Paribu Review 2025: In‑Depth Look at Turkey’s Leading Crypto Exchange

Paribu Fee Calculator

| Tier | Volume Range (TRY) | Maker Fee (%) | Taker Fee (%) |

|---|---|---|---|

| 1 | 0 - 999 | 0.25% | 0.35% |

| 2 | 1,000 - 4,999 | 0.24% | 0.34% |

| 3 | 5,000 - 9,999 | 0.23% | 0.33% |

| 4 | 10,000 - 24,999 | 0.22% | 0.32% |

| 5 | 25,000 - 49,999 | 0.21% | 0.31% |

| 6 | 50,000 - 99,999 | 0.20% | 0.30% |

| 7 | 100,000 - 249,999 | 0.19% | 0.29% |

| 8 | 250,000 - 499,999 | 0.18% | 0.28% |

| 9 | 500,000 - 999,999 | 0.17% | 0.27% |

| 10 | 1,000,000+ | 0.01% | 0.06% |

Quick Summary

- Founded in 2017, Paribu serves Turkish users with TRY‑based spot trading.

- Supports roughly 150‑190 crypto assets; core pairs are BTC/TRY, ETH/TRY, and a handful of altcoins.

- Maker fees 0.01%‑0.25%, taker fees 0.06%‑0.35% - higher than global averages.

- Security includes 2FA and transaction codes; no hardware‑key support.

- Mobile apps for iOS/Android are praised; no API, futures, or margin trading.

What Is Paribu?

Paribu is a Turkish cryptocurrency exchange launched in 2017, headquartered in Istanbul, and focused on spot trading with Turkish Lira (TRY) pairs. It targets retail investors, small businesses, and anyone who wants to trade crypto using local banks. This Paribu review evaluates whether its simplicity and local focus outweigh the lack of advanced tools.

How Paribu Handles Deposits and Withdrawals

Deposits must be in TRY and are routed through nine partner banks. Transfers happen instantly during banking hours; after‑hours FAST transfers are available within set limits. The minimum deposit is TRY10, and there’s no cap on how much you can move. Withdrawal fees are modest - for Bitcoin the fee is 0.0005BTC, which sits below the industry norm.

Because Paribu only accepts Turkish fiat, international users cannot fund accounts directly. No credit‑card or PayPal options exist, which limits accessibility outside Turkey.

Fee Structure Explained

Paribu runs a 10‑tier volume‑based fee model. New users start at tier1 with maker fees of 0.25% and taker fees of 0.35%. As monthly trading volume climbs, fees drop to a maker rate of 0.01% and a taker rate of 0.06% at tier10.

Compared with global benchmarks - Binance’s typical taker fee sits at 0.10% and Coinbase at 0.50% - Paribu’s fees sit in the middle but are still higher for casual traders. The fee schedule is transparent, displayed in the user dashboard, and applied automatically.

Security and Regulatory Compliance

Security basics include email/password login plus two‑factor authentication (2FA) via Google Authenticator or SMS. Each withdrawal also requires a unique transaction code sent to the registered phone number.

Paribu complies with Turkish financial regulations and holds a license from the local authorities. However, it does not offer cold‑storage guarantees, insurance coverage, or hardware‑security‑key integration that larger exchanges like Binance or Coinbase provide.

Trading Interface and Feature Set

The web platform embeds TradingView charts for basic technical analysis. The UI is intentionally minimal: a single “Buy” and “Sell” button per asset, price alerts, and a simple order‑book view. There is no API access, no futures or margin contracts, and no advanced order types beyond limit and market.

Mobile apps for iOS and Android replicate the desktop experience, offering push notifications for price changes and a smooth touch‑friendly interface. Users report fast load times and reliable order execution during peak Turkish market hours.

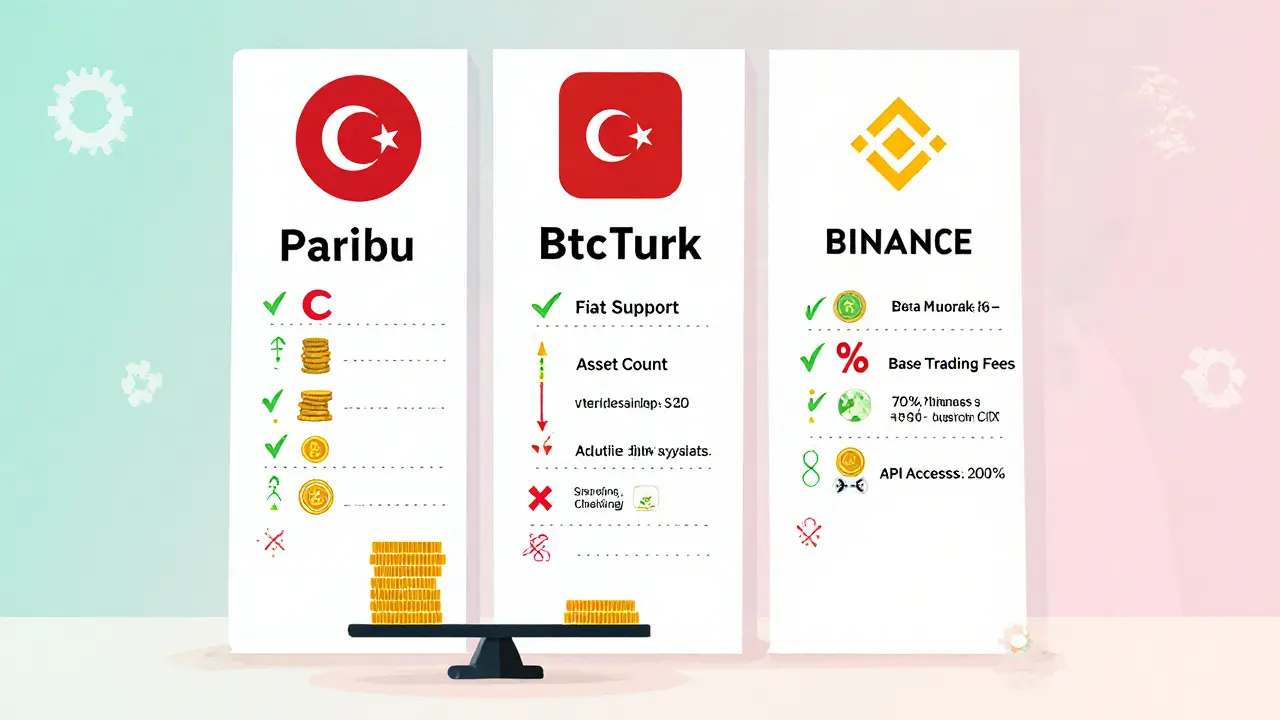

How Paribu Stacks Up Against Competitors

| Feature | Paribu | BtcTurk | Binance |

|---|---|---|---|

| Supported Fiat | TRY only | TRY, USD, EUR | USD, EUR, GBP, many others |

| Crypto Count (2025) | ~170 | ~120 | >5,000 |

| Base Trading Fees (taker) | 0.35% (tier1) | 0.30% (tier1) | 0.10% (standard) |

| Advanced Products | Spot only | Spot, limited futures | Spot, futures, margin, options, staking |

| API Access | No | No | Yes |

| Mobile App Rating (iOS/Android) | 4.3/4.2 | 4.1/4.0 | 4.7/4.6 |

Paribu shines in local banking integration and Turkish‑language support, but it falls short on asset variety, fee competitiveness, and advanced trading tools.

Real‑World User Experience

Account creation requires a Turkish national ID and proof of residence; verification typically completes within 24‑48hours. New users enjoy a short learning curve thanks to the clean UI. Common praise points include:

- Fast TRY deposits through partner banks.

- Intuitive mobile app with push price alerts.

- Responsive 24/7 phone support (local toll‑free number).

Recurring complaints focus on:

- Higher taker fees compared to Binance.

- Missing advanced charting tools beyond basic TradingView.

- Limited customer‑service channels - no live chat.

- Absence of English language help pages.

Overall, beginners in Turkey find Paribu a solid entry point, while seasoned traders quickly outgrow its feature set.

Pros and Cons Checklist

| Pros | Cons |

|---|---|

| Local TRY deposits/withdrawals via 9 banks | Only Turkish fiat - no USD/EUR |

| Mobile app rated >4stars in Turkey | Higher base trading fees |

| Simple UI great for newcomers | No futures, margin, or API |

| Regulatory compliance within Turkey | Limited security features vs. global peers |

Is Paribu Right for You?

If you are a Turkish resident looking for an easy way to buy Bitcoin or Ethereum with TRY, Paribu checks most boxes. It offers fast bank transfers, a Turkish‑language platform, and a straightforward mobile app.

However, if you trade frequently, need low fees, or want futures, margin, and API trading, you’ll likely outgrow Paribu and should consider global exchanges that accept multiple fiat currencies.

Final Verdict

Paribu occupies a comfortable niche in Turkey’s crypto ecosystem. Its strengths lie in local banking integration, regulatory clarity, and a beginner‑friendly interface. The trade‑off is higher fees and a stripped‑down feature set that can’t satisfy power traders. For most Turkish retail users in 2025, Paribu remains a solid first‑step exchange, but the platform must evolve-adding more assets, tighter fees, and advanced tools-to stay competitive as the market matures.

Frequently Asked Questions

Can I deposit dollars or euros into Paribu?

No. Paribu only accepts Turkish Lira (TRY) via its partner banks. To trade with other fiat currencies you’d need a different exchange.

Does Paribu offer futures or margin trading?

No. The platform is spot‑only. Futures, margin, and leverage products are available on competitors like Binance or BtcTurk.

How secure is Paribu compared to global exchanges?

Paribu uses standard 2FA and transaction codes, which meet basic security standards. It lacks hardware‑key support, extensive cold‑storage guarantees, and insurance that larger platforms provide.

What is the typical fee for a Bitcoin withdrawal?

Paribu charges a flat 0.0005BTC per Bitcoin withdrawal, which is lower than most international exchanges.

Is there an English version of the Paribu website?

No, the platform is fully Turkish‑language. Non‑Turkish speakers may need translation tools or choose a different exchange.

25 Comments

Paribu is the Shakespeare of Turkish exchanges, I suppose.

Look, I barely skimmed the article and it feels like they threw a bunch of numbers at us. The fees are higher than Binance, which is kinda obvious. Also, who needs that fancy UI when you can just use a plain one? Anyway, that's my two cents.

Ah, another "transparent" platform that probably reports its numbers to some shadowy cabal in Ankara. The fact that they only support TRY is a sign they’re trying to keep the money in a single, controllable basket. Maybe the real fee is your privacy.

If you're just starting out, stick to the basics: deposit, trade, withdraw. The app is clean, so you won't get lost. Keep an eye on the fee tier and you can save a few percent over time.

Great, another Turkish exchange that pretends it's a global player.

The Paribu saga reads like a modern tragedy: a platform that promises ease, yet shackles you with fees. One wonders if the architects of this beast are merely mortals or members of a secret consortium. Their tiered structure is a labyrinth, designed to siphon the unwary. Yet, the allure of swift TRY deposits blinds many. In a world where every token is a potential revolution, why settle for a gateway that limits your horizon? It's a paradox that fuels both hope and frustration.

I get why beginners love Paribu – it's straightforward and it talks your language. But if you plan to trade daily, the fees will bite you. Maybe consider a hybrid approach: start here, then migrate to a platform with lower taker rates once you’re comfortable.

Honestly, the article is solid – gives the numbers, tells you the pros and cons. I like the way they broke down the fee tiers, makes it easy to compare. But yeah, it could've dived deeper into security measures.

Paribu is a decent entry for Turkish folk. It has its ups, like fast bank deposits, and its downs, like higher fees.

From a systems integration perspective, Paribu's API limitations are a bottleneck. The lack of programmatic access hinders algorithmic trading pipelines. In a mature market, this is a non‑trivial opportunity cost.

One must, with due reverence, acknowledge the sheer audacity of Paribu's fee architecture-an elegant dance of percentages that would make even the most seasoned economist weep. Yet, this very elegance betrays a subtle tyranny over the retail trader.

Oh, great, another platform that pretends to be for the little guy while charging the big guy’s rates. If you’re serious about crypto, you’ll outgrow this sandbox fast-unless you love paying extra for mediocrity.

Interesting take! 👍 Paribu looks solid for newcomers, but power users might want more tools. 😎

Sure, it’s a local exchange, but who needs the world when you’ve got Turkey?

From a cultural viewpoint, Paribu’s Turkish‑only interface fosters a sense of community among local traders, which can be both a strength and a barrier for international collaboration.

Reading through the Paribu review reminded me of that first time I tried to navigate a new exchange-everything feels both exciting and intimidating. The fee tier table is laid out clearly, which is a plus for anyone who hates digging through fine print. I appreciate the emphasis on local bank integration; fast TRY deposits are a game‑changer in a market where banking delays can cost you precious market moves. However, the higher taker fees compared to giants like Binance are a real pain point. For beginners, the simple UI does a great job of lowering the learning curve, but once you start trading larger volumes, those fees start adding up. The lack of advanced charting tools means you’ll have to rely on external platforms if you want deeper technical analysis. Also, the absence of a live chat support channel can be frustrating when you’ve got a time‑sensitive issue. The fact that there’s no English documentation is another hurdle for non‑Turkish speakers who might want to try the platform. Still, the 24/7 phone support is a redeeming feature, especially in a country where trust in online services can be low. Security-wise, while two‑factor authentication is standard, the lack of hardware‑key support and limited cold‑storage guarantees make me a bit uneasy. As a user who transitioned from a global exchange to a local one, I’d say Paribu is a solid stepping stone but not a final destination. If you’re looking to dip your toes into crypto with a Turkish fiat, it’s a comfortable start. Yet, if you aim to become a power trader, you’ll soon outgrow its feature set and might need to migrate elsewhere. In short, Paribu shines for its niche-local convenience-but falls short on the broader, more competitive aspects of crypto trading.

Regulatory compliance is often a double‑edged sword; while it builds trust, it can also stifle innovation. Paribu seems to walk that line carefully.

While Maggie spots the higher fees, it’s also worth noting that Paribu’s liquidity pools are still catching up, which explains part of the cost structure.

Kristen’s optimism is refreshing, yet the lack of English support remains a practical obstacle for broader adoption.

Dear esteemed author of the extensive analysis, your eloquence is commendable, yet I must inquire whether the presented data accounts for seasonal volatility in Turkish Lira valuations.

Ah, the ever‑present “seasonal volatility” myth-nothing more than a smokescreen conjured by those who wish to undermine the sovereign stability of TRY. Trust no one.

Look, the market moves regardless of conspiracies; focus on fees and tools.

C Brown’s critique hits home-if you’re serious about trading, you’ll outgrow Paribu’s limited feature set.

Great point, Noel! If you’re just getting started, Paribu’s easy UI can be a confidence booster.

Gregg’s brief take underscores a common sentiment: ease of use often comes at the price of depth.