Zedxion Wrapped: What It Is and Why It Matters in Crypto Trading

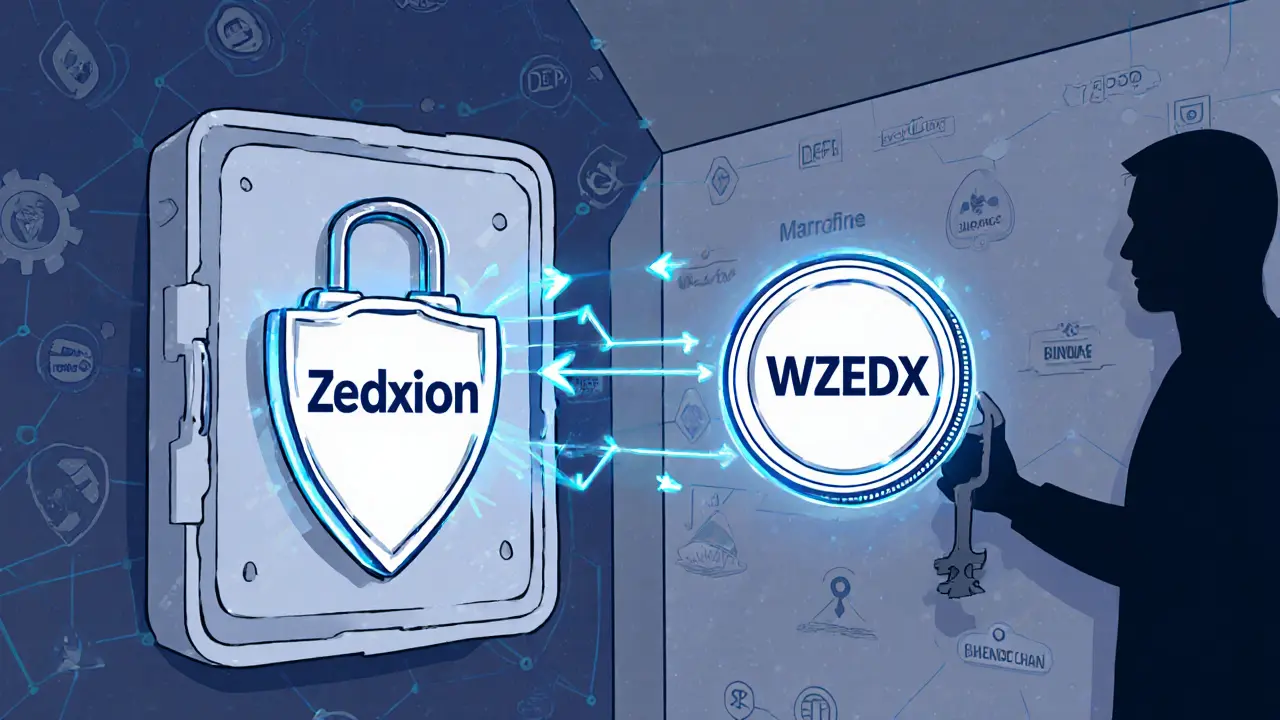

When you hear Zedxion wrapped, a tokenized representation of an asset on a blockchain, often used to enable cross-chain compatibility in DeFi. Also known as wrapped Zedxion, it’s not a new coin—it’s a digital wrapper that lets one asset behave like another on a different network. Think of it like putting a physical key in a plastic case so it fits into a different lock. In crypto, wrapping lets you take an asset from one blockchain—say, Bitcoin or Ethereum—and represent it on another, like BSC or Avalanche, so it can be used in DeFi apps, liquidity pools, or lending protocols that don’t natively support the original token.

This isn’t just technical noise. Wrapped tokens, digital representations of native assets that maintain value parity while enabling interoperability across blockchains are everywhere in DeFi. You’ve probably used wrapped ETH (WETH) or wrapped BTC (WBTC) without even realizing it. They’re the invisible glue holding together cross-chain trading, yield farming, and multi-chain portfolios. Blockchain tokenization, the process of converting real-world or digital assets into blockchain-based tokens that can be traded, transferred, or used in smart contracts is what makes this possible. Zedxion wrapped fits right into this system—it’s not a project with its own blockchain, but a bridge. It lets users move value between ecosystems without relying on centralized exchanges or risky bridges.

But here’s the catch: not all wrapped tokens are created equal. Some are backed 1:1 by real assets and audited regularly. Others? They’re just code with no real reserves behind them. That’s why you’ll find posts here about exchanges like GDEX and GCOX—platforms that tried to ride the wrapped token wave but collapsed under low liquidity and fake volume. You’ll also see guides on airdrops like MTLX and B2M, where wrapped tokens were used as eligibility triggers. And in places like Cyprus and Nepal, where crypto rules are tightening, wrapped assets are being scrutinized because they can hide ownership trails.

So if you’re seeing Zedxion wrapped pop up in a trading strategy, a wallet alert, or an airdrop requirement, don’t just click ‘claim.’ Ask: Is this backed? Is it audited? Is it even needed? The best DeFi users don’t chase shiny wrappers—they understand what’s inside. Below, you’ll find real reviews, deep dives, and blunt takes on the tokens, exchanges, and systems that rely on wrapping. No fluff. Just what works—and what’s a trap.

Wrapped Zedxion (WZEDX) lets Zedxion be used on Ethereum and BSC, but its price is inconsistent, supply is centralized, and there's no audit. Learn what it really is - and why it's risky to hold.

Read More