standards.

Key Elements of the Arizona Crypto ATM Framework

One major pillar of the Arizona crypto ATM law is the need for a money transmitter license, issued by the Arizona Department of Financial Institutions (DFI). Without this license, an operator cannot legally place a machine in the state. The license process demands proof of financial stability, background checks, and a detailed compliance plan. Another essential component is KYC/AML compliance, the practice of verifying user identity and monitoring transactions for suspicious activity. The law requires operators to collect government‑issued ID, retain transaction logs for at least five years, and report any activity that meets the federal suspicious activity thresholds. These requirements directly influence how crypto ATMs are programmed, what user interfaces look like, and the cost of operating a network of machines across the state.

Beyond licensing and KYC/AML, the Arizona crypto ATM law interacts with state consumer protection rules, which mandate clear fee disclosures and limits on transaction amounts for retail users. Operators must display fee schedules on the screen, limit daily transaction volume per user, and provide a straightforward way to reverse erroneous transactions. Failure to meet these standards can trigger fines and revocation of the money transmitter license. The law also aligns with federal guidance from the Financial Crimes Enforcement Network (FinCEN), meaning that compliance is not just a local concern but part of a national anti‑money‑laundering framework. By tying together licensing, KYC/AML, and consumer protection, the Arizona crypto ATM law creates a comprehensive compliance ecosystem that shapes every operational decision of a crypto vending service.

All of these pieces—license requirements, identity verification, fee transparency, and reporting duties—form a tightly linked network that determines whether a crypto ATM can legally serve Arizona residents. The articles below break down each element in plain language, highlight common pitfalls, and give you actionable steps to stay compliant. Whether you’re a startup planning your first machine or an established operator expanding into the Grand Canyon State, the following guides will help you navigate the legal landscape with confidence.

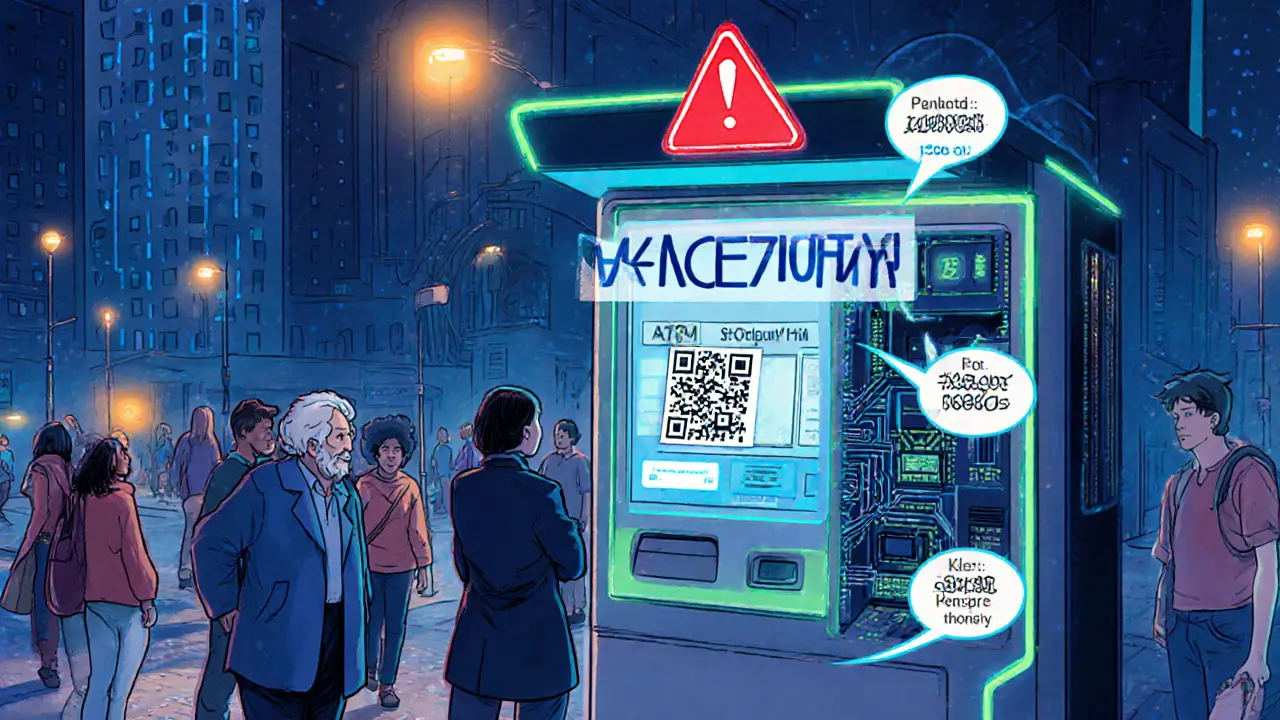

Crypto ATM scams have caused $246.7million in losses, mainly affecting seniors. Learn how vulnerabilities, weak regulation, and real‑world cases fuel fraud, plus tips and new laws to stay safe.

Read More