Understanding Your Jurisdiction's Crypto Laws and Regulations in 2025

Before you buy, trade, or hold any cryptocurrency, you need to know crypto laws where you live. It’s not just about price charts or wallet security-it’s about whether you’re breaking the law. In 2025, over 78% of countries have some kind of crypto regulation, and the rules vary wildly. What’s legal in Singapore could land you in jail in Algeria. What’s tax-free in Portugal costs you 30% in India. Ignoring this isn’t negligence-it’s risky.

How Countries Classify Crypto: Three Real Paths

Countries don’t just regulate crypto-they define it. And how they define it changes everything. There are three main approaches you’ll run into:

- Restrictive: Some countries ban crypto outright. China stopped all exchanges and mining in 2021. Bangladesh makes crypto trading illegal under money laundering laws. In Algeria, you could face 2 to 5 years in prison for holding Bitcoin. These places don’t just discourage crypto-they criminalize it.

- Neutral: These countries treat crypto like any other asset. The U.S. is the prime example. The SEC says most tokens are securities. The CFTC says Bitcoin is a commodity. State regulators add another 50 layers of rules. You’re not banned, but you’re caught in a maze. Coinbase spends $120 million a year just to keep up with U.S. state-by-state rules.

- Crypto-friendly: These places build rules specifically for crypto. The UAE created VARA, a dedicated crypto regulator. Switzerland’s "Crypto Valley" in Zug has clear licensing for exchanges and token issuers since 2019. Singapore’s MAS updates its guidelines quarterly and even approved Bitcoin ETFs in 2024. These countries want innovation-they just want it done right.

Your jurisdiction falls into one of these. If you’re in the U.S., you’re in the messy middle. If you’re in the UAE, you’re in the fast lane. If you’re in India, you’re paying 30% tax on every gain-plus 1% withheld at source. That means if you make $1,000 in profit, you lose $354 in taxes before you even touch your wallet.

What You Actually Need to Comply With

Regulations aren’t abstract. They hit your wallet, your trades, and your paperwork. Here’s what you’re likely required to do, depending on where you live:

- Licensing for exchanges: If you run or use a crypto exchange, it must be licensed. In the EU, MiCAR requires all service providers to get approved by national regulators. In South Africa, the FSCA has licensed 138 crypto businesses since 2023. If your exchange isn’t licensed, your funds aren’t protected.

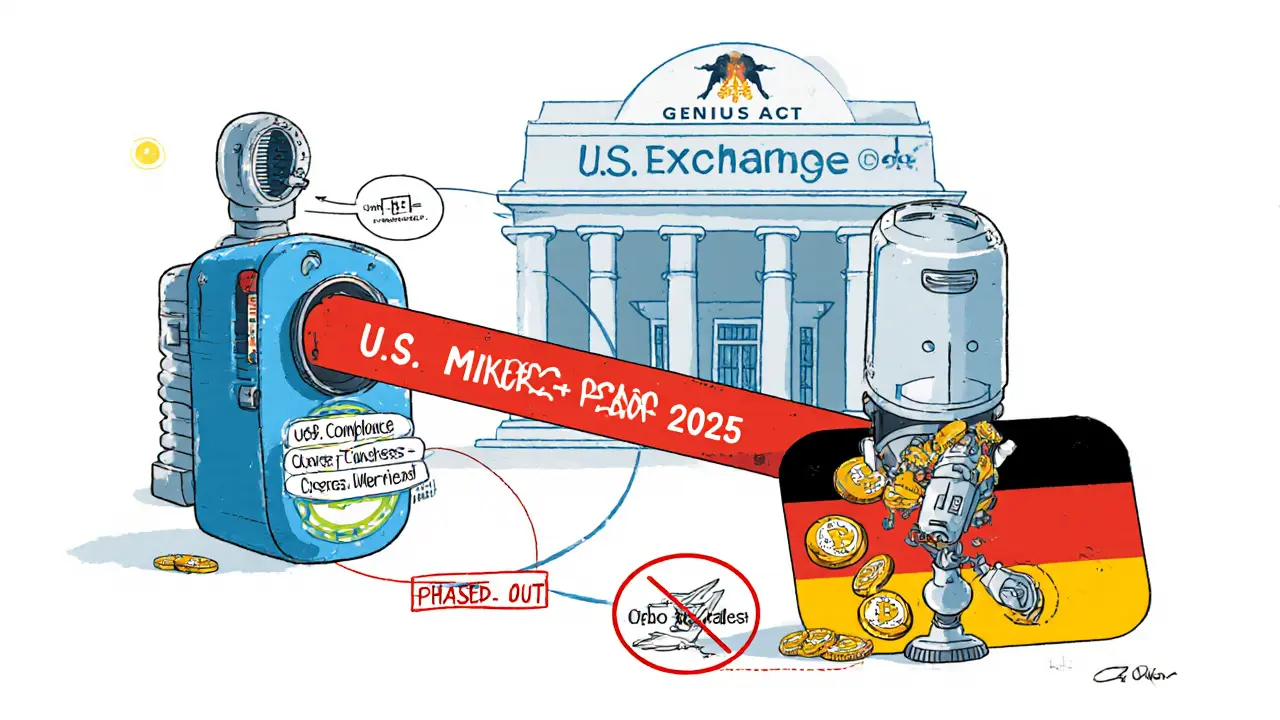

- Travel Rule compliance: Starting in 2025, most countries require exchanges to collect and send beneficiary info for transactions over $3,000. That means if you send $5,000 to a friend in Germany, your exchange must share your name, address, and ID with the recipient’s exchange. Privacy coins? They’re being phased out.

- Stablecoin rules: The U.S. passed the GENIUS Act in July 2025. Now, payment stablecoins must be 1:1 backed by U.S. dollars or Treasury bills. They need monthly audits and public reports. If a stablecoin isn’t compliant, you can’t legally trade it on U.S. platforms.

- Tax reporting: This is where most people get tripped up. In Germany, if you hold crypto for over a year, you pay zero capital gains tax. In Portugal, you pay 28%. In Australia, you pay capital gains tax but can offset losses. In India, you pay 30% flat tax with no deductions. You can’t guess this-you need to know your country’s exact rules.

Real-world impact? A user in France lost €1,850 in staking rewards after MiCAR forced his exchange to drop 23 tokens. In South Africa, someone recovered 100% of stolen funds because FSCA licensing requires exchanges to carry insurance. Compliance isn’t bureaucracy-it’s protection.

Where You Live Changes Everything

Let’s compare real examples:

| Jurisdiction | Legal Status | Tax Rate on Gains | Exchange Licensing | Stablecoin Rules |

|---|---|---|---|---|

| United States | Neutral (fragmented) | 15-37% (federal capital gains) | Yes, state + federal | GENIUS Act: 1:1 backing, audits, monthly reports |

| European Union | Crypto-friendly (MiCAR) | Varies by country (0-30%) | Yes, mandatory under MiCAR | 1:1 reserves, monthly attestations, Travel Rule at €1,000 |

| India | Restrictive | 30% flat + 1% TDS | Allowed but heavily monitored | No official framework yet |

| United Arab Emirates | Crypto-friendly | 0% capital gains tax | Yes, via VARA or ADGM | Regulated under Dubai’s framework |

| China | Restrictive | Banned | Illegal | Banned |

| Switzerland | Crypto-friendly | Varies by canton (0-11.5%) | Yes, FINMA licensed | Regulated as financial instruments |

Notice how the same asset-Bitcoin-can be taxed at 0% in the UAE, 30% in India, or 37% in the U.S. depending on your income. That’s not a coincidence. It’s policy. If you’re a U.S. citizen living abroad, you still owe taxes to the IRS. If you’re a European using a U.S.-based exchange, you’re subject to both MiCAR and U.S. rules. Jurisdiction isn’t just where you live-it’s where your money flows.

What Happens If You Ignore the Rules

People think crypto is lawless. It’s not. Regulators are catching up fast. In 2024, the SEC filed 87 enforcement actions against unregistered crypto offerings. In 2025, the FATF is pushing 138 countries to enforce the Travel Rule. If you’re using an unlicensed exchange, you’re not just risking your funds-you’re risking legal exposure.

Real cases:

- A Canadian trader used a non-licensed exchange to trade altcoins. When the exchange froze withdrawals, he couldn’t prove ownership because it wasn’t registered. He lost $42,000.

- An Indian investor didn’t report $80,000 in crypto gains. The tax department matched his wallet addresses with bank deposits. He was fined 300% of the unpaid tax.

- A U.S.-based DeFi project didn’t register as a money transmitter. The CFTC shut it down and fined the founders $2.4 million.

Penalties aren’t just fines. They’re criminal charges. In Bangladesh, crypto trading can lead to imprisonment. In Algeria, possession alone is punishable. Even in "friendly" jurisdictions, failure to report can trigger audits, asset freezes, or loss of business licenses.

How to Find Your Jurisdiction’s Rules

You don’t need a law degree. Here’s how to find your rules in 5 steps:

- Identify your country: Don’t assume your neighbor’s rules apply to you. If you’re in New Zealand, you’re under the FMA. If you’re in Brazil, it’s the CVM.

- Check your financial regulator’s website: Look for terms like "digital assets," "virtual currencies," or "crypto assets." In the U.S., that’s the SEC, CFTC, FinCEN. In the UK, it’s the FCA.

- Look for licensing lists: If your exchange isn’t on the official list, it’s not compliant. South Africa’s FSCA publishes a public registry. So does Singapore’s MAS.

- Search for tax guidance: Most tax agencies have specific crypto sections. The IRS has Pub 544. HMRC in the UK has Cryptoassets Manual. Australia’s ATO has detailed examples.

- Join local crypto communities: Reddit threads, local Telegram groups, or forums like CoinSwitch Kuber (India) or ZARtrader (South Africa) often share real compliance experiences.

Don’t rely on YouTube influencers or crypto newsletters. They’re not lawyers. Use official sources-even if they’re boring.

What’s Coming Next (2025-2026)

Regulation isn’t static. It’s accelerating:

- The EU is working on MiCA II, targeting DeFi and NFTs. If you’re using DeFi protocols, expect licensing requirements by late 2026.

- The Basel Committee is finalizing new rules that could make banks hold 1,250% capital against crypto holdings. That means banks might stop offering crypto services unless they’re ultra-safe.

- South Africa is testing its CBDC and pushing to get off the FATF gray list by December 2025-meaning stricter AML rules are coming.

- The U.S. may create a federal stablecoin charter, cutting through the 50-state mess.

By 2026, 92% of the world’s population will live under some form of crypto regulation. The days of "crypto is unregulated" are over. The question isn’t whether regulation is coming-it’s whether you’re ready for it.

Is it legal to own Bitcoin in my country?

It depends. In most countries, owning Bitcoin is legal-but how you use it may not be. China bans exchanges and mining but doesn’t explicitly ban personal ownership. India taxes it heavily but doesn’t ban it. In Algeria, Bolivia, and Bangladesh, owning or trading crypto is illegal. Check your country’s financial regulator’s website for the official stance.

Do I have to pay taxes on crypto gains?

Almost always. Nearly every country with a functioning tax system treats crypto as property or an asset. The U.S., Canada, Australia, and the EU all tax capital gains. India taxes at 30% flat. Germany exempts gains after one year. Portugal taxes at 28%. If you sold, traded, or used crypto to buy something, you likely triggered a taxable event. Keep records of every transaction.

Can I use any crypto exchange?

No. Only use exchanges licensed in your jurisdiction. In the EU, exchanges must be MiCAR-licensed. In Singapore, they need MAS approval. In the U.S., they need state money transmitter licenses plus federal compliance. Unlicensed exchanges don’t offer legal protections. If they get shut down or hacked, you have no recourse. Always check the regulator’s public registry before depositing funds.

What happens if I move to another country?

Your tax obligations don’t disappear. The U.S. taxes citizens on worldwide income, even if you live abroad. The UK taxes residents on global gains. If you move, you may owe taxes in your old country for past gains, and your new country may tax future gains. Some countries have tax treaties-others don’t. Consult a cross-border tax specialist before relocating.

Are NFTs and DeFi regulated too?

Yes, and faster than you think. The EU’s MiCA II (expected 2026) will bring NFTs and DeFi under licensing rules. The SEC has already sued DeFi platforms for unregistered securities. If you’re providing liquidity, staking, or trading NFTs, you’re likely subject to the same rules as exchanges. Ignoring this is becoming riskier than ever.

What to Do Next

Don’t wait for a tax notice or a frozen account. Here’s your action plan:

- Go to your country’s financial regulator website right now. Search for "crypto" or "digital assets."

- Find the official stance on ownership, trading, and taxation.

- Check if your exchange is licensed there.

- Review your crypto transactions from the last three years. Are they reported?

- If you’re unsure, talk to a local tax advisor who’s handled crypto cases before.

Regulation isn’t the enemy of crypto-it’s what lets it survive. Countries that got it right, like Switzerland and Singapore, now have thriving crypto industries. Countries that banned it, like China, still have massive underground markets. The smart move isn’t to fight the rules. It’s to understand them, follow them, and build within them.

18 Comments

India’s 30% tax plus 1% TDS is a joke. You buy at $30k, sell at $35k, and the government takes $10,600 before you even see the profit. No deductions, no losses offset. Just pure extraction.

As an Indian, I feel this deeply 😭. We’re punished for participating in the future. Meanwhile, UAE folks are sipping coffee tax-free while we’re filling out 12-page forms for every trade. Why does innovation always come with a fine?

It’s not that complicated. If you’re in the U.S., you’re subject to SEC, CFTC, FinCEN, AND your state’s rules. There’s no excuse for ignorance. People who claim they ‘didn’t know’ are just irresponsible. This isn’t a game-it’s financial law. Get your act together.

Bro, I just bought my first Bitcoin in 2023 and now I’m terrified I’ll get audited. But honestly? I’m glad we have rules. At least now I know what I’m doing. Before this, I was just guessing. Thanks for the clarity.

Ugh. More crypto regulation content. Can we just go back to when we didn’t care about taxes and just HODL’d?

in india its worse then u think. i lost 18k last year because i forgot to file form 3CEB. now they want me to pay 30% on top of that. no one tells you this until its too late.

If you’re using an unlicensed exchange, you’re already gambling with your life savings. Don’t be that person who loses everything because they trusted a Telegram group. Check the FSCA, MAS, or FinCEN registry. It takes 5 minutes. Do it.

Why are we letting foreign regulators dictate how Americans trade? The SEC is a joke. They’re chasing crypto like it’s 2018. We need to build our own system-not follow the EU’s overregulated mess.

There’s a quiet irony here. The more we try to control crypto, the more it slips through the cracks. China bans it, but underground mining thrives. India taxes it heavily, but people still use P2P. Maybe regulation isn’t about stopping it… but guiding it.

My cousin in Algeria got arrested for holding Bitcoin. He didn’t even trade it. Just stored it. That’s not regulation. That’s fear.

Wait-MiCAR II is coming for DeFi? So staking on Aave will require a license? That’s insane. We’re turning decentralized finance into centralized bureaucracy. What’s the point anymore? 🤔

STOP. Just stop. Go to your country’s financial regulator website. RIGHT NOW. Do it. I’m serious. You can thank me later.

The emotional weight of this post is not lost on me. For many, crypto represents freedom, innovation, and financial sovereignty. But when the state turns it into a minefield of compliance, we lose something deeper than money-we lose trust. We must regulate, yes-but with humanity.

I’ve helped 12 friends file crypto taxes this year. One guy didn’t know he owed tax on a $500 NFT trade. Another thought ‘no tax’ meant ‘no reporting.’ You don’t need to be a genius-you just need to be careful. Start with the IRS Pub 544. It’s free.

Let’s be honest: if you’re still using Coinbase in 2025 and you’re not in the U.S., you’re either naive or complicit. They’re a U.S.-based entity. They follow U.S. law. Your ‘privacy’ is a myth. And your ‘decentralized’ wallet? It’s just a gateway to the SEC’s radar.

My exchange just dropped 15 tokens because of MiCAR. Lost $12k. No warning. No refunds. This isn’t regulation-it’s corporate cowardice.

As a compliance officer at a Tier-1 bank, I can confirm: the Basel Committee’s 1,250% capital requirement will force institutions to exit crypto entirely. The next wave of losses won’t come from volatility-it’ll come from liquidity collapse.

I moved from the U.S. to Portugal last year. I thought I was getting out of taxes. Then I realized I still had to report my 2023 gains to the IRS. Now I’m paying both. The world is smaller than we think.