What is Soil (SOIL) Crypto Coin? The Confused DeFi Project Behind the Token

Soil (SOIL) isn’t a coin you buy because it’s going to make you rich. It’s a crypto project stuck between two identities, and nobody seems to agree on which one is real. One minute, you’re told it’s a DeFi protocol that lets you earn yield by lending stablecoins to real-world businesses. The next, you’re told it’s an agricultural token built to track soil health data on the blockchain. Both can’t be true. And that confusion is killing its chances.

What Soil (SOIL) Actually Does (If Anything)

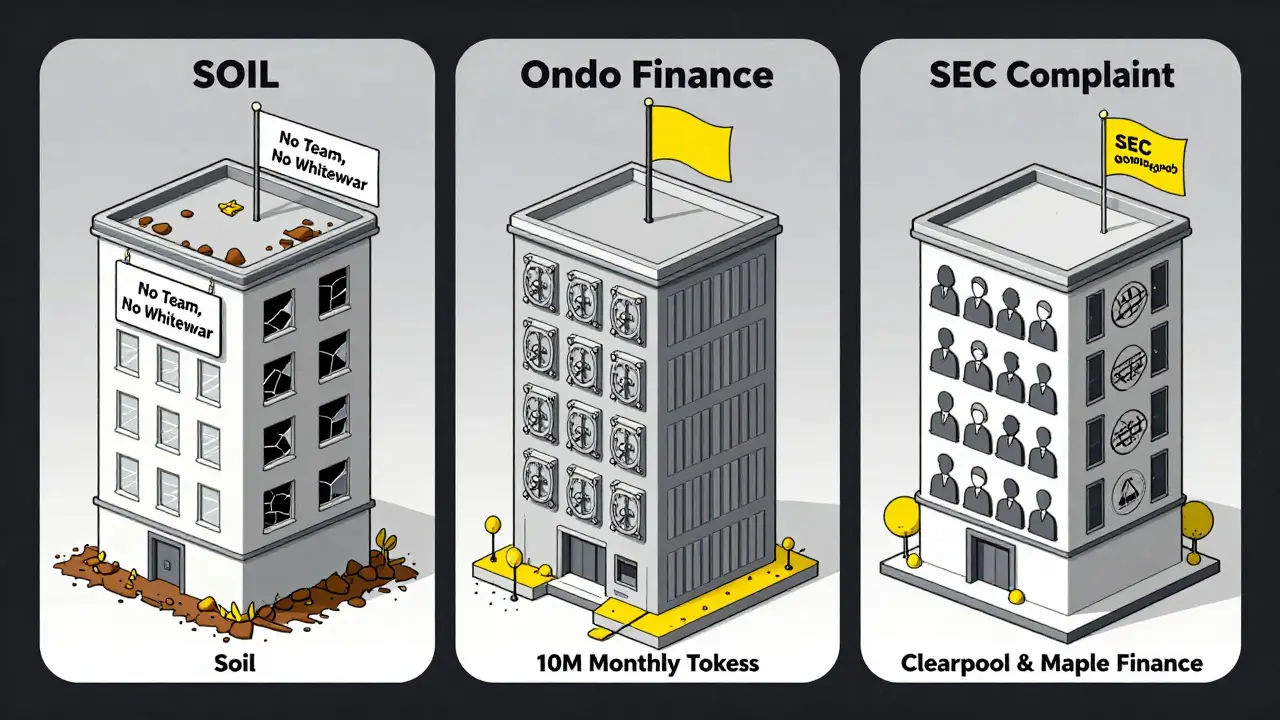

Soil claims to be a regulated DeFi protocol that connects traditional finance with crypto. It says companies can get loans backed by real assets - like equipment, invoices, or farmland - and investors can lend stablecoins like USDC to earn interest. That sounds like Ondo Finance or Maple Finance, both of which have billions in value and clear whitepapers.

But then MEXC and some other sites call SOIL an agricultural token designed to share environmental data. No one explains how soil samples get turned into blockchain tokens. No one shows a working app. No developer team is listed. No GitHub repo exists. And if it’s really about farming, why does its website talk about ‘lending pools’ and ‘yield generation’?

The truth? Soil doesn’t have a clear product. It has two conflicting stories, and neither is backed by proof.

Price, Supply, and Market Chaos

As of January 2026, Soil’s price varies wildly across exchanges:

- CoinMarketCap: $0.1462

- MEXC: $0.12397

- Chainbroker: $0.3286

- CoinCodex: Predicts $0.07669 by January 22, 2026

That’s not volatility - that’s market manipulation or outright confusion. The same token can’t be worth 2.5x more on one exchange than another unless one of them is listing a different asset entirely.

The total supply is 100 million SOIL tokens. Only 40-52 million are circulating. That means nearly half the supply is still locked up in vesting schedules from early investors. The seed round had a 6-month cliff and releases 7.5% monthly. The private round releases 10.6% monthly. That’s over 10 million tokens about to hit the market every month for the next year.

With only $200,000 in daily trading volume, even a small sell-off from these unlocks could crash the price. And with no major exchange like Binance or Kraken listing it, liquidity is razor-thin. You might not even be able to sell your tokens when you want to.

Who’s Behind Soil? Nobody Knows

There’s no team page. No LinkedIn profiles. No public founders. No press releases from credible outlets. The project raised $882,000 across two private rounds in 2024, but no names of investors are disclosed. That’s not normal for a ‘fully regulated’ DeFi protocol. Legitimate RWA projects like Ondo Finance have institutional backing - banks, asset managers, regulated funds.

Soil’s website doesn’t link to a whitepaper. No legal disclaimers. No compliance documentation. If this were a real regulated product, you’d see SEC filings, FINRA registrations, or at least a clear jurisdiction (like Switzerland or Singapore) where it’s licensed. You see none of that.

The absence of transparency isn’t just a red flag - it’s a blackout.

Why Soil Is Underperforming

Soil’s 7-day price change is -6%. The broader crypto market is up 0.5%. The Polygon ecosystem - where Soil claims to live - is flat. That’s not just underperformance. That’s failure.

Compare it to real RWA projects:

| Project | Market Cap | Trading Volume (24h) | Transparency |

|---|---|---|---|

| Soil (SOIL) | $9M-$17M | $200K | None |

| Ondo Finance | $1.2B | $85M | Full whitepaper, institutional investors, SEC compliance |

| Clearpool | $180M | $12M | Clear team, audited contracts, public roadmap |

| Maple Finance | $210M | $15M | Regulated, institutional lenders, public audits |

Soil isn’t just smaller - it’s in a different league. It doesn’t have the infrastructure, the trust, or the users. It’s a ghost project in a space that’s growing fast.

The Real-World Asset (RWA) Boom - And Why Soil Isn’t Part of It

The RWA tokenization market hit $20 billion in early 2026. It’s growing at 2% per month. Big players like BlackRock and Fidelity are investing in tokenized bonds and real estate. This isn’t speculation anymore - it’s institutional adoption.

Soil doesn’t belong here. It doesn’t have partnerships with asset managers. It doesn’t have audited smart contracts. It doesn’t have legal structure. It doesn’t even have a clear purpose.

What it does have is a confusing name and a weak marketing story. ‘Soil’ sounds like an environmental project. But it’s not. It’s trying to be a lending platform. And it’s failing at both.

Should You Buy Soil (SOIL)?

No - unless you’re willing to lose everything.

Here’s why:

- No utility: You can’t use SOIL for anything except trading. No staking, no governance, no access to yields - even if the protocol worked, you’d need to lend stablecoins, not SOIL.

- Low liquidity: With $200K daily volume, you’ll get crushed by slippage if you try to sell more than a few hundred dollars worth.

- Upcoming token unlocks: Over 10 million SOIL tokens will be released monthly through 2026. That’s massive selling pressure.

- No community: Reddit threads are empty. Twitter has 500 followers. Telegram is dead. No one cares.

- Price predictions are bearish: CoinCodex, the most detailed analyst here, forecasts a 25% drop. Even the bullish ones (like BeInCrypto) offer no data to back it up.

There’s no scenario where SOIL becomes valuable unless someone fixes its identity crisis - and no one has shown any sign they’re trying.

What You Should Do Instead

If you want exposure to Real World Assets in crypto, skip Soil. Go for projects that actually work:

- Ondo Finance - Tokenized U.S. Treasuries, backed by institutional investors.

- Clearpool - Lending to institutions with real credit ratings.

- Maple Finance - Proven track record, audited, regulated.

These projects have teams, audits, whitepapers, and real users. Soil has a name, a price chart, and a lot of confusion.

Final Verdict

Soil (SOIL) is not a crypto coin you invest in. It’s a warning sign.

It’s a project that sounds like it could be something - but never delivered. It’s stuck between two ideas, has no team, no transparency, no community, and is about to flood the market with new tokens. The price might spike for a day because someone’s pumping it. But when the unlocks hit, and no one’s buying, it will collapse.

If you’re looking for a DeFi yield project - go with one that’s real. If you’re looking for an environmental token - find one that actually tracks soil data. Don’t waste your money on a coin that can’t decide what it wants to be.

Is Soil (SOIL) a real cryptocurrency?

Yes, SOIL is a real token that exists on the blockchain - but that doesn’t mean it’s legitimate. It has a price, supply, and trading volume, but no clear purpose, team, or utility. Its identity as either a DeFi lending protocol or an agricultural data token is contradictory and unverified.

Can I earn interest by holding SOIL?

No. Holding SOIL tokens does not generate yield. The project claims to offer yield through lending stablecoins to real-world businesses, but you need to deposit USDC or similar, not SOIL. SOIL itself has no staking, liquidity mining, or reward mechanism.

Where can I buy Soil (SOIL) coin?

SOIL is listed on MEXC, Bybit, and possibly Coinbase, but trading volume is extremely low - under $200,000 per day. This means high slippage and difficulty selling. Avoid buying unless you’re prepared to hold indefinitely with no exit plan.

Is Soil regulated like a financial product?

There is no public evidence that Soil is regulated. While some sources call it a ‘fully regulated DeFi protocol,’ no jurisdiction, regulatory body, or compliance document has been disclosed. Legitimate RWA projects always publish their legal status - Soil does not.

Why is the price so different on different exchanges?

This usually happens when a token is thinly traded or when exchanges list different versions of the same token. In Soil’s case, it’s likely due to low liquidity and possible market manipulation. One exchange might be listing a different contract or simply misreporting data. Never trust a price on one platform - always cross-check with multiple sources.

Will Soil’s price go up in 2026?

Most technical analyses, including CoinCodex, predict a price decline. With over 50 million tokens still locked and set to unlock in 2026, and no demand signal from users or institutions, the odds of a price increase are extremely low. Any short-term rally is likely a pump-and-dump scheme.

Is Soil related to agriculture or environmental data?

No. While MEXC and some marketing materials suggest SOIL is for tracking soil health, there is no app, no data platform, no sensors, and no blockchain-based environmental tracking system associated with it. This appears to be a misleading marketing tactic to attract ESG-focused investors - but it’s not backed by any real product.

4 Comments

Bro, just don't touch this token. I've seen worse, but this? This is like buying a flashlight with no batteries and hoping it glows. 🤡

i read the whole thing and im still confused like why does it even have a name like soil?? like is it compost or a loan platform?? idk man

Soil... Soil?! What is this, a metaphor for the decay of crypto? A project that claims to be rooted in reality but has no soil beneath its roots? No team, no whitepaper, no transparency-just a name that sounds like a gardening app and a price chart that looks like a seizure diagram. It's not a DeFi project. It's not an agri-token. It's a Rorschach test for speculators. Everyone sees what they want to see-until the unlocks hit, and then everyone sees their portfolio in freefall.

You know who’s behind this? Probably some shell company linked to a Cayman Islands LLC that’s also funding three other ‘RWA’ tokens with the same team. I’ve seen this pattern before. They create a name that sounds eco-friendly to lure in ESG investors, then pivot to DeFi when the green crowd gets bored. The price discrepancies? That’s not ‘volatility’-that’s wash trading across five fake trading pairs. They’re not trying to build anything. They’re just harvesting dumb money.