TradeOgre Review: Is This Crypto Exchange Safe and Worth Using?

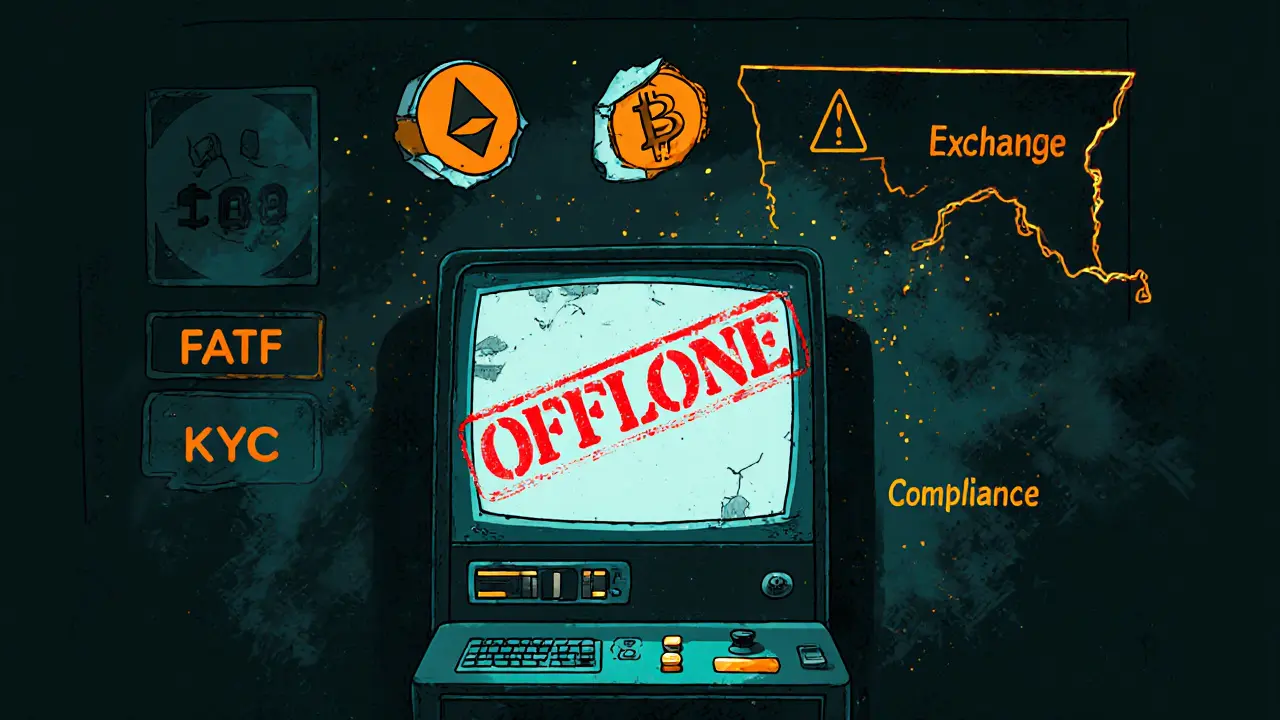

When you hear TradeOgre, a decentralized, anonymous crypto exchange that doesn’t require KYC. Also known as TradeOgre.io, it’s one of the few platforms still letting users trade without ID checks. That’s great if you value privacy—but it’s also a red flag if you care about security. Unlike regulated exchanges like Kyrrex or Binance.US, TradeOgre operates with zero oversight, no insurance, and no customer support team you can actually reach. If something goes wrong, you’re on your own.

What makes TradeOgre stand out isn’t its features—it’s what it doesn’t do. No verification. No withdrawals to banks. No fiat on-ramps. Just direct crypto-to-crypto trades with over 300 tokens, including obscure altcoins you won’t find anywhere else. That’s why traders use it: to swap tokens like $PNDR, $CSHIP, or $ICG that other exchanges delisted after discovering they’re dead or scams. But here’s the catch: if you trade on TradeOgre, you’re also trading with people who might be running rug pulls. There’s no way to verify who’s on the other side of the trade. And since the platform doesn’t hold your funds, you’re responsible for every transaction—no chargebacks, no disputes, no safety net.

It’s not all bad. If you’re experienced and know exactly what you’re doing, TradeOgre can be a useful tool. It has low fees—just 0.2% per trade—and supports direct wallet connections via MetaMask or Trust Wallet. You can trade Bitcoin, Ethereum, Dogecoin, and even niche tokens tied to failed projects like OPNX or UniWorld. But if you’re new, or if you’re holding anything of real value, this isn’t the place. There are no alerts for suspicious activity. No phishing protection. No two-factor authentication you can actually trust. And after the 2025 crypto crash, when over $19 billion in leveraged positions liquidated overnight, platforms like TradeOgre became even riskier—because people desperate for liquidity turned to anonymous exchanges, flooding them with scams and fake tokens.

TradeOgre doesn’t pretend to be something it’s not. It’s not a bank. It’s not a secure exchange. It’s a digital flea market for crypto traders who want to move fast and stay hidden. But in 2025, that’s becoming harder—and more dangerous. The posts below show you exactly what users have run into: fake airdrops tied to TradeOgre tokens, wallets drained after trusting unknown pairs, and tokens that vanished the moment they were bought. Some people made quick gains. Most lost everything. If you’re thinking of using TradeOgre, read these real stories first—before you send your coins.

TradeOgre was a no-KYC crypto exchange popular for privacy coins like Monero. It shut down in July 2025 after Canadian authorities seized $40 million in assets. Here's why it failed and what it means for crypto privacy.

Read More