Unlicensed Crypto Mining in Iran: How the IRGC Controls the Network

On any given night in Tehran, families huddle under blankets as the lights go out. The fridge stops humming. The heater dies. Kids can’t finish their homework. Meanwhile, just outside the city, in a secured compound behind concrete walls and armed guards, thousands of computer chips hum nonstop-converting electricity into Bitcoin. This isn’t science fiction. It’s Iran’s reality, and the Islamic Revolutionary Guard Corps (IRGC) is at the center of it.

The Energy Theft Behind the Screens

Iran has one of the lowest electricity prices in the world. That’s not because it’s rich-it’s because the government subsidizes power to keep people from rebelling. But when the IRGC started mining crypto in 2019, that subsidy became a weapon. Instead of powering homes, factories, or hospitals, massive amounts of electricity were rerouted to hidden mining farms. These aren’t small operations. One farm in Rafsanjan, Kerman Province, alone uses 175 megawatts-enough to power a city of 200,000 people. And it’s not alone.Experts estimate that Iran has around 180,000 active crypto mining devices. Of those, roughly 100,000 are controlled by state-linked groups. That means more than half the country’s mining power belongs to the IRGC or its allies, like Astan Quds Razavi, a massive religious foundation directly under Supreme Leader Ali Khamenei’s control. These groups don’t pay bills. They don’t ask permission. They just take.

Energy Minister Ali Abadi, a former IRGC commander himself, called this theft “an ugly and unpleasant crime.” His words were rare, but they rang hollow. He’s part of the same system that enabled it. When the state’s own officials run the theft, enforcement becomes a joke.

How the IRGC Built a Crypto Empire

The IRGC didn’t just stumble into crypto mining. They planned it. After U.S. and EU sanctions froze Iran’s access to global banking, the regime needed a way to move money without banks. Bitcoin offered the answer: no intermediaries, no audits, no paper trail. But Bitcoin mining requires serious power-and power is tightly controlled in Iran.By 2020, the IRGC had already started building mining farms inside military bases and special economic zones. These locations are off-limits to inspectors. They’re protected by armed personnel. And they get electricity before hospitals, schools, or homes. In 2022, Iran’s parliament passed a law allowing the military to build its own power plants and transmission lines. That wasn’t about energy security. It was about crypto.

The IRGC didn’t have to buy the machines either. Chinese manufacturers, desperate for customers after Western sanctions hit their own crypto sector, shipped thousands of ASIC miners to Iran. These aren’t regular computers. These are machines built for one thing: mining Bitcoin as fast and efficiently as possible. Each one uses 3,000 watts-more than a household air conditioner. And tens of thousands of them run 24/7.

Even the money they make isn’t free. The IRGC doesn’t cash out on exchanges like Coinbase. Instead, they sell Bitcoin to the Central Bank of Iran (CBI) at fixed rates. The CBI then converts it into rials and funnels the cash to IRGC-linked businesses, militias, and weapons programs. This isn’t just mining. It’s a sanctioned, state-run money printer.

The Two-Tiered System: Legal vs. Illegal

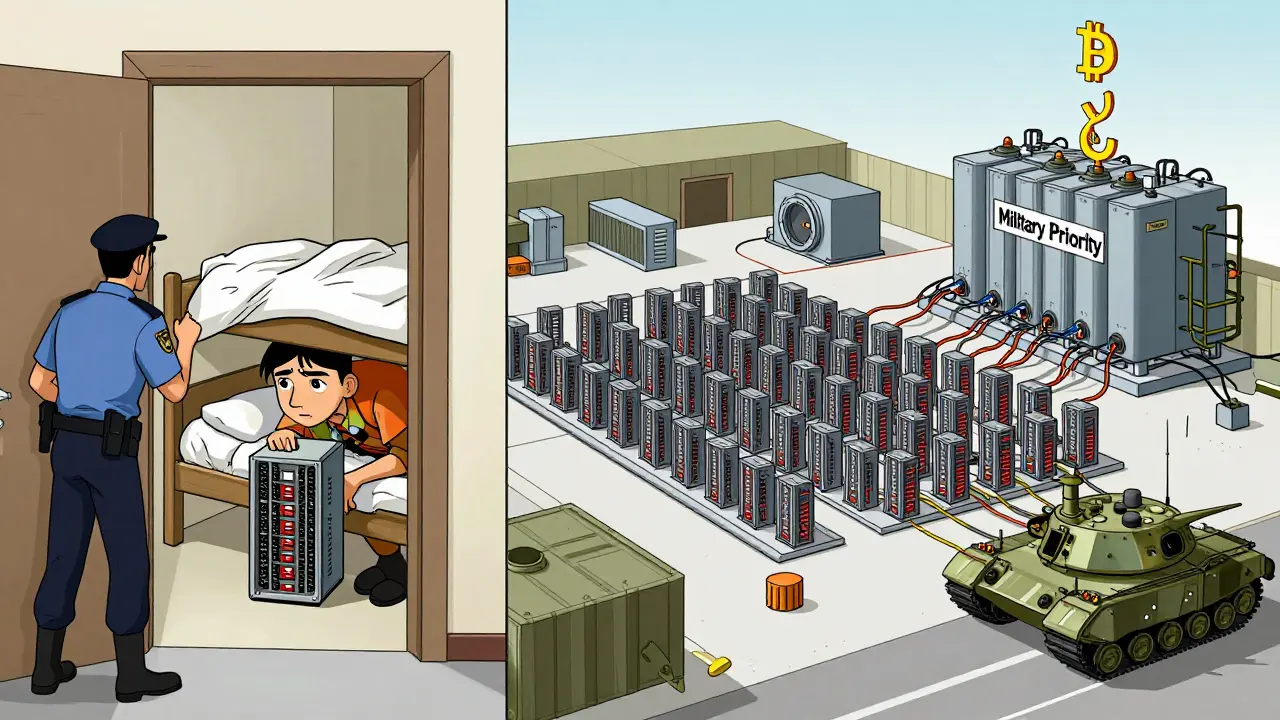

Iran officially legalized crypto mining in 2019. Sounds fair, right? Not quite. The government created a licensing system that only works for them. Private miners have to pay high electricity rates and hand over all their mined coins to the Central Bank. That’s not a business model-it’s a tax. Most private miners went underground. Others just gave up.Meanwhile, IRGC-linked miners operate under no rules. They get subsidized power. They don’t report earnings. They don’t need licenses. Their operations are hidden behind military checkpoints. When the government cracks down on “unlicensed” mining, it’s always targeting civilians. Not the IRGC.

This isn’t corruption. It’s institutionalized theft. The state created a system where only those with guns and political ties can profit. Ordinary Iranians who try to mine crypto with a few machines in their garage face fines, equipment seizures, or even arrest. But the IRGC? They get a national power grid.

Sanctions Evasion Through Blockchain

The IRGC doesn’t just mine crypto. They use it to bypass sanctions. U.S. Treasury and Israeli intelligence have tracked Bitcoin wallets linked to IRGC operations. These wallets send funds to Hezbollah in Lebanon, to Houthi rebels in Yemen, and to paramilitary groups in Syria. Unlike wire transfers, crypto moves directly from wallet to wallet. No bank. No paperwork. No oversight.Blockchain is public, but identities aren’t. You can see the money move-but not who owns it. That’s why the IRGC loves it. A single Bitcoin transaction can fund a missile shipment. A few thousand can pay a militia for months. And since Iran’s mining output is estimated to be among the top five globally, the cash flow is massive.

Western sanctions were meant to cripple Iran’s economy. Instead, they pushed it into crypto. And the IRGC turned that into an advantage.

What’s Happening Now? The Central Bank’s Double Game

On December 27, 2024, Iran’s Central Bank blocked all domestic cryptocurrency-to-rial transactions. The message was clear: no more crypto trading. But by January 2025, they quietly reopened exchanges-only this time, through a government-controlled API. Every transaction is monitored. Every user is tracked. Every dollar is accounted for.This isn’t a crackdown. It’s a takeover. The state doesn’t want to stop crypto. It wants to own it. Private Iranians can still use VPNs to access foreign exchanges like Nobitex, but they’re playing with fire. The government knows who they are. And they know what they’re buying.

Meanwhile, the IRGC continues to expand. New mining farms are being built in desert provinces. More Chinese hardware is arriving. More power lines are being diverted. The energy crisis worsens. And the regime gets richer.

Why This Matters Beyond Iran

What’s happening in Iran isn’t just a local issue. It’s a warning. If a military force can hijack a nation’s electricity to fund global terrorism through crypto, what’s stopping others from doing the same? Countries under sanctions-Venezuela, North Korea, Russia-are watching closely. The IRGC has shown that crypto isn’t just a tool for individuals. It’s a weapon for states.And the world is slow to react. Sanctions target banks. They don’t target power grids. They don’t track ASIC miners. They don’t freeze the electricity supply to a military base.

Until they do, the IRGC will keep mining. And Iran’s people will keep living in the dark.