$60: How It Shapes Crypto Fees, Airdrops, Margin Trades and Token Purchases

When budgeting $60, a modest amount that many traders use to test strategies or claim promotions. Also known as sixty dollars, it serves as a practical entry point for a range of crypto activities.

A key related concept is crypto exchange fee, the cost charged by platforms when you buy, sell or move assets. Most exchanges list fees as a percentage, so with $60 you can calculate the exact spend after fees – for example, a 0.2% taker fee leaves you with $59.88 to allocate. Knowing the fee structure helps you compare platforms like MorCrypto, Coinmetro or OSL, all of which appear in our article collection.

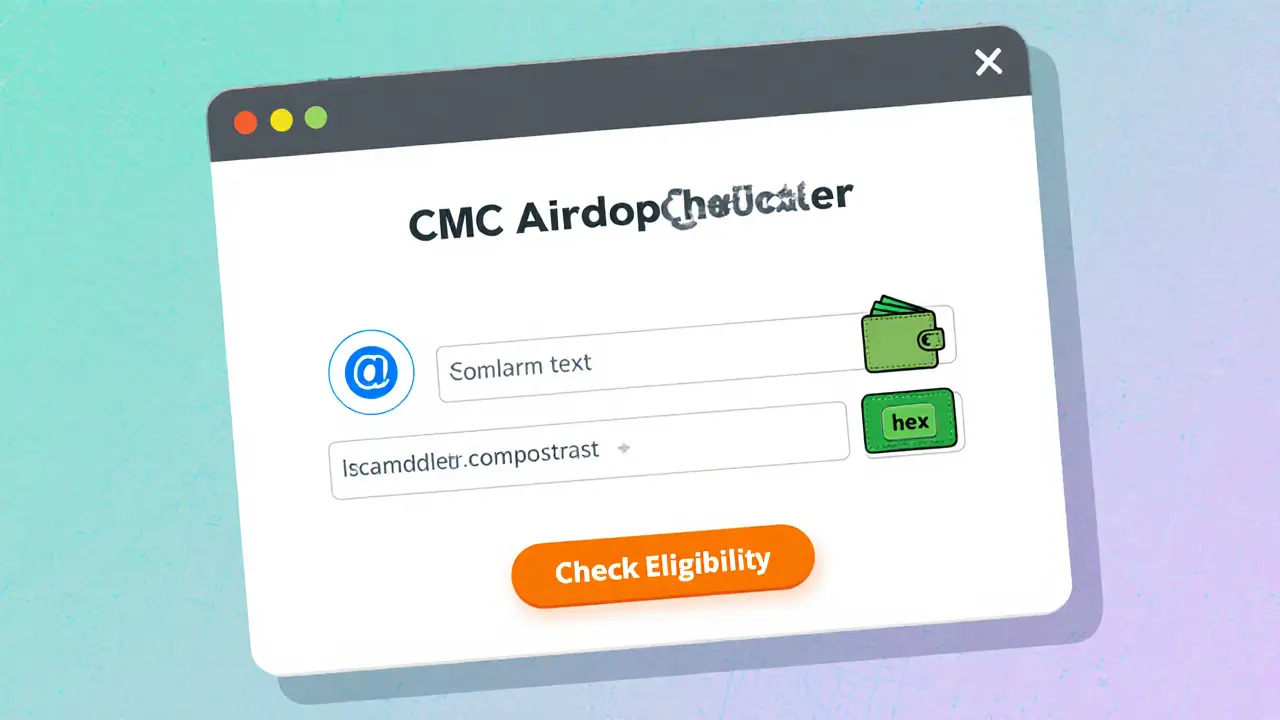

Another entity that ties directly to $60 is the airdrop reward, free tokens distributed to eligible wallets. Many airdrops set a minimum holding threshold; $60 in a qualifying coin often meets that bar, unlocking bonuses such as the Bit2Me B2M airdrop or the TopGoal NFT giveaway. By calculating the dollar value of your holdings, you can see whether you qualify before you spend time on claim steps.

margin trading, leveraged trading that lets you control larger positions with a small deposit also hinges on capital like $60. Brokers require a minimum margin; with $60 you can access modest leverage, test short‑selling or volatility strategies, and evaluate risk tools before scaling up. Finally, platform token, a utility token that grants discounts or governance rights on a specific blockchain platform can be purchased directly with $60, turning a small investment into potential fee rebates or voting power.

All these pieces—fees, airdrop eligibility, leveraged capital and token utility—interact around the simple figure of $60. Below you’ll find a curated set of articles that break down each area, from detailed exchange reviews and airdrop guides to margin‑trading tactics and platform‑token deep dives. Dive in to see how far $60 can take you in the crypto world.

A detailed guide to the Age of Tanks (AOT) CoinMarketCap airdrop, covering the $60k prize pool, 700 guaranteed NFTs, claim steps, game mechanics, and how to maximize the reward.

Read More