What Is Institutional Grade Crypto Infrastructure and Why It Matters for Finance

When banks, hedge funds, and asset managers want to invest in Bitcoin or Ethereum, they don’t use MetaMask or Coinbase Wallet. They need something far more robust-something built for trillions in assets, not thousands. That’s where institutional grade crypto infrastructure comes in. It’s not just a fancy wallet. It’s a full financial system designed to meet the strict rules of traditional finance while operating on blockchain networks.

What Makes Crypto Infrastructure "Institutional Grade"?

Forget the hype. Institutional crypto infrastructure isn’t about flashy new tokens or DeFi yields. It’s about control, safety, and compliance. Think of it like the vaults and audit trails of Wall Street-but for digital assets.

To qualify as institutional grade, a system must deliver four non-negotiable things:

- Legal clarity: Who owns the asset? Who can move it? When? Every action must be traceable and legally enforceable.

- Embedded compliance: KYC, AML, and regulatory rules aren’t added later-they’re coded into every transaction. Wallets auto-block transfers to blacklisted addresses. Smart contracts enforce transfer rules.

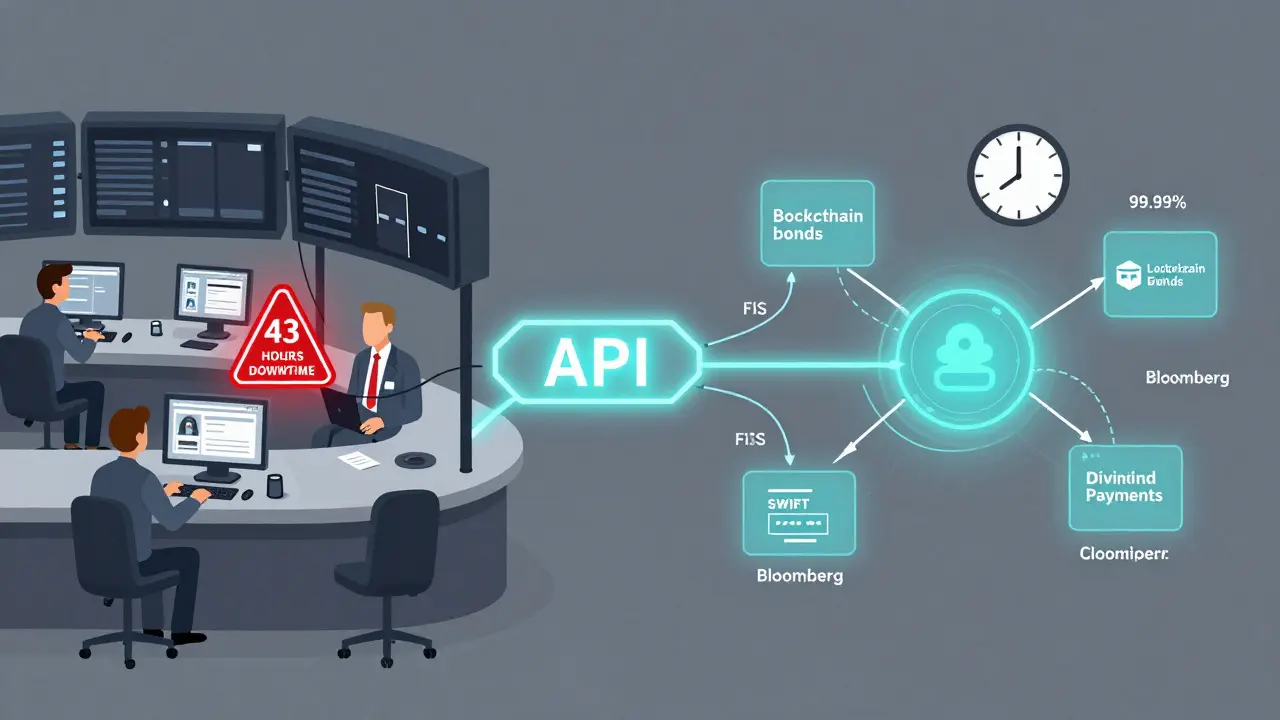

- Seamless integration: It must plug into Bloomberg terminals, SWIFT, FIS, and legacy fund administration systems without requiring teams to rebuild their entire workflow.

- Full lifecycle automation: From issuing tokenized bonds to paying dividends or handling corporate actions, everything runs automatically. No manual spreadsheets. No email chains.

These aren’t nice-to-haves. They’re requirements. A 2024 Deloitte study found that institutions using this infrastructure saw a 98.7% drop in unauthorized access incidents compared to retail wallets. That’s not a small improvement-it’s the difference between staying in business and facing a regulatory shutdown.

How It Works: Security Beyond Hot Wallets

Retail users protect their crypto with a 12-word recovery phrase. If they lose it, they lose everything. Institutions can’t afford that risk.

Institutional systems use multi-party computation (MPC). Instead of one private key, the signing power is split across multiple devices and locations. To move $1 million or more, you need approvals from at least three out of five authorized personnel-each using separate hardware, often in different countries. No single person, device, or breach can steal the assets.

That’s not theory. Fireblocks, one of the largest providers, processed over $10 billion in monthly transactions in Q2 2024 using this model. Their infrastructure includes perimeter firewalls, intrusion detection systems, and constant monitoring of blockchain nodes and smart contracts. Every line of code undergoes formal verification and repeated third-party audits.

And uptime? Institutional platforms target 99.99% availability. That’s less than 53 minutes of downtime per year. Retail platforms often settle for 99.5%-which still means over 43 hours of downtime annually. When markets move fast, even 10 minutes of downtime can cost millions.

Integration: The Real Challenge

Here’s the catch: the most secure system in the world is useless if it can’t talk to your existing systems.

Institutions don’t start from scratch. They use decades-old software for portfolio tracking, accounting, and reporting. Institutional crypto infrastructure must connect to all of it-through APIs, not manual exports.

BlockInvest’s clients report an average of 47 integrations per firm, linking to systems like Bloomberg, FIS, and SWIFT. One European private bank spent 14 weeks just connecting their fund administration software to a tokenized asset platform. The result? 78 hours of manual work saved every month. But the road there was long.

On Reddit, a portfolio manager at a $50 billion firm said their onboarding took six weeks-and delayed their crypto allocation by two quarters. Another hedge fund CTO on LinkedIn spent 220 hours trying to connect three different crypto platforms to their order management system. The promise of "seamless" integration? Often overstated.

EnterpriseCryptoReviews.com shows institutional users rate security features at 4.2/5, but ease of integration at just 3.1/5. That gap is where most failures happen.

Costs and Trade-offs

You don’t get institutional-grade security for free.

Annual licensing fees range from $150,000 to $2 million, depending on scale. Retail wallets? Free. But that’s not the full cost. You need at least 3-5 staff members who understand both traditional finance operations and blockchain technology. Most firms hire external consultants or partner with infrastructure providers for ongoing support.

Support quality is another pain point. Only 37% of providers offer 24/7 enterprise support with 15-minute response times for critical outages. If your custody system goes down during a market crash, you need help now-not tomorrow.

And then there’s DeFi. Institutional infrastructure supports only about 12 of the top 50 DeFi protocols. Why? Because most DeFi platforms lack compliance controls, audit trails, or legal accountability. Institutions can’t risk exposure to unregulated protocols-even if the yields look tempting.

Market Growth and Regulation

The market is exploding. In 2023, institutional crypto infrastructure was worth $4.2 billion. By 2027, McKinsey predicts it will hit $18.7 billion-a 45% annual growth rate.

Why? Because 87 of the top 100 asset managers now have crypto exposure. And 63% of them rely on dedicated institutional infrastructure, not retail platforms.

Regulation is driving adoption, not holding it back. The EU’s MiCA rules, effective since June 2024, require custody standards, transparency, and operational controls. Providers like BlockInvest and Fireblocks have already built MiCA-compliant features into their platforms-automated tax reporting, regulatory disclosures, and audit-ready logs.

Big players are moving in too. Broadridge bought Paxos’ post-trade services for $1.2 billion. Traditional financial infrastructure firms are acquiring crypto-native startups. The sector is consolidating fast. In the first nine months of 2024 alone, 37 infrastructure providers were acquired for $5.1 billion.

What’s Next?

The next wave is real-world asset tokenization. Real estate, private equity, and bonds are being turned into blockchain-based tokens. In 2024, deployments in this area grew 320% year-over-year.

Fireblocks just integrated with SWIFT’s new digital asset network, letting banks send crypto payments through the same messaging system they use for wire transfers. BlockInvest launched "Lifecycle Automation 2.0," automating everything from dividend payments to regulatory filings under MiCA.

But the biggest risk isn’t technology. It’s fragmentation. There are 68 different regulatory regimes across major jurisdictions. What’s legal in Singapore might be banned in New York. Infrastructure providers must constantly adapt-or risk leaving clients exposed.

As DataBird Journal put it: "As institutional capital flows increase, the infrastructure must evolve at the same pace or risk creating systemic vulnerabilities."

Who Needs This?

If you’re a retail investor buying Bitcoin on Coinbase, you don’t need this. You’re fine with a recovery phrase and a 99.5% uptime guarantee.

But if you’re managing money for pension funds, endowments, or family offices-then this isn’t optional. It’s the baseline. Investors now expect digital asset managers to operate with the same infrastructure they demand from hedge funds or private equity firms.

The goal isn’t to replace traditional finance. It’s to extend it. To bring the same level of safety, compliance, and reliability to crypto that we’ve had in stocks and bonds for decades.

Institutional crypto infrastructure isn’t about getting rich quick. It’s about building a system that lasts.

What’s the difference between retail and institutional crypto infrastructure?

Retail infrastructure, like MetaMask or Coinbase Wallet, uses single-signature keys and recovery phrases. It’s simple, free, and fast-but insecure for large amounts. Institutional infrastructure uses multi-party computation (MPC), requires multiple approvals for transactions, embeds compliance rules into every transfer, integrates with legacy financial systems, and offers 99.99% uptime. It’s designed for institutions managing billions, not individuals managing thousands.

Is institutional crypto infrastructure only for banks?

No. While banks are major users, hedge funds, asset managers, family offices, insurance companies, and even large corporations with treasury departments are adopting it. Any organization that must comply with fiduciary duties, audit standards, or regulatory requirements needs institutional-grade tools. Even crypto-native firms raising institutional capital now use this infrastructure to prove they’re serious about security and compliance.

Can institutional infrastructure interact with DeFi?

Limitedly. Most institutional platforms only support 12 of the top 50 DeFi protocols because DeFi lacks compliance controls, audit trails, and legal accountability. Institutions avoid risky, unregulated protocols-even if yields are high. Some providers are building "compliance bridges" to allow limited DeFi exposure, but it’s still the exception, not the norm.

How long does it take to implement institutional crypto infrastructure?

Typically 8 to 12 weeks, but it can stretch to 14-16 weeks if legacy system integration is complex. The delay isn’t from the crypto platform-it’s from connecting to internal systems like portfolio management software, accounting tools, and compliance databases. Firms often need 200-500 hours of engineering work just to make the APIs talk to each other.

What’s the biggest mistake institutions make when adopting this?

Assuming security alone is enough. Many institutions focus on MPC and cold storage but overlook integration, compliance automation, and support quality. A system that’s secure but can’t report to auditors or connect to their fund administrator is a liability, not an asset. The real value isn’t in the tech-it’s in how well it fits into existing workflows.

Is this infrastructure regulated?

Not directly-but the institutions using it are. Regulations like the EU’s MiCA, the U.S. SEC’s guidance on custody, and Japan’s FSA rules require institutions to use compliant infrastructure. So providers are forced to build to those standards. A provider that doesn’t meet MiCA requirements won’t get business from European banks. The regulation is on the user, but the infrastructure must be built to satisfy it.

7 Comments

This is the future and you know it. 🚀

Man, I’ve seen so many startups claim they’re ‘institutional grade’ but half of them can’t even handle a simple API call without crashing. Fireblocks is the real deal though - their MPC setup is next level. If you’re managing real money, you don’t mess around with single keys anymore.

Who cares about compliance when you can just buy btc and hodl? This whole institutional thing is just wall street trying to control what should be free

It’s funny how people act like institutional infrastructure is some kind of betrayal of crypto’s roots. But honestly? If we want this to survive long-term, we need the systems that keep the money flowing without blowing up. Retail wallets are great for beginners, but they’re not built for the real world. And that’s okay.

I’ve worked with both sides - the chaotic DeFi guy with his 12-word phrase and the hedge fund guy with his 5-of-7 MPC setup. The latter doesn’t feel less ‘crypto.’ It feels more responsible.

People forget that crypto isn’t just about tech - it’s about trust. And trust doesn’t come from anonymity. It comes from accountability.

When your pension fund invests in tokenized real estate, you don’t want some random hacker to drain it because someone lost their seed phrase. You want layers. You want audits. You want redundancy.

And yeah, integration sucks. I spent three months trying to get our legacy portfolio system to talk to a custody provider. It felt like teaching a mainframe to TikTok dance.

But once it worked? We saved 120 hours a month. No more copying paste from PDFs into Excel. No more midnight emails asking ‘did you approve this?’

It’s not sexy. But it’s necessary.

And if you think MiCA is overreach? Try explaining to a European regulator why your fund lost $20M because your ‘secure’ wallet had no audit trail.

The infrastructure isn’t here to kill decentralization. It’s here to let crypto grow up without dying in the process.

Real talk - if you're still using a hot wallet for anything over $10k, you're one phishing link away from a very bad day. I used to think MPC was overkill until my buddy’s fund got hit by a supply chain attack. They had 3-of-5 approval, geographically distributed keys, and hardware tokens. Zero loss. Meanwhile, a competitor with a single private key? Gone. $47M. Poof.

Security isn't about being fancy. It's about being stubborn.

Also, the 99.99% uptime? Non-negotiable. Last year, a major exchange went down for 47 minutes during a Fed announcement. Institutions lost over $200M in slippage alone. Retail? They just reload the page. Big difference.

Let’s be real - the biggest barrier isn’t tech. It’s people. Most finance teams still think blockchain is just ‘Bitcoin for nerds.’ They don’t get MPC. They don’t care about formal verification. They just want to know if it’s ‘safe’ and if they can explain it to their boss without sounding like a sci-fi fan.

The winning providers? They don’t sell tech. They sell peace of mind. They make compliance look like a checklist, not a nightmare.

And yes, integration is hell. But if you can get Bloomberg to show your tokenized bonds like regular ETFs? That’s the holy grail. Suddenly, your CIO stops asking ‘why crypto?’ and starts asking ‘how much more?’

Wow, another corporate shill article. Of course the banks want control. They’re terrified of real decentralization. This ‘institutional grade’ nonsense is just Wall Street putting a suit on anarchy so they can charge you 2% for it.

You think MiCA is about protection? It’s about control. They don’t want you to own crypto - they want you to rent it from them.

And don’t even get me started on ‘compliance bridges’ to DeFi. That’s like putting a lock on a door that’s already open. You’re not securing it - you’re just making it slower.

This isn’t progress. It’s colonization.