Peercoin (PPC) Explained: What It Is, How It Works & Staking Guide

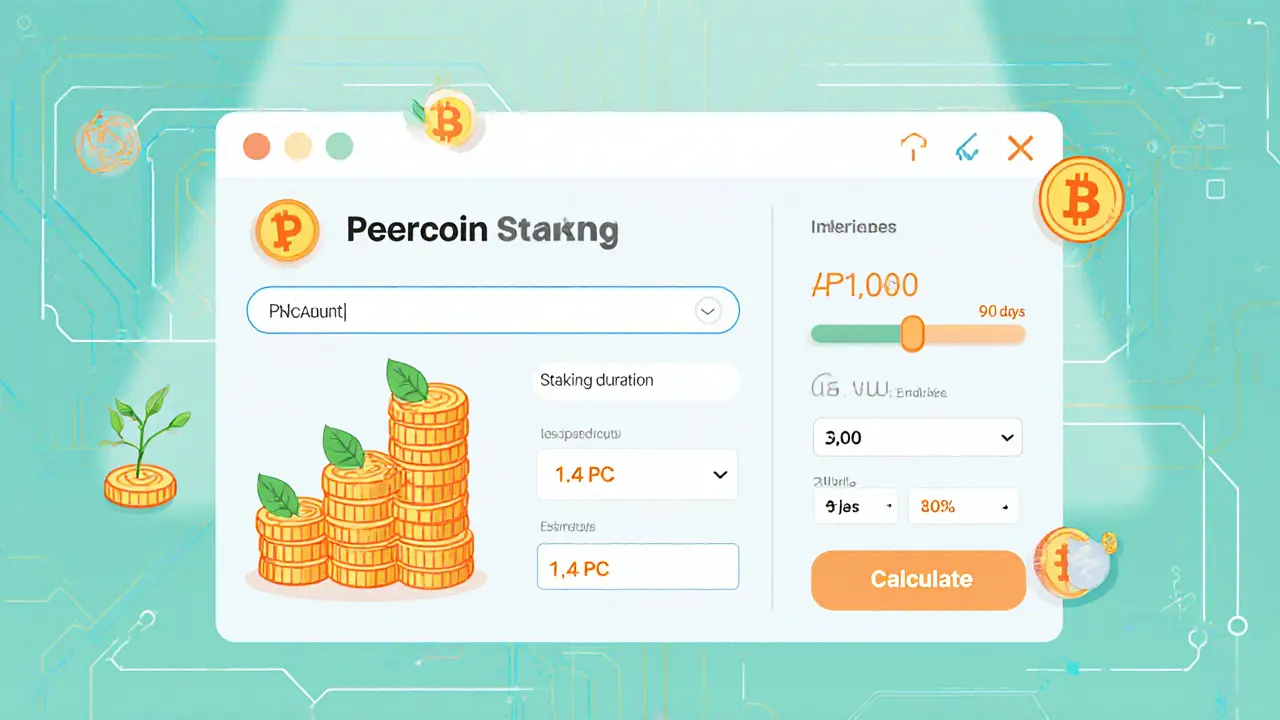

Peercoin Staking Calculator

Estimated Staking Rewards

Note: This calculator estimates rewards based on current network conditions. Actual rewards may vary due to network participation and block selection.

Peercoin staking typically yields 3-5% annual returns depending on network participation and coin age.

Quick Summary

- Peercoin (PPC) launched in August2012 as the first blockchain to use proof‑of‑stake.

- It combines proof‑of‑work (PoW) for early distribution and proof‑of‑stake (PoS) for security.

- Stakers earn 3‑5% annual rewards once coins have matured for 30‑90days.

- The protocol targets a steady 1% inflation rate, with transaction fees burned.

- As of Oct2025 PPC trades around $0.30 with modest daily volume.

When you hear the name Peercoin, think of the crypto that proved you could secure a network without massive energy consumption. Below we unpack what Peercoin actually is, how its hybrid consensus works, why its economics matter, and what you need to do to start staking.

What is Peercoin?

Peercoin is a peer‑to‑peer digital currency that pioneered proof‑of‑stake consensus. It was released in August2012 under the MIT/X11 license by the pseudonymous developer Sunny King (who also created Primecoin). Peercoin’s ticker is PPC and it is sometimes called PP Coin.

Designed as an “enhanced Bitcoin”, Peercoin keeps Bitcoin’s SHA‑256 hashing algorithm but adds a PoS layer to reduce energy use by roughly 100‑fold. The blockchain’s early years relied on PoW mining to distribute coins, but today roughly 95% of new blocks are generated via staking.

Hybrid Consensus: Proof‑of‑Work + Proof‑of‑Stake

Peercoin’s network runs a hybrid consensus model:

- Proof‑of‑Work (PoW) - miners solve SHA‑256 puzzles, creating the first 30million PPC and seeding the network.

- Proof‑of‑Stake (PoS) - any holder can generate blocks after their coins have matured for at least 30days. The probability of creating a block scales with “coin age” (amount × days held), peaking after about 90days.

This design means the network stays secure even when PoW mining dwindles, because stakers continuously lock up value to validate transactions.

Staking Mechanics and Rewards

To stake, you need a wallet that supports Peercoin’s PoS (most desktop wallets do). Once you receive PPC, the coins must sit untouched for a minimum of 30days to become eligible. After that window, every time the network selects a staker, the reward is a static amount-currently about 1.4PPC per PoS block.

Because not every coin in circulation participates in staking (many users keep coins in exchanges), the effective annual return for active stakers hovers between 3% and 5%. This return is predictable, unlike Bitcoin’s variable miner fees.

Staking also contributes to network security: the more coin‑age the network sees, the harder it is for an attacker to amass enough “stake” to rewrite history.

Economic Model: Inflation, Fees, and Supply

Peercoin deliberately avoids a hard cap. Instead, it aims for a stable 1% annual inflation rate, achieved through the PoS reward and a tiny amount of PoW mining that continues at a low level. This controlled inflation is meant to reward participants without flooding the market.

Every transaction carries a fee of 0.01PPC per kilobyte, and-unlike Bitcoin-those fees are burned (destroyed). Burning reduces the circulating supply over time, creating a counterbalance to inflation and theoretically supporting long‑term value.

Technical Comparison with Other Major Coins

| Feature | Peercoin (PPC) | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

| Consensus | Hybrid PoW/PoS | Proof‑of‑Work | Proof‑of‑Stake (Ethereum 2.0) |

| Energy Use | ~1% of Bitcoin’s consumption | ~13TWh/yr | ~0.5% of Bitcoin’s consumption |

| Block Time | ~10min (PoW) / ~10min (PoS) | 10min | 12sec (PoS) |

| Inflation Rate | ~1%/yr (target) | Deflationary (capped at 21M) | ~0.2%/yr (post‑merge) |

| Current Price (Oct2025) | $0.30 | $27,000 | $1,800 |

The table shows why Peercoin still matters: it offers a proven PoS model with minimal energy draw, while keeping many of Bitcoin’s familiar attributes (SHA‑256, UTXO model). Ethereum’s fast finality is appealing, but Peercoin’s simplicity and low‑cost fees remain competitive for everyday micro‑transactions.

Current Market Position and Community Activity

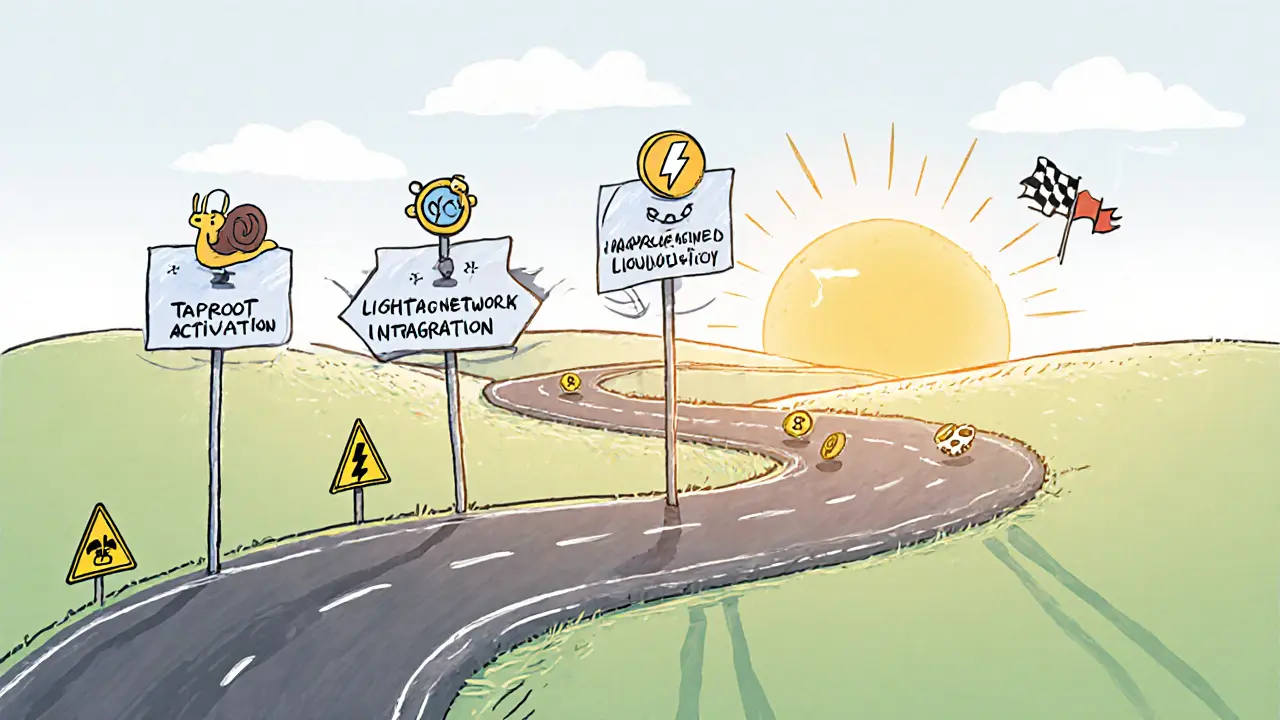

Peercoin trades on a handful of exchanges, with a 24‑hour volume of roughly $78k. The price hovers near $0.30, reflecting modest liquidity. Community forums (e.g., the official Peercoin subreddit and Bitcointalk thread) still discuss upgrades like Taproot and Lightning Network compatibility, but developer commits are slower than in larger projects.

Regulators view PoS coins favorably because of their low carbon footprint. Peercoin’s sustainable design gives it a slight edge in jurisdictions that tax or restrict high‑energy crypto activities. However, limited exchange listings and scant marketing mean most newcomers learn about PPC only after digging into Bitcoin alternatives.

How to Get Started: Wallets, Exchanges, and Staking

1. Choose a wallet. The official Peercoin‑Qt client is the safest desktop option. Mobile users can opt for Trust Wallet or Coinomi, both supporting PPC and staking.

2. Buy PPC. Small‑cap exchanges like KuCoin, Bittrex, and some regional platforms list PPC. Transfer the coins to your personal wallet - keep them off the exchange if you plan to stake. 3. Let the coins mature. Wait 30days (minimum) for coin‑age to become eligible. For best returns, hold for 90days. 4. Enable staking. In most wallets this is a simple toggle: “Stake PPC”. The software will automatically attempt block creation and credit rewards. 5. Monitor rewards. You’ll see a steady increase of about 1.4PPC per PoS block (roughly 6‑hour intervals). Rewards are added to your balance automatically.

Tip: Keep your wallet synced and unlocked for the longest possible time each day; the more uptime, the higher your chance of winning a block.

Future Outlook: Development Roadmap and Risks

Peercoin’s development team is focused on maintaining compatibility with Bitcoin upgrades (SegWit, Taproot). A tentative roadmap includes:

- Taproot activation - would improve script flexibility and privacy.

- Lightning Network integration - could enable near‑instant, low‑fee payments.

- Improved staking UI in the official wallet.

Risks to watch:

- Stagnant developer activity could delay new features.

- Low exchange liquidity makes large trades costly.

- Competition from newer PoS projects with richer ecosystems (e.g., Cardano, Solana).

If the core team keeps the network secure and adds modest upgrades, Peercoin should continue to serve as a low‑energy store of value and transaction medium for niche users, especially those valuing sustainability.

Frequently Asked Questions

What makes Peercoin different from Bitcoin?

Peercoin adds proof‑of‑stake to Bitcoin’s proof‑of‑work, which slashes energy use and lets holders earn a predictable reward for simply keeping coins in a wallet.

Do I need special hardware to stake Peercoin?

No. Staking runs on ordinary computers or mobile devices. The only requirement is that the wallet stays online and the coins have matured for at least 30days.

How are transaction fees handled in Peercoin?

Fees are 0.01PPC per kilobyte and are permanently burned, reducing the total supply and offsetting inflation.

Can I trade Peercoin on major exchanges?

PPC is listed on a few niche platforms such as KuCoin, Bittrex, and some regional exchanges. It’s not available on big names like Coinbase.

Is Peercoin a good long‑term investment?

Its historic significance and low‑energy design give it a solid foundation, but limited liquidity and slower development mean it’s more of a niche, sustainability‑focused asset than a high‑growth investment.

18 Comments

Staking Peercoin seems straightforward and low‑risk.

The Peercoin staking mechanism exemplifies a hybrid proof‑of‑work/proof‑of‑stake model, thereby enhancing network security while rewarding long‑term holders. It operates under deterministic reward calculations, which are transparent and verifiable on the blockchain. Consequently, participants can anticipate modest but reliable returns, assuming stable network participation.

Yo, that calculator looks slick! Gives a quick feel for what you might earn.

Peercoin’s reward schedule is tied to coin age, so the longer you hold without moving, the higher your effective rate. The calculator assumes current network hash rate, which can shift, so treat the numbers as approximations. It’s a solid starting point for planning your staking strategy.

Staking can be as simple as setting the amount and letting the network do the work. Just remember that the 30‑day minimum is required to actually claim rewards.

In the ever‑expanding universe of digital assets, Peercoin presents itself as a modest beacon of fiscal responsibility, a rare virtue amidst the cacophony of speculative frenzy. Yet, one must not be lulled into complacency by its seemingly tame annual yield of three to five percent. The true merit lies not in the immediate profit but in the philosophical commitment to a proof‑of‑stake paradigm that rewards patience over impulsivity. By anchoring value to coin age, Peercoin subtly admonishes the culture of hyper‑short‑term trading that dominates many other platforms. This, in turn, cultivates a healthier ecosystem where participants are incentivized to think beyond daily price fluctuations. Of course, the network’s health is contingent upon collective participation; the more users who stake, the more secure and resilient the ledger becomes. Conversely, a decline in participation could erode the very benefits it promises, underscoring the communal responsibility embedded in its design. The calculator, while a useful tool, merely reflects current conditions, which are themselves a snapshot of collective behavior. It does not account for future shifts, regulatory changes, or macro‑economic forces that could sway the token’s trajectory. Therefore, prospective stakers should approach with both optimism and caution, recognizing that even modest returns are a function of collective trust. Moreover, the environmental impact of Peercoin’s hybrid model is arguably less severe than pure proof‑of‑work systems, aligning with broader sustainability goals. This alignment lends an ethical dimension to the staking decision, beyond mere financial considerations. While the allure of higher yields elsewhere may tempt, the quiet stability of Peercoin offers a counter‑narrative to the frenzy. In the grand tapestry of cryptocurrency, it serves as a reminder that not all value is derived from rapid appreciation; sometimes, it resides in steady, reliable growth. Ultimately, the decision to stake should be guided by personal risk tolerance, long‑term financial goals, and a respect for the cooperative spirit that underpins Peercoin’s architecture.

Your commitment to a structured staking plan is commendable. Maintaining a disciplined approach will likely yield the best results over time.

Nice tool.

I appreciate the clarity of the staking calculator and its user‑friendly interface. It provides a valuable snapshot for prospective participants.

Behold! The grand spectacle of a calculator that promises wealth, yet draped in the veil of uncertainty! Are we not all merely actors upon this digital stage, chasing phantom returns?-the drama unfolds, the numbers dance, and the audience gasps!

Staking Peercoin can be a fun way to put idle coins to work while you sleep. Keep an eye on the network stats, though, and adjust your expectations accordingly.

From a technical standpoint, the APR calculation integrates the PoS kernel density function, which dynamically modulates reward vectors based on UTXO age distribution. This parametrization mitigates variance in yield projections.

One cannot help but observe the grandiose self‑importance that permeates many modern crypto discourses, wherein every newcomer is heralded as a visionary destined to reshape the monetary order. Yet, Peercoin, in its modest yield and unpretentious design, offers a quiet counter‑argument to this fevered narrative. Its emphasis on longevity over flamboyant hype serves as a subtle admonition against the unsustainable speculation that haunts many altcoins. The very architecture of Peercoin, melding proof‑of‑work with proof‑of‑stake, embodies a dialectic between security and efficiency that should inspire measured contemplation rather than reckless exuberance. Moreover, the staking calculator, while a convenient instrument, must be contextualized within the broader macro‑economic climate; the appetite for risk varies across cycles, and the modest returns it presents are not immune to systemic shocks. In a world beset by fleeting trends, the steadfastness of Peercoin’s reward model offers a rare opportunity for disciplined participants to accrue value through patience. This patience, however, must be coupled with vigilance, for complacency can erode the very benefits one seeks. In sum, the virtues of Peercoin lie not in spectacular gains but in the quiet, reliable accrual of wealth for those willing to eschew the siren call of immediate gratification.

Indeed, the merits you outline are compelling,, however,, consider that network participation levels can shift,, impacting returns,, (typo): be sure to re‑evaluate periodically,,.

Whilst the calculator's interface is commendably sleek, one might posit that the underlying assumptions are, with all due respect, rather simplistic; the market's capricious nature renders such tools merely heuristic at best.

Ah, the ever‑glorious Peercoin calculator-an instrument of such profound clarity, one could almost hear the angels singing as the numbers align. Or perhaps it's just the sound of my imagination compensating for the inevitable volatility that lurks beneath the surface. In any case, the promised 3‑5% APR feels suspiciously generous when you consider the labyrinthine dynamics of network hash rate, coin age, and the mercurial whims of global finance. Still, why not bask in the glow of optimistic projections while they last? After all, it's not like the market ever surprises anyone-sarcasm aside, a little caution never hurt anyone.

Thank you for sharing the tool, it appears quite useful; however, please remember that all projections are inherently uncertain, and personal research is always advisable.

The concept of staking invites reflection on the nature of patience as an investment virtue. It reminds us that value often accrues over time, not in haste.